StatCan COVID-19: Data to Insights for a Better Canada Financial impacts of the pandemic on the culture, arts, entertainment and recreation industries in 2020

StatCan COVID-19: Data to Insights for a Better Canada Financial impacts of the pandemic on the culture, arts, entertainment and recreation industries in 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Text begins

Acknowledgements

The authors would like to thank Larry Arbenser, Jason Keats, Sylvie Lafond and Ben Veenhof for their helpful guidance in the analysis.

The culture, arts, entertainment and recreation sectors play a vital role in many communities and bring numerous socioeconomic benefits to Canadians.Note These sectors comprise businesses operating in the motion picture, sound recording, publishing, performing arts, spectator sports and related industries, as well as the amusement and recreation industries.

The COVID-19 pandemic abruptly disrupted many businesses that create and distribute arts and culture or offer recreational activities. Several arts and recreation businesses were identified as non-essential services during various waves of the pandemic and could not operate. However, like in the rest of the economy, some industries were able to adapt their business models to continue providing services during this period. In addition, the pandemic accelerated technological shifts that were already influencing large segments of the creative and recreational industries. The digitization of operations brought benefits as many businesses struggled to generate revenue, but, ultimately, for most industries in this part of the economy, close proximity and in-person interaction remain the optimal ways to deliver services and obtain revenue. Despite new operating methods and remote work, the COVID-19 pandemic has had significant financial and workforce impacts.

To estimate the financial implications of the pandemic on the culture, arts, entertainment and recreation sectors, this study examined alternative datasets that allowed for more timely financial estimates, before annual business survey estimates are available. After treatment, data from the goods and services tax (GST) and payroll deduction (PD7) files were historically comparable for most service-producing industries and acted as a coherent proxy for preliminary estimates of operating revenue and salary, wage, commission and benefit expenses for 2020.

Based on the GST data, a first paper (https://www150.statcan.gc.ca/n1/pub/45-28-0001/2021001/article/00020-eng.htm) presented preliminary operating revenue estimates for selected industries providing professional and administrative services for businesses and consumers in Canada. Despite government programs and new operating methods, financial losses resulting from the pandemic were significant for most businesses in the professional service sector.

Extensive declines for the culture, arts and recreation industries in 2020

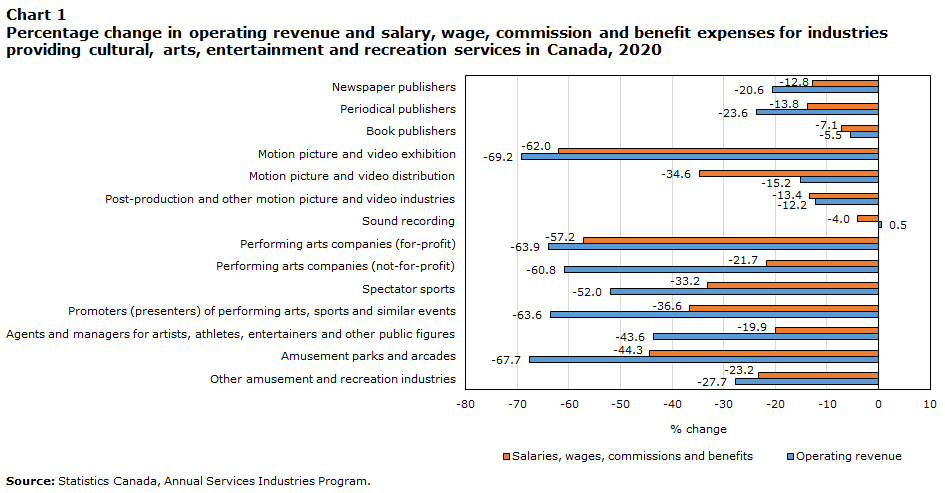

The COVID-19 pandemic has had a massive impact on the culture, arts, entertainment and recreation sectors globally and in Canada. Preliminary estimates suggest that operating revenue fell in all industries in those sectors in Canada in 2020, with the exception of the sound recording industries.Note Similarly, despite government assistance, salary, wage, commission and benefit expenses fell in all industries (Chart 1). Several factors contributed to these extensive declines, including the in-person nature of the sectors; venue closures; the cancellation of events, festivals and performances; operating restrictions; and changing consumer preferences for physically distanced, at-home and online activities.Note

Data table for Chart 1

| Operating revenue | Salaries, wages, commissions and benefits | |

|---|---|---|

| % change | ||

| Newspaper publishers | -20.6 | -12.8 |

| Periodical publishers | -23.6 | -13.8 |

| Book publishers | -5.5 | -7.1 |

| Motion picture and video exhibition | -69.2 | -62.0 |

| Motion picture and video distribution | -15.2 | -34.6 |

| Post-production and other motion picture and video industries | -12.2 | -13.4 |

| Sound recording | 0.5 | -4.0 |

| Performing arts companies (for-profit) | -63.9 | -57.2 |

| Performing arts companies (not-for-profit) | -60.8 | -21.7 |

| Spectator sports | -52.0 | -33.2 |

| Promoters (presenters) of performing arts, sports and similar events | -63.6 | -36.6 |

| Agents and managers for artists, athletes, entertainers and other public figures | -43.6 | -19.9 |

| Amusement parks and arcades | -67.7 | -44.3 |

| Other amusement and recreation industries | -27.7 | -23.2 |

| Source: Statistics Canada, Annual Services Industries Program. | ||

Digital technologies help stem the decline for cultural industries

The ability of businesses to use digital technologies alleviated some financial pressures and staffing issues as companies could continue to operate using alternative methods for cultural creation, digital distribution networks, accessibility and engagement. The digital transformation was well underway before the pandemic hit and was accelerated by changing economic conditions.

For example, video-on-demand services in the film, television and video distribution industry in Canada were one of the few revenue streams that grew from 2017 to 2019.Note As well, sales of streaming services in the sound recording and music publishing industry grew to $312.9 million in 2019, up 73.4% from 2017.Note Digital newspaper advertising sales have also been increasing since 2014, while print newspaper advertising sales have declined.Note In addition, consumers have been buying more books online—online sales of print books rose 70.2% from 2014 to 2018, while e-book sales increased 14.8%.Note However, although these digital solutions expanded outreach during the pandemic, they did not always translate into earned revenue.

A look at financial estimates for the culture sector in 2020

Book publishing suffers from the pandemic

Book publishers had relatively stable operating revenue in Canada from 2014 to 2019.Note However, the industry is evolving, as the share of digital sales of print books has been rising at the expense of sales in brick-and-mortar establishments. Reading books was a popular activity during the pandemic lockdowns, but publishers were unable to turn that into higher operating revenue. Book publishers’ operating revenue is estimated to have contracted by 5.5% in Canada in 2020, while salary, wage, commission and benefit expenses dropped 7.1%. Factors that may have affected book publishers’ operations during the pandemic include distribution supply challenges and the delay or cancellation of book launches, writers’ tours and marketing plans.Note Every province experienced a pullback, but it was generally much less than in other industries in the culture and arts sectors (Chart 2).

Data table for Chart 2

| Operating revenue | Salaries, wages, commissions and benefits | |

|---|---|---|

| % change | ||

| Newfoundland and Labrador | -20.0 | -10.1 |

| New Brunswick | -29.0 | -2.3 |

| Quebec | -2.0 | -22.5 |

| Ontario | -5.7 | -2.4 |

| Manitoba | -15.5 | -7.8 |

| Alberta | -24.1 | -7.3 |

| British Columbia | -10.6 | -0.9 |

| Canada | -5.5 | -7.1 |

|

Note: Prince Edward Island, Nova Scotia and Saskatchewan suppressed to meet the confidentiality requirements of the Statistics Act. Source: Statistics Canada, Annual Services Industries Program. |

||

Newspaper and periodical publishers: Declining trends continue through the pandemic

The financial strains of the pandemic were more significant for the other publishing industries. Operating revenue had been on a declining trend prior to the pandemic for newspaper and periodical publishers. In 2020, newspaper publishers saw an estimated decline of 20.6% in operating revenue, while it fell by 23.6% for periodical publishers. Despite reliance on the news industry for information about the pandemic, financial strains worsened for media publishers, leading companies to restructure, permanently or temporarily shut down, or modify their production schedules. Print advertising revenue was significantly affected by economic conditions and the shutdown of businesses,Note leading to significant losses in what was previously the greatest source of sales revenue for this industry.Note The reduction in foot traffic in stores and shopping centres was detrimental to periodical publishers, significantly affecting the demand chain for these publications.

However, salary, wage, commission and benefit expenses did not decline to the same extent. Because of shrinking operating revenue, newspaper and periodical publishers had already completed significant downsizing and restructuring activities in the years prior to the pandemic. These industries were also able to more easily transition to working from home and using digital delivery services. Although there were still changes to the workforce in 2020, the salary, wage, commission and benefit expenses did not contract as much as in other industries (Chart 3). The news industry relied on government assistance during the pandemic, as did many other industries.

Data table for Chart 3

| Operating revenue | Salaries, wages, commissions and benefits | |

|---|---|---|

| % change | ||

| Newspaper publishers | -20.6 | -12.8 |

| Periodical publishers | -23.6 | -13.8 |

| Source: Statistics Canada, Annual Services Industries Program. | ||

A difficult year for the motion picture and video industries in 2020

With many movie theatres closed and with changes to film festivals during the pandemic, the motion picture and video exhibition industry was significantly affected financially. Despite the emerging practice of releasing content through Internet-based streaming services,Note operating revenue for the motion picture and video exhibition industry plunged 69.2% in 2020 at the national level. Salary, wage, commission and benefit expenses fell by 62.0%, as not nearly as many employees were needed to operate physical locations.

Other segments of the motion picture sector for which financial estimates could be assessed through administrative data were also affected by pandemic conditions.Note Though many employees in these other industries could work from home, the halting of film production, closure of movie theatres and delay of film releases dampened the demand for other film and video services. The motion picture and video distribution industry saw a 15.2% decline in operating revenue in 2020, while salary, wage, commission and benefit expenses fell by a steeper 34.6%.

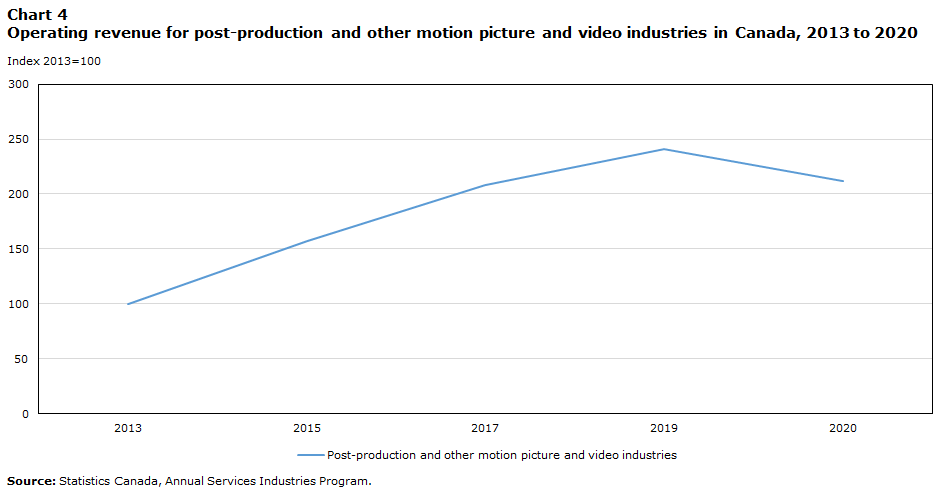

As for the post-production and other motion picture and video industries, whose operating revenue more than doubled from 2013 to 2019, preliminary estimates indicate that their financial situation deteriorated during the pandemic. Employees in these industries were able to work remotely on projects filmed before the pandemic, but pandemic disturbances to Canadian and foreign cinematography schedules led to salary, wage, commission and benefit expenses falling 13.4% in 2020, while operating revenue declined by 12.2% (Chart 4).

Data table for Chart 4

| Post-production and other motion picture and video industries | |

|---|---|

| Index 2013=100 | |

| 2013 | 100.0 |

| 2015 | 157.1 |

| 2017 | 207.7 |

| 2019 | 241.1 |

| 2020 | 211.7 |

| Source: Statistics Canada, Annual Services Industries Program. | |

Sound recording industries least affected by the pandemic in 2020

The sound recording industries were affected by the COVID-19 pandemic, although to a lesser extent than most other cultural industries in Canada. In fact, the sound recording industries as an aggregate were the only segment of the culture sector not to experience a decline in operating revenue and to hold their labour-related expenses relatively constant. The sound recording industries are segmented into record production and distribution, music publishers, sound recording studios, and other sound recording industries. While many musical groups and artists depend on live concerts and events for much of their income, this is not the case for most companies in the sound recording industries. With increasing access to music on mobile platforms, revenue from streaming services accounts for a significant part of the record production and distribution industry’s revenue. Overall, estimates suggest that with the exception of sound recording studios, all other segments experienced modest growth in operating revenue in 2020, with moderate declines in salary, wage, commission and benefit expenses (Chart 5).

Data table for Chart 5

| Operating revenue | Salaries, wages, commissions and benefits | |

|---|---|---|

| % change | ||

| Music publishers | 2.7 | -2.0 |

| Sound recording studios | -16.5 | -14.2 |

| Record production and distribution | 2.5 | -0.8 |

| Other sound recording industries | 2.0 | -4.2 |

| Source: Statistics Canada, Annual Services Industries Program. | ||

A look at the financial estimates for the arts, entertainment and recreation sector in 2020

Significant impacts for recreation service industries

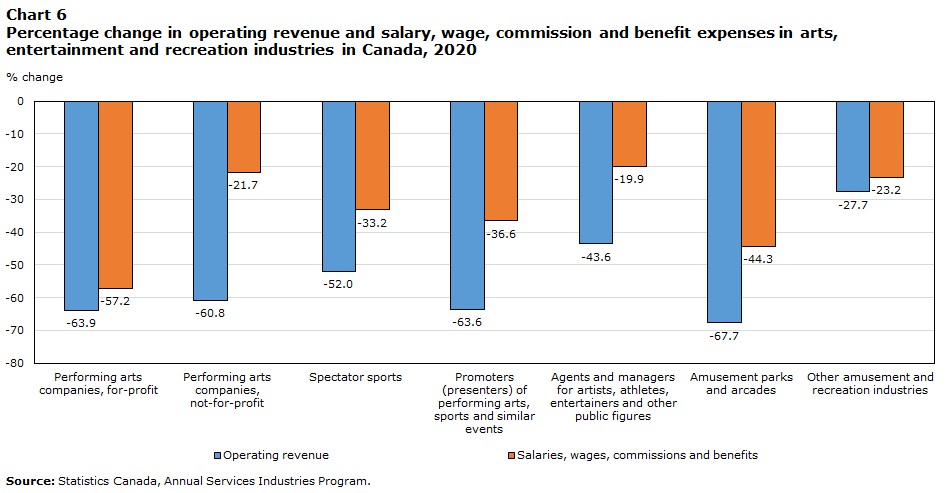

With advisories against non-essential travel, border restrictions, and strict lockdowns in several provinces and territories, the financial strains and workforce adjustmentsNote in the arts, entertainment and recreation sector were significant in 2020, with few alternatives to providing services during the pandemic. Large live events such as theatre plays, dance performances, music concerts and sports events were cancelled for the season across Canada because of business and gathering restrictions. While some businesses were able to operate in innovative alternative ways by operating digital shows, classes or events, it was not enough to mitigate the financial pressures. Preliminary estimates suggest that nearly all industries in the arts, entertainment and recreation sector generated less than half of their pre-pandemic operating revenue in 2020. However, the contraction in labour-related expenses was not as steep, owing to a number of government support programs and several grants and funding opportunities (Chart 6). Canadian workers and employers affected by the economic difficulties related to the pandemic could receive temporary benefits under a number of government support programs, including the Canada Emergency Wage Subsidy (CEWS). More than half of active businesses in the arts, entertainment and recreation sector received CEWS support in 2020.Note

Data table for Chart 6

| Operating revenue | Salaries, wages, commissions and benefits | |

|---|---|---|

| % change | ||

| Performing arts companies, for-profit | -63.9 | -57.2 |

| Performing arts companies, not-for-profit | -60.8 | -21.7 |

| Spectator sports | -52.0 | -33.2 |

| Promoters (presenters) of performing arts, sports and similar events | -63.6 | -36.6 |

| Agents and managers for artists, athletes, entertainers and other public figures | -43.6 | -19.9 |

| Amusement parks and arcades | -67.7 | -44.3 |

| Other amusement and recreation industries | -27.7 | -23.2 |

| Source: Statistics Canada, Annual Services Industries Program. | ||

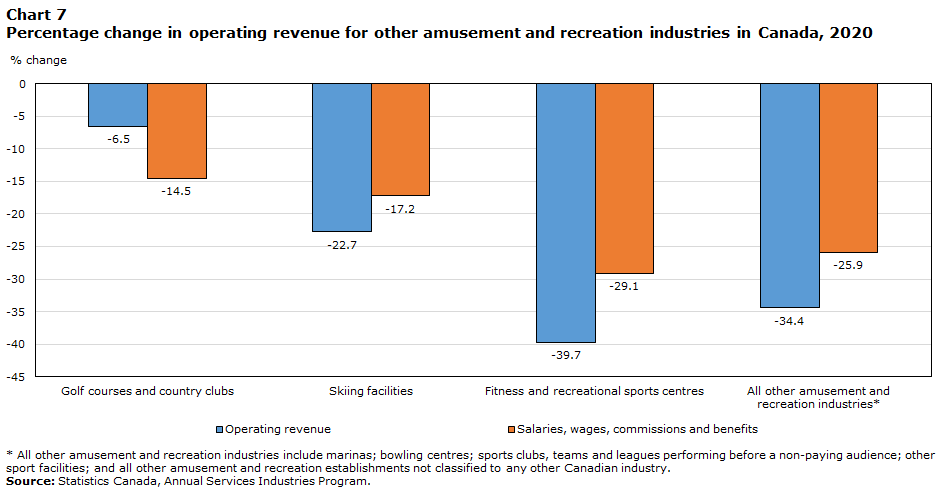

A few recreation industries fared relatively better. The other amusement and recreation industries grouping, which includes golf courses and country clubs, skiing facilities, marinas, and fitness and recreational sports centres, lost just over one-quarter of its operating revenue in 2020 (-27.7%), and its labour-related expenses fell 23.2%. In particular, the golf courses and country clubs industry experienced even smaller declines in financial standing (Chart 7). Golf courses and country clubs benefited from an increase in rounds played but were nevertheless affected by pandemic protocols on social events and indoor public gatherings.Note

Data table for Chart 7

| Operating revenue | Salaries, wages, commissions and benefits | |

|---|---|---|

| % change | ||

| Golf courses and country clubs | -6.5 | -14.5 |

| Skiing facilities | -22.7 | -17.2 |

| Fitness and recreational sports centres | -39.7 | -29.1 |

| All other amusement and recreation industriesNote * | -34.4 | -25.9 |

|

||

Conclusion

The pandemic created a difficult environment for businesses in the culture, arts, entertainment and recreation sectors, but at the same time accelerated digital trends. Nonetheless, the financial and workforce impacts were significant. Preliminary estimates suggest that, with the exception of the sound recording industries, operating revenue fell in all industries, with most losing more than half of their operating revenue in 2020. However, the contraction in labour-related expenses in several industries was not as steep, owing to a number of wage subsidy support programs.

Challenges remain for the culture, arts, entertainment and recreation sectors. In its April 2021 budget, the federal government earmarked close to $800 million in specific funding to help rebuild the sectors, complementing the relief programs already in place.Note It is unclear how many workers and businesses will remain active in the creative and recreation sectors once restrictions are lifted. The pandemic has led many workers to reconsider their careers, with as many as one in four Canadians thinking of changing jobs.Note There is also uncertainty as to what consumer activities, habits and spending will look like and whether increasing digital reliance will be permanent.

Many performing arts industries will be among the last to reopen, and it may take significant time before audiences, visitors and tourists return and companies can resume operating at the same scale as before the pandemic. For other industries that were already restructuring before the pandemic, such as newspaper publishers, the pandemic has further exacerbated a downward trend in operating revenue and labour expenses. These industries may not rebound similarly as other culture and arts industries.

- Date modified: