Consumer Price Index, May 2023

Released: 2023-06-27

May 2023

3.4%

(12-month change)

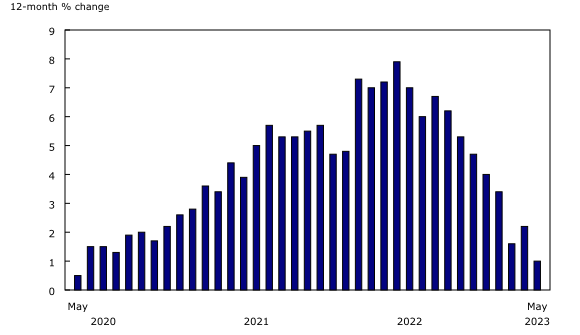

The Consumer Price Index (CPI) rose 3.4% year over year in May, following a 4.4% increase in April. This is the smallest increase since June 2021. The slowdown was largely driven by lower year-over-year prices for gasoline (-18.3%) resulting from a base-year effect. Excluding gasoline, the CPI rose 4.4% in May following a 4.9% increase in April.

The mortgage interest cost index (+29.9%) remained the largest contributor to the year-over-year CPI increase. Excluding mortgage interest cost, the CPI rose 2.5% in May, following a 3.7% increase in April.

On a monthly basis, the CPI was up 0.4% in May, following a 0.7% gain in April. The largest contributors to the month-over-month increase were mortgage interest costs and travel services, which includes traveller accommodation and travel tours. On a seasonally adjusted monthly basis, the CPI rose 0.1%.

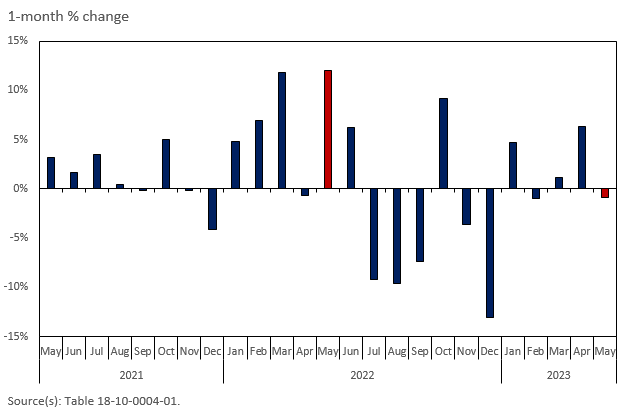

Base-year effects and the headline Consumer Price Index

The Consumer Price Index (CPI) is a standard measure of the price of a representative basket of goods and services. The headline consumer inflation is measured as the percentage change between the CPI in the current month (May 2023) and the CPI in a base month or the same calendar month of the previous year (May 2022).

A base-year effect refers to the impact that price movements from 12 months earlier have on the current month's headline consumer inflation. When a large 1-month upward price change in the base month stops influencing—or falls out of—the 12-month price movement, this has a downward effect on headline CPI in the current month. Conversely, when a large 1-month downward price change in the base month falls out, this creates upward pressure on the current month's 12-month figure.

In the first half of 2022, the global economy was affected by the Russian invasion of Ukraine and Canadian consumers experienced a significant increase in prices from January to June 2022. Headline consumer inflation increased from 5.1% in January to 8.1% in June 2022. The broad increase in prices in the early months of 2022, stemming from energy, durable goods and wheat-based food products, had a downward impact on the year-over-year rate of consumer inflation in May 2023. This is because higher prices from May 2022 were used as the basis for year-over-year comparison.

Price increases observed in the first half of 2022 will continue to fall out of the 12-month price movement. While inflation has slowed in recent months, prices remain elevated. Users should consider the impact of base-year effects when interpreting the 12-month price movement.

Year-over-year decline in energy prices driven by base-year effect

Energy prices fell 12.4% in May compared with the same month a year earlier, when supply uncertainty surrounding Russia's invasion of Ukraine led to energy prices rising substantially. While this mainly affected the year-over-year price changes for gasoline and fuel oil and other fuels, a decrease in the price of natural gas (-3.5%) also contributed to the energy price deceleration. This was the first year-over-year decline in natural gas prices since August 2020, and it was due, in part, to lower commodity rates.

Gasoline prices fell 18.3% in May 2023 compared with the high prices from May 2022. On a monthly basis, gas prices declined 0.8% after a 6.3% increase in April 2023.

Prices for fuel oil and other fuels also exhibited a base-year effect, falling 36.9% year over year in May following a 14.8% decline in April.

Furniture and passenger vehicles contribute to the deceleration in prices for durable goods

Prices for durable goods grew at a slower pace year over year in May, rising 1.0% after increasing 2.2% in April. The increase in May is the smallest since May 2020 and coincided with easing supply chain pressures compared with a year ago. This was reflected in furniture prices (-2.9%), which fell by the largest amount since June 2020, and in passenger vehicle prices (+3.2%), which showed the smallest increase since February 2021.

Lower prices for cellular services

Year over year, consumers paid 8.2% less for cellular services in May, as a result of lower-priced cellular data plans. This is the largest year-over-year decline since April 2022.

Grocery prices remain elevated, while prices for restaurant food accelerate

Grocery prices rose 9.0% year over year in May. This increase was still more than double the rate of headline inflation and nearly unchanged from the 9.1% increase in April. The highest year-over-year increases among grocery items include edible fats and oils (+20.3%), bakery products (+15.0%) and cereal products (+13.6%).

Prices for food purchased from restaurants rose at a slightly faster year-over-year pace in May (+6.8%) than in April (+6.4%), amid ongoing elevated labour shortages, input costs and expenses, which can disproportionately affect these businesses.

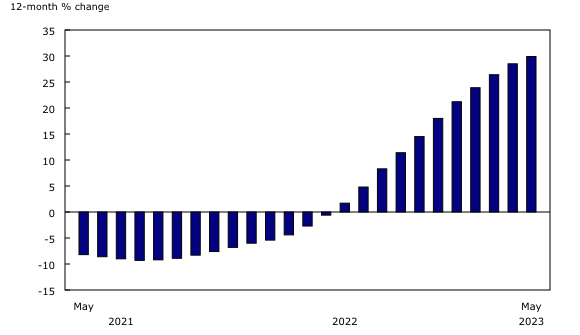

The mortgage interest cost index increases at the fastest pace on record, for the third consecutive month

The mortgage interest cost index rose 29.9% on a year-over-year basis in May following a 28.5% increase in April. For the third consecutive month, this was the largest increase on record, as Canadians continued to renew and initiate mortgages at higher interest rates.

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Find the answers to the most common questions about the CPI in the context of the COVID-19 pandemic and beyond.

Regional highlights

Year over year, prices rose at a slower pace in May compared with April in all provinces. Price growth slowed more in Atlantic provinces, coinciding with lower prices for fuel oil and other fuels, which are more commonly used in these provinces.

Note to readers

Reddit Ask Me Anything

Do you have questions about the Consumer Price Index (CPI), Canadian inflation or what the new CPI basket means for measuring consumer prices? Join us for our "Reddit Ask Me Anything" event on June 28, 2023, at 1:30 p.m., Eastern Time.

Basket Update

The basket of goods and services used in the calculation of the CPI has been updated with the release of the May 2023 data. The new basket weights, available in table 18-10-0007-01, are based on 2022 expenditure data, ensuring the relevance of the CPI as a reflection of the most recent consumer expenditure data available.

The new basket weight reference period is 2022, based on the most recent Household Final Consumption Expenditure data, and other alternative data.

The base period, in which the all-items CPI is set to equal 100, remains 2002.

Had the headline CPI for May 2023 been calculated using the 2021 basket weights, it would have been close to 0.1 percentage points lower.

For more detailed information, consult the document entitled "An Analysis of the 2023 Consumer Price Index Basket Update, Based on 2022 Expenditures" in the Prices Analytical Series (62F0014M).

Homeowners' home and mortgage insurance and passenger vehicle insurance premiums

With the release of the May 2023 CPI, a new data source is now used for the calculation of the homeowners' home and mortgage insurance and passenger vehicle insurance premium indexes. These indexes represent 1.31% and 2.16% of the 2022 CPI basket and are part of the shelter and transportation components, respectively. This change incorporates more price quotes and a broader range of consumer profiles in the calculation of the insurance indexes.

In recent years, and particularly following the implementation of COVID-19 restrictions during the pandemic, Statistics Canada has increased relevance by incorporating new alternative data sources and methods for CPI calculation. More alternative and administrative data sources are used in the CPI calculation, replacing traditional in-store price collection and other sources that may become unavailable. Statistics Canada continues to adapt and prioritizes the quality of data sources, methods, timeliness, and the cost and level of detail, to ensure the ongoing accuracy and relevance of the CPI.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on July 10. For more information, consult the document "Real-time data tables."

Next release

The CPI for June will be released on July 18.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: