Labour Force Survey, January 2023

Released: 2023-02-10

Highlights

Employment increased by 150,000 (+0.8%) in January, and the unemployment rate held steady at 5.0%.

Employment gains were driven primarily by people aged 25 to 54 (+100,000; +0.8%), split evenly between women and men in this group. Employment also increased among people aged 55 and older (+43,000, +1.0%), while it was little changed among youth aged 15 to 24.

The largest employment increases were in Ontario (+63,000; +0.8%), Quebec (+47,000; +1.1%) and Alberta (+21,000; +0.9%). Employment declined in Newfoundland and Labrador (-2,300; -1.0%).

There were gains across several industries, led by wholesale and retail trade (+59,000; +2.0%), health care and social assistance (+40,000; +1.5%) and educational services (+18,000; +1.3%). At the same time, employment declined in transportation and warehousing (-17,000; -1.7%).

The number of employees grew in both the private (+115,000; +0.9%) and public (+32,000; +0.8%) sectors. The number of self-employed workers was little changed.

Total hours worked rose 0.8% in January and were up 5.6% on a year-over-year basis. The proportion of employees absent due to illness or disability was 7.1% during the reference week. This was below the record-high 10.0% observed in January 2022 and on par with a typical January (not seasonally adjusted).

Average hourly wages rose 4.5% (+$1.42 to $33.01) on a year-over-year basis in January, down from 4.8% (+$1.49) in December (not seasonally adjusted).

There were large employment increases in both Canada and the United States in January.

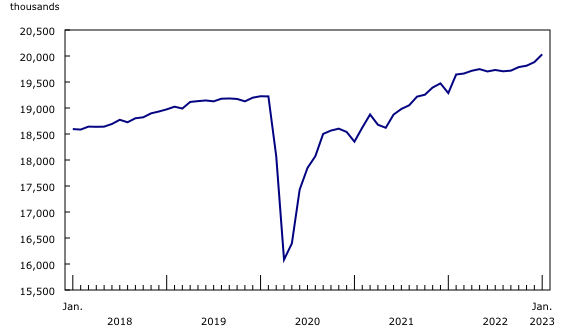

Employment continues upward trend

Employment rose by 150,000 (+0.8%) in January, mostly in full-time work (+121,000; +0.7%). This continued an upward trend in total employment that began in September 2022, with cumulative gains totalling 326,000 (+1.7%). The increase in January pushed the employment rate—the percentage of people aged 15 and older who are employed—to 62.5%, a level last observed in April and May 2019.

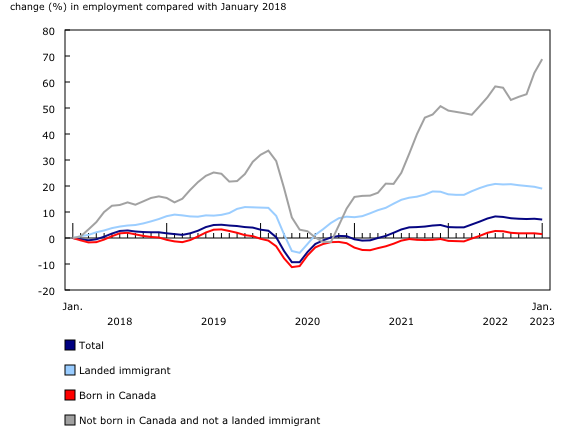

Notable employment growth among the group that includes non-permanent residents

According to the latest population estimates, in the third quarter of 2022, Canada's population grew at the fastest rate in over 50 years, mainly driven by an increase in non-permanent residents.

In the Labour Force Survey (LFS), non-permanent residents represent the majority of a larger group which includes all those who were not born in Canada and have never been a landed immigrant. Non-permanent residents can hold various kinds of work, study, or residence permits.

On a year-over-year basis, employment for those who were not born in Canada and have never been a landed immigrant was up 13.3% (+79,000) in January, compared with growth in total employment of 2.8% (+536,000). As of January, this group accounted for 3.4% of total employment, up slightly from 3.1% a year earlier (three-month moving averages; not seasonally adjusted).

Employment among those who were not born in Canada and have never been a landed immigrant was spread across a range of industries in January 2023, including professional, scientific and technical services (13.1%), retail trade (12.3%), accommodation and food services (11.2%), and health care and social assistance (9.8%) (three-month moving averages; not seasonally adjusted).

Employment growth driven by core-aged women and men

Among women aged 25 to 54, employment rose by 51,000 (+0.8%) in January, boosting their employment rate up 0.5 percentage points to 82.2%, the highest rate since comparable data became available in 1976. On a year-over-year basis, the employment rate for core age women was up 2.1 percentage points.

The employment rate among core-aged women whose youngest child was under six rose markedly over the previous 12 months, from 72.9% to 76.6%. Core-aged women with young children are typically less likely to be employed, and these increases can reflect a tight labour market as well as a range of factors, such as the need to meet household financial requirements or changing access to childcare. The employment rate of core-aged women with young children increased in most provinces in the 12 months to January, although it declined in Manitoba and Nova Scotia (not seasonally adjusted).

Employment among core-aged men increased by 50,000 (+0.7%) in January, and the employment rate for this group climbed 0.5 percentage points to 88.3%. For core-aged men with young children, the employment rate was 93.0%, up from 92.2% in January 2022 (not seasonally adjusted). On a year-over-year basis, employment grew at a slower pace for core-aged men (+179,000; +2.7%) than for core-aged women (+246,000; +4.1%).

Employment rate for men aged 55 to 64 reaches new high

Among people aged 55 and older, employment rose by 43,000 (+1.0%) in January. This growth was led by men aged 55 to 64 (+24,000; +1.4%), and the employment rate for this group increased 1.0 percentage points to 70.5%, reaching a high not seen since 1981. Similarly, 59.6% of women aged 55 to 64 were employed in January, the highest rate since 1976. Employment rates among people 55 to 64 have been on a strong upward trend since the summer of 2022, mirroring the rise in employment over that period observed among most demographic groups.

On a year-over-year basis, employment among people aged 55 and older was up in a number of industries in January, led by professional, scientific and technical services (+59,000; +17.3%), manufacturing (+31,000; +6.8%), "other services" (+30,000; +18.0%), and health care and social assistance (+30,000; +6.0%) (not seasonally adjusted).

Year-over-year growth in average hourly wages slows for a second consecutive month

Average hourly wages rose 4.5% (+$1.42 to $33.01) on a year-over-year basis in January, down from 4.8% (+$1.49) in December. Year-over-year wage growth reached 5.0% in June 2022 and peaked at 5.8% in November (not seasonally adjusted).

In general, changes in wage growth can be the result of many factors, including changes in the composition of employment by industry and occupation. The slower pace of year-over-year wage growth in January 2023 partly reflects relatively high average wages in January 2022. With COVID-19 pandemic-related public health restrictions in place at that time, associated employment declines in lower-wage industries—including wholesale and retail trade, accommodation and food services, as well as information, culture, and recreation—helped temporarily boost the average wage.

Unemployment remains near record low, while participation increases

The unemployment rate held steady at 5.0% in January, just shy of the record-low 4.9% observed in June and July 2022. The total number of unemployed people stood at 1.0 million, similar to the level observed since the summer of 2022.

Among people aged 25 to 54, the unemployment rate edged down (-0.1 percentage point to 4.1%) in January, while it increased for people aged 55 and older (+0.2 percentage points to 4.5%) and was little changed for youth aged 15 to 24. On a year-over-year basis, the unemployment rate was down among all major demographic groups, with youth seeing the largest decline (-3.0 percentage points to 9.5%).

The unemployment rate trended down for most core-aged racialized population groups in the 12 months to January, but remained higher than the national average for several groups. The unemployment rate in January 2023 remained highest among Arab (8.1%) and Korean (8.0%) Canadians, followed by Black (7.2%) and West Asian (5.8%) Canadians (three-month moving averages; not seasonally adjusted).

The majority (63.9%) of unemployed people in January had been unemployed for a relatively short amount of time—between 1 and 13 weeks. Long-term unemployment (the proportion of the unemployed who had been out of work continuously unemployed for 27 weeks or more) was 15.8%, down from 19.9% in January 2022.

The size of the labour force has continued to grow. In January, an additional 153,000 (+0.7%) people joined the labour force, boosting the participation rate to 65.7% (+0.3 percentage points). The participation rate had recovered to its pre-pandemic level (65.9%) in September 2021 before trending slightly downward and reaching 65.3% in June 2022. In recent months—from July 2022 to January 2023—the labour force grew by 336,000 (+1.6%), outpacing population growth. The participation rate was up across virtually all major demographic groups over this period, particularly among core-aged women and people aged 55 to 64.

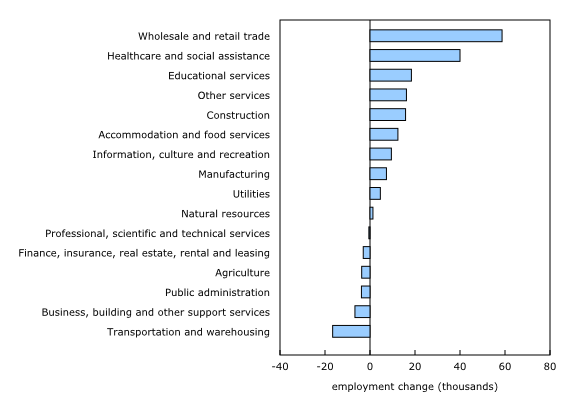

Employment rises in six industries, led by wholesale and retail trade

The increase in employment in January was widespread across industries. In wholesale and retail trade, the number of people working grew by 59,000 (+2.0%), the first notable increase since February 2022. This increase follows a decline in retail sales and a general slowing of economic activity in the retail industry in November. On a year-over-year basis, employment in wholesale and retail trade was little changed. Monthly employment increases were spread across five provinces, including British Columbia (+18,000; +4.3%), Ontario (+16,000; +1.5%) and Quebec (+12,000; +1.8%).

The health care and social assistance industry saw employment gains of 40,000 (+1.5%) in January, offsetting losses observed in December. On a year-over-year basis, employment in the industry was up by 49,000 (+1.9%). The monthly increase was concentrated primarily in Ontario (+21,000; +2.2%) and Quebec (+11,000; +1.9%). The latest Job Vacancy and Wage Survey data from November show a slight decrease in job vacancies in the healthcare and social assistance industry after remaining elevated for several months.

After three consecutive months of little change, the number of people working in educational services rose by 18,000 (+1.3%) in January and was on par with the level seen 12 months earlier. Much of this increase occurred in Quebec (+9,000; +2.6%).

Employment in construction grew by 16,000 (+1.0%) in January, building on a gain of 27,000 recorded in December 2022. On a year-over-year basis, employment was up 114,000 (+7.6%), making construction one of the fastest-growing industries over the previous 12 months, exceeded only by accommodation and food services (+23.0%), information, culture and recreation (+12.6%), and professional, scientific and technical services (+8.9%).

The number of people working in the "other services" industry—which includes a variety of services such as personal care and repair and maintenance—rose in January (+16,000; +2.2%), the second increase in three months. Employment in utilities was also up in January (+4,600; +3.2%).

Employment in transportation and warehousing fell by 17,000 (-1.7%) in January, the first notable decrease since March 2022. Compared with 12 months earlier, employment in the industry was down 37,000 (-3.6%) in January 2023.

Employment up in five provinces in January

Employment increased in Ontario, Quebec, Alberta, Nova Scotia, and Saskatchewan, while it declined in Newfoundland and Labrador. There was little change in the other provinces. For further information on key province and industry-level labour market indicators, see "Labour Force Survey in brief: Interactive app."

Employment in Ontario rose by 63,000 (+0.8%) in January, the third notable employment gain in four months. The unemployment rate for the province was little changed at 5.2%. In the census metropolitan area (CMA) of Toronto, employment increased by 28,000 (+0.8%), and the unemployment rate was 5.9%.

Employment was up by 47,000 (+1.1%) in Quebec in January, the third significant employment increase since September. At 3.9%, the provincial unemployment rate continued to hover around a record low and was the lowest among the provinces. The CMA of Montréal saw little change in both the employment and the unemployment rate (4.6%) in the month.

In Alberta, employment rose by 21,000 (+0.9%) in January, bringing gains since September 2022 to 48,000 (+2.0%). The unemployment rate increased 0.4 percentage points to 6.0% in January as more Albertans searched for work. On a year-over-year basis, employment in the province increased by 99,000 (+4.3%), nearly all in full-time work. The bulk of the year-over-year employment gains were in professional, scientific and technical services (+54,000 or + 27.3%), while employment fell in natural resources (-15,000; -10.1%).

Nova Scotia recorded an employment gain of 1.9% (+9,400) in January, the second notable gain in three months. The unemployment rate fell 1.2 percentage points to 5.0%, matching the national rate.

Following little change in November and December, employment in Saskatchewan increased by 4,500 in January (+0.8%), while the unemployment rate was little changed at 4.3%. In the 12 months to January, employment in Saskatchewan rose by 14,000 (+2.5%), with gains across the services-producing sector.

Newfoundland and Labrador was the only province with fewer people employed (-2,300; -1.0%) in January, mostly offsetting a gain in December. The unemployment rate rose 1.7 percentage points to 11.8% in January.

In the Spotlight: both Canada and the United States observe strong employment growth in January

Comparisons between the labour market situation in Canada and in the United States can be made by adjusting Canadian data to US concepts. For more information, see "Measuring Employment and Unemployment in Canada and the United States – A comparison."

Similar to Canada, employment in the US grew strongly in January, with total non-farm payroll employment increasing 517,000 (+0.3%). At the same time, the US unemployment rate was 3.4%, the lowest in over 50 years. In comparison, employment in Canada—using LFS data adjusted to US concepts—increased by 141,000 (+0.7%) in January. The Canadian unemployment rate adjusted to US concepts was unchanged at 4.0%.

As reported in the recent article "Employment growth in Canada and the United States during the recovery from COVID-19," employment rebounded faster in Canada than it did in the United States, following a sharp drop in employment during the COVID-19 lockdowns of early 2020. Employment in Canada had returned to its pre-COVID-19 level by February 2022, while in the US, it did so in June 2022.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Labour Force Survey is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goals:

Note to readers

The Labour Force Survey (LFS) estimates for January are for the week of January 15 to 21, 2023.

The LFS estimates are based on a sample and are therefore subject to sampling variability. As a result, monthly estimates will show more variability than trends observed over longer time periods. For more information, see "Interpreting Monthly Changes in Employment from the Labour Force Survey."

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

LFS estimates at the Canada level do not include the territories.

The LFS estimates are the first in a series of labour market indicators released by Statistics Canada, which includes indicators from programs such as the Survey of Employment, Payrolls and Hours (SEPH); Employment Insurance Statistics; and the Job Vacancy and Wage Survey. For more information on the conceptual differences between employment measures from the LFS and those from the SEPH, refer to section 8 of the Guide to the Labour Force Survey (71-543-G).

Face-to-face personal interviewing resumed in November 2022. Telephone interviews continued to be conducted by interviewers working from their homes rather than Statistics Canada's call centres, as they have since March 2020. About 48,500 interviews were completed in January and in-depth data quality evaluations conducted each month confirm that the LFS continues to produce an accurate portrait of Canada's labour market.

The employment rate is the number of employed people as a percentage of the population aged 15 and older. The rate for a particular group (for example, youths aged 15 to 24) is the number employed in that group as a percentage of the population for that group.

The unemployment rate is the number of unemployed people as a percentage of the labour force (employed and unemployed).

The participation rate is the number of employed and unemployed people as a percentage of the population aged 15 and older.

Full-time employment consists of persons who usually work 30 hours or more per week at their main or only job.

Part-time employment consists of persons who usually work less than 30 hours per week at their main or only job.

Total hours worked refers to the number of hours actually worked at the main job by the respondent during the reference week, including paid and unpaid hours. These hours reflect temporary decreases or increases in work hours (for example, hours lost due to illness, vacation, holidays or weather; or more hours worked due to overtime).

In general, month-to-month or year-to-year changes in the number of people employed in an age group reflect the net effect of two factors: (1) the number of people who changed employment status between reference periods, and (2) the number of employed people who entered or left the age group (including through aging, death or migration) between reference periods.

Seasonal adjustment

Unless otherwise stated, this release presents seasonally adjusted estimates, which facilitate comparisons by removing the effects of seasonal variations. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Revisions to the Labour Force Survey

On January 30, 2023, revised LFS data were released, resulting in minor changes to recent and historical LFS data.

There are three main components to the revision:

1. To align LFS data with the most recent version of the National Occupational Classification, as is done every five years;

2. To introduce enhancements to the rules and parameters used in the editing and imputation of LFS data to take full advantage of data processing and information technology systems changes made in 2019; and

3. To fine-tune the parameters used in the seasonal adjustment of LFS estimates, as is done every year.

These revisions ensure that survey estimates accurately reflect the Canadian labour market, while having minimal impact on the comparability of labour market indicators, such as employment, unemployment and participation rates, over time.

The January 2023 data released today are aligned with the revised series.

Next release

The next release of the LFS will be on March 10, 2023. February 2023 data will reflect labour market conditions during the week of February 12 to 18, 2023.

Products

More information about the concepts and use of the Labour Force Survey is available online in the Guide to the Labour Force Survey (71-543-G).

The product "Labour Force Survey in brief: Interactive app" (14200001) is also available. This interactive visualization application provides seasonally adjusted estimates by province, sex, age group and industry.

The product "Labour Market Indicators, by province and census metropolitan area, seasonally adjusted" (71-607-X) is also available. This interactive dashboard provides customizable access to key labour market indicators.

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to labour market indicators for Canada, provinces, territories and economic regions.

The product Labour Force Survey: Public Use Microdata File (71M0001X) is also available. This public use microdata file contains non-aggregated data for a wide variety of variables collected from the Labour Force Survey. The data have been modified to ensure that no individual or business is directly or indirectly identified. This product is for users who prefer to do their own analysis by focusing on specific subgroups in the population or by cross-classifying variables that are not in our catalogued products.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: