One in four Canadians are unable to cover an unexpected expense of $500

Released: 2023-02-13

One in four Canadians are unable to cover an unexpected expense of $500

In fall 2022, over one-third (35%) of Canadians reported that it was difficult for their household to meet its financial needs in the previous 12 months. When asked whether their household had the resources to cover an unexpected expense of $500, 26% said that they would be unable to do so, with a slightly larger percentage of women (29%) reporting this difficulty than men (24%). Further, while the vast majority of Canadians were concerned with rising gasoline and food prices, almost half (44%) said they were very concerned with their household's ability to afford housing or rent.

These results come from the most recent cycle of the Canadian Social Survey on Quality of Life and Cost of Living, collected from October 21 to December 4, 2022, conducted in response to rising economic inflation.

In 2022, Canada saw the largest increase in the Consumer Price Index (CPI) since 1982 (+10.9%), with an increase of 6.8% since 2021. Prices rose for all eight major components of the CPI, with the largest increases in transportation (+10.6%), food (+8.9%) and shelter (+6.9%).

While most Canadians reported concerns over increasing challenges of affordability, not all individuals were affected equally.

Young adults are struggling to meet financial needs

Young adults were among those most concerned over finances. Almost half (46%) of people aged 35 to 44 years found it difficult to meet their financial needs in the previous 12 months, the highest proportion of any other age group. Those aged 45 to 54 years (41%) had the next highest proportion, and people aged 65 years and older (25%) were the least likely to report difficulty.

Similarly, when asked whether their household could cover an unexpected expense of $500 today, more than one-third (35%) of people aged 35 to 44 years said that they would be unable to do so, followed by those aged 45 to 54 years (30%). People aged 65 years and older (19%) were the least likely to expect difficulty covering such an unexpected expense.

This generational disparity was particularly noticeable over concern with housing prices. When asked if they were concerned about their ability to afford housing or rent, 58% of people aged 15 to 24 years reported being very concerned, followed by 56% of those aged 25 to 34 years. People aged 65 years and older (27%) reported the least concern.

When asked whether rising housing prices influenced their decision to move in the last six months, 44% of people aged 25 to 34 years reported that, due to rising prices, they either wanted to purchase a home or move but did not, or they moved sooner than planned or chose a more affordable option (e.g., downsizing to a more affordable house or rental). In comparison, less than 15% of Canadians aged 45 years and older gave this answer. This is in line with 2021 findings that Canadian homeownership has been on the decline since 2011, particularly among young adults.

Certain racialized groups are disproportionately affected by the rising cost of housing

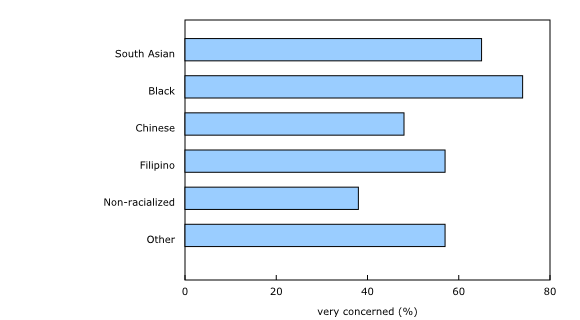

Younger Canadians were not the only ones concerned with rising housing prices. Among Black Canadians, 74% reported being very concerned over the cost of housing, as did 65% of South Asians. According to the 2021 Census of Population, some of these groups were less likely to be home owners and more likely to face financial vulnerability related to housing. Non-racialized, non-Indigenous people (38%) reported the least concern over housing prices.

When asked whether rising prices influenced their decision to move within the past six months, over 4 in 10 Filipino (48%), South Asian (41%) and Black (40%) people agreed that it had, compared with slightly over 1 in 5 non-racialized, non-Indigenous individuals (21%).

Other indicators also suggested more financial vulnerability among certain population groups. When asked if their household could cover an unexpected expense of $500 today, over half (51%) of Black people replied that they could not, followed by 38% of Filipino people. By comparison, 14% of Chinese people reported that they would be unable to cover an unexpected expense of $500.

Canadians in different regions face different financial pressures

The effects of the rising cost of living varied across regions in Canada. For the Atlantic Region and the Prairie Region, 38% of respondents in each region reported difficulty in meeting their household financial needs in the previous 12 months, compared with Quebec (29%), which reported the least amount of difficulty. This is consistent with consumer prices increasing at a greater rate in Prince Edward Island (+8.9%) and Manitoba (+7.9%).

Additionally, when asked if their household could cover an unexpected expense of $500 today, one-third (33%) of respondents in the Atlantic Region replied that they could not, followed by 28% in the Prairie Region. Respondents in British Columbia were best equipped to handle the expense, with fewer than one in five respondents (19%) indicating they could not cover it.

Conversely, the Atlantic Region and the Prairie Region (39% each) were the least concerned with rising housing prices and the least likely to have their decision to move be influenced by the higher cost of housing (21% in the Atlantic region and 23% in the Prairie Region). This is in contrast with British Columbia (46%) and Ontario (47%), where almost half of respondents reported being very concerned with their ability to afford housing or rent. Additionally, 28% of respondents in British Columbia and 28% of those in Ontario reported they either wanted to move but did not or moved sooner than planned due to rising housing prices.

Financial optimism remains in face of challenges

Despite higher levels of concern about increasing cost of living, Canadians aged 25 to 34 years reported the highest level of optimism regarding an improvement in their financial situation in one year, with 37% reporting a belief that it will improve. This optimism steadily declined across older demographics, with 7% of those aged 65 years and older believing that their financial situation would improve within one year. One possible explanation is that seniors are more likely to live on a fixed income or pension.

Similarly, despite reporting financial vulnerability and concern, over one-quarter of racialized individuals reported believing that their financial situation would improve in one year, including over one-third (35%) of Black people, compared with fewer than one in five non-racialized individuals (19%).

Note to readers

This release used the Canadian Social Survey (CSS) – Quality of Life and Cost of Living (collected from October 21 to December 4, 2022), released today. The CSS collects information on a variety of social topics such as health, well-being, impacts of the COVID-19 pandemic, changes in the household, work–life balance, time use, intentions to have children, and changes in marital status.

The following questions were included in this release: "Are you concerned with your ability to afford housing or rent because of rising housing prices?"; "Have rising housing prices or rents influenced decisions about whether to move from your current residence within the last six months?"; "In the past 12 months, how difficult or easy was it for your household to meet its financial needs in terms of transportation, housing, food, clothing and other necessary expenses?"; "Today, could your household cover an unexpected expense of $500 from your household's resources?" and "Do you think your financial situation will be better, about the same or worse in one year?"

The CSS aims to better understand social issues rapidly by conducting surveys on different topics every three months. Statistics Canada would like to thank all Canadians who took the time to answer the questions.

In this release, the term "Canadians" refers to residents of Canada, regardless of citizenship status.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: