Economic and Social Reports

Impact of COVID-19 on parental expectations, savings intentions and other plans to financially support children’s postsecondary education

DOI: https://doi.org/10.25318/36280001202100100003-eng

Skip to text

Text begins

Abstract

This Insights article examines changes in parental expectations—between before and after the beginning of the COVID-19 lockdown—that their children will pursue postsecondary education. It also looks at the various ways in which parents plan to help their children financially, for example, by putting aside savings for their children’s postsecondary education; offering them free room and board when they are attending a postsecondary institution; or, later still, helping to repay their student loans. The analysis in this study is based on data from the 2020 Survey of Approaches to Educational Planning, which was conducted both before and during the lockdown.

Authors

Aneta Bonikowska and Marc Frenette are with the Social Analysis and Modelling Division, Analytical Studies Branch at Statistics Canada.

Introduction

The COVID-19 pandemic has created high levels of uncertainty among postsecondary students. Between late April and early May 2020, 49% of postsecondary students who responded to a crowdsourcing initiative and who had job prospects at the beginning of March had lost their job prospects (Statistics Canada 2020). Moreover, a recent study estimated that the 2020 graduate cohort could lose $25,000 or more in earnings, over the next five years, as a result of the COVID-19-related economic downturn (Frenette, Messacar and Handler 2020). There are also potential academic repercussions, given that 11% of crowdsourcing respondents indicated that they were not able to complete their credential as planned (Statistics Canada 2020).

Could the academic implications of COVID-19 be even farther reaching? Specifically, could the pandemic also affect the likelihood of younger children enrolling in and completing postsecondary education? Job losses, limited childcare options and fear of returning to work in the COVID-19 era could limit the ability of parents to save for their children’s postsecondary education, in both the short and the long term. This is an important consideration, since it has been shown that the presence of savings in a Registered Education Savings Plan account is positively correlated with youth participation in postsecondary studies, even after taking into account differences in parental income and education and the child’s high-school marks and standardized test scores (Frenette 2017).

This study looks at whether parental expectations of their children to attain further education and their plans for helping their children with the financial aspects of postsecondary education—through savings and other means—have changed since the arrival of COVID-19. The analysis is based on the Survey of Approaches to Educational Planning (SAEP), conducted between February 2 and June 20, 2020. The sample includes children aged 17 and younger who had not yet started any postsecondary education and whose parent or legal guardian responded to the survey. Parental expectations and planned strategies to help finance the children’s postsecondary studies are compared for childrenNote whose parentsNote were surveyed during the period up to and including March 13, 2020 (referred to in this article as “before the lockdown”), and those whose parents were surveyed in May or June 2020 (during the lockdown).Note

Some of the differences in observed outcomes between the pre-lockdown and lockdown periods may have resulted from differences in the characteristics of the survey respondents interviewed in these two time periods. Indeed, parents surveyed during the lockdown were less likely to have a university degree, less likely to be immigrants, somewhat less likely to have high household incomeNote and somewhat more likely to have a very young childNote (Table A.1 in the appendix). The estimates presented in this study are those observed in the data, i.e., unadjusted; however, a multivariate approach was also used to obtain estimates adjusted for differences in these characteristics, and the results are discussed where appropriate.Note

Parental expectations regarding children’s educational attainment remained high several weeks into the COVID-19 lockdown

Parents’ expectations that their children will pursue postsecondary studies remained high during the lockdown—91.7% of children whose parents were surveyed in May or June 2020 were expected to pursue some type of postsecondary education, compared with 93.9% of children whose parents were surveyed before mid-March (Table 1). Given the increased economic uncertainty brought about by COVID-19, one may have expected a decrease in parental expectations, particularly among lower-income parents or parents of high-school-aged children. The observed drop, while statistically significant, is modest in magnitude.

Table 1

| Before lockdown | During lockdown | Difference | |

|---|---|---|---|

| percent | percentage points | ||

| Overall | 93.9 | 91.7 | -2.3Note * |

| Equivalent household income quartile | |||

| First (bottom) | 88.4 | 85.4 | -1.3 |

| Second | 95.0 | 90.9 | -4.1Note * |

| Third | 95.2 | 94.9 | -0.3 |

| Fourth (top) | 96.9 | 95.4 | -1.5 |

| Highest level of completed education of responding parent | |||

| Less than high school | 75.6 | 74.2 | -1.3 |

| High school diploma or equivalent | 90.5 | 83.3 | -7.3Note * |

| Non-university postsecondary | 95.3 | 94.3 | -1.0 |

| University degree | 96.2 | 96.3 | 0.1 |

| Immigrant status of responding parent | |||

| Immigrant | 96.1 | 92.4 | -3.7Table 1 Note † |

| Canadian-born | 92.6 | 91.5 | -1.1 |

| Child's age | |||

| 0 to 5 | 91.1 | 90.4 | -0.6 |

| 6 to 12 | 94.8 | 92.4 | -2.4 |

| 13 to 17 | 95.5 | 91.9 | -3.6Note * |

| number | |||

| Sample size | 4,240 | 2,149 | Note ...: not applicable |

... not applicable

*** significantly different than zero (p < 0.001) Note: Statistical significance is shown for the differences only. Source: Statistics Canada, Survey of Approaches to Educational Planning, 2020. |

|||

Expectations about children’s postsecondary education increase with household income and parental education and are somewhat higher among immigrants than among Canadian-born parents. However, little to no change in expectations was observed across these characteristics before and after the beginning of the COVID-19 lockdown. This was the case even among children whose responding parents had characteristics typically associated with lower levels of postsecondary expectations (e.g., those with a lower income or less than a high school diploma). There was essentially no difference in expectations for young children; however, a small, but statistically significant, drop in expectations was observed among high-school-aged children.Note

The analysis in the remainder of this study focuses only on children whose parents had expressed an expectation that the children will pursue postsecondary studies.

Reported plans to save for the children’s postsecondary education became more polarized during the lockdown

The presence of savings for children’s education increases with household income and parental education and is also, on average, higher among children with an immigrant responding parent than a Canadian-born responding parent. However, the differences were not significant between children whose parents were surveyed before and during the COVID-19 lockdown, in terms of whether these parents had started saving for their children’s postsecondary education. Although the lockdown may have created concerns among parents about their children’s ability to pay for a postsecondary education, because of reduced youth employment opportunities (Frenette, Messacar and Handler 2020), it may also have limited their ability to put money aside because of their own economic insecurity. In addition, many children in the study were several years away from reaching the age to attend postsecondary institutions.

In contrast, a shift in stated intentions to save in the future emerged during the pandemic. Among children whose parents had not yet started saving for postsecondary studies, parental savings intentions became more polarized since the lockdown began. More children had parents who expected to save in the future, as well as parents who did not expect to do so. During the lockdown, 54.4% had parents who said they expected to save in the future, compared with 46.2% of those whose parents were surveyed before mid-March (Chart 1). At the same time, there was an increase in the share of children whose parents indicated no plans to save in the future (from 18.3% to 24.8%). Conversely, the share of children with parents who did not know whether they would save in the future declined (from 35.5% to 20.9%). This increased polarization in parents’ intentions for future savings remained similar in magnitude and statistically significant even after accounting for differences in parental education, immigrant status, the child’s age and household income.

Chart 1

Data table for Chart 1

| Before lockdown | During lockdown | Difference | |

|---|---|---|---|

| percent | |||

| Started saving | 72.3 | 70.2 | -2.1 |

| Had not saved, expected to save in the future |

46.2 | 54.4 | 8.2Note * |

| Had not saved, did not expect to save |

18.3 | 24.8 | 6.5Note * |

| Had not saved, did not know if will save |

35.5 | 20.9 | -14.7Note *** |

† significantly different than zero (p < 0.10) Note: Statistical significance is shown for the differences only. Plans for future savings are expressed as the percentage of children whose parents had not yet started saving. Source: Statistics Canada, Survey of Approaches to Educational Planning, 2020. |

|||

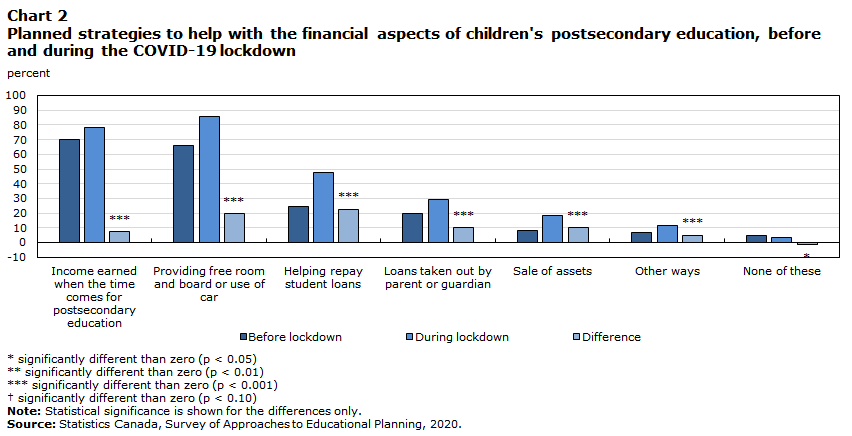

Parents interviewed during the lockdown consider broader range of ways in which to financially help their children with their postsecondary education

Parents were also asked about other ways, aside from savings, in which they planned to help their children finance their postsecondary studies. One of the most often cited ways to help was with income earned while the child is attending a postsecondary institution. This was more likely to be cited as the level of education of the responding parent and household income increased. Children whose responding parent is an immigrant were more likely to have parents who planned to take out loans, sell their assets and help their children repay student loans, than children whose responding parent was born in Canada. The latter, however, were more likely to receive an offer of free room and board or the use of a car. Very young children (aged 5 or younger) were less likely to have parents who planned on selling assets to help finance their children’s education or to help repay their student loans than were high-school-aged children.

Since the beginning of the lockdown, parents have reported more ways, other than savings, in which they intend to help their children finance their postsecondary education. Before the lockdown, just over 70% of children had parents who planned to help them with income earned when they begin their postsecondary education, while about 66% could expect to receive free room and board or the use of a car (Chart 2). These shares increased to 78% and close to 86%, respectively, after the beginning of the lockdown. Since the beginning of the pandemic, over 47% of children could expect help with repaying student loans (up from nearly 25%), 29% could expect their parents to take out loans (up from 19%) and 18% could expect parents to sell assets (up from 8%). Other ways in which parents reported that they would help, and that increased in popularity during the lockdown, included plans to help with supplies, such as textbooks, groceries and living expenses, and offers to help “in any way required.”

Chart 2

Data table for Chart 2

| Before lockdown | During lockdown | Difference | |

|---|---|---|---|

| Income earned when the time comes for postsecondary education | 70.4 | 77.9 | 7.5Note *** |

| Providing free room and board or use of car | 66.1 | 85.6 | 19.5Note *** |

| Helping repay student loans | 24.8 | 47.5 | 22.7Note *** |

| Loans taken out by parent or guardian | 19.4 | 29.3 | 9.9Note *** |

| Sale of assets | 8.0 | 18.2 | 10.2Note *** |

| Other ways | 6.8 | 11.9 | 5.0Note *** |

| None of these | 4.7 | 3.1 | -1.6Note * |

† significantly different than zero (p < 0.10) Note: Statistical significance is shown for the differences only. Source: Statistics Canada, Survey of Approaches to Educational Planning, 2020. |

|||

Enhanced plans to help children finance their postsecondary education observed across parental and child characteristics

An increase in the number of ways in which parents plan to help their children finance their postsecondary education was observed across household income quartiles, parental education and immigrant status. It was also observed for children of all ages, rather than just among older teenagers who might be graduating from high school in difficult economic conditions. The double-digit percentage-point increases in the share of children who might expect to receive parental help with financing their postsecondary studies through different means likely reflect the uncertainty about the long-term impacts of the pandemic and a determination to help realize the children’s postsecondary education prospects and ensure their future wellbeing is not upended by the pandemic and its fallout.

Conclusion

The uncertainty created by the COVID-19 pandemic did not dampen parental expectations that their children will pursue postsecondary studies. Instead, parents were considering a broader range of ways in which to help their children finance their postsecondary education. The most immediate course of action is to put aside savings specifically for this purpose. The share of children whose parents had started saving for their postsecondary education did not increase during the first few months of the lockdown. This is not surprising, since the pandemic has created considerable economic uncertainty among many families. Furthermore, many children in the study were several years away from being old enough to attend a postsecondary institution. What the study did show was a shift in parental expectations about saving in the future among those who had yet to save. Indeed, savings intentions became more polarized since the beginning of the pandemic—more children had parents who expected to save in the future, but, also, more had parents who did not expect to do so, and fewer had parents who did not know whether they would save. Parents were more likely to report numerous ways—aside from savings—in which they planned to help their children financially with their postsecondary education. These include, among others, income earned when the time comes for higher education, the offer of free room and board or the use of a car, help with repaying student loans or taking out loans in their own name, or even the sale of assets.

These differences, between children whose parents were interviewed before and after the lockdown, remained virtually unchanged when differences in parental education, immigrant status, household income, and the child’s age were taken into account. Parents may have been experiencing or anticipating a disruption in their ability to save for their children’s postsecondary education, as well as longer-term negative impacts of the pandemic on the economy that may impact their children’s future ability to work and save for their own postsecondary studies. Whatever the reasons, this shift in the expressed willingness to help financially highlights the importance that parents place on postsecondary education for their children.

Appendix

Table A.1

| Before lockdown | During lockdown | Difference | |

|---|---|---|---|

| percent | percentage points | ||

| Equivalent household income quartile | |||

| First (bottom) | 24.5 | 24.4 | -0.1 |

| Second | 24.2 | 26.1 | 1.9 |

| Third | 25.2 | 25.6 | 0.4 |

| Fourth (top) | 26.0 | 23.8 | -2.2 |

| Highest level of completed education of responding parent | |||

| Less than high school | 5.0 | 6.0 | 1.0 |

| High school diploma or equivalent | 15.9 | 19.6 | 3.7Note * |

| Non-university postsecondary | 35.3 | 38.5 | 3.2Table A.1 Note † |

| University degree | 43.8 | 35.9 | -7.9Note *** |

| Immigration status of responding parent | |||

| Immigrant | 34.3 | 26.3 | -8.0Note *** |

| Canadian-born | 63.3 | 71.2 | 7.9Note *** |

| Other | 2.5 | 2.5 | 0.1 |

| Child's age | |||

| 0 to 5 | 28.3 | 29.9 | 1.6 |

| 6 to 12 | 42.0 | 42.1 | 0.1 |

| 13 to 17 | 29.7 | 28.0 | -1.7 |

| number | |||

| Sample size | 4,240 | 2,149 | Note ...: not applicable |

... not applicable

Notes: Totals may not add up to 100% because of rounding. Statistical significance is shown for the differences only. Source: Statistics Canada, Survey of Approaches to Educational Planning, 2020. |

|||

References

Frenette, M. 2017. Which Families Invest in Registered Education Savings Plans and Does It Matter for Postsecondary Enrolment? Analytical Studies Branch Research Paper Series, no. 392. Statistics Canada Catalogue no. 11F0019M. Ottawa: Statistics Canada.

Frenette, M., D. Messacar, and T. Handler. 2020. Potential Earnings Losses among High School and Postsecondary Graduates Due to the COVID-19 Economic Downturn.Economic Insights, no. 114. Statistics Canada Catalogue no. 11-626-X. Ottawa: Statistics Canada.

Statistics Canada. 2020. “How are postsecondary students in Canada impacted by the COVID-19 pandemic?” Statistics Canada – Infographics. Statistics Canada Catalogue no. 11-627.

- Date modified: