Consumer Price Index, April 2023

Released: 2023-05-16

April 2023

4.4%

(12-month change)

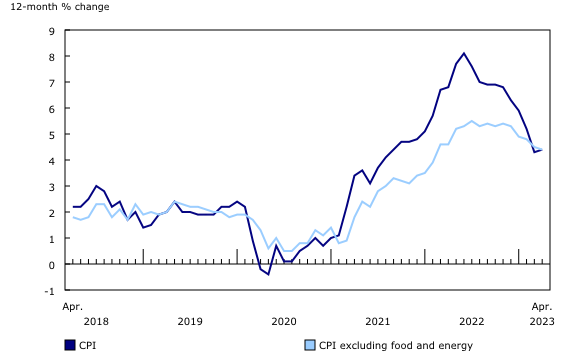

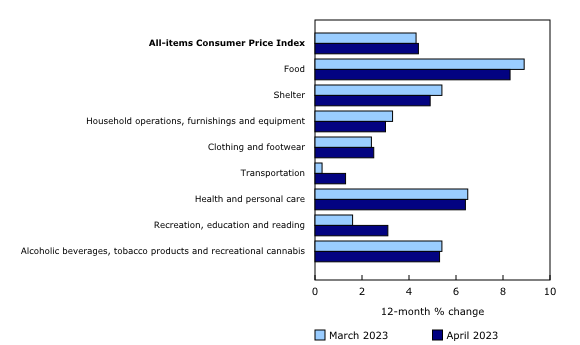

The Consumer Price Index (CPI) rose 4.4% year over year in April, following a 4.3% increase in March. This was the first acceleration in headline consumer inflation since June 2022. On a year-over-year basis, higher rent prices and mortgage interest costs contributed the most to the all-items CPI increase in April 2023.

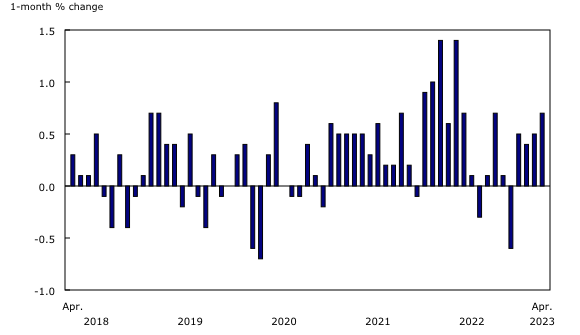

On a monthly basis, the CPI was up 0.7% in April, following a 0.5% gain in March. Prices for gasoline (+6.3%) contributed the most to the headline month-over-month movement. Excluding gasoline, the monthly CPI rose 0.5%. On a seasonally adjusted monthly basis, the CPI rose 0.6%.

Gasoline prices continue to fall year over year

Gasoline prices rose by 6.3% in April compared with March, the largest monthly increase since October 2022 and contributing the most to the acceleration in the headline CPI. This increase followed an announcement from OPEC+ (countries from the Organization of Petroleum Exporting Countries Plus) to reduce oil output, pushing prices higher. The switch to summer blend and an increase in carbon levies also contributed to higher prices.

Nevertheless, gas prices were 7.7% lower in April 2023 compared with April 2022, when prices were higher due in part to Russia's invasion of Ukraine. Compared with 18 months earlier, gasoline prices were 10.0% higher in April 2023.

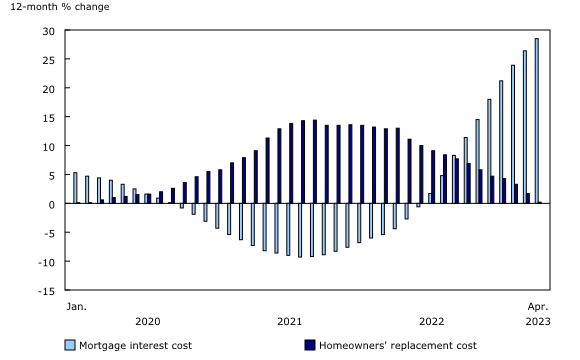

Mortgage interest cost rises as homeowners' replacement cost slows

Shelter costs rose 4.9% on a year-over-year basis in April, after a 5.4% increase in March. Canadians continued to pay more in mortgage interest cost in April (+28.5%) compared with April 2022, as more mortgages were initiated or renewed at higher interest rates. The higher interest rate environment may also be contributing to rising rents in April 2023 (+6.1%) by stimulating higher rental demand.

The year-over-year increase in the homeowners' replacement cost index slowed for the 12th consecutive month in April (+0.2%) compared with March (+1.7%), reflecting a general cooling of the housing market.

Natural gas prices decelerated, increasing by 0.9% on a year-over-year basis in April, compared with a 13.4% increase in March. Driving this deceleration was a smaller natural gas price increase in Ontario (+4.6%) in April, after a 31.8% increase in March. Lower delivery fees contributed to the slowdown in April.

Grocery prices increase at a slower pace

Year over year, prices for groceries rose at a slower rate in April (+9.1%) than in March (+9.7%), with the slowdown stemming from smaller price increases for fresh vegetables and coffee and tea.

Price increases for fresh vegetables slowed year over year in April (+8.8%) compared with March (+10.8%), mainly driven by lower prices for lettuce (-3.3%), which have fallen from record price levels in December 2022.

Similarly, coffee and tea prices increased 6.4% on a year-over-year basis in April 2023 compared with 11.1% in March.

Moderating the deceleration were prices for fresh fruit, which increased by 8.3% year over year in April, following a 7.1% gain in March. The increase was led by faster growth in prices for oranges (+12.0%).

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Find the answers to the most common questions about the CPI in the context of the COVID-19 pandemic and beyond.

Regional highlights

Year over year, prices rose at a faster pace in April compared with March in six provinces. Price growth accelerated the most in Alberta, partially due to higher electricity prices.

Note to readers

Consumer Price Index basket update in June 2023

The Consumer Price Index (CPI) is based on a fixed basket of goods and services designed according to international standards and methods. On June 20, 2023, updated basket weights for the goods and services used in the calculation of the CPI will be made available in table 18-10-0007-01. The new basket weight reference period will be 2022, based on the most recent household final consumption expenditure data and other alternative data. The methods and data sources used will be similar to the last basket update in June 2022.

One week later, on June 27, 2023, the May CPI will be released, based on the updated basket weights.

For general information on basket updates, consult The Canadian Consumer Price Index reference paper, chapter 8, "Weights and basket updates."

Homeowners' home and mortgage insurance and passenger vehicle insurance premiums

With the release of the May 2023 CPI, a new data source will be used for the calculation of the homeowners' home and mortgage insurance and passenger vehicle insurance premium indexes. These indexes represent 1.37% and 1.99% of the 2021 CPI basket and are part of the shelter and transportation components, respectively. This change will incorporate more price quotes and a broader range of consumer profiles in the calculation of the insurance indexes.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on May 29. For more information, consult the document "Real-time data tables."

Planned maintenance

The Consumer Price Index Data Visualization Tool will be temporarily unavailable from June 20 to 27, 2023, due to planned maintenance related to the updated basket.

Next release

The updated basket weights for the Consumer Price Index, based on the 2022 weight reference period, will be released on June 20.

The CPI for May will be released on June 27.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: