Canadian Income Survey, 2021

Released: 2023-05-02

$68,400

2021

0.9%

(annual change)

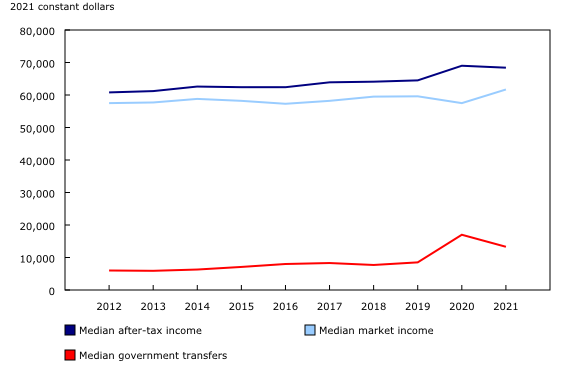

The median after-tax income of Canadian families and unattached individuals was $68,400 in 2021— little change from 2020. With the easing of economic shutdowns related to the COVID-19 pandemic, market income increased in 2021, led by a rebound in employment income and a reduced reliance on COVID-19 relief programs. Despite relatively stable after-tax income, Canada's official poverty rate increased by 1.0 percentage point to 7.4% in 2021, but remained well below the pre-pandemic poverty rate (10.3% in 2019).

Market income growth in 2021 led by employment income

Although many sectors of the economy continued to be impacted by the pandemic in 2021, the median market income of families and unattached individuals grew by 7.3% to $61,700. This growth more than offset the decline observed in 2020 and brought the median market income 3.5% higher than its 2019 level.

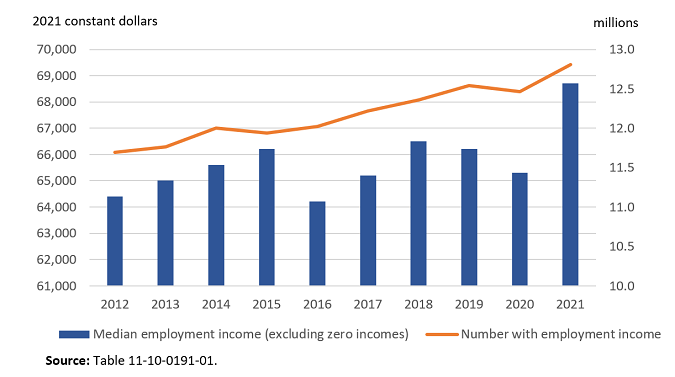

The largest component of market income is employment income, which represents about 80% of the overall amount of market income received by Canadians. Among families and unattached individuals who received employment income, the median amount increased by 5.2% to $68,700 in 2021. This increase in employment income erased losses experienced in 2020 and left the median 3.8% above the pre-pandemic level in 2019.

Government transfers decrease in 2021

As pandemic-related labour market disruptions eased and employment incomes recovered from the drop in 2020, median government transfers received by families and unattached individuals decreased from a high of $17,000 in 2020 to $13,300 in 2021. However, this amount remains well above the 2019 pre-pandemic level of $8,500.

Total COVID-19 benefits received by Canadians dropped by 68% in 2021, and while these benefits represented 28% of all government transfers in 2020, this share decreased to 11% in 2021. On the other hand, both the amounts and number of recipients of Employment Insurance (EI) benefits increased in 2021, as many of those affected by COVID-19 measures in 2021 were supported through EI, rather than through COVID-19 benefits, as in 2020. However, increases in EI benefits only offset a portion of the decreases in COVID-19 benefits, which led to an overall decline in government transfers.

Median after-tax income holds steady in 2021

The median after-tax income for Canadian families and unattached individuals was virtually unchanged in 2021, at $68,400.

Among family types, the median after-tax income increased to $39,600 (+6.7%) in 2021 from the previous year for unattached persons aged younger than 65, and to $92,200 (+2.7%) for non-senior couples. Median after-tax income was relatively unchanged for all other family types.

Improvements to the Canadian Income Survey for the 2021 reference year

With the release of its 2021 estimates, the Canadian Income Survey (CIS) is introducing improvements to the methods and systems used to produce income estimates. Beginning with the 2021 reference year, CIS income data are produced from the Administrative Personal Income Masterfile, a comprehensive source of personal income data generated not only from T1 tax returns, but also from associated tax slips. Estimates for previous reference years were produced using T1 tax returns only. Other changes to income processing were introduced at the same time, and estimates for 2021 also incorporated updates to the weighting methodology. These changes to the data source, processing system and weighting improve the quality of the data, while having minimal impact on key estimates and trends.

The poverty rate increases in 2021, while remaining lower than the pre-pandemic level

According to the Market Basket Measure, Canada's Official Poverty Line, 7.4% of the population, or approximately 2.8 million Canadians lived below the poverty line in 2021, up from 6.4% in 2020. The increase in the poverty rate is partially attributable to a reduction in the number of people who received government transfers and the amount they received. However, despite the increase, the poverty rate in 2021 remained lower than the pre-pandemic level of 10.3% in 2019.

The poverty rate for seniors increased by 2.5 percentage points to 5.6% in 2021, close to the 2019 poverty rate (5.7%), mainly because of the decrease in COVID-19 benefits. Similarly, after a decrease from 12.0% in 2019 to 7.4% in 2020, the poverty rate for unattached seniors increased to 13.0% in 2021. The poverty rate for children increased by 1.7 percentage points, from 4.7% in 2020 to 6.4% in 2021.

Lone-parent families and unattached individuals are more vulnerable to poverty

The poverty rate for unattached individuals was 21.9% in 2021, almost five times the rate for persons in families (4.4%). In 2019, prior to the pandemic, the poverty rate was 26.9% for unattached individuals, while it was 7.0% for persons in families.

In 2021, 16.1% of persons living in lone-parent families experienced poverty, and those in female lone-parent families (17.2%) were more likely to experience poverty than those in male lone-parent families (11.6%). In 2019, 22.0% of persons living in lone-parent families were living under the poverty line.

Indigenous people and racialized groups are more likely to experience poverty

Among Indigenous people aged 16 and older, 13.9% were below the poverty line in 2021, which was nearly double that of the corresponding non-Indigenous population (7.4%).

In 2021, the poverty rate of those who belonged to racialized groups increased to 9.5%, up 1.5 percentage points from 2020. The 2021 poverty rates for the three largest racialized groups in Canada were 7.0% for South Asian Canadians, 11.7% for Chinese Canadians and 11.5% for Black Canadians.

Persons with a disability are also at a higher risk of poverty

Historically, persons with a disability have been more likely to live below the poverty line. In 2021, approximately 979,000 (10.6%) of persons aged 16 and older with a disability lived below the poverty line. This was a 2.1 percentage point increase from the 2020 poverty rate of 8.5%, but 3.1 percentage points less than the 2019 pre-pandemic rate of 13.7%.

Low-income measure increases in 2021, while remaining lower than the pre-pandemic level

Statistics Canada also reports low income based on the low-income measure. The low-income rate in Canada increased from 9.3% in 2020 to 10.6% in 2021. Although the low-income rate increased in 2021, it was still the second-lowest rate in Canada since 1989.

Food insecurity increases

The impacts of the COVID-19 pandemic are still being felt today and expand further than income. In 2021, 18.4% of Canadians, or 6.9 million people lived in households that experienced marginal, moderate or severe food insecurity, up from 15.7%, or 5.8 million people in 2020.

Families with children were more likely to experience food insecurity. Specifically, 42.6% of people living in female lone-parent families and 21.1% of people living in couple families with children experienced food insecurity in 2021. Likewise, increases in food insecurity in 2021 mainly affected families with children. Of the 1.1 million more people in food insecurity in 2021, 802,000 were in families with children.

Looking at 2022

In 2022, Canadians were faced with rapidly increasing costs of living, driven by increased shelter and food costs. At the same time, disposable income grew at a slower-than-average pace for the lowest quintile in 2022, according to National accounts estimates. Rising costs combined with a slow growth rate in income suggests that some families could fall behind.

As described in Market Basket Measure poverty thresholds and provisional poverty trends for 2021 and 2022, the changes observed in the annual Consumer Price Index and disposable income suggest that the poverty rate will increase in 2022 to a level approaching the pre-pandemic mark of 10.3%. The official poverty rate for 2022 will be available in early 2024.

Note to readers

This release covers only the 10 provinces. The release of 2021 results for the territories from the Canadian Income Survey (CIS) is scheduled for June 2023.

The CIS estimates are based on probability samples and are therefore subject to sampling variability, especially for smaller groups and geographies. As a result, year-to-year estimates will show more variability than trends observed over longer periods.

In this release, differences between estimates are statistically significant at the 95% confidence level unless otherwise noted.

Definitions

An economic family refers to a group of two or more persons who live in the same dwelling and are related to each other by blood, marriage, common-law union, adoption or a foster relationship. This concept differs from the census family concept used in the Annual Income Estimates for Census Families and Individuals.

Senior families refer to families in which the highest income earner is aged 65 years or over.

Non-senior families refer to families in which the highest income earner is under 65 years old.

Couples without children refer to non-senior couples without children.

Indigenous people refers to persons aged 16 years and over who self-identified as First Nations (North American Indian), Métis or Inuk (Inuit).

Racialized group is derived directly from the concept of visible minority. A visible minority refers to whether a person is a visible minority or not, as defined by the Employment Equity Act. This act defines visible minorities as "persons, other than Indigenous peoples, who are non-Caucasian in race or non-white in colour." The visible minority population consists mainly of the following groups: South Asian, Chinese, Black, Filipino, Arab, Latin American, Southeast Asian, West Asian, Korean and Japanese. Measurement for population groups designated as visible minorities started in 2020.

Persons with a disability refers to persons aged 16 years and over who met the disability screening questions criteria.

This release analyzes income on the basis of medians. The median is the level of income at which half the population had higher income and half had lower income. Income estimates are expressed in 2021 constant dollars to factor in inflation and enable comparisons across time in real terms.

After-tax income is the total of market income and government transfers, less income tax.

Market income consists of employment income and private pensions, as well as income from investments and other market sources.

Government transfers include benefits such as Old Age Security, the Guaranteed Income Supplement, the Canada Pension Plan and the Quebec Pension Plan, Employment Insurance, social assistance, the goods and services tax credit, provincial tax credits, and child benefits.

For 2020 and 2021, government transfers include emergency response and recovery benefits in response to the COVID-19 pandemic. In this release, COVID-19 benefit estimates include: federal emergency and recovery benefit programs (e.g., Canada Emergency Response Benefit, Canada Emergency Student Benefit, Canada Recovery Benefit, Canada Recovery Caregiving Benefit and Canada Recovery Sickness Benefit) and programs administered by provincial governments as well as a special one-time payment to disabled Canadians. Enhancements to existing federal programs are not included in COVID-19 benefit estimates but are included in total government transfers.

The low-income measure defines an individual as having low income if their household's adjusted after-tax income falls below 50% of the median adjusted after-tax income.

The market basket measure is based on the cost of a specific basket of goods and services representing a modest, basic standard of living. It includes the costs of food, clothing, footwear, transportation, shelter and other expenses for a reference family. These costs are compared with the disposable income of families to determine whether they fall below the poverty line. For more information please see, Report on the second comprehensive review of the Market Basket Measure.

Food insecurity is the inadequate or insecure access to food due to financial constraints. Food insecurity in this release refers to people living in households that experienced marginal, moderate or severe food insecurity.

Products

Two new tables including data by visible minority group, Indigenous group and immigration status are now available: Average and median market, total and after-tax income of individuals by selected demographic characteristics and Poverty and low-income statistics by selected demographic characteristics.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: