Farm income, 2022 (revised data)

Released: 2023-11-28

Realized net income for Canadian farmers fell 7.7% to $11.8 billion in 2022, as growth in expenses outpaced the rise in farm cash receipts. The decrease in 2022 followed a 69.6% gain in 2021 and a 101.6% increase in 2020. Excluding cannabis, realized net income in 2022 was down 5.9% to $11.8 billion.

Realized net income is the difference between a farmer's cash receipts and operating expenses, minus depreciation, plus income in kind.

In 2022, total farm cash receipts increased by 14.6% compared with 2021. Higher prices resulted in Canadian farmers receiving more receipts for both crop (+$7.1 billion) and livestock (+$3.6 billion) products in 2022. However, an 18.6% increase in total expenses pushed realized net income lower. Farmers faced higher costs for key agricultural inputs, including fertilizer, feed and fuel.

Saskatchewan ($3.8 billion) had the highest realized net income in 2022, followed by Alberta ($3.0 billion) and Ontario ($2.5 billion).

Higher prices result in increased farm cash receipts

Farm cash receipts, which include crop and livestock revenues, as well as program payments, rose 14.6% to $95.2 billion in 2022—the second straight year of strong year-over-year growth (+15.8% in 2021). Broad gains in commodity prices helped push receipts higher. In 2022, most crop prices continued their upward trend, which started at the beginning of the COVID-19 pandemic, while livestock prices built on gains recorded in 2021. The 2021 drought in Western Canada also led to increased crop insurance payments in 2022.

Farm cash receipts were up in every province. Alberta (+$3.5 billion) posted the largest increase, followed by Ontario (+$2.9 billion).

Higher wheat and canola prices drive the rise in crop receipts

In 2022, crop receipts rose 15.2% to $53.9 billion on the second straight year of higher average prices for all major grain and oilseed commodities. The increase in crop receipts in 2022 followed a 12.4% gain in 2021 and a 14.8% rise in 2020.

Domestic crop prices rose in 2022 in response to low opening inventories for the year, following the drought in Western Canada in 2021 and two years of strong export demand. Crop prices in 2022 were also supported by increased demand for livestock feed, as the drought caused pastures in Western Canada to suffer.

Farm cash receipts for wheat (excluding durum) increased by 28.6% to $9.3 billion in 2022. Prices rose 41.8%, while marketings fell 9.3%. Coming out of the 2021 drought, opening stocks for wheat (excluding durum) in 2022 were at their lowest level since 2008, leading to the drop in marketings. The volume of Canadian wheat (excluding durum) exports to the rest of the world fell 10.1% in 2022, compared with the previous year; however, the value of those exports rose 25.6%.

Canola receipts increased by 13.4% to $13.7 billion. Canola prices rose 38.9% from their average 2021 level, more than offsetting the 18.4% decline in marketings. Opening stocks of canola in 2022 were at their lowest level since 2013. Because of tight supplies, domestic crushing of canola seed fell for the second straight year in 2022 and the quantity of exports decreased by 32.2%.

Together, the increase in wheat (excluding durum) and canola accounted for over half of the growth in crop receipts. Soybeans and corn for grain also posted significant gains in 2022 compared with 2021.

Excluding cannabis, crop receipts were up 15.9% to $50.9 billion in 2022.

Strength in cattle markets drives the rise in livestock receipts

In 2022, livestock receipts climbed 11.9% to $34.0 billion on gains across the cattle, dairy, poultry and hog sectors. This increase followed a 13.7% rise in 2021 and a 0.6% drop in 2020, when the pandemic disrupted the meat processing supply chain.

Cattle receipts increased by 16.3% to $10.8 billion in 2022, primarily because of a rise in slaughter cattle receipts (+15.6%). The number of cattle slaughtered in Canada reached its highest level since 2006. The cost of feed grains rose in 2022 as a result of the previous year's drought, which put pressure on feed costs for livestock farmers. Slaughter numbers increased, as farmers facing high input costs were forced to reduce the size of their herds.

In the supply-managed sector, which accounted for just over 40% of total livestock receipts, receipts grew 12.5% to $14.1 billion in 2022. An 11.4% rise in dairy receipts (unprocessed milk from bovine) to $8.2 billion accounted for just over half of the increase. Unprocessed milk prices were up 11.3% in 2022 in response to the rising cost of production for dairy farmers. Despite challenges posed by the avian influenza virus, poultry receipts were up 13.9% compared with 2021.

In 2022, price increases helped hog receipts grow 4.4% to $6.5 billion. Prices rose 5.6% for the year, while marketings decreased 1.2%. Much of the gain in hog receipts was due to higher hog slaughter prices. Both Ontario (+8.3%) and Manitoba (+9.8%) recorded strong increases in hog slaughter receipts.

Drought-related payments continue in 2022

In 2022, total direct payments to Canadian producers rose 23.6% to $7.3 billion, following gains of 71.8% in 2021 and of 10.8% in 2020. In 2022, more than 80% of the increase in total direct program payments was attributable to higher crop insurance payments in Alberta, Saskatchewan and Manitoba, where drought-related losses from 2021 continued to trigger payments.

In 2022, direct payments rose 137.6% in Prince Edward Island, as farmers faced an export ban because of the potato wart fungus.

Prices for fertilizer, feed and fuel continue to rise

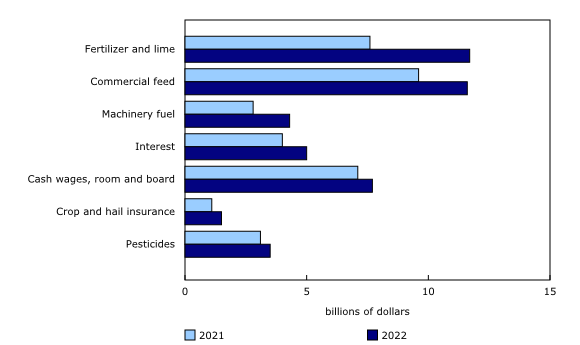

Total farm operating expenses (after rebates) increased by 19.9% to $73.3 billion in 2022—the largest gain since 1979 (+21.1%)—surpassing the 9.5% rise in 2021.

Fertilizer expenses for Canadian farmers increased by 54.4% to $11.7 billion in 2022. Fertilizer prices began to escalate in early 2021 and have continued to rise since then. Russia's invasion of Ukraine added more pressure to fertilizer markets, which had already been stressed by natural disasters and high natural gas prices. In response to the invasion, Canada applied sanctions that included a 35% tariff on most goods coming from Russia, including fertilizers.

Commercial feed expenses for livestock producers increased by 20.7% to $11.6 billion in 2022. The 2021 drought in Western Canada negatively affected pastures, limiting the amount of hay and grain feed that could be stored on farms or purchased from others. Alberta, home to many of Canada's largest feedlots, imported record amounts of corn in 2022.

Machinery fuel expenses increased by 52.5% to $4.3 billion in 2022. Fuel prices began to rise in 2021, as economies around the world opened up after taking measures to curb the spread of COVID-19. In 2022, fuel prices were supported by supply-chain disruptions influenced by sanctions imposed on Russia following its invasion of Ukraine.

Total farm expenses (after rebates), which include operating expenses and depreciation, increased by 18.6% to $83.4 billion in 2022, as depreciation charges rose 9.9%. Total farm expenses were up in every province.

Higher inventories boost total net income

Total net income increased by $15.8 billion to $21.3 billion in 2022. The Prairie provinces saw large gains in total net income, while all other provinces posted declines. A combination of high commodity prices and recovering inventory levels following the 2021 drought led to the increases in the Prairies.

Total net income is realized net income adjusted for changes in farmer-owned inventories of crops and livestock. It represents the return to owner's equity, unpaid farm labour, management and risk.

Excluding cannabis, total net income increased by $16.0 billion to $21.3 billion in 2022.

Note to readers

Realized net income can vary widely from farm to farm because of several factors, including the farm's mix of commodities, prices, weather and economies of scale. This and other aggregate measures of farm income are calculated on a provincial basis employing the same concepts used to measure the performance of the overall Canadian economy. They are measures of farm business income, not farm household income.

The decrease in the realized net income when excluding the cannabis sector is the result of the latter having a negative realized income, expenses being higher than revenues.

Preliminary farm income data for the previous calendar year are first released in May of each year, five months after the reference period. Revised data are then released in November of each year, incorporating data received too late to be included in the first release. Data for the year prior to the reference period are also subject to revision.

Additional financial data for 2022, collected at the individual farm business level using surveys and other administrative sources, will be made available later this year. These data will help explain differences in the performance of various types and sizes of farms.

A summary set of farm income components excluding cannabis-related receipts and expenses is available upon request from 2015 to 2022. For confidentiality reasons, non-cannabis estimates for some of the provinces are not available.

This release comprises the complete set of revisions resulting from the release of data from the 2021 Census of Agriculture on May 11, 2022.

For details on farm cash receipts for the first quarter of 2023, see the "Farm cash receipts" release in today's Daily.

For the latest information on the Census of Agriculture, visit the Census of Agriculture portal.

For more information on agriculture and food, visit the Agriculture and food statistics portal.

Products

The interactive data visualization tool "Net farm income, by province," is available on the Statistics Canada website.

The Agriculture and food statistics portal, accessible from the Subjects module of the Statistics Canada website, provides users a single point of access to a wide variety of information related to agriculture and food.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: