Canadian international merchandise trade, August 2016

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2016-10-05

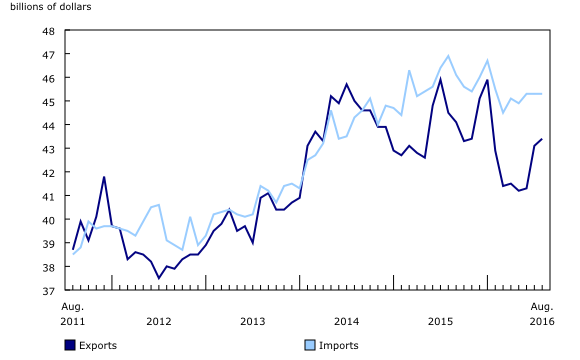

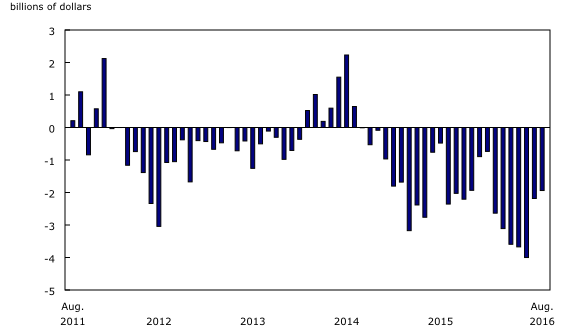

Canada's exports increased 0.6% to $43.4 billion in August. Exports volumes rose 0.4% and prices edged up 0.2%. Imports were largely unchanged at $45.3 billion in August, as a 0.8% increase in volumes was offset by a 0.7% decrease in prices. Consequently, Canada's merchandise trade deficit with the world narrowed from $2.2 billion in July to $1.9 billion in August.

Exports to countries other than the United States advance

Exports to countries other than the United States rose 7.7% to $11.0 billion in August, the largest monthly increase since May 2014. Exports to the United Kingdom contributed the most to the gain, rising $370 million on higher exports of unwrought gold. Exports to China, Norway, Switzerland and South Korea also increased in August. Imports from countries other than the United States were up 0.3% to $15.4 billion. Higher imports from the United Kingdom (+$281 million) and the Netherlands (+$69 million) were partially offset by lower imports from Mexico (-$111 million) and India (-$94 million). As a result, Canada's trade deficit with countries other than the United States narrowed from $5.2 billion in July to $4.4 billion in August.

Exports to the United States decreased 1.6% to $32.4 billion in August, while imports edged down 0.1% to $29.9 billion. Consequently, Canada's trade surplus with the United States narrowed from $3.0 billion in July to $2.5 billion in August.

Consumer goods, and metal and non-metallic mineral products lead export growth

Total exports were up 0.6% to $43.4 billion in August, with 6 of 11 sections recording gains. The overall rise was attributable to higher exports of consumer goods, metal and non-metallic mineral products, and energy products. These increases were offset by lower exports of motor vehicles and parts, and aircraft and other transportation equipment and parts. In August, exports excluding energy products were unchanged from the previous month. Year over year, total exports were down 2.5%.

Exports of consumer goods rose 7.0% to $6.3 billion in August on higher volumes. Pharmaceutical and medicinal products led the increase, up 23.7% to $1.2 billion, the highest level since January 2016. This was also their strongest monthly gain since January 2016.

Exports of metal and non-metallic mineral products, up 6.2% to $5.0 billion, also contributed to the advance in August. Increases were widespread throughout the section and were led by unwrought precious metals and precious metal alloys, up 13.0% to $1.8 billion. Higher exports of unwrought gold were mainly responsible for the gain. For the section as a whole, volumes rose 3.2% and prices were up 2.9%.

Exports of energy products also contributed to the overall increase in August, rising 4.4% to $6.0 billion on widespread gains throughout the section. This was the sixth consecutive monthly advance. Overall, volumes increased 3.4% and prices were up 1.0%.

In contrast, exports of motor vehicles and parts fell 5.8% to $7.8 billion in August, following a 7.3% increase in July. Passenger cars and light trucks were the main source of the decline, down 8.9% to $5.3 billion. This decrease coincided with atypical shutdowns at some Canadian automobile manufacturing plants in August. For the section as a whole, volumes fell 5.3% and prices were down 0.6%.

Exports of aircraft and other transportation equipment and parts also fell, down 16.2% to $1.8 billion in August. Exports of aircraft contributed the most to the decline, decreasing 34.8% to $631 million, the lowest level since January 2016.

Offsetting movements leave imports unchanged

Total imports for August were largely unchanged at $45.3 billion, as advances in five sections were offset by declines in the six remaining sections. Higher imports of metal and non-metallic mineral products, consumer goods, and motor vehicles and parts were counterbalanced by lower imports of energy products. On a year-over-year basis, imports were down 3.3%.

In August, imports of metal and non-metallic mineral products rose 8.6% to $3.8 billion, the strongest monthly gain since August 2015. Unwrought precious metals and precious metal alloys led the advance, up 52.7% to $935 million, mainly on higher imports of gold and silver. For the section as a whole, volumes rose 7.0% and prices increased 1.5%.

Imports of consumer goods rose 0.9% to $9.9 billion in August, as volumes were up 2.1%, while prices decreased 1.2%. Imports of pharmaceutical and medicinal products contributed the most to the increase, up 10.0% to $1.4 billion.

Imports of motor vehicles and parts also increased in August, up 0.8% to $9.1 billion. Passenger cars and light trucks rose 3.8% to a record high $4.3 billion in August. This gain was partly offset by imports of medium and heavy trucks, buses and other motor vehicles, which fell 16.9% to $711 million, the lowest level since December 2013. Overall, volumes were up 2.8%, while prices decreased 1.9%.

Offsetting these gains, imports of energy products fell 16.6% to $2.2 billion, following five consecutive monthly increases. Imports of crude oil and crude bitumen decreased 16.3% to $1.3 billion in August on lower volumes (-8.7%) and prices (-8.3%). Imports of refined petroleum energy products also declined, down 23.4% to $573 million, mostly on lower volumes. For the section as a whole, volumes fell 13.5% and prices decreased 3.6%.

Real trade surplus narrows in August

In real (or volume) terms, imports increased 0.8% in August as higher imports of basic and industrial chemical, plastic and rubber products, and motor vehicles and parts were moderated by lower imports of energy products. Export volumes were up 0.4%, as higher exports of consumer goods and energy products were partially offset by lower exports of motor vehicles and parts. Consequently, Canada's trade surplus with the world in real terms narrowed from $886 million in July to $740 million in August.

Revisions to July imports and exports

Revisions reflected initial estimates being updated with or replaced by administrative and survey data as they became available, and amendments made for late documentation of high-value transactions. Imports in July, originally reported as $45.2 billion in last month's release, were revised to $45.3 billion with the current month's release. Exports, originally reported as $42.7 billion in last month's release, were revised to $43.1 billion.

Note to readers

Merchandise trade is one component of Canada's international balance of payments (BOP), which also includes trade in services, investment income, current transfers, and capital and financial flows.

International trade data by commodity are available on both a BOP and a customs basis. International trade data by country are available on a customs basis for all countries and on a BOP basis for Canada's 27 principal trading partners (PTPs). The list of PTPs is based on their annual share of total merchandise trade—imports and exports—with Canada in 2012. BOP data are derived from customs data by making adjustments for factors such as valuation, coverage, timing and residency. These adjustments are made to conform to the concepts and definitions of the Canadian System of National Accounts.

For a conceptual analysis of BOP versus customs based data, see "Balance of Payments trade in goods at Statistics Canada: Expanding geographic detail to 27 principal trading partners."

For more information on these and other macroeconomic concepts, see the Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) and User Guide: Canadian System of Macroeconomic Accounts (13-606-G), available from the Browse by key resource module of our website, under Publications.

Data in this release are on a BOP basis, seasonally adjusted and in current dollars. Constant dollars are calculated using the Laspeyres volume formula (2007=100).

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Revisions

In general, merchandise trade data are revised on an ongoing basis for each month of the current year. Current year revisions are reflected in both the customs and BOP based data.

The previous year's customs data are revised with the release of the January and February reference months and on a quarterly basis. The previous two years of customs based data are revised annually and revisions are released in February with the December reference month.

The previous year's BOP based data are revised with the release of the January, February, March and April reference months. To remain consistent with the Canadian System of Macroeconomic Accounts, revisions to BOP based data for previous years are released annually in December with the October reference month.

Factors influencing revisions include the late receipt of import and export documentation, incorrect information on customs forms, replacement of estimates produced for the energy section with actual figures, changes in classification of merchandise based on more current information, and changes to seasonal adjustment factors.

For information on data revisions for crude oil and natural gas, see "Revisions to trade data for crude oil and natural gas."

Revised data are available in the appropriate CANSIM tables.

Real-time CANSIM tables

Real-time CANSIM table 228-8059 will be updated on October 17. For more information, consult the document, Real-time CANSIM tables.

Next release

Data on Canadian international merchandise trade for September will be released on November 4.

Products

Customs based data are now available in the Canadian International Merchandise Trade Database (65F0013X). From the Browse by key resource module of our website, choose Publications.

The August 2016 issue of Canadian International Merchandise Trade, vol. 70, no. 8 (65-001-X), is also available from the Browse by key resource module of our website, under Publications.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Benoît Carrière (613-415-5305; benoit.carriere@canada.ca), International Accounts and Trade Division.

- Date modified: