Canada's international investment position, first quarter 2014

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2014-06-13

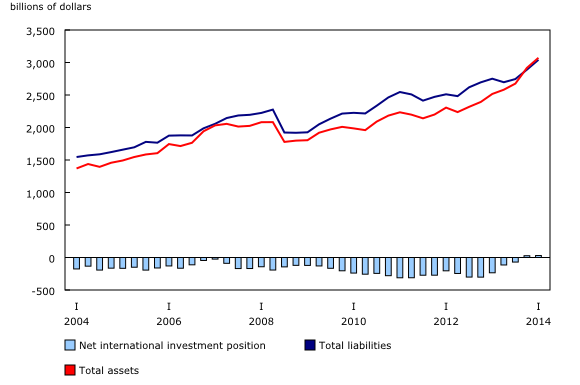

Canada's net asset position edged up by $2.5 billion to $30.2 billion in the first quarter, as both international assets and liabilities advanced. The increase in the value of Canada's foreign currency-denominated international assets reflected the effect of a weaker Canadian dollar, while liabilities held by non-resident investors were up mainly on higher Canadian equity prices.

Canada's net international investment position has trended up for five straight quarters, moving from a net debt position to a net asset position in the fourth quarter of 2013. This swing occurred despite the ongoing need to borrow funds from abroad to finance the current account deficit. Overall, the effect on international assets and liabilities of a weakening Canadian dollar, combined with the relatively strong performance of foreign equity markets over most of this period, more than offset Canada's borrowing requirements.

Increases in international assets continue to exceed those in international liabilities

Canada's international assets increased $154.7 billion to $3,072.1 billion at the end of the first quarter, mainly as a result of the upward revaluation effect of a weaker Canadian dollar on foreign currency-denominated assets. Over the quarter, the Canadian dollar lost 3.8% against the US dollar, 4.4% against the British pound, 3.8% against the euro and 5.6% against the Japanese yen. International assets also benefited from higher Canadian portfolio investment abroad in the quarter.

On the other side of the ledger, Canada's international liabilities were up by $152.1 billion to $3,041.9 billion. This change was concentrated in capital gains on non-resident holdings of Canadian equity, as the Standard and Poor's Toronto Stock Exchange composite index advanced 5.2% over the quarter. New investments placed in Canada and the upward revaluation of selected Canadian debt denominated in foreign currencies also added to the overall increase in international liabilities.

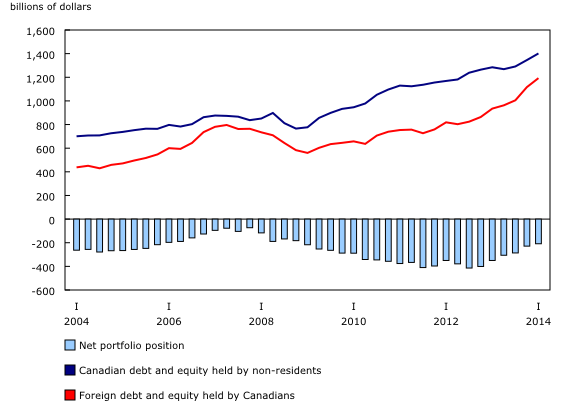

Net foreign liability position on portfolio investment declines further

Canada's net liability on cross-border holdings of securities declined for a sixth straight quarter, falling to $208.7 billion, the lowest level since the end of 2008. The largest changes in international assets and liabilities were led by capital gains.

On the asset side, Canadian holdings of foreign securities were up by $76.0 billion in the first quarter, led by the revaluation effect of the weaker Canadian dollar. These gains were supported by increased investment abroad, as the first quarter marked the largest acquisition of foreign securities by Canadian investors in more than a year.

On the liability side, foreign investors' holdings of Canadian securities increased by $55.9 billion in the first quarter. This was largely the result of upward revaluations of holdings of Canadian shares. These equity gains were moderated by lower foreign holdings of Canadian money market instruments in the quarter. Non-resident holdings of Canadian government debt securities continued to decline, mainly through retirements, in line with the overall reduction in federal government instruments outstanding.

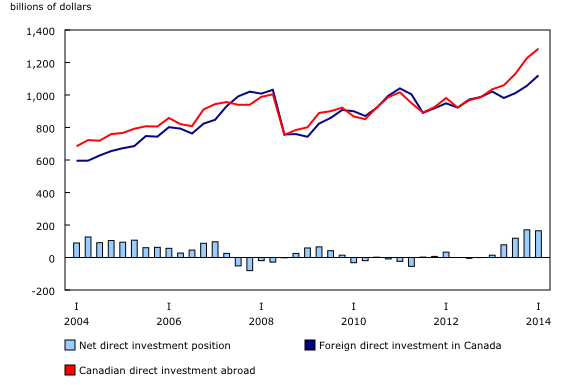

Net foreign asset position on direct investment edges down

The value of foreign direct investment in Canada was up by $64.0 billion to $1,120.8 billion in the first quarter. To a large extent, this reflected the valuation effect of a relatively strong Canadian stock market on direct investment. This increase was supported by strengthened foreign investment in Canadian enterprises. On the other hand, the value of Canadian direct investment assets abroad increased by $58.5 billion to $1,285.3 billion. The upward revaluation effect of a lower Canadian currency on these assets was the main contributor to this change.

As a result, Canada's net asset position on cross-border direct investment decreased $5.6 billion to $164.5 billion at the end of the first quarter. This followed five quarters of an increasing net balance attributable to relatively strong growth in the stock of Canadian direct investment abroad.

Note to readers

The main measure of the International Investment Position Account now incorporates market valuation for tradeable securities and foreign direct investment equity. This adds a further dimension to the analysis of Canada's net international investment position and more accurately reflects changes in that position. The international investment position at book value is still available, as the annual foreign direct investment release includes geographical and industry details. For more information see Valuation of assets and liabilities.

Currency valuation

The value of assets and liabilities denominated in foreign currency is converted to Canadian dollars at the end of each period for which a balance sheet is calculated. Most of Canada's foreign assets are denominated in foreign currencies while less than half of Canada's international liabilities are in foreign currencies. When the Canadian dollar is appreciating in value, the restatement of the value of these assets and liabilities in Canadian dollars lowers the recorded value. The opposite is true when the Canadian dollar is depreciating.

Change to annual revision practices

The Canadian System of macroeconomic accounts is implementing a new revision policy. Annual revisions for Canada's international investment position, which affect the three most recent calendar years, will take place in December rather than June, as was previously the practice. For more information, see Latest Developments in the Canadian Economic Accounts (Catalogue number13-605-X).

Definitions

The international investment position presents the value and composition of Canada's assets and liabilities to the rest of the world.

Canada's net international investment position is the difference between Canada's assets and liabilities to the rest of the world.

The excess of international liabilities over assets can be referred to as Canada's net foreign debt.

The excess of international assets over liabilities can be referred to as Canada's net foreign assets.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca).

To enquire about the concepts, methods or data quality of this release, contact Marie-Josée Lamontagne (613-951-5179; marie-josee.lamontagne@statcan.gc.ca), International Accounts and Trade Division.

- Date modified: