StatCan COVID-19: Data to Insights for a Better Canada Postsecondary education planning before and during the COVID-19 lockdown

StatCan COVID-19: Data to Insights for a Better Canada Postsecondary education planning before and during the COVID-19 lockdown

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

by Aneta Bonikowska and Marc Frenette

Text begins

This article provides disaggregated data to better understand the impact of COVID-19 on specific groups. Visit the Gender, Diversity and Inclusion Statistics Hub for more analysis, including disaggregated data on labour, public safety, health and more.

The COVID-19 pandemic has led to a rapid and substantial increase in unemployment and to uncertainty about future job prospects. Despite this increased uncertainty, parents’ expectations that their children will pursue postsecondary studies remained high during the lockdown—91.7% of children whose parents were surveyed in May or June 2020 were expected to pursue some type of postsecondary education, compared with 93.9% of children whose parents were surveyed in February or by March 13, 2020.Note Little to no change in expectations was observed across a wide spectrum of child characteristics, such as age, parental education, immigrant status and household income.

Among children whose parents expected them to pursue a postsecondary education, those whose parents were surveyed before and during the COVID-19 lockdown also did not differ much in the likelihood of having had savings already put aside for their postsecondary education.Note The pandemic appears to have created more polarized expectations about future savings among children whose parents have not yet begun saving for their children’s postsecondary education. During the lockdown, 54.4% of children had parents who said they planned to save in the future, compared with 46.2% of those whose parents were surveyed before mid-March (Chart 1). At the same time, the share of children whose parents reported that they did not expect to save also increased, from 18.3% to 24.8%. Conversely, the share of children with parents who did not know whether they would save in the future declined (from 35.5% to 20.9%). These gaps remained statistically significant, even after accounting for differences in parental education, immigrant status, the child’s age and household income.

Data table for Chart 1

| Before lockdown | During lockdown | Difference | |

|---|---|---|---|

| percent | |||

| Started saving | 72.30 | 70.20 | -2.10 |

| Had not saved, expected to save in the future |

46.20 | 54.40 | 8.20Note * |

| Had not saved, did not expect to save |

18.30 | 24.80 | 6.50Note * |

| Had not saved, did not know if will save |

35.50 | 20.90 | -14.70Note *** |

** significantly different than zero (p < 0.01) Note: Statistical significance is shown for the differences only. Plans for future savings are expressed as the percentage of children whose parents had not yet started saving. Source: Statistics Canada, Survey of Approaches to Educational Planning, 2020. |

|||

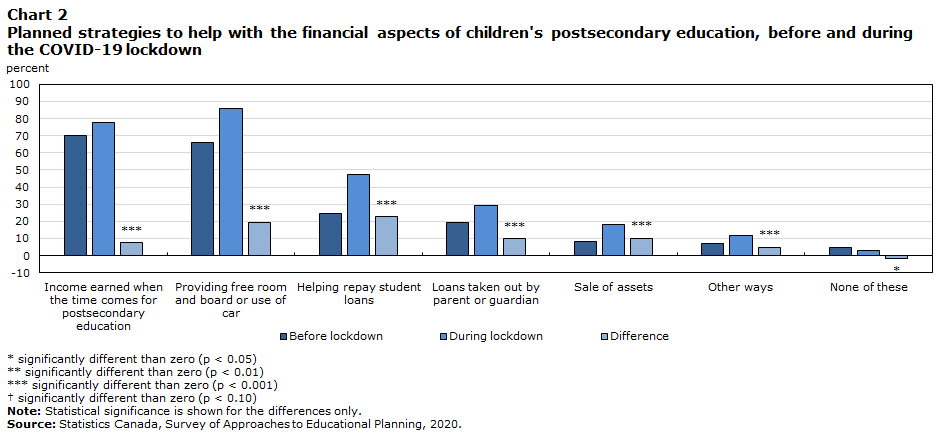

Regardless of whether they had already started saving for their children’s postsecondary education, or whether they planned to in the future, parents planned to help financially in a variety of other ways. In fact, during the lockdown, parents reported more ways in which they planned to help with their children’s postsecondary education (Chart 2). For example, a larger percentage of children had parents who were willing to help them with free room and board or with the use of a car during the lockdown (85.6%) than before the lockdown (66.1%). Before the lockdown, 24.8% of children had parents who planned to help them with their student loans—a figure that rose to 47.5% during the lockdown. Some children had parents who were even enticed to take out loans of their own to help their children—the share rising from 19.4% prior to the lockdown to 29.3% during the lockdown. While relatively few parents were able and willing to sell their own assets to help pay for their children’s postsecondary education, the share more than doubled after the lockdown began (from 8.0% to 18.2%). A small increase in the share of children whose parents planned to use income earned when the time for postsecondary education comes was also observed (from 70.4% to 77.9%).

Data table for Chart 2

| Before lockdown | During lockdown | Difference | |

|---|---|---|---|

| percent | |||

| Income earned when the time comes for postsecondary education | 70.4 | 77.9 | 7.5Note *** |

| Providing free room and board or use of car | 66.1 | 85.6 | 19.5Note *** |

| Helping repay student loans | 24.8 | 47.5 | 22.7Note *** |

| Loans taken out by parent or guardian | 19.4 | 29.3 | 9.9Note *** |

| Sale of assets | 8.0 | 18.2 | 10.2Note *** |

| Other ways | 6.8 | 11.9 | 5.0Note *** |

| None of these | 4.7 | 3.1 | -1.6Note * |

** significantly different than zero (p < 0.01) Note: Statistical significance is shown for the differences only. Source: Statistics Canada, Survey of Approaches to Educational Planning, 2020. |

|||

In summary, the uncertainty created by the COVID-19 pandemic did not dampen parental expectations that their children will pursue postsecondary studies. Instead, parents were considering a broader range of ways in which to help their children finance their postsecondary education. Parents who had not previously saved for their child’s education reported more polarized expectations about saving in the future. However, parents also reported having considered a wider variety of other approaches to help pay for their child’s education (compared with before the COVID-19 lockdown), e.g., providing free room and board or the use of a car, helping repay student loans or taking out loans of their own, selling assets, using income earned when the time comes for postsecondary education, or using other methods. Collectively, these results highlight the importance that parents place on postsecondary education for their children, regardless of the economic climate.

References

Bonikowska, A., and M. Frenette. 2021. Impact of COVID-19 on Parental Expectations, Savings Intentions and Other Plans to Financially Support Children’s Postsecondary Education. Economic and Social Reports, Vol. 1, No. 1. Statistics Canada Catalogue no. 36-28-0001. Ottawa: Statistics Canada.

- Date modified: