Gross domestic product, income and expenditure, second quarter 2024

Released: 2024-08-30

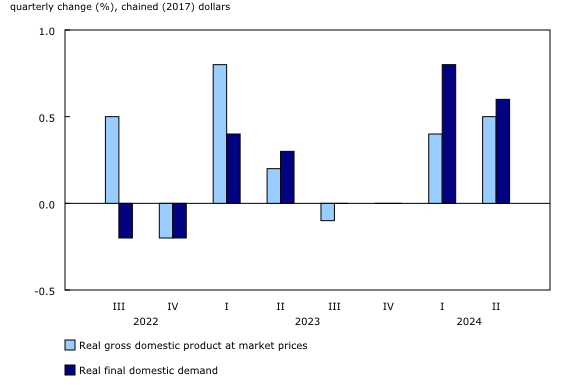

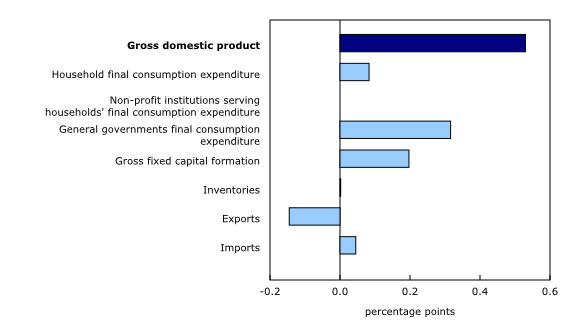

Real gross domestic product (GDP) increased 0.5% in the second quarter after rising 0.4% in the first quarter. Higher government final consumption expenditures, business investment in engineering structures and machinery and equipment, and household spending on services in the second quarter were moderated by declines in exports, residential construction and household spending on goods.

On a per capita basis, GDP fell 0.1% in the second quarter – the fifth consecutive quarterly decline.

Government spending rises on higher wages

Government expenditures rose 1.5% in the second quarter, as there were increases in compensation of employees, which is an expense for governments, and hours worked across all levels of government. Purchases of goods and services in the federal as well as in provincial and territorial governments also rebounded in the second quarter from a decline in the first quarter.

Higher business investment in machinery and equipment and engineering structures

Business spending on machinery and equipment increased 6.5% in the second quarter, led by higher spending on aircraft and other transportation equipment and parts. This coincided with increased imports of aircraft and ships.

Business investment in non-residential structures increased 0.5% in the second quarter due to higher spending on engineering structures, primarily in the oil and gas sector. Business investment in non-residential building construction fell 1.2%, as investment in commercial and industrial structures declined.

Business spending on intellectual property products edged up 0.3% in the second quarter, mainly due to increased spending on mineral exploration and evaluation (+4.5%).

Household spending slows in second quarter

Growth in household spending slowed to 0.2% in the second quarter after rising 0.9% in the first quarter. Higher expenditures for rental fees for housing, food and electricity led the increase in the second quarter. Meanwhile, fewer purchases of new trucks, vans and sport utility vehicles as well as reduced expenditures by Canadians abroad tempered overall growth.

Population growth outpaced the increase in household spending in the second quarter, and, as a result, per capita household expenditures fell 0.4% after rising 0.3% in the first quarter.

Weakening net trade, as exports decline more than imports

Exports of goods and services fell 0.4% in the second quarter after rising 0.5% in the first quarter. In the second quarter, lower exports of unwrought gold, silver, and platinum group metals as well as of passenger cars and light trucks and refined petroleum energy products were moderated by higher exports of crude oil and bitumen.

Imports of goods and services edged down 0.1% in the second quarter after recording no change in the first quarter. Lower imports of industrial machinery, equipment and parts, commercial services and refined petroleum energy products led the decrease in the second quarter, while higher imports of passenger cars and light trucks tempered the overall decline.

Residential construction continues to decline, falling in eight of the last nine quarters

Housing investment was down 1.9% in the second quarter, the largest decline since the first quarter of 2023. The decrease in the second quarter of 2024 was driven by lower investment in new construction (-1.6%), as work put in place for single-family dwellings and apartments fell, primarily in Ontario. Renovations fell 2.6%, and ownership transfer costs, which represent the resale market, declined 1.1%, led by less activity in Ontario.

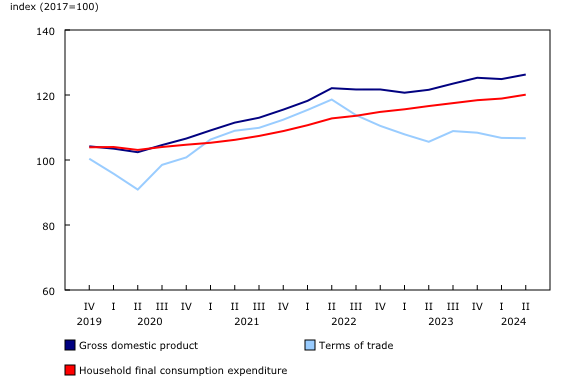

Gross domestic product deflator up on higher prices for services

The GDP deflator rose 1.1% in the second quarter, led by higher prices for household consumption of services.

The ratio of the price of exports to the price of imports—the terms of trade—fell 0.1% in the second quarter as growth in import prices outpaced the growth in export prices.

Compensation of employees rises

Compensation of employees rose 1.6% in the second quarter after increasing 1.5% in the first quarter. Growth in the second quarter was led by increased wages in health care and social assistance, educational services and finance and insurance. Retroactive payments associated with arbitration decisions for members of the Ontario Secondary School Teachers' Federation and Elementary Teachers' Federation of Ontario were a large contributor to the wage growth in educational services. Among all industries, wages and salaries in mining and oil and gas extraction (+5.6%) had the strongest growth in the second quarter.

Household saving rate up on higher wages

The household savings rate reached 7.2% in the second quarter, as gains in disposable income outpaced increases in nominal consumption expenditure. Disposable income gains were mainly from wages and salaries.

Growth in investment income slowed in the second quarter, rising 2.8%, mainly on higher interest received and dividends. At the same time, household property income payments, comprised of mortgage and non-mortgage interest expenses, rose at a faster pace (+5.7%) compared with the first quarter (+4.1%). The Bank of Canada announced a cut to the policy interest rate at the beginning of June, followed by a further cut in July; however, many mortgage borrowers are still facing relatively higher renewal costs following the rate hikes that began in early 2022.

Higher income households tend to earn greater share of investment income than lower income households, while lower income households tend to have interest expenses that represent a greater share of their disposable income.

Corporate incomes

In the second quarter of 2024, total corporate incomes (i.e., gross operating surplus) rose 3.1% after falling 5.6% in the first quarter. In the second quarter, the operating surplus of non-financial corporations rose 3.1%, with gains in the oil and gas extraction sector, while financial corporations surplus rose 2.9%.

Did you know we have a mobile app?

Download our mobile app and get timely access to data at your fingertips! The StatsCAN app is available for free on the App Store and on Google Play.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

Data on gross domestic product, income and expenditure are an example of how Statistics Canada supports the reporting on global sustainable development goals. This release will be used to measure the following goals:

Note to readers

Gross domestic product (GDP) data for the second quarter of 2024 have been released along with updated data for the first quarter. Updates to the first quarter were due to the incorporation of updated source data and the intentions estimates from the Capital and Repair Expenditures survey. Additionally, new survey results from Statistics Canada's National Travel Survey (imports) and Visitor Travel Survey (exports) were integrated.

With this release, the calculation of the inventory stock (book value) and sales used to derive the economy-wide stock-to-sales ratio has been modified to exclude gold and other precious metals. Inventory for gold and precious metals include those held as a store of value which are not held as an input into future production or sales. The entire time series for the stock, sales and economy-wide stock-to-sales ratio have been updated with the new calculation.

Revisions to Canada's gross domestic product

To satisfy the opposing goals for both timeliness and accuracy, Statistics Canada regularly updates (revises) estimates of Canada's GDP. Further details are outlined in the article "Revisions to Canada's GDP."

Accounting for First Nations Settlements

During the first quarter of 2024, the Government of Canada announced the final settlement agreement on compensation and agreement-in-principle for long-term reform of First Nations Child and Family Services and Jordan's Principle. As of this release, the Income and Expenditure Accounts have been revised to account for the initial creation of a fiduciary trust in the first quarter from which payments will flow to households as settlement claims are processed. The initial payment has been recorded as a capital transfer from the federal government to the financial corporations' sector with the settlement funds held in trust. These funds will be disbursed to claimants over subsequent quarters with payments shown as current transfers from financial corporations to households along with corresponding impacts on household disposable income and saving. This revision led to a significant but temporary impact on the federal government's budget deficit (on a national accounts basis) during the first quarter.

Accounting for e-commerce transactions with non-resident vendors

The indicators used to estimate Household Final Consumption Expenditure have been adjusted to account for non-resident e-commerce sales. The Monthly Retail Trade Survey collects data only on resident vendor e-commerce sales. The non-resident vendor e-commerce adjustment, which is applied to the indicators to estimate household consumption, mainly the Retail Commodity Survey, is a non-seasonally adjusted, quarterly value. This adjustment has been in place since the fourth quarter of 2019. For the second quarter of 2024, the adjustment represents 736.1 million dollars, applied to the household consumption indicators. The adjustment is derived using sources such as details from customs transactions, GST remittances and financial statements for certain enterprises.

General

Percentage changes for expenditure-based statistics (such as household spending, investment and exports) are calculated from volume measures that are adjusted for price variations. Percentage changes for income-based statistics (such as compensation of employees and operating surplus) are calculated from nominal values; that is, they are not adjusted for price variations. Unless otherwise stated, growth rates represent the percentage change in the series from one quarter to the next: for instance, from the first quarter of 2024 to the second quarter of 2024.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Real-time tables

Real-time tables 36-10-0430-01 and 36-10-0431-01 will be updated on September 10, 2024.

Next release

Data on GDP by income and expenditure for the third quarter will be released on November 29.

Products

The data visualization product "Gross domestic product by income and expenditure: Interactive tool," which is part of the Statistics Canada – Data Visualization Products series (71-607-X), is now available.

The document "Revisions to Canada's GDP," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is now available.

The document, "Recording new COVID measures in the national accounts," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: