Aquaculture, 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-11-24

Aquaculture industry hit by COVID-19 pandemic in 2020, production and value decreased

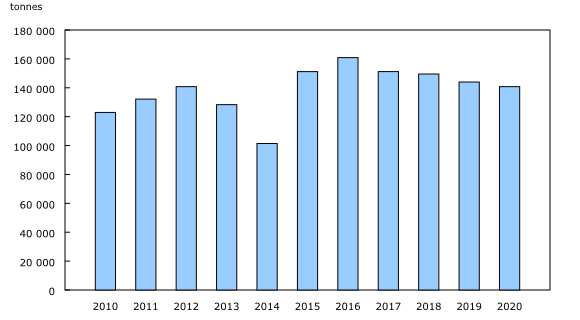

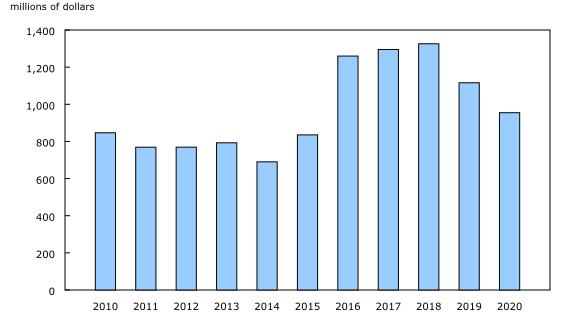

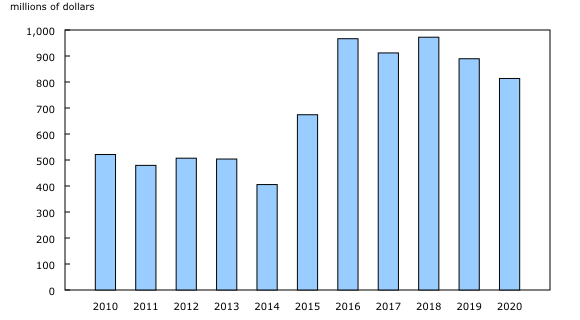

Sales of aquaculture products and services were down 16.8% from 2019 to $1.1 billion in 2020. The decline was mainly because of lower national prices for finfish products and lower production levels for both finfish and shellfish.

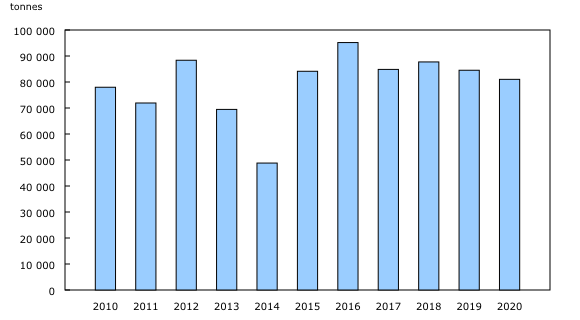

At the national level, prices of finfish products fell from $7.75 per kg in 2019 to $6.78 per kg in 2020, while production dropped 2.2%. Shellfish production fell 30.5% from 2019.

The gross value added to the economy by the aquaculture industry—that is, the difference between gross output and total product inputs—decreased 46.4% from 2019 to $163.6 million in 2020, mainly because of a lower gross output, down 12.0% to $1.2 billion.

Market shift in sales from food services to retail do not offset the decrease in demand in finfish products

Finfish and shellfish products are frequently consumed in restaurants and at large hospitality events (e.g., weddings). As such, the aquaculture industry relies heavily on the food services market for sales. With lockdown measures in place in certain jurisdictions in response to the COVID-19 pandemic, there was a decrease in demand for aquaculture products from the food services segment. However, a market shift in finfish sales from food services to retail was observed, and some large integrated aquaculture businesses capitalized on the shift in consumer behaviour by expanding on value-added finfish products (frozen produce) sold at retail outlets. Although retail sales were able to offset some of the demand shortfall, the net demand was down, resulting in lower national finfish prices.

Lower finfish prices impact sales on the west and east coasts of Canada

Finfish production in British Columbia rose 3.3% from 2019, accounting for 66.5% of the Canadian finfish production in 2020. Despite the growth in finfish production in British Columbia, lower prices resulted in a 5.3% year-over-year decrease in finfish revenue in this province.

Opening 2020 finfish stocks were low in the Atlantic provinces as a result of challenging biological conditions (mass mortality, algal blooms and infectious salmon anemia) reported in 2019, resulting in a reduced harvest. Lower harvest volumes in the larger finfish-producing provinces and a decrease in finfish prices negatively impacted finfish sales, down 56.2% in Newfoundland and Labrador and 33.6% in New Brunswick, relative to 2019.

Export prices for farmed Atlantic salmon, including fillets, were down 4.6% from 2019 to $10.04 per kg. Export volumes were also down 4.1%, leading to an 8.5% decrease in sales to $813.6 million. The United States is the largest importer of Canadian farmed Atlantic salmon, accounting for 96.3% of the total exports.

Decrease in demand for shellfish products from the food services industry results in lower production

Unlike the finfish market, the shellfish industry did not shift to retail sales and remained heavily reliant on the food services industry. Sales of farmed shellfish, which accounted for 8.3% of the total sales of aquaculture products and services in 2020, fell 23.0% from 2019 to $88.5 million in 2020, while Canadian shellfish production decreased 30.5% from 2019 to 30 029 tonnes. Prince Edward Island, the largest producer of mussels in Canada, saw a 37.2% year-over-year decrease in harvest to 12 756 tonnes. British Columbia, the largest producer of oysters, showed a decrease in production of 33.8 % to 5 149 tonnes in 2020.

With a decrease in global demand, the quantity of Canadian mussels exported was also down 28.0% from 2019, while value was down 23.1% to $37.4 million. Because of the reduced food services purchases, an over-supply of shellfish products was reported in some provinces, which will be carried over to 2021.

Note to readers

Aquaculture production and value data are provided annually by each of the provincial ministries responsible for aquaculture. Producers must report their production and value as part of their provincial licensing agreements.

Canadian export statistics are obtained from administrative records.

Revenue, expense and inventory data come from the 2020 Annual Survey of the Aquaculture Industry.

The publication Aquaculture Statistics was discontinued on November 17, 2016. All the data for this product can be found in tables 32-10-0107-01: Aquaculture, production and value; 32-10-0108-01: Aquaculture economic statistics, value added account; and 32-10-0005-01: Aquaculture, exports of selected Canadian aquaculture products, by destination.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: