Gross domestic product by industry, May 2023

Released: 2023-07-28

May 2023

0.3%

(monthly change)

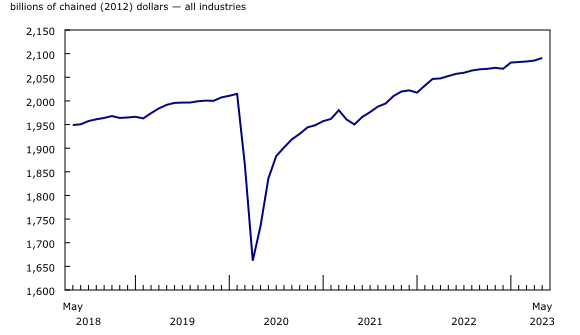

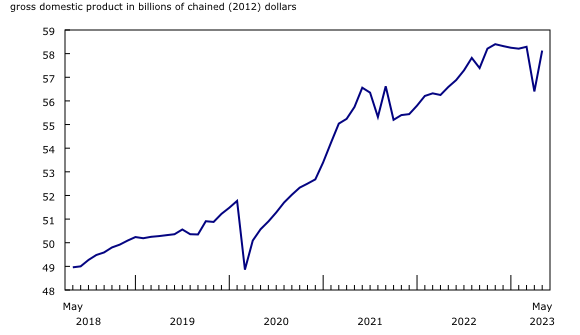

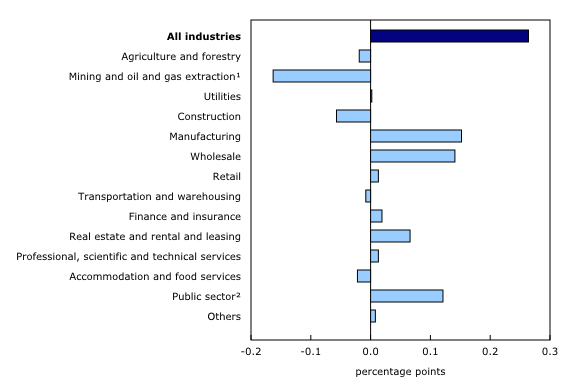

Real gross domestic product (GDP) increased 0.3% in May, following a 0.1% uptick in April. Services-producing industries were up 0.5%, while goods-producing industries partially offset the increase with a 0.3% decline in May. Overall, 12 of 20 industrial sectors posted increases.

Manufacturing, wholesale and public administration drive the increase, while forest fires hamper growth in some energy-related industries

A rebound in wholesale and public administration helped boost GDP, with the latter bouncing back in May as most federal government workers who were on strike returned to work by the end of April. Moreover, gains in manufacturing and real estate and rental and leasing also helped boost growth.

Meanwhile, mining, quarrying and oil and gas extraction was the biggest detractor to growth in May, as many companies, specifically in Alberta, reduced operations as a result of forest fires in the province.

Energy sector industries adversely impacted by forest fires in May

The energy sector, which was severely impacted by wildfires in May, was down 2.1%. This was the sector's first decline in five months and its largest since August 2020. In May 2023, the energy sector was most impacted by declines in mining, quarrying and oil and gas extraction, which fell 2.9%.

Following four months of growth, the oil and gas extraction subsector fell 3.6% in May, as all components contributed to the decline. Oil and gas extraction (except oil sands) dropped 6.6% as a result of the forest fires in Alberta. The fires primarily impacted installations in the western parts of the province, from Edmonton to the Rocky Mountains' Foothills in the Clearwater, Montney and Duvernay formations. These played a crucial role in the industry's largest monthly contraction since April 2020, resulting in a steep drop in both natural gas extraction and crude oil. Oil sands extraction decreased 1.6% in May 2023, as maintenance at a number of facilities in Alberta throughout the month contributed to lower production.

At the same time, pipeline transportation contracted 2.1%, reflecting a 3.8% decrease in transportation of natural gas and a 0.4% decline in crude oil and other pipeline transportation. Natural gas distribution also dropped, down 3.9% as both commercial and residential distribution contributed the most to the decline.

Support activities for mining and oil and gas extraction decreased 4.0% as all types of supporting activities were down in May.

Easing of supply chain issues helps boost the wholesale and manufacturing sectors

Easing of supply chain issues with respect to semiconductor chip supplies, which became prevalent during the COVID-19 pandemic, aided in the increases of both the manufacturing and the wholesale sectors, especially subsectors involved in the automotive supply chain.

Manufacturing advanced 1.6% in May, its largest gain since October 2021, with both durable (+2.1%) and non-durable (+1.0%) goods manufacturing increasing. Durable goods manufacturing was up for the fourth time in the last five months, led by transportation equipment manufacturing (+2.2%) and machinery manufacturing (+3.0%) in May.

Wholesale trade advanced 2.9% in May, as seven of nine subsectors grew. Machinery, equipment and supply wholesalers sharply increased by 6.3%, the largest monthly expansion since June 2020.

Motor vehicle and motor vehicle parts and accessories wholesalers advanced 6.0% in May 2023, reflecting increases in imports and exports of motor vehicles and parts.

Public sector rebounds amid return to work for federal workers

The federal government public administration subsector constituted the bulk of the gain in the public sector (+0.6%) in May, advancing 3.1% as the majority of workers represented by the Public Service Alliance of Canada labour union returned to work in May following strike action that began in April. However, approximately 35,000 Canada Revenue Agency workers remained on strike for an additional three days in May, dampening the rebound.

Strong growth continues for offices of real estate agents and brokers

Demand for real estate remained strong in May, and activity at the offices of real estate agents and brokers and activities related to real estate advanced for a fourth consecutive month. The 7.6% increase in May was led by higher home reselling activity in the majority of Canada's largest markets, led by the Greater Toronto Area, Montréal, Greater Vancouver, Calgary, Edmonton and Ottawa. Legal services, which derive most of their activity from real estate transactions, advanced 0.3% in May, its sixth consecutive gain.

Construction retreats, driven by a decline in residential building construction

The construction sector contracted 0.8% in May, following a 0.2% increase in April and no change in March, as almost all subsectors posted declines. Residential building construction (-1.8%) contributed the most to the decrease, driven by declines in home alterations and improvement and construction of new single-detached homes. Non-residential building construction contracted 1.3% in May, partly offsetting the previous month's expansion. Nevertheless, this was the subsector's first decline in five months. Repair construction declined 0.3%. Meanwhile, engineering and other construction activities edged up 0.1%.

Advance estimate for real gross domestic product for June and the second quarter of 2023

Advance information indicates that real GDP decreased 0.2% in June. The decrease was driven by the wholesale trade and manufacturing sectors, whose downward movements more than offset the increases recorded in May. These decreases were partially offset by increases in oil and gas extraction as well as in the real estate and rental and leasing sector in June. Oil and gas extraction's increase partially offset the decrease recorded in the previous month. This advance information indicates a 0.3% increase in real GDP by industry in the second quarter of 2023. Owing to their preliminary nature, these estimates will be updated on September 1, 2023, with the release of the official GDP data for June and the second quarter.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports monitoring the progress of global sustainable development goals. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry's value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUTs) up to the latest SUT year (2019).

For the period starting in January 2020, data are derived by chaining a fixed-weight Laspeyres volume index to the previous period. The fixed weights are 2019 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

An advance estimate of industrial production for June 2023 is available upon request.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?."

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2022.

Each month, newly available administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, data confrontation and reconciliation process and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time table

Real-time table 36-10-0491-01 will be updated on August 14.

Next release

Data on GDP by industry for June will be released on September 1.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: