Job vacancies, first quarter 2024

Released: 2024-06-18

Job vacancies continue to decline in the first quarter

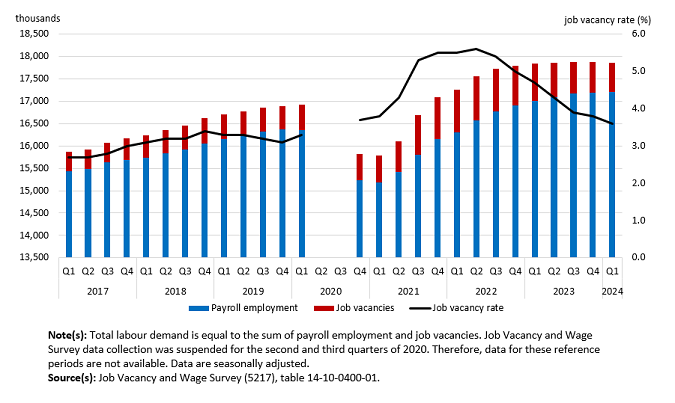

Job vacancies fell by 24,300 (-3.6%) to 648,600 in the first quarter, marking the seventh consecutive quarterly decline from the record high of 983,600 reached in the second quarter of 2022. Job vacancies decreased for permanent positions (-24,500; -4.5%), with little change for temporary positions. In the first quarter of 2024, vacancies fell more for full-time jobs (-15,400; -3.1%) than for part-time jobs (-8,900; -5.1%).

Meanwhile, payroll employment held steady in the first quarter. Total labour demand (the sum of filled and vacant positions) edged down 0.1% from the fourth quarter of 2023 and was virtually unchanged from the first quarter of the same year.

The job vacancy rate—which corresponds to the number of vacant positions as a proportion of total labour demand—decreased 0.2 percentage points to 3.6% in the first quarter of 2024, marking the seventh consecutive quarterly decline. The job vacancy rate in the first quarter was at its lowest since the first quarter of 2020.

Unemployment-to-job vacancy ratio highest since the second quarter of 2021

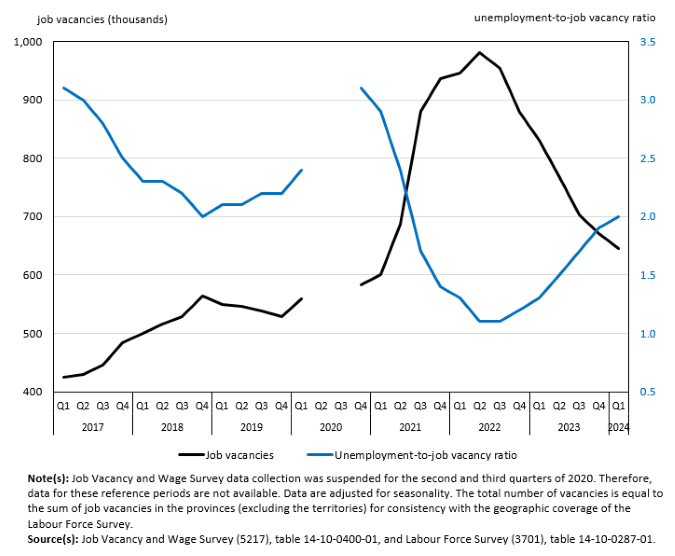

There were 2.0 unemployed persons for every job vacancy in the first quarter of 2024. The overall unemployment-to-job vacancy ratio has trended up since the third quarter of 2022. The steady increase in this ratio from the third quarter of 2022 to the first quarter of 2024 was driven both by a decrease in job vacancies (-309,400; -32.3%) and by an increase in the number of unemployed persons (+214,100; +20.3%, as estimated in the Labour Force Survey).

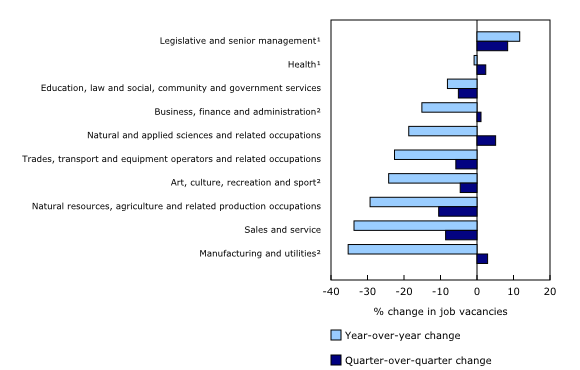

Job vacancies decline in 4 of 10 broad occupational groups and hold steady in 5

In the first quarter, job vacancies decreased in 4 of the 10 broad occupational groups: sales and service occupations (-17,600; -8.6%), trades, transport and equipment operators and related occupations (-7,800; -5.8%), occupations in education, law and social, community and government services (-3,200; -5.1%), and natural resources, agriculture and related production occupations (-1,700; -10.5%). The only occupational group to see an increase in job vacancies was natural and applied sciences and related occupations (+2,300; +5.1%). Previously released data from the Labour Force Survey (LFS) show that, in the first quarter, employment was little changed in these occupations.

Job vacancies in the first quarter were little changed in the remaining five broad occupational groups, including health occupations (93,700 vacancies representing 14.4% of total vacancies), business, finance and administration occupations (80,700; 12.4%), and occupations in manufacturing and utilities (24,000; 3.7%).

Year over year, the proportion of long-term vacancies—vacancies for which recruitment efforts have been ongoing for 90 days or more—has decreased in 5 of the 10 broad occupational groups in the first quarter. The largest decreases were in occupations in manufacturing and utilities (-11.9 percentage points to 30.7%) and natural resources, agriculture and related production occupations (-7.8 percentage points to 30.5%). The only group to see an increase in the proportion of long-term vacancies was health occupations (+4.0 percentage points to 55.7%) (not seasonally adjusted).

Sales and service occupations continue to drive decline in vacancies

Job vacancies in sales and service occupations declined by 17,600 (-8.6%) to 186,800 in the first quarter, the largest quarterly decline of any broad occupational group for the sixth quarter in a row. Vacancies in sales and service occupations accounted for 28.8% of all vacancies in the first quarter.

Year over year, job vacancies in sales and service occupations declined by 82,200 (-33.6%) to 162,500 in the first quarter. Within this broad occupational group, sales and service support occupations (-43,500 to 66,500), and sales and service representative and other customer and personal service occupations (-21,700 to 46,300) saw the largest year-over-year drops in vacancies in the first quarter (not seasonally adjusted).

Job vacancies continue to decline in trades, transport and equipment operators and related occupations

In the first quarter, job vacancies decreased by 7,800 (-5.8%) in trades, transport and equipment operators and related occupations, continuing the decline from the record high (195,000) reached in the second quarter of 2022.

On a year-over-year basis, the number of vacant positions in trades, transport and equipment operators and related occupations fell by 39,300 (-25.6%) in the first quarter of 2024. This included declines in vacancies for general trades (-17,000 to 29,700) and technical trades and transportation officers and controllers (-14,100 to 47,800), the two major occupational groups with the highest number of vacancies in the first quarter of 2023 and in the first quarter of 2024 (not seasonally adjusted).

Vacancies in health occupations show little change quarter to quarter and year over year

There were 93,700 job vacancies in health occupations in the first quarter of 2024, with little change from the previous quarter. Aside from legislative and senior management occupations, health occupations were the only broad occupational category where vacancies held steady year over year.

On a year-over-year basis, vacancies were little changed in the first quarter for professional occupations in health (40,300 vacancies), technical occupations in health (24,800), and specialized middle management occupations in health care (1,000). Taken together, these three major groups accounted for 71.6% of all vacancies in health occupations. Assisting occupations in support of health services (-2,200 to 26,200) was the only major group within health occupations to record a significant year-over-year variation (not seasonally adjusted).

Growth in average offered hourly wage accelerates in the first quarter

Year over year, the average offered hourly wage for vacant positions grew at a faster pace in the first quarter of 2024 (+7.3% to $27.25) compared with the fourth quarter of 2023 (+5.8% to $26.35) and the first quarter of 2023 (+5.0% to $25.40). In comparison, year-over-year growth in average hourly wages for all employees (from the Labour Force Survey) was 5.1% in the first quarter of 2024, slightly above the increase of 5.0% in the previous quarter (not seasonally adjusted).

Part of these increases in average offered hourly wages for vacant positions was due to a shift in the relative composition of job vacancies from lower- to higher-offered-wage occupations. Using a method that holds the composition of job vacancies by occupation at the first quarter of 2023, average offered hourly wages grew by 4.7% on a year-over-year basis in the first quarter of 2024, up from an increase of 3.7% in the fourth quarter of 2023, and from an increase of 3.4% in the third quarter of 2023 (not seasonally adjusted).

Occupations with the highest annual growth of their average offered hourly wage in the first quarter of 2024 were central control and process operators and aircraft assemblers and inspectors (+20.5% to $37.10) and processing, manufacturing and utilities supervisors and utilities operators and controllers (+9.5% to $35.10).

In contrast, middle management occupations in production and agriculture (-27.3% to $33.35), technical occupations in art, culture, and sport (-9.2% to $29.15), and supervisors in natural resources, agriculture and related production (-8.6% to $29.65) saw their offered hourly wages drop in the first quarter on a year-over-year basis.

Average offered wage reaches parity with average reservation wage

The matching process between employers looking for new hires, and workers looking for jobs, is influenced by many factors. For workers, non-wage conditions such as employer-sponsored pension plans, medical insurance and paid leave entitlements can be important, but a principal factor remains the relationship between the wages offered by employers and the wage expectations of job seekers.

In February and March of 2022 and 2024, the LFS collected data on reservation wages, or the lowest amount of pay, before taxes, that unemployed people would be prepared to accept if they found a suitable job.

When offered wages are close to, or above, the reservation wage, it can be easier for employers to fill a job vacancy. In February and March 2022, the average hourly reservation wage was $26.52, while the average offered hourly wage for vacant positions in the first quarter of 2022 was $24.20. This meant that the average job vacancy was offering lower wages than what the average unemployed worker reported being willing to accept.

In February and March 2024, the reservation wage was $27.33, up by 3.1% compared with the same period in 2022. Meanwhile, from the first quarter of 2022 to the first quarter of 2024, the average offered hourly wage for vacant positions rose 12.6% to $27.25. As such, the average offered hourly wage was effectively at parity with the average reservation wage in the first quarter of 2024.

Fewer job vacancies in 12 of 69 economic regions

In the first quarter, job vacancies decreased in six provinces: Manitoba (-8.7% to 22,400), New Brunswick (-8.1% to 11,200), Quebec (-6.4% to 153,000), Saskatchewan (-5.9% to 21,900), Alberta (-4.8% to 77,100) and British Columbia (-4.4% to 105,800). At the same time, the number of job vacancies increased in the Northwest Territories (+24.8% to 1,400) and Prince Edward Island (+20.5% to 3,000) and was little changed in the remaining provinces and territories.

Job vacancies were down in 12 of 69 economic regions in the first quarter. In Manitoba, Winnipeg (-13.1% to 13,000) accounted for 91.3% of the provincial decrease in vacancies and in Quebec, Montréal (-11.6% to 41,100) accounted for 51.5% of the provincial decrease. Meanwhile, among the 4 economic regions to see increases, the largest occurred in the Northwest Territories (+24.8% to 1,400), while vacancies held steady in the remaining 53 economic regions.

Year over year, the job vacancy rate declined in 53 economic regions in the first quarter of 2024, with the largest declines in Kootenay, British Columbia (-2.6 percentage points to 4.4%), Côte-Nord and Nord-du-Québec (-2.4 percentage points to 3.9%), and Capitale-Nationale, Quebec (-2.3 percentage points to 4.0%).

Did you know we have a mobile app?

Download our mobile app and get timely access to data at your fingertips! The StatsCAN app is available for free on the App Store and on Google Play.

Note to readers

The Job Vacancy and Wage Survey (JVWS) provides comprehensive data on job vacancies and offered wages by industrial sector and detailed occupation for Canada and the provinces, territories and economic regions. Job vacancy and offered wage data are released quarterly.

Estimates by sector are based on the North American Industry Classification System 2022 Version 1.0. Estimates by geographical area are based on the Standard Geographical Classification 2021. Estimates by occupation reflect the National Occupational Classification (NOC) 2021 Version 1.0. The NOC is a five-tiered hierarchical structure of occupational groups with successive levels of disaggregation. The structure is as follows: (1) 10 broad occupational categories, also referred to as one-digit NOC; (2) 45 major groups, also referred to as two-digit NOC; (3) 89 sub-major groups, also referred to as three-digit NOC; (4) 162 minor groups, also referred to as four-digit NOC; and (5) 516 unit groups, also referred to as five-digit NOC.

Because of the COVID-19 pandemic, data collection for the JVWS was suspended for the second and third quarters of 2020.

In January 2020, a new electronic questionnaire was introduced. Minor changes to the content are documented in the most recent Guide to the Job Vacancy and Wage Survey (75-514-G).

Beginning with the reference period of October 2020, preliminary monthly estimates from the JVWS are released on a monthly basis alongside the Survey of Employment, Payrolls and Hours release. These estimates provide information on the number of job vacancies and the job vacancy rate by province and by industrial sector.

The target population of the survey includes all business locations in Canada, excluding those involved primarily in religious organizations and private households. Federal, provincial, and territorial, as well as international and other extraterritorial public administrations, are also excluded from the survey.

Unless otherwise stated, this release presents seasonally adjusted estimates, which facilitate comparisons by removing the effects of seasonal variations. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Seasonally adjusted quarterly job vacancy data are available online (tables 14-10-0398-01, 14-10-0399-01 and 14-10-0400-01). The analyses of the job vacancy levels and rates by sector (20 broad industrial sector groups), one-digit NOC (10 broad occupational categories), province and economic region are based on seasonally adjusted data. However, the analyses of the job vacancy levels and rates by subsector, two-digit NOC, three-digit NOC, four-digit NOC, and five-digit NOC are based on non-seasonally adjusted data.

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

Data tables

Tables 14-10-0325, 14-10-0326, 14-10-0328 and 14-10-0356 have now been archived. They have been replaced with 14-10-0441-01, 14-10-0442-01, 14-10-0443-01, and 14-10-0444-01, respectively, presenting the new classifications.

Data tables are updated on June 18, 2024.

Next releases

Data on job vacancies from the JVWS for the second quarter of 2024 will be released on September 17, 2024.

Preliminary monthly data on job vacancies from the JVWS for April 2024 will be released on June 27, 2024.

Products

More information about the concepts and use of data from the Job Vacancy and Wage Survey is available online in the Guide to the Job Vacancy and Wage Survey (75-514-G).

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to Statistics Canada's labour market indicators for Canada, by province, territory and economic region, and allows users to view a snapshot of key labour market indicators, observe geographical rankings for each indicator using an interactive map and table, and easily copy data into other programs.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: