StatCan COVID-19: Fallout from the COVID-19 pandemic: A look back at selected industries in the service sector in 2020

StatCan COVID-19: Fallout from the COVID-19 pandemic: A look back at selected industries in the service sector in 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Skip to text

Acknowledgements

The authors would like to thank Larry Arbenser, Jason Keats and Ben Veenhof for their helpful guidance in the analysis.

In Canada, the COVID-19 pandemic affected economic activity the most in the accommodation services, food services, travel-related and cultural industries.Note Mandatory shutdowns, border closures and stay-at-home guidance reduced the demand for tourism-related services for most of 2020 and prevented these industries from operating at capacity. As well, the pandemic-induced recession disrupted business activity broadly in other service industries, including professional and administrative services for businesses and consumers.

Many businesses suffered financial setbacks even after restrictions were lifted. Businesses in service industries adapted their operating methods, increased their use of digital technologies, prioritized working from home, delivered services through alternate means, and relied on government programs to continue to operate. Roughly two-thirds of approved Canada Emergency Wage Subsidy claims in 2020 were made by businesses in service industries.Note Nevertheless, the financial losses resulting from the COVID-19 pandemic are significant. Using alternative data sources and methods, this study gives an overview of preliminary operating revenue estimates for key selected industries providing professional and administrative services for businesses and consumers in Canada in 2020.Note These estimates help explore trends in a more timely manner while the information is still current, but before the actual estimates are available.

Data and methods

Financial data for service industry groupings, including operating revenue statistics, are usually obtained through detailed annual business surveys that are not finalized yet for 2020. As a timelier alternative, this study used data from administrative datasets, such as goods and services tax (GST) data, to estimate operating revenue for 2020 (Chart 1). For several industries providing professional and administrative services for businesses and consumers, the GST data after validation were historically comparable, reliable and a high-quality coherent proxy for preliminary estimates of operating revenue for 2020.Note A second paper will present the findings for other service-sector industries, such as arts and cultural industries.

Data table for Chart 1

| % change | ||

|---|---|---|

| Software publishers | 18.7 | 16.3 |

| Data processing, hosting and related services | 22.0 | 14.7 |

| Accounting, tax preparation, bookkeeping and payroll services | 5.2 | 2.6 |

| Engineering services | 12.6 | 1.1 |

| Management, scientific and technical consulting services | 5.3 | -3.2 |

| Architectural services | 2.4 | -4.0 |

| Surveying and mapping services | 2.1 | -9.1 |

| Employment services | 8.1 | -10.7 |

| Specialized design services | 3.2 | -12.6 |

| Commercial and industrial machinery and equipment rental and leasing services | 2.1 | -16.2 |

| Consumer goods and general rental | 5.9 | -22.5 |

| Accommodation services | 4.7 | -46.1 |

| Travel arrangement services | 4.4 | -61.5 |

| Source: Statistics Canada’s Annual services industries program | ||

Professional business services: Mixed outcomes

Many professional service providers were deemed non-essential in large parts of Canada at the onset of the COVID-19 pandemic and could not operate in person or with people in close proximity to each other until conditions were loosened in May and June 2020. Pent-up demand spurred recovery for several service industries, while uncertain economic conditions and ongoing restrictions limited the rebound and economic activity for others.

Spurred by large-scale projects, engineering services continue to grow

Engineering services are one of the largest employers in professional services,Note offering some of the highest-paying jobsNote in the country. Despite the pandemic altering development plans for ongoing projects, development sites facing mandatory shutdowns and some investment plans being delayed indefinitely, estimates suggest that operating revenue for engineering services rose 1.1% in 2020 after a 12.6% bounce-back in 2019. Large-scale developments for the emerging liquefied natural gas industry and public infrastructure projects helped support growing demand for engineering services. Looking forward, engineering services should benefit from the broader economic recovery in 2021, as well as a 7.5% increase in non-residential investment intentions.Note

Architectural services hindered by the COVID-19 pandemic

In 2019, architectural services posted its weakest growth (+2.4%) in operating revenue in six years. Estimates indicate that this weakening trend accelerated in 2020. Low interest rates spurred an increase in new residential construction,Note but architectural services were limited by restrictions on non-essential services at the height of the pandemic and investment in non-residential building construction was lower,Note leading to a 4.0% drop in operating revenue in 2020 in this industry.

Surveying and mapping services take a step back

On a path to recovery since 2016 after the energy-sector investment bust in 2015, surveying and mapping services faced a decline in operating revenue of just under 10% in 2020. Activities in the surveying and mapping services industry are typically influenced by the oil and gas industry and developments in the commercial and industrial sectors, as well as residential construction. Those sectors faced mixed outcomes in 2020, with residential investment rising by almost 10%Note but non-residential investment in the oil and gas sector dropping by nearly 40%.Note

Specialized design services see operating revenue decline to lowest level since 2015

Specialized design services also experienced a drop in operating revenue during the COVID-19 pandemic in 2020 as some interior design projects in public and commercial spaces were put on hold. Many areas of the industry rely on a high level of in-person interaction, as well as freelance-type work. According to first estimates, the pullback in 2020 was a pronounced double-digit decline (-12.6%), the lowest level of operating revenue for this industry since 2015.

Accounting services weather the steepest recession in decades

The operating revenue of accounting services is estimated to have grown at a more modest pace than in previous years, by just under 3% in 2020. The industry saw fluctuating trends throughout 2020 as the Canada Revenue Agency extended the tax filing deadline to June 30, 2020, and the payment deadline to September 30, 2020. But generally, because many government programs for businesses were quickly put in place to alleviate some of the operational pressures of the shutdowns and restrictions, many businesses needed the support of professional services such as accounting services during the pandemic. More than $68 billion in Canada Emergency Wage Subsidy claims were approved in 2020,Note and the federal government put in place several other new programs to provide financial support, loans and access to credit.

Informatics services continue to thrive as technological changes accelerate during the pandemic

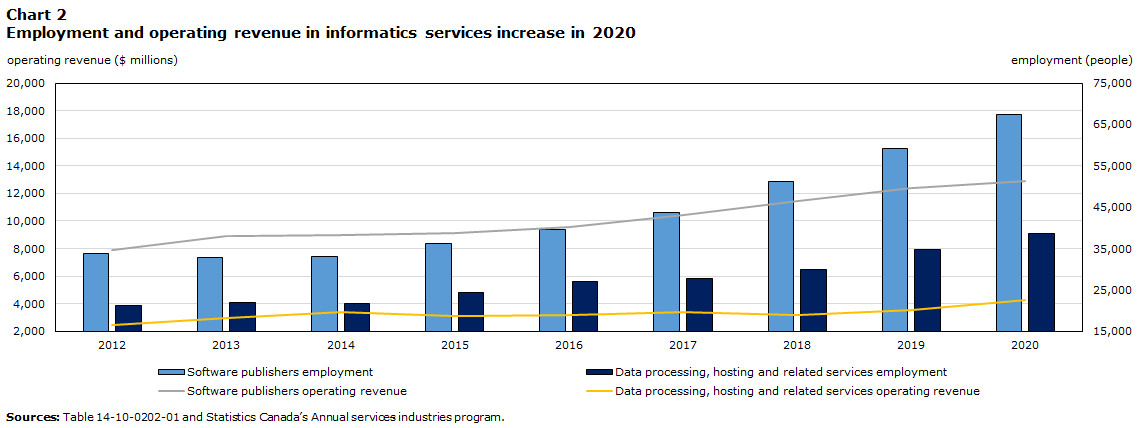

Following the upward trend of the last several years, software publishers saw an increase of 16.3% in operating revenue in 2020, while operating revenue rose by 14.7% for data processing, hosting and related services. These service industries benefited from the acceleration of technological changes during the pandemic, including Canadian businesses’ growing use of the cloud and artificial intelligence, as well as an increasingly digital business environment. Software publishers and data processing, hosting and related services are two of the few industries in Canada that added workers to payrolls in 2020Note (see Chart 2).

Data table for Chart 2

| Operating revenue | Employment | |||

|---|---|---|---|---|

| Software publishers employment | Data processing, hosting and related services employment | Software publishers operating revenue | Data processing, hosting and related services operating revenue | |

| $ millions | people | |||

| 2012 | 7,669.00 | 3,872.10 | 34,628 | 16,493 |

| 2013 | 7,376.50 | 4,080.40 | 38,087 | 18,227 |

| 2014 | 7,408.00 | 4,037.00 | 38,296 | 19,624 |

| 2015 | 8,330.10 | 4,778.20 | 38,787 | 18,652 |

| 2016 | 9,414.80 | 5,594.00 | 40,172 | 19,041 |

| 2017 | 10,579.70 | 5,818.40 | 43,050 | 19,601 |

| 2018 | 12,859.00 | 6,507.00 | 46,434 | 18,923 |

| 2019 | 15,264.70 | 7,940.50 | 49,684 | 20,157 |

| 2020 | 17,752.85 | 9,107.75 | 51,259 | 22,509 |

| Sources: Table 14-10-0202-01 and Statistics Canada’s Annual services industries program. | ||||

Administrative and support services significantly affected

While some professional service industries were able to increase their operating revenue despite the COVID-19 pandemic, many industries providing administrative and support services were more heavily affected by the changes in the economy.

Employment services' operating revenue down in 2020

The employment services industry comprises employment placement agencies and executive search services, temporary help services, and professional employer organizations. In 2020, the COVID-19 pandemic led to business closures in all sectors,Note and the unemployment rate jumped to 9.5%, as 986,400 Canadians lost their jobs.Note Changes to the way businesses operate, as well as border restrictions on the movement of temporary foreign workers who rely on placement agencies, pushed down operating revenue for the industry by 11% in 2020 after several years of strong growth.

Tourism-related services take a big fall

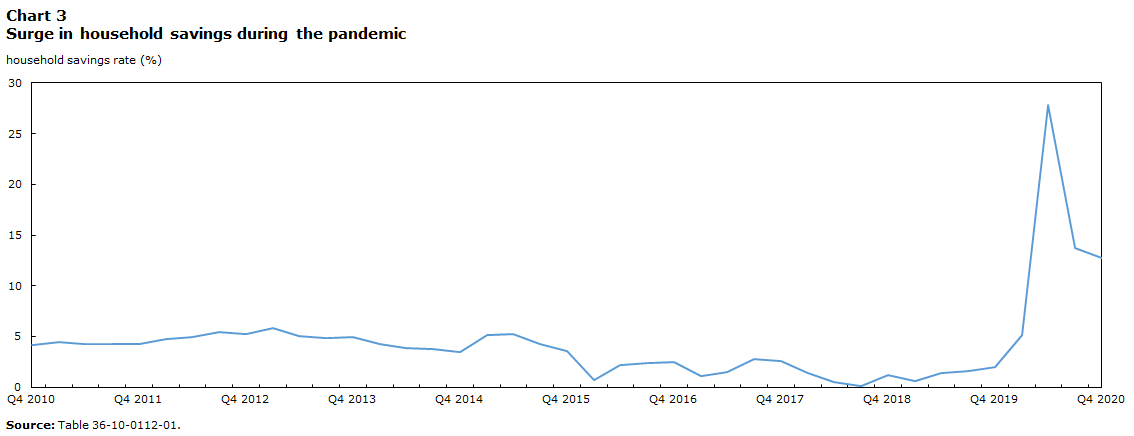

With advisories against non-essential travel, border restrictions, and strict lockdowns in several provinces and territories, the operating revenue of travel arrangement and reservation services plummeted by 61.5% in 2020. The accommodation services industry was also severely affected, as operating revenue fell by almost half (-46.1%) in 2020. Despite the build-up in household savings,Note the recovery of hospitality industries will be largely influenced by people’s readiness to travel and the reopening of international and interprovincial borders (see Chart 3).

Data table for Chart 3

| Household savings rate | |

|---|---|

| percent | |

| 2010 | |

| Q4 | 4.2 |

| 2011 | |

| Q1 | 4.5 |

| Q2 | 4.3 |

| Q3 | 4.3 |

| Q4 | 4.3 |

| 2012 | |

| Q1 | 4.7 |

| Q2 | 4.9 |

| Q3 | 5.4 |

| Q4 | 5.2 |

| 2013 | |

| Q1 | 5.8 |

| Q2 | 5.0 |

| Q3 | 4.8 |

| Q4 | 4.9 |

| 2014 | |

| Q1 | 4.3 |

| Q2 | 3.9 |

| Q3 | 3.8 |

| Q4 | 3.5 |

| 2015 | |

| Q1 | 5.1 |

| Q2 | 5.2 |

| Q3 | 4.3 |

| Q4 | 3.6 |

| 2016 | |

| Q1 | 0.7 |

| Q2 | 2.2 |

| Q3 | 2.4 |

| Q4 | 2.5 |

| 2017 | |

| Q1 | 1.1 |

| Q2 | 1.5 |

| Q3 | 2.8 |

| Q4 | 2.6 |

| 2018 | |

| Q1 | 1.4 |

| Q2 | 0.5 |

| Q3 | 0.1 |

| Q4 | 1.2 |

| 2019 | |

| Q1 | 0.6 |

| Q2 | 1.4 |

| Q3 | 1.6 |

| Q4 | 2.0 |

| 2020 | |

| Q1 | 5.1 |

| Q2 | 27.8 |

| Q3 | 13.7 |

| Q4 | 12.7 |

| Source: Table 36-10-0112-01. | |

Conclusion

The Canadian economy is growing again—however, not every industry is benefiting. In general, businesses in the service sector are still contending with uncertainty and a shift in consumer demand even as the vaccination rollout is underway. The COVID-19 variants, the timeliness of vaccine deployment and the way consumers spend their accumulated savings will shape the broad-based recovery of the service sector in 2021. Furthermore, the recovery also depends on what will be the new normal after the pandemic, as businesses and consumers adjust. It is possible that the operating revenue of some service-sector industries never fully recovers. Many service industries may also face labour shortages, further limiting the recovery potential of this part of the economy.

- Date modified: