Labour productivity, hourly compensation and unit labour cost, first quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-06-03

First quarter 2020

3.4%

(quarterly change)

Labour productivity rises, as hours worked fall faster than output

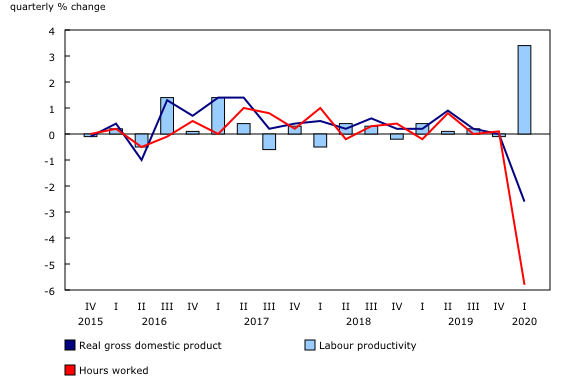

Labour productivity of Canadian businesses rose 3.4% in the first quarter, the largest quarterly increase recorded, as hours worked fell faster than business output.

Following measures taken in March to stop the spread of COVID-19, including lockdown and the temporary closure of many businesses, output and hours worked both fell sharply for the first quarter. However, hours worked fell more sharply than business output, resulting in a strong overall productivity increase.

The many closures imposed by governments to contain the COVID-19 virus led to record employment declines, compounded by reductions in hours worked per job. As business output did not decline in the same proportion as hours worked, this led to an unprecedented increase in labour productivity.

Real gross domestic product (GDP) of businesses fell 2.6%, reflecting the impact of the COVID-19 pandemic in mid-March, along with other factors earlier in the quarter. Output fell in both goods-producing businesses (-1.1%) and service-producing businesses (-2.5%). The sectors most affected were arts, entertainment and recreation (-14.4%), accommodation and food services (-13.1%) and transportation and warehousing (-5.2%).

Meanwhile, hours worked in the business sector fell 5.8%, surpassing the previous record decline of 2.9% during the 2008/2009 financial crisis.

Employment fell by 4.5% and hours worked per job were down 1.4%. The number of people who held more than one job posted a historic decline (-10.4%), while the number absent without pay saw a record increase (+30.3%).

Hours worked fell at a similar pace in both goods-producing businesses (-5.9%) and service-producing businesses (-5.8%), with all major sectors showing considerable declines. The largest decreases were in accommodation and food services (-12.7%), arts, entertainment and recreation (-9.7%), real estate (-7.7%), construction (-7.5%), transportation and warehousing (-6.7%), and manufacturing (-5.8%).

Impact of the COVID-19 pandemic on hours worked in the business sector, March 2020

The estimates of hours worked in the business sector are primarily based on data from the Labour Force Survey (LFS). Note that hours worked (used to measure productivity) take into account secondary jobs, and not only the main job as in the LFS. The survey for the March reference period did not capture the significant job losses at the end of the month. To account for these, significant revisions using data from the questions added to the LFS questionnaire in April (for the March reference period) were made to the employment estimates. These revisions to the employment data are reflected in the data on hours worked and related measures (including productivity) for the first quarter of 2020.

Due to the lockdown imposed across the country as of mid-March, many workers reduced their working hours, while others worked more overtime hours. In the business sector, if we consider only those in the labour force or on paid leave, 171 million hours of work were lost in March, while 27 million hours of overtime were worked. The net effect was a loss of 144 million hours.

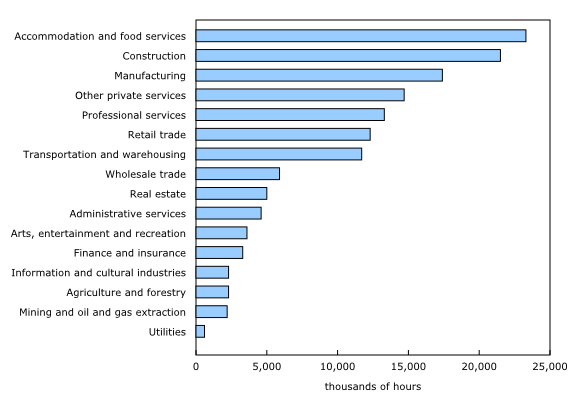

Largest loss of hours occurred in accommodation and food services

The hours lost vary according to the industrial sector. In March, 23.3 million hours were lost in accommodation and food services, the largest number of hours lost in any sector. Other sectors most affected by the loss of hours were construction (-21.5 million), manufacturing (-17.4 million), other private services (-14.7 million), retail trade (-12.3 million), and transportation and warehousing (-11.7 million).

The smallest losses in hours were recorded in utilities, the mining, quarrying, and oil and gas extraction sector, agriculture and forestry, and information and cultural industries.

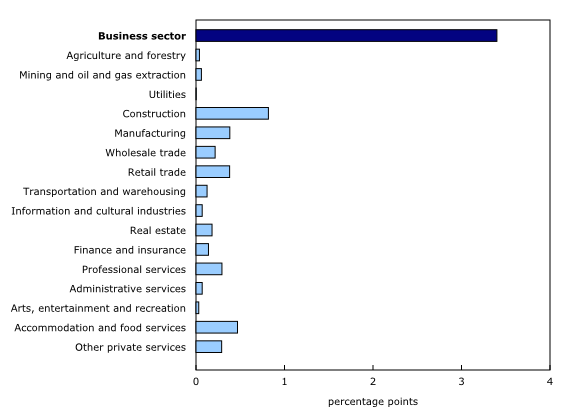

In the first quarter, productivity increased 5.1% in goods-producing businesses and 3.5% in service-producing businesses, with all main industrial sectors increasing, except for arts, entertainment and recreation (-5.2%), administrative services (-0.7%), and accommodation and food services (-0.5%). Significant increases were observed in real estate (+8.2%), construction (+8.1%), manufacturing (+3.9%) and wholesale trade (+3.7%).

The large increase in labour productivity of Canadian businesses in the first quarter may be explained in particular by two main factors. Firstly, the decline in hours worked was larger for sectors with lower productivity levels. In particular, accommodation and food services, and arts, entertainment and recreation posted large declines in hours worked in the first quarter, reducing their relative shares and resulting in an upward compositional effect in overall productivity growth.

Secondly, within business sector industries, small and medium size businesses were impacted more than larger enterprises, whose productivity benefits from economies of scale. Furthermore, self-employed workers were impacted more than paid workers by loss of hours. The resulting increases in the weight of large enterprises within industry groups may have also contributed to productivity increases in the first quarter.

In the United States, labour productivity of businesses declined 0.6% in the first quarter. Real GDP of American businesses and hours worked fell 1.5% and 1.0%, respectively.

Growth in unit labour costs remains high

Labour costs per unit of output in Canadian businesses rose 1.1% in the first quarter, a similar pace as in the previous two quarters.

This growth in unit labour costs reflected record growth in average compensation per hour worked (+4.5%), which surpassed the productivity increase (+3.4%).

Average hourly compensation grew at a similar pace in both goods-producing businesses (+4.4%) and service-producing businesses (+4.5%) in the first quarter. The largest gains were observed in accommodation and food services (+12.3%), arts, entertainment and recreation (+8.8%), transportation and warehousing (+8.2%), construction (+6.7%) and real estate (+6.5%).

After two quarters of appreciation, the average value of the Canadian dollar relative to the US dollar was down 1.8% in the first quarter. With this depreciation, unit labour costs expressed in US dollars for Canadian businesses fell 0.8%, following a 1.0% increase in the previous quarter.

By comparison, unit labour costs of American businesses rose 1.1% in the first quarter, after posting small increases in each of the previous three quarters.

Sustainable development goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The release "Labour productivity, hourly compensation and unit labour cost" is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goal:

Note to readers

Revisions

With this release on labour productivity and related measures, data were revised back to the first quarter of 2019 at the aggregate and industry levels. These revisions are consistent with those incorporated in the quarterly gross domestic product (GDP) by income and expenditure and monthly GDP by industry, released on May 29, 2020.

Productivity measures

The term productivity in this release refers to labour productivity. For the purposes of this analysis, labour productivity and related variables cover the business sector only.

Labour productivity is a measure of real GDP per hour worked.

Unit labour cost is defined as the cost of workers' wages and benefits per unit of real GDP.

The approach to measure the real output in the business sector differs from the one that is used in the estimates by industry. For the business sector, output is measured using the expenditure based GDP approach at market prices. This approach is similar to that used for the quarterly measures of productivity in the United States. However, output by industry is based on the value added at basic prices.

All the growth rates reported in this release are rounded to one decimal place. They are calculated with index numbers rounded to three decimal places, which are now available in data tables.

All necessary basic variables for productivity analyses (such as hours worked, employment, output and compensation) are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Next release

Labour productivity, hourly compensation and unit labour cost data for the second quarter will be released on September 2.

Products

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: