Monthly credit aggregates, September 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-11-19

Household borrowing

Household sector borrowing is divided into financing in the form of non-mortgage loans, or funds that are principally for consumption, and mortgage loans, or debt acquired to finance the purchase of a property.

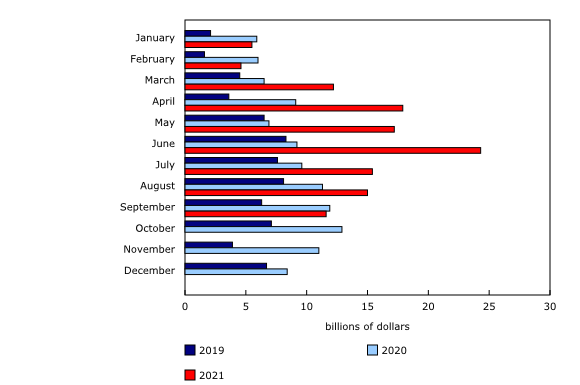

Households added $11.6 billion in mortgage debt in the month of September, representing a rise of 0.7% from the previous month. The rate of mortgage borrowing continued to reduce, slowing to a pace more aligned with pre-pandemic activity. The volume of existing home sales, which has been on a downward trend over the previous months, remained 10.1% higher than February of 2020, prior to the pandemic being officially announced. At the same time, residential construction investment decreased by 1.6% in September, but was still 21.6% higher than in February 2020.

Non-mortgage debt grew 0.6% in September to reach $802.8 billion. Increasing credit card debt and lines of credit with chartered banks were the main contributors to the increase. Credit card liabilities reached $79.3 billion at the end of September, while lines of credit rose by $2.1 billion, largely caused by growth in Home Equity Lines of Credit. Compared with pre-pandemic levels, credit card balances were down 10.6% from February 2020, while other personal loans balances were up 21.7%. The latter category includes bridge loans, intended to bridge the gap between the time a house sale closes and the mortgage funds are received.

Overall, the total credit liabilities of households reached $2,584.9 billion in September, a 0.6% increase from August. Real estate secured debt, composed of both mortgage debt and home equity lines of credit, increased by 0.7% (+$13.3 billion) to reach $2,052.3 billion.

Private non-financial corporation borrowing

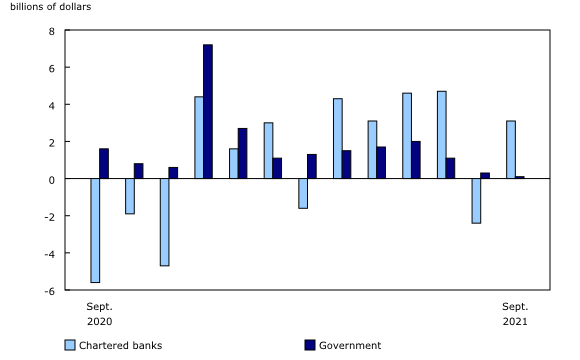

Total non-mortgage loan liabilities of private non-financial corporations increased by $4.1 billion (+0.5%) in September. Non-mortgage loans provided by chartered banks and non-banks both increased in September. Chartered banks led the increase in dollar terms, expanding their loans to non-financial corporations by $3.1 billion (+0.6%), while non-banking institutions added $940 million (+0.4%).

The pace of government lending to private corporations further decelerated from the pandemic-led support of prior months, with balances edging up 0.2% in September (+$0.1 billion). Key federal government support programs that provided direct financing have either wound down, such as the Canadian Business Emergency Account, or have largely curtailed their lending activities.

In terms of debt securities, private non-financial corporations recorded net issuances in debt securities of $1.4 billion in September, mainly in the form of long-term instruments (i.e., bonds).

The mortgage debt of private non-financial corporations rose 0.6% (+$2.2 billion) to reach $356.4 billion. Overall, total credit liabilities of private non-financial corporations reached $2,945.2 billion, an increase of 0.3% (+$9.2 billion) in September.

Note to readers

Overview of the monthly credit aggregates

The monthly credit aggregates break down a portion of the quarterly National Balance Sheet Accounts (NBSA) by month. They provide details on lending to households and non-financial corporations—in other words, the stock of these sectors' outstanding liabilities from the debtor perspective—across a range of credit instruments, including mortgage loans, non-mortgage loans, and debt and equity securities. The aggregates cover all lending sectors, including chartered banks, non-bank deposit-taking institutions, other financial corporations, government and other lenders. The estimates are presented as booked-in-Canada to capture activity within Canada, with either domestic or non-resident lenders. In addition, amounts are reported on an end-of-period basis (i.e., the value of the stock of an asset on the final day of the month). The third month of each quarter is benchmarked to the corresponding quarterly release of the NBSA.

The NBSA are composed of the balance sheets of all sectors and subsectors of the economy. The main sectors are households, non-profit institutions serving households, financial corporations, non-financial corporations, government and non-residents. The NBSA cover all national non-financial assets and all financial asset-liability claims outstanding in all sectors and—similarly—they present stocks as of the end of each quarter.

Estimates are available on a seasonally adjusted basis to improve the interpretability of period-to-period changes in debt. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on the concepts, methodologies and classifications used to compile these monthly estimates, please see the document "Guide to the Monthly Credit Aggregates."

Next release

Data on the monthly credit aggregates for October will be released on December 20, 2021.

Products

The document "Guide to the Monthly Credit Aggregates," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The document "An overview of revisions to the Financial and Wealth Accounts, 1990 to 2020," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The data visualization product "Financial accounts on a from-whom-to-whom basis, selected financial instruments," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The data visualization product "Distributions of Household Economic Accounts, Wealth: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The data visualization product "Securities statistics," which is part of Statistics Canada – Data Visualization Products (71-607-X), is available.

The Economic Accounts Statistics Portal, accessible from the Subjects module of the Statistics Canada website, provides an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: