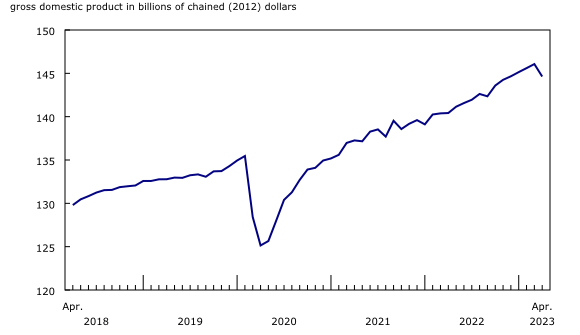

Gross domestic product by industry, April 2023

Released: 2023-06-30

April 2023

0.0%

(monthly change)

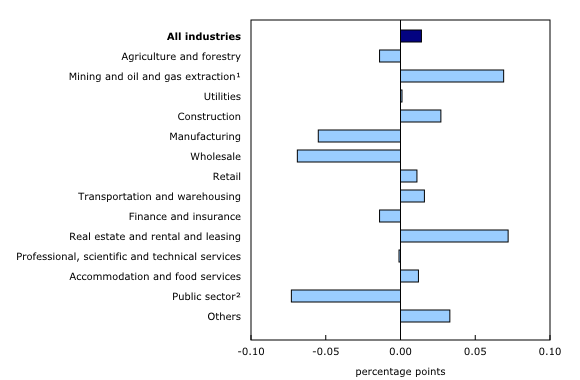

Real gross domestic product (GDP) was essentially unchanged in April, following a slight uptick in March (+0.1%). Goods-producing industries edged up 0.1%, whereas services-producing industries (0.0%) were essentially unchanged. Overall, 11 of 20 industrial sectors posted increases.

Mining, quarrying, and oil and gas extraction grows for fourth consecutive month

Mining, quarrying, and oil and gas extraction (+1.2%) grew in April as all subsectors were up. This was the fourth consecutive month of growth in the sector.

The oil and gas extraction subsector rose 0.8% in April. This is the first time since the fall of 2021 that the subsector increased in at least four consecutive months.

Oil and gas extraction (except oil sands) led the growth with a 2.1% expansion in April 2023 following a tepid start to the year. Crude petroleum extraction contributed the most to the increase as increased production off Canada's North Atlantic coast more than offset lower crude production in the west. Natural gas extraction, led by Alberta, continued to expand, reflecting continued natural gas storage replenishment.

Oil sands extraction edged down 0.1%, while support activities for mining and oil and gas extraction (+4.6%) grew for the third consecutive month, largely due to increases in both rigging and drilling activity in April.

The mining and quarrying (except oil and gas extraction) subsector expanded 0.8% in April. A 2.4% increase in non-metallic mineral mining and quarrying contributed the most to the subsector's growth, led by potash mining (+2.3%). Coal mining (+5.2%) further contributed to the growth in the subsector, coinciding with monthly increases in both rail carloadings and higher exports of the commodity to South Korea.

Public sector contracts as strike by federal workers reduces activity

The public sector (educational services, health care and social assistance and public administration) experienced its first decline since January 2022, with a 0.3% contraction in April 2023. While both educational services as well as health care and social assistance remained flat, public administration recorded a large decline (-1.0%).

The decline in public administration was its largest since April 2020. A strike by federal government workers represented by the Public Service Alliance of Canada labour union, that began in April 2023, resulted in a 4.3% contraction in federal government public administration (except defence).

Construction activity increases

Construction activity grew 0.4% in April, as lower residential building construction was more than offset by broad-based increases in other types of construction.

Engineering and other construction activities (+1.1%) contributed the most to the increase seen in April, continuing its upward growth trend that started at the tail end of 2020.

Non-residential building construction rose for a fifth consecutive month, up 1.4% in April 2023 on the strength of commercial and industrial building construction. The construction of a new manufacturing building in Bécancour, Quebec helped the industrial building construction continue its uninterrupted expansion that began in April 2022.

Residential construction offset some of the growth in the construction sector, dipping 0.8% in April 2023, with declines in single detached homes driving the decrease.

Real estate and rental and leasing up on higher home sales

The real estate and rental and leasing sector grew for a sixth consecutive month, expanding 0.5% in April. It is the sector's largest growth rate since December 2020.

Activity at the offices of real estate agents and brokers and activities related to real estate increased 8.6% in April 2023. It is the third consecutive month of growth and the largest since July 2020. The housing resale market built on gains seen in February and March 2023, with British Columbia's Lower Mainland and the Greater Toronto Area in Ontario accounting for the bulk of higher home sales in April.

Wholesale trade declines for third consecutive month

Wholesale trade contracted 1.4% in April, as wholesaling activity declined in six of nine subsectors. This was the third consecutive month of decline in the sector. The miscellaneous merchant wholesalers (-5.7%) contributed the most to the decline in April, reflecting lower activity in the agricultural supplies industry as a number of high-valued shipments of agricultural supply products were delivered in previous months.

Motor vehicle and motor vehicle parts and accessories wholesalers rose 2.6% in April, partially offsetting declines in the sector, coinciding with higher imports and exports of passenger cars and light trucks.

Manufacturing declines for first time in four months

The manufacturing sector declined 0.6% in April, down for the first time in four months, as both durable and non-durable goods manufacturing were down in the month.

Non-durable goods manufacturing decreased 0.6% in April, as six of nine subsectors decreased. Chemical manufacturing (-2.6%) contributed the most to the decrease, and paper manufacturing contracted 6.6% in part due to a curtailment of production in British Columbia.

Durable goods manufacturing was down 0.6% in April, as 8 of 10 subsectors contracted. Contributing the most to the decrease were miscellaneous manufacturing (-7.8%) and non-metallic mineral product manufacturing (-4.7%), whereas a 8.7% increase in motor vehicle and parts manufacturing—thanks in large part to a higher output of engine and other motor vehicle parts in the month—offset some of the declines.

Transportation and warehousing

Transportation and warehousing (+0.4%) was up for the second consecutive month as six of nine subsectors increased in April. Pipeline transportation (+1.1%) was up in the month as volumes of crude oil transported to international markets and domestic refineries increased. Air transportation rose 1.6%, up for a second consecutive month, but nevertheless was 30% below the pre-COVID-19 pandemic level.

Advance estimate for real gross domestic product for May 2023

Advance information indicates that real GDP increased 0.4% in May. Growth was led by the manufacturing and wholesale trade sectors, as well as by offices of real estate agents and brokers. There was also a rebound in federal government public administration (except defence). These increases were partially offset by decreases in the mining, quarrying, and oil and gas extraction sector, as well as the utilities sector. Owing to its preliminary nature, these estimates will be updated on July 28, 2023, with the release of the official GDP data for May.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports monitoring the progress of global sustainable development goals. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry's value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUTs) up to the latest SUT year (2019).

For the period starting in January 2020, data are derived by chaining a fixed-weight Laspeyres volume index to the previous period. The fixed weights are 2019 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

An advance estimate of industrial production for May 2023 is available upon request.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?."

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2022.

Each month, newly available administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, data confrontation and reconciliation process and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time table

Real-time table 36-10-0491-01 will be updated on July 10.

Next release

Data on GDP by industry for May will be released on July 28.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: