Canadian Agriculture at a Glance

Canada’s farms were more profitable in 2020 than in 2015

by Zong Jia Chen and Justin Clark

Skip to text

Text begins

Canada’s farms must always adapt quickly to various challenges, such as trade disputes and fluctuating prices. The COVID-19 pandemic added to these challenges in the form of labour shortages, disruptions in the food supply chain and rising input prices.

In particular, crop farms benefited from large increases in product prices in the second half of the 2020 calendar year, in part because of high-quality crops, increased global demand, and lower oil and fertilizer prices. These factors contributed to higher profit margins in the Prairie provinces in 2020 compared with 2015. Meanwhile, livestock farms faced slaughter delays because of COVID-19 outbreaks at processing facilities, which negatively influenced Canada’s livestock prices.

Despite the numerous challenges, farms in Canada were 4.0 cents per dollar more profitable on average in 2020 than in 2015. Data from the 2021 Census of Agriculture show that the expense-to-revenue ratio for farms in Canada averaged 82.9 cents per dollar in 2020, down from 86.9 cents per dollar in 2015. In other words, for every dollar of revenues earned in 2020, 17.1 cents were profit, up from 13.1 cents in 2015.

Start of text boxAll estimates related to 2015 operating revenues and expenses in this article have been adjusted to 2020 constant dollars using the Farm Product Price Index and the Farm Input Price Index, respectively. The lower the expense-to-revenue ratio, the higher the profit margin. Net operating income is the difference between total operating revenues and total operating expenses.

In Canada, 189,874 farms were counted, reporting a total of $87.0 billion in operating revenues and $72.2 billion in operating expenses in 2020. On average, the operating revenues and expenses per farm reached $458,458 and $380,175, respectively.

Information on farm operating revenues and expenses help paint a portrait of Canada’s agricultural businesses. This article sheds light on farm profitability (by revenue class, operating arrangement, total farm area and farm type) and some potential driving forces behind the profitability trends observed.

Farms with revenues of $2,000,000 and over account for over half of Canada’s total farm revenues

In 2020, over half (51.5%) of Canada’s total farm operating revenues came from just 4.1% (7,746) of farms, all of which belonged to the $2,000,000 and over revenue class. By comparison, in 2015, this revenue class provided 41.5% of Canada’s total operating revenues and comprised 2.7% (5,236) of farms.

Furthermore, farms in the top three revenue classes ($500,000 to $999,999, $1,000,000 to $1,999,999, and $2,000,000 and over) accounted for 83.2% of total operating revenues in 2020. By comparison, farms in these three revenue classes represented over three-quarters (76.6%) of total operating revenues in 2015 (Table 1).

| Revenue class | Total operating revenues | Total operating expenses | ||

|---|---|---|---|---|

| 2015 | 2020 | 2015 | 2020 | |

| percent | ||||

| Less than $100,000 | 4.7 | 3.4 | 5.6 | 4.5 |

| $100,000 to $249,999 | 7.2 | 5.2 | 7.1 | 5.3 |

| $250,000 to $499,999 | 11.5 | 8.1 | 11.0 | 7.9 |

| $500,000 to $999,999 | 17.1 | 14.1 | 16.4 | 13.5 |

| $1,000,000 to $1,999,999 | 18.0 | 17.6 | 17.3 | 16.6 |

| $2,000,000 and over | 41.5 | 51.5 | 42.6 | 52.1 |

|

Note: The sum of each column equals 100%. Sources: Statistics Canada, Census of Agriculture, 2016 and 2021 (3438). |

||||

Farms with revenues of $100,000 and over are more profitable than five years ago

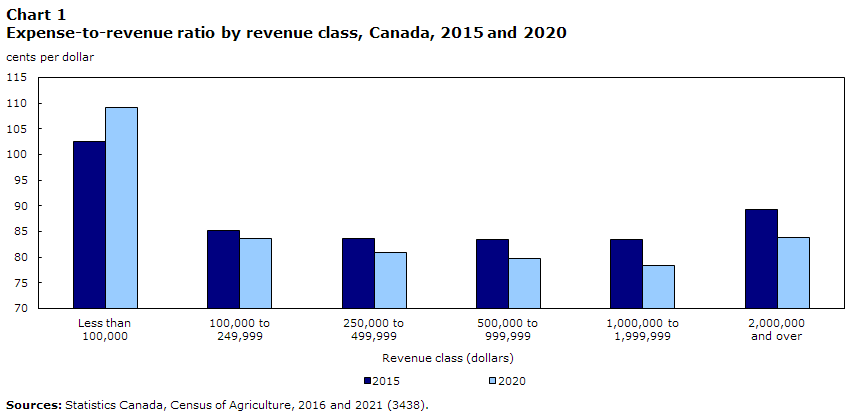

Farms in Canada with revenues of $100,000 and over reported improved expense-to-revenue ratios in 2020 compared with 2015. The magnitude of the improvement was largest for farms with revenues of $2,000,000 and over (-5.3 cents per dollar), followed by farms with revenues from $1,000,000 to $1,999,999 (-5.0 cents per dollar) (Chart 1).

Farms with revenues of less than $100,000 are not as profitable as they were five years ago

Meanwhile, farms in Canada with revenues of less than $100,000 produced profitability ratios in 2020 that were below the 2015 ratios for that same revenue class, indicating that profit margins shrank over time. This lower profitability for smaller farms could act as an entrance barrier for new farmers (Chart 1).

Data table for Chart 1

| Revenue class | Expense-to-revenue ratio | |

|---|---|---|

| 2015 | 2020 | |

| cents per dollar | ||

| Less than $100,000 | 102.6 | 109.2 |

| $100,000 to $249,999 | 85.1 | 83.5 |

| $250,000 to $499,999 | 83.6 | 80.9 |

| $500,000 to $999,999 | 83.5 | 79.7 |

| $1,000,000 to $1,999,999 | 83.4 | 78.4 |

| $2,000,000 and over | 89.2 | 83.9 |

| Sources: Statistics Canada, Census of Agriculture, 2016 and 2021 (3438). | ||

Non-family corporations are the most profitable farm operating arrangement

The most common farm operating arrangement reported is sole proprietorship, accounting for over half of farms in Canada (50.9%; 96,702 farms). In 2020, these farms reported $12.9 billion in operating revenues, $11.1 billion in operating expenses and averaged $19,468 in net operating income, with an expense-to-revenue ratio of 85.5 cents per dollar.

Conversely, non-family corporations made up 2.4% (4,591) of total farms in Canada but reported $8.2 billion and $6.7 billion in operating revenues and expenses, respectively, in 2020. As a result, non‑family corporations had the lowest expense-to-revenue ratio of 81.7 cents per dollar and had the highest average net operating income of $326,274 per farm. Non-family corporations generated nearly three-quarters (74.3%) of the amount of operating revenues that partnerships reported. However, the number of farms classified as non-family corporations were one tenth (10.2%) of the number of farms classified as partnerships (Table 2).

| Operating arrangement | Total operating revenues | Total operating expenses | Average net operating income | Expense-to-revenue ratio |

|---|---|---|---|---|

| dollars | cents per dollar | |||

| Sole proprietorship | 12,940,582,542 | 11,057,960,503 | 19,468 | 85.5 |

| Partnership | 11,044,233,367 | 9,371,222,025 | 37,129 | 84.9 |

| Family corporation | 54,581,051,580 | 44,817,123,274 | 225,844 | 82.1 |

| Non-family corporation | 8,204,400,086 | 6,706,474,196 | 326,274 | 81.7 |

| Other operating arrangements | 278,964,933 | 232,543,406 | 160,628 | 83.4 |

| Source: Statistics Canada, Census of Agriculture, 2021 (3438). | ||||

Farms with larger total land area have greater profit margins

In 2020, farms with a total land area of 2,240 acres and over accounted for less than one tenth (8.9%) of the total number of farms in Canada and contributed 37.3% ($32.5 billion) of Canada’s total operating revenues and 36.5% ($26.3 billion) of total operating expenses. The expense-to-revenue ratio for these farms was 81.1 cents per dollar.

In contrast, farms with a total land area of less than 240 acres accounted for over half (52.3%) of the total farms in Canada and contributed around one-quarter of Canada’s total operating revenues (24.9%; $21.6 billion) and expenses (26.0%; $18.8 billion). The expense-to-revenue ratio for these farms was 86.8 cents per dollar. The profit margin for farms under 240 acres was lower than farms with larger acreages (Table 3).

| Total farm area | Total operating revenues | Total operating expenses | Expense-to-revenue ratio |

|---|---|---|---|

| dollars | cents per dollar | ||

| Under 240.00 acres | 21,636,617,040 | 18,784,665,494 | 86.8 |

| 240.00 to 399.99 acres | 6,430,958,287 | 5,441,902,088 | 84.6 |

| 400.00 to 559.99 acres | 4,939,950,169 | 4,088,498,669 | 82.8 |

| 560.00 to 759.99 acres | 4,281,835,757 | 3,503,103,168 | 81.8 |

| 760.00 to 1,119.99 acres | 6,197,107,645 | 5,064,386,781 | 81.7 |

| 1,120.00 to 1,599.99 acres | 5,219,405,202 | 4,232,471,975 | 81.1 |

| 1,600.00 to 2,239.99 acres | 5,873,126,277 | 4,744,735,458 | 80.8 |

| 2,240.00 acres and over | 32,470,232,131 | 26,325,559,771 | 81.1 |

| Source: Statistics Canada, Census of Agriculture, 2021 (3438). | |||

Oilseed and grain farms are the largest and most profitable farms

Oilseed and grain farms accounted for over one-third (34.3%) of the total number of farms in Canada and led all other farm types in average farm area. In 2020, oilseed and grain farms contributed 38.6% ($33.6 billion) of the total operating revenues and 35.5% ($25.6 billion) of the total operating expenses reported by farms in Canada. Moreover, oilseed and grain farms accounted for over half (53.7%; $8.0 billion) of Canada’s total net operating income.

From 2015 to 2020, oilseed and grain farms surpassed dairy and milk farms to become the most profitable farm type in Canada, with an average expense-to-revenue ratio of 76.3 cents per dollar in 2020. This was largely because of increased crop product prices, high export demand and above-average yields resulting from favourable weather conditions. Conversely, sheep and goat farms continued to be on the lower end of profitability, with an expense-to-revenue ratio of 96.7 cents per dollar in 2020 (Table 4).

| Farm type | 2020 | 2020 | 2015 | ||

|---|---|---|---|---|---|

| Total operating revenues | Total operating expenses | Net operating income | Expense-to-revenue ratio | ||

| dollars | cents per dollar | ||||

| Oilseed and grain farming | 33,613,839,952 | 25,634,868,496 | 7,978,971,456 | 76.3 | 85.4 |

| Vegetable and melon farming | 3,830,129,023 | 3,099,656,460 | 730,472,563 | 80.9 | 83.6 |

| Fruit and tree nut farming | 1,928,709,598 | 1,612,736,001 | 315,973,597 | 83.6 | 84.3 |

| Greenhouse, nursery and floriculture production | 5,903,520,432 | 4,837,454,253 | 1,066,066,179 | 81.9 | 84.9 |

| Other crop farming | 3,881,597,625 | 3,294,032,038 | 587,565,587 | 84.9 | 85.3 |

| Beef cattle ranching and farming, including feedlots | 14,336,665,493 | 13,525,965,002 | 810,700,491 | 94.3 | 95.5 |

| Dairy cattle and milk production | 8,507,629,402 | 6,833,453,315 | 1,674,176,087 | 80.3 | 77.2 |

| Hog and pig farming | 5,703,062,950 | 5,227,063,665 | 475,999,285 | 91.7 | 92.4 |

| Poultry and egg production | 6,215,010,866 | 5,286,035,573 | 928,975,293 | 85.1 | 84.2 |

| Sheep and goat farming | 333,112,723 | 322,042,960 | 11,069,763 | 96.7 | 96.5 |

| Other animal production | 2,795,954,444 | 2,512,015,641 | 283,938,803 | 89.8 | 91.8 |

| Sources: Statistics Canada, Census of Agriculture, 2016 and 2021 (3438). | |||||

Overall farm profitability in the Prairie provinces is aided by oilseed and grain farms

Oilseed and grain farms in the Prairie provinces benefited greatly from the increase in crop prices and in the international demand for their products. Farms in the Prairie provinces were able to leverage lower fuel prices to improve profit margins. In 2021, 63.1% of Canada’s oilseed and grain farms were in Saskatchewan, Manitoba and Alberta.

In 2021, Saskatchewan was home to nearly one-third (31.4%) of Canada’s oilseed and grain farms, and these farms contributed 80.8% of the province’s total farm operating revenues. Oilseed and grain farms in Saskatchewan are the main factor behind the province having the lowest expense-to-revenue ratio (75.6 cents per dollar) among all provinces. The 2020 ratio reflected a sizable improvement of 14.2 cents per dollar over Saskatchewan’s 2015 ratio (89.8 cents per dollar). Furthermore, oilseed and grain farms enabled Saskatchewan to generate the largest total net farm operating income ($4.1 billion; 27.6% of Canada’s total) and the largest average net operating income per farm ($120,123) in Canada.

Manitoba’s average net operating income was $83,998 per farm in 2020. Manitoba’s oilseed and grain farms generated over half (52.4%) of the province’s total farm operating revenues in 2020, contributing to a provincial expense-to-revenue ratio of 85.1 cents per dollar.

Meanwhile, Alberta reported the highest total farm operating revenues among the Prairie provinces in 2020, with 40.4% of its operating revenues coming from oilseed and grain farms. Alberta farms reported an expense-to-revenue ratio of 85.5 cents per dollar, which is an improvement from the 90.8 cents per dollar ratio in 2015. This resulted in Alberta reporting an average net operating income of $77,480 per farm (Table 5).

| Geography | 2020 | 2020 | 2015 | ||

|---|---|---|---|---|---|

| Total operating revenues | Total operating expenses | Net operating income | Expense-to-revenue ratio | ||

| dollars | cents per dollar | ||||

| Newfoundland and Labrador | 153,577,942 | 129,368,431 | 24,209,511 | 84.2 | 88.6 |

| Prince Edward Island | 681,856,517 | 561,311,461 | 120,545,056 | 82.3 | 84.1 |

| Nova Scotia | 724,120,473 | 638,237,733 | 85,882,740 | 88.1 | 92.6 |

| New Brunswick | 727,984,646 | 630,886,674 | 97,097,972 | 86.7 | 80.1 |

| Quebec | 13,046,605,255 | 10,901,330,972 | 2,145,274,283 | 83.6 | 83.9 |

| Ontario | 19,719,296,233 | 16,454,681,272 | 3,264,614,961 | 83.4 | 83.2 |

| Manitoba | 8,211,011,330 | 6,989,428,657 | 1,221,582,673 | 85.1 | 86.9 |

| Saskatchewan | 16,772,920,365 | 12,673,364,913 | 4,099,555,452 | 75.6 | 89.8 |

| Alberta | 22,217,129,159 | 19,001,323,036 | 3,215,806,123 | 85.5 | 90.8 |

| British Columbia | 4,794,730,588 | 4,205,390,255 | 589,340,333 | 87.7 | 85.8 |

| Canada | 87,049,232,508 | 72,185,323,404 | 14,863,909,104 | 82.9 | 86.9 |

| Sources: Statistics Canada, Census of Agriculture, 2016 and 2021 (3438). | |||||

Dairy cattle and milk farms report the highest profit margin and average net operating income among livestock farms

On average, dairy cattle and milk farms in Canada reported operating revenues of $904,778 and operating expenses of $726,731 in 2020. This resulted in an expense-to-revenue ratio of 80.3 cents per dollar, suggesting that for every dollar of revenue earned, 19.7 cents were profit. Notably, the profit margin for dairy cattle and milk farms has decreased since 2015 by 3.1 cents per dollar, suggesting that these farms may be becoming more expensive to operate. While oilseed and grain farms benefited from increased crop prices, livestock farms faced increased feed costs that may have negatively impacted their profit margins. However, despite the increased feed costs, the average net operating income of dairy cattle and milk farms in 2020 was $178,047 per farm, the second highest among all farm types in Canada (Table 6).

| Farm type | Average operating revenues | Average operating expenses | Average net operating income |

|---|---|---|---|

| dollars | |||

| Oilseed and grain farming | 516,064 | 393,565 | 122,499 |

| Vegetable and melon farming | 754,557 | 610,649 | 143,907 |

| Fruit and tree nut farming | 271,611 | 227,114 | 44,497 |

| Greenhouse, nursery and floriculture production | 1,123,196 | 920,368 | 202,828 |

| Other crop farming | 127,224 | 107,966 | 19,258 |

| Beef cattle ranching and farming, including feedlots | 361,736 | 341,280 | 20,455 |

| Dairy cattle and milk production | 904,778 | 726,731 | 178,047 |

| Hog and pig farming | 1,890,936 | 1,733,111 | 157,825 |

| Poultry and egg production | 1,173,529 | 998,118 | 175,411 |

| Sheep and goat farming | 93,178 | 90,082 | 3,096 |

| Other animal production | 176,145 | 158,257 | 17,888 |

| Source: Statistics Canada, Census of Agriculture, 2021 (3438). | |||

Hog and pig farms report the largest average operating revenues

In 2020, hog and pig farms produced the largest average operating revenues among all farm types in Canada, with $1.9 million. However, farms with the highest operating revenues do not always end up with the highest net operating income.

The average operating expenses for hog and pig farms were $1.7 million per farm in 2020. Their expense-to-revenue ratio was 91.7 cents per dollar, a profit margin of 8.3 cents. The resulting average net operating income was $157,825 per farm (Table 6).

Greenhouse farms have the highest average net operating income

The greenhouse industry in Canada has been growing in recent years, and greenhouse, nursery and floriculture farms led all farm types in Canada in average net operating income. In 2020, these farms averaged $202,828 in net operating income per farm, followed by dairy cattle and milk farms ($178,047 per farm) and poultry and egg farms ($175,411 per farm). Additionally, greenhouse, nursery and floriculture farms netted an average of $1.1 million in operating revenues and $920,368 in operating expenses, producing an expense-to-revenue ratio of 81.9 cents per dollar. This was an improvement from 2015’s ratio of 84.9 cents per dollar.

In 2020, sheep and goat farms had the lowest net operating income among all farm types, averaging $3,096 per farm. Sheep and goat farms had the smallest operating revenues in Canada compared with other livestock farms. On average, sheep and goat farms generated $93,178 in operating revenues and $90,082 in operating expenses, producing an expense-to-revenue ratio of 96.7 cents per dollar in 2020, which was on the lower end of profitability. This ratio left just 3.3 cents of profit for every dollar of revenue earned (Table 6).

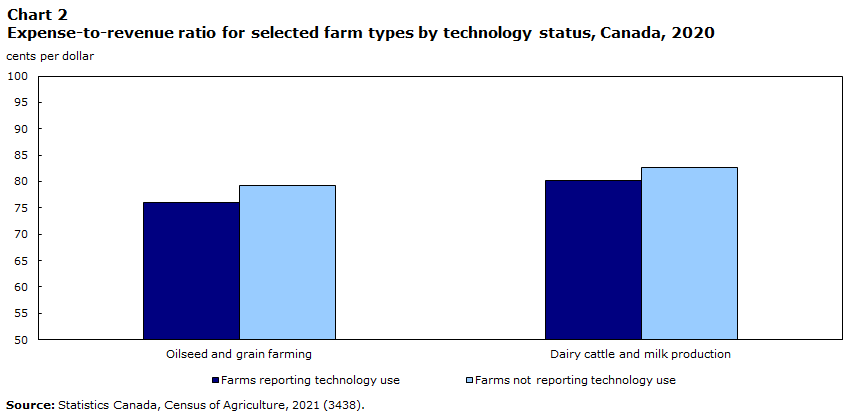

Farm technology use correlates with higher profit margins

Farms use technology to reduce labour costs and improve farming efficiencies, which may increase profitability. This can be seen when comparing the expense-to-revenue ratios of farms with and without reported technology adoption. The 2021 Census of Agriculture asked farmers to report the use of the following technologies: automated guidance steering systems (auto-steer), Geographic Information System mapping (GIS), variable-rate input application, drones, soil sample test, slow-release fertilizer, fully robotic milkers and robotic greenhouse equipment.

In 2020, over half (50.4%) of farms in Canada reported using technology. Farms that reported technology use had an average expense-to-revenue ratio of 81.5 cents per dollar, which was lower than the 88.1 cents per dollar for farms that did not report technology use. This difference suggests that farms that have implemented modern farming technologies may be directly benefiting from their investments through improved profitability ratios. Profitability was more noticeable for farms reporting technology use that had revenues of $250,000 and over in 2020.

With respect to farm type, dairy cattle and milk farms were most likely to report technology use. In 2020, 84.1% of these farms reported using at least one type of technology, and they produced the second-highest profit margin (19.9 cents per dollar) among all farm types in Canada. Specifically, dairy cattle and milk farms that reported fully robotic milkers had better expense-to-revenue ratios than dairy cattle and milk farms that did not report using this technology.

Oilseed and grain farms were the second most likely farm type to report technology use (79.2%) in 2020, and they produced the highest profit margin (23.9 cents per dollar) among all farm types in Canada (Chart 2).

Specifically, in 2020, oilseed and grain farms that used automated guidance steering systems (auto-steer) had a better expense-to-revenue ratio than oilseed and grain farms that did not report using this technology.

Data table for Chart 2

| Farm Type | Farms reporting technology use | Farms not reporting technology use |

|---|---|---|

| cents per dollar | ||

| Oilseed and grain farming | 76.1 | 79.2 |

| Dairy cattle and milk production | 80.1 | 82.8 |

| Source: Statistics Canada, Census of Agriculture, 2021 (3438). | ||

Note to readers

The Census of Agriculture is conducted every five years.

All estimates presented in this article exclude data from cannabis operations and data from Canada’s three territories.

All estimates presented in this article have not undergone random tabular adjustment.

Livestock farms include farms classified as beef cattle ranching and farming, including feedlots; dairy cattle and milk production; hog and pig farming; poultry and egg production; sheep and goat farming; and other animal production.

Definitions and concepts

Expense-to-revenue ratio

The farm expense-to-revenue ratio is the average amount of total operating expenses incurred for a dollar in total operating revenues. The 2015 ratio is calculated in 2020 constant dollars.

Farm definition

A significant conceptual change has been introduced for the 2021 Census of Agriculture: a “farm” or an “agricultural holding” (i.e., the census farm) now refers to a unit that produces agricultural products and reports revenues or expenses for tax purposes to the Canada Revenue Agency. Before 2021, a “farm” was defined as an agricultural operation that produced at least one agricultural product intended for sale.

Farm operating revenues

The Census of Agriculture collects total gross farm operating revenues (i.e., revenues before deducting expenses), in current dollars, for the calendar or accounting year before the census. Farm operating revenues include operating revenues from all agricultural products sold, program payments and custom work revenues.

The following items are not considered farm operating revenues: sales of forestry products (for example, firewood, pulpwood, logs, fence posts and pilings), sales of capital items (for example, quota, land and machinery) and revenues from the sale of any goods purchased only for retail sales.

Farm operating expenses

The Census of Agriculture collects total farm operating expenses, in current dollars, for the calendar or accounting year before the census. Farm operating expenses include any expenses associated with producing agricultural products (such as the cost of seed, feed, fuel and fertilizers).

The following items are not considered operating expenses: the purchase of land, buildings or equipment; depreciation; and capital cost allowance.

Farm type

The type of farm is established through a procedure that classifies each census farm according to the predominant type of production. This is done by estimating the potential revenues from the inventories of crops and livestock reported on the questionnaire and determining the product or group of products that makes up the majority of the estimated receipts. For example, a census farm with total potential revenues of 60% from hogs, 20% from beef cattle and 20% from wheat would be classified as a hog and pig farm. The farm types presented in this document are derived based on the 2017 North American Industry Classification System.

Price indexes

Price indexes were used to obtain constant dollar estimates of operating revenues and expenses, to eliminate the impact of price change in year-to-year comparisons. All estimates related to 2015 operating revenues and expenses in this article have been adjusted to 2020 constant dollars based on the Farm Product Price Index and the Farm Input Price Index, respectively. Index data were accessed on May 11, 2022.

Total farm area

The total farm area is the total area of land owned or operated by an agricultural operation, and it includes cropland, summerfallow, improved and unimproved pasture, woodlands and wetlands, and all other land (including idle land and land on which farm buildings are located).

- Date modified: