Consumer Price Index, January 2023

Released: 2023-02-21

January 2023

5.9%

(12-month change)

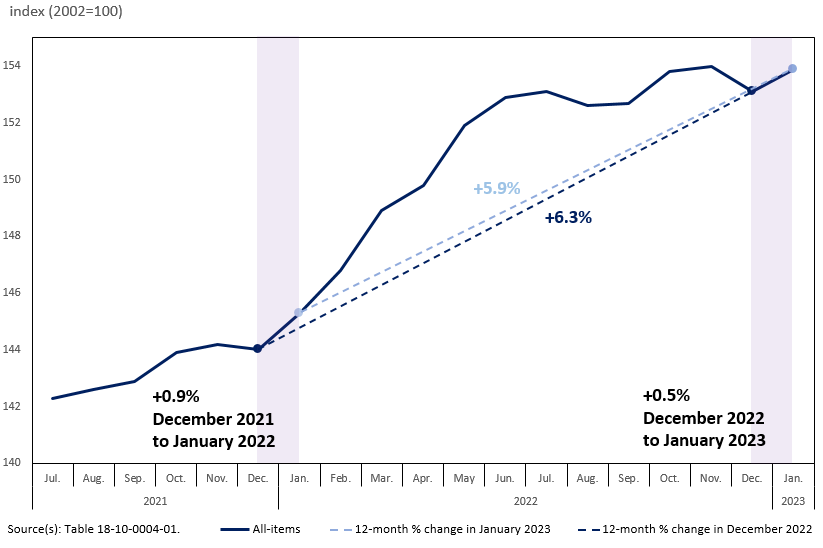

The Consumer Price Index (CPI) rose 5.9% year over year in January, following a 6.3% increase in December. Prices for cellular services and passenger vehicles contributed to the deceleration in the all-items CPI. However, mortgage interest cost and prices for food continue to rise.

In January, prices rose 4.9% on a year-over-year basis excluding food and energy and 5.4% excluding mortgage interest cost. In both cases, year-over-year price growth slowed compared with December.

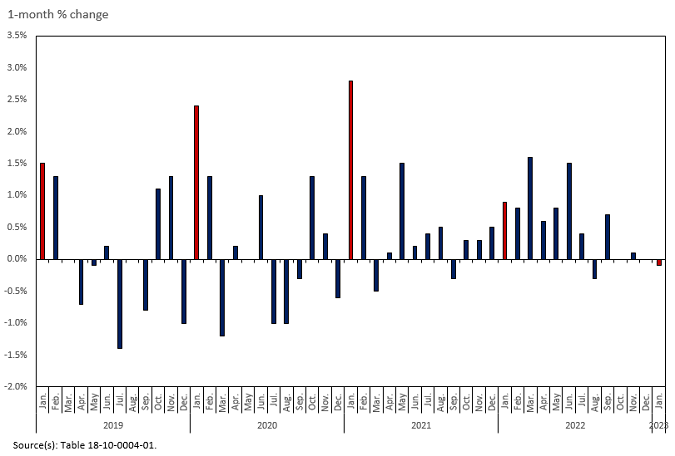

The headline CPI grew at a slower pace year over year in January (+5.9%) compared with December (+6.3%) due to a base-year effect. This is because the monthly increase in January 2023 (+0.5%) was smaller than the monthly increase in January 2022 (+0.9%). In January 2022, mounting tensions amid the threat of a Russian invasion of Ukraine coupled with supply chain disruptions and higher prices for housing put upward pressure on prices.

On a monthly basis, the CPI rose 0.5% in January 2023 following a 0.6% decline in December. Higher gasoline prices contributed the most to the month-over-month increase, followed by a rise in mortgage interest cost and meat prices. On a seasonally adjusted monthly basis, the CPI rose 0.3%.

Base-year effects and the headline Consumer Price Index

The Consumer Price Index (CPI) is a standard measure of the price of a representative basket of goods and services. The headline consumer inflation is measured as the percentage change between the CPI in the current month (January 2023) and the CPI in a base month or the same calendar month of the previous year (January 2022).

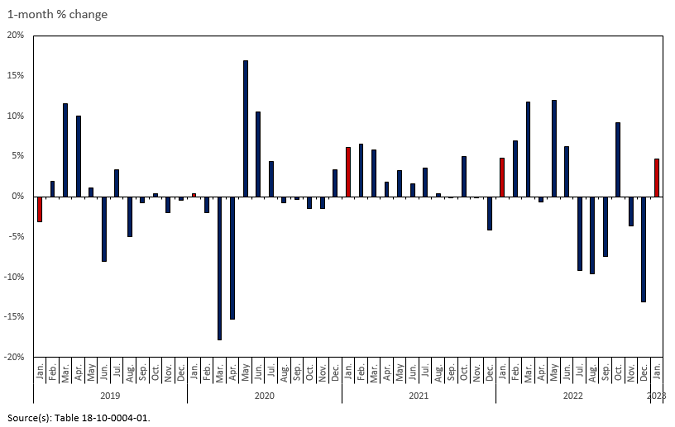

A base-year effect refers to the impact that price movements from 12 months earlier have on the current month's headline consumer inflation. When a large 1-month upward price change in the base month stops influencing or falls out of the 12-month price movement, this has a downward effect on headline CPI in the current month. Conversely, a large 1-month downward price change in the base month creates upward pressure on the current month's 12-month figure.

In the first half of 2022, the global economy was significantly affected by the Russian invasion of Ukraine, and Canadian consumers experienced a significant increase in prices from January to June 2022. Headline consumer inflation increased from 5.1% in January to 8.1% in June 2022. The broad increase in prices in the early months of 2022, led by energy products, had a downward impact on the year-over-year rate of consumer inflation in January 2023, because higher prices from January 2022 were used as the basis for year-over-year comparison.

Price increases observed in the first half of 2022 will continue to fall out of the 12-month price movement. While inflation has slowed in recent months, prices remain elevated. Users should consider the impact of base-year effects when interpreting the 12-month price movement.

Consumers pay more at the pump in January compared with December

Gasoline prices contributed the most to the month-over-month increase in the all-items CPI, rising 4.7% in January. The price increase was related to refinery closures in the southwestern United States following winter storm Elliot.

On a year-over-year basis, prices for gasoline rose 2.9% in January, decelerating slightly from a 3.0% increase in December.

Consumers pay less for cellular services

Cellular service prices fell 7.9% on a year-over-year basis in January, following a 2.5% increase in December. Some Boxing Day sales remained available into January, leading to a decline when compared with the same month a year earlier.

Year-over-year passenger vehicle prices increase at a slower rate

Year over year, consumers paid 6.2% more for passenger vehicles in January following a 7.2% increase in December. This slowdown in price growth is partly attributable to a base-year effect, caused by a 0.9% month-over-month increase in January 2022, when prices were impacted by ongoing supply chain constraints. In comparison, vehicle prices declined 0.1% month over month in January 2023. Lower availability of new model-year vehicles in January 2023 compared with January 2022 may also be contributing to the year-over-year deceleration.

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Find the answers to the most common questions about the CPI in the context of the COVID-19 pandemic and beyond.

Shelter prices decelerate despite continued upward pressure from mortgage interest cost

On a year-over-year basis, shelter prices increased at a slower rate, rising 6.6% in January after a 7.0% increase in December. Growth in other owned accommodation expenses (+1.1%) and homeowners' replacement cost (+4.3%) continued to decelerate amid the ongoing cooling of the housing market.

At the same time, the mortgage interest cost index continued to rise at a faster year-over-year pace amid the higher interest rate environment, rising 21.2% in January, the largest increase since September 1982, following an 18.0% increase in December.

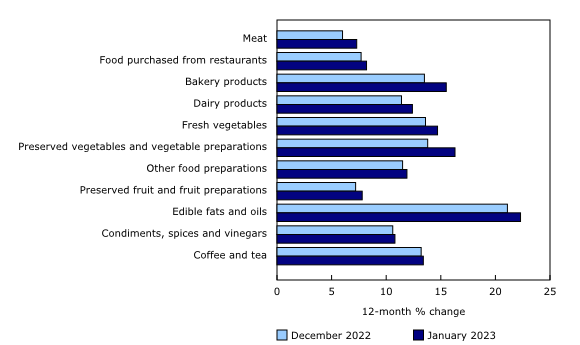

Food prices rise at a faster pace year over year

Food prices, which include both groceries and food from restaurants, rose at a slightly faster pace year over year in January (+10.4%) than in December (+10.1%).

Grocery price acceleration in January was driven in part by year-over-year growth in meat prices (+7.3%), resulting from the largest month-over-month increase since June 2004. Fresh or frozen chicken prices were a notable contributor to the gain, rising 9.0% in January compared with December, the largest monthly increase since September 1986. Among other factors, chicken prices rose amid stronger seasonal demand as well as ongoing supply constraints, elevated input costs and issues related to avian influenza. Additional acceleration was seen in year-over-year price increases for bakery products (+15.5%), dairy products (+12.4%) and fresh vegetables (+14.7%).

Food purchased from restaurants also rose at a faster pace, rising 8.2% in January following a 7.7% increase in December. The gain was the result of higher prices for fast food and takeout.

Regional highlights

Year over year, prices rose at a slower pace in January compared with December in nine provinces. Price growth slowed the most in Manitoba, the province with the largest deceleration in gasoline prices. At the same time, New Brunswick was the only province where prices rose at a faster pace in January, as price growth for gasoline accelerated the most compared with the rest of the country.

Lower energy prices in Alberta

Electricity prices in Alberta fell 45.6% in January compared with December, the largest monthly decline on record. The decline follows a provincial initiative to reduce electricity rates and increase the provincial electricity rebate.

Alberta was the only province with a year-over-year decline in gasoline prices (-6.4%). This reflects the complete suspension of the provincial gas tax starting January 1, following the previous partial suspension.

Note to readers

Find the answers to the most common questions about the Consumer Price Index (CPI), including how food prices are collected and how shelter costs are measured.

Enhancements to CPI-median and CPI-trim

With today's release of the January 2023 CPI, the CPI-trim and CPI-median were revised back 84 months as per their normal annual revision policy. Two enhancements were made:

1. Statistics Canada published, for the first time, index-level data series for the CPI-trim and CPI-median to accompany the year-over-year figures published monthly since December 2016. The change was made in response to user requests, and to provide users additional flexibility with the data.

2. The seasonal adjustment treatment of step-series indexes that are included in the calculation of the CPI-trim and CPI-median was enhanced as part of the regular review of methodologies that ensures techniques are improved to produce the most accurate indicators as possible for users. These enhancements had no impact on the All-items CPI, seasonally adjusted All-items CPI, or the CPI-common.

These enhancements have no impact on the All-items CPI, seasonally adjusted All-items CPI, or the CPI-common.

Additional details can be found in the explanatory note, Enhancements to the publication of core inflation measures based on the trimmed mean (CPI-trim) and the weighted median (CPI-median).

Upcoming enhancement: New approach to estimating the sub-indices of the digital computing equipment and devices index

The computer equipment, software and supplies index and the multipurpose digital devices index, which are sub-indices of the digital computing equipment and devices index, will be updated with an enhanced methodology and new data sources with the release of the February CPI on March 21. A technical paper describing the new approach is now available, Measuring the price of digital computing equipment and devices in the Consumer Price Index.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on March 6. For more information, consult the document "Real-time data tables."

Next release

The CPI for February will be released on March 21.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: