Canada's international transactions in securities, February 2023

Released: 2023-04-17

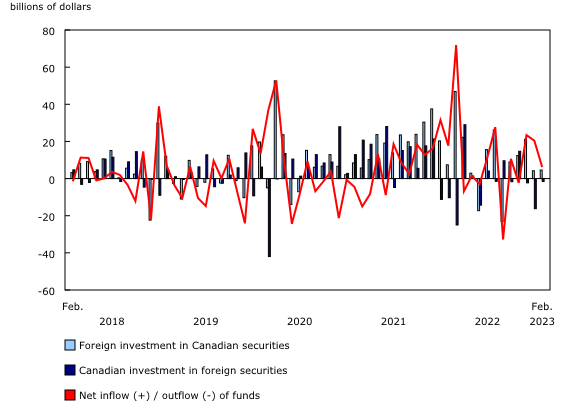

Foreign investment in Canadian securities totalled $4.6 billion in February, led by acquisitions of corporate bonds. Meanwhile, Canadian investors reduced their exposure to foreign securities by $1.6 billion, a third consecutive month of divestment. As a result, international transactions in securities generated a net inflow of funds of $6.2 billion in the Canadian economy in the month.

Foreign investment in Canadian securities continues

Foreign investment in Canadian securities continued for a fifth consecutive month, as non-resident investors added $4.6 billion worth to their portfolios in February. Investments in Canadian debt securities (+$11.2 billion) were moderated by a divestment in equity securities (-$6.6 billion).

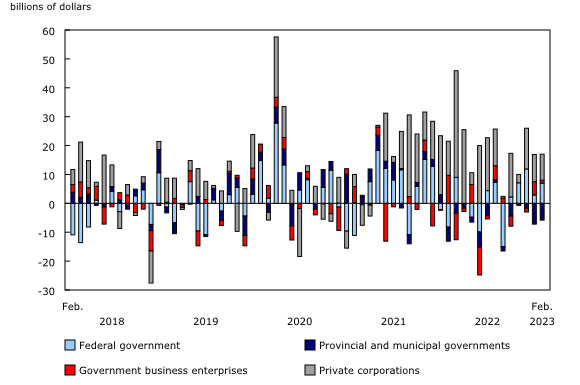

Non-resident investors bought $10.9 billion of private corporate bonds in February, the largest investment since July 2022. The activity in February 2023 was led by new issuances of US dollar denominated bonds abroad by financial corporations. In addition, foreign investors increased their exposure to federal government debt securities by $7.0 billion in February, nearly equally split between bonds and short-term instruments. A reduction in foreign holdings of provincial debt securities moderated the overall investment in the month.

In February, Canadian long-term interest rates were stable, while short-term rates rose to their highest level since July 2007. Meanwhile, the Canadian dollar depreciated against the US dollar in February 2023.

On the other hand, foreign investors reduced their holdings of Canadian equities by $6.6 billion in February. The divestment was widespread across industries, excluding the banking sector. Canadian share prices, as measured by the Standard and Poor's/Toronto Stock Exchange composite index, were down by 2.6% in February.

Canadian divestment in foreign securities slows

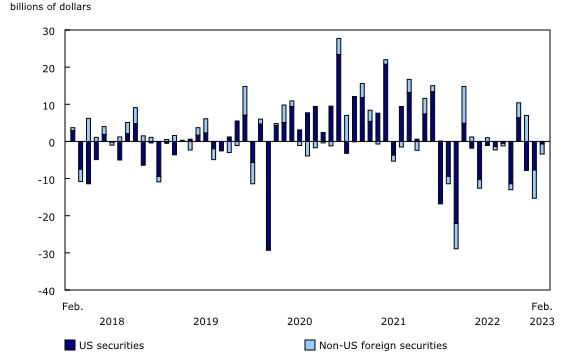

Canadian investors reduced their holdings of foreign securities by $1.6 billion in February after divesting $16.2 billion in January. Canadian divestment in foreign equities continued in February but at a slower pace and was moderated by acquisitions of foreign debt securities. Sales of US shares eased to $691 million in February from an average divestment of $7.8 billion in the previous two months. US share prices, as measured by the Standard and Poor's 500 composite index, fell 2.6% in February.

Note to readers

The data series on international transactions in securities covers portfolio transactions in equity and investment fund shares, bonds, and money market instruments for both Canadian and foreign issues. This activity excludes transactions in equity and debt instruments between affiliated enterprises. These are classified as foreign direct investment in international accounts.

Equity and investment fund shares include common and preferred equities, as well as units or shares of investment funds. For the sake of brevity, the terms "shares" and "equity and investment fund shares" have the same meaning.

Debt securities include bonds and money market instruments.

Bonds have an original term to maturity of more than one year.

Money market instruments have an original term to maturity of one year or less.

Government of Canada paper includes Treasury bills and US-dollar Canada bills.

All values in this release are net transactions unless otherwise stated.

Next release

Data on Canada's international transactions in securities for March will be released on May 17.

Products

The Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China, and Japan.

As a complement to this release, the data visualization product "Securities statistics," part of the series Statistics Canada – Data Visualization Products (71-607-X), is available online.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: