Consumer Price Index, June 2023

Released: 2023-07-18

June 2023

2.8%

(12-month change)

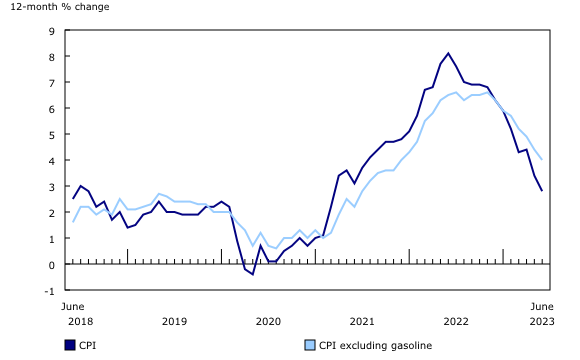

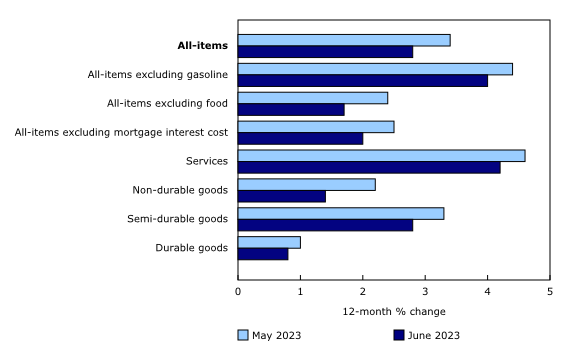

The Consumer Price Index (CPI) rose 2.8% year over year in June, following a 3.4% increase in May. While deceleration was fairly broad-based, another base-year effect in gasoline prices led the slowdown in the CPI. Excluding gasoline, headline inflation would have been 4.0% in June, following a 4.4% increase in May.

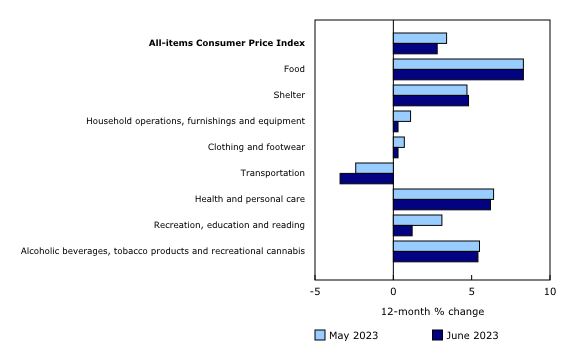

Canadians continued to see elevated grocery prices (+9.1%) and mortgage interest costs (+30.1%) in June, with those indexes contributing the most to the headline CPI increase. The all-items excluding food index rose 1.7% and the all-items excluding mortgage interest cost index rose 2.0%.

On a monthly basis, the CPI edged up 0.1% in June, following a 0.4% gain in May. After contributing to the increase in May, travel tours put downward pressure on the monthly all-items index in June. On a seasonally adjusted monthly basis, the CPI also rose 0.1%.

Base-year effects drive deceleration in the transportation component

On a year-over-year basis, the transportation component fell 3.4% in June after a 2.4% decline in May.

Gasoline prices fell 21.6% year over year in June following an 18.3% decline in May. The year-over-year decrease was a result of elevated prices in June 2022 amid higher global demand for crude oil as China, the largest importer of crude oil, eased some COVID-19 public health restrictions. In June 2023, consumers paid 1.9% more at the pump compared with May.

Passenger vehicle prices rose at a slower pace in June (+2.4%) than in May (+3.2%). The year-over-year slowdown was the result of a base-year effect, with a 1.5% month-over-month increase in June 2022 being replaced with a smaller 0.6% month-over-month increase in June 2023. This coincided with improved supply chains and inventories compared with a year ago.

Moderating deceleration in the transportation component was passenger vehicle insurance premiums, which rose 5.4% in June after a 3.1% increase in May. The index recorded a 0.5% monthly increase in June 2023 compared with a 1.7% monthly decline in June 2022.

Smaller year-over-year increase in travel tour prices

Prices for travel tours rose at a slower pace year over year in June (+6.8%) than in May (+23.4%), putting downward pressure on the all-items CPI. This was largely driven by an 11.5% month-over-month decline, in line with normal seasonal patterns leading up to the peak travel season in July.

Prices for telecommunications fall

Consumers paid 14.7% less for cellular services year over year in June, following an 8.2% decline in May. This was a result of both lower prices for cellular data plans and promotional pricing.

Prices for Internet access services fell 3.2% in June on a year-over-year basis after increasing 1.0% in May. On a month-over-month basis, prices declined 5.0%, the largest 1-month decline since February 2019. This was mostly due to promotions in Ontario and lower prices in Quebec.

Grocery prices continue to put upward pressure on the Consumer Price Index

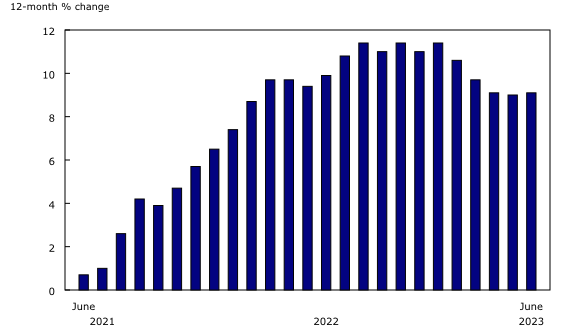

Grocery prices remain one of the largest contributors to the all-items CPI, with a 9.1% year-over-year increase in June, nearly unchanged from the increase in May (+9.0%). The largest contributors within the food component were meat (+6.9%), bakery products (+12.9%), dairy products (+7.4%) and other food preparations (+10.2%).

Fresh fruit prices grew at a faster pace year over year in June (+10.4%) than in May (+5.7%), driven, in part, by a 30.0% month-over-month increase in the price of grapes.

Food purchased from restaurants continued to contribute to the headline CPI increase, albeit at a slower year-over-year pace in June (+6.6%) than in May (+6.8%).

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Regional highlights

Year over year, prices rose at a slower pace in June compared with May in eight provinces. Among the provinces, year-over-year consumer inflation was lowest in Prince Edward Island (+0.2%), largely the result of the largest decline in energy prices (-24.1%) in the country.

Note to readers

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on July 31. For more information, consult the document "Real-time data tables."

Next release

The Consumer Price Index for July will be released on August 15.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: