Consolidated Canadian Government Finance Statistics, 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-11-22

Canadian general government deficit shrinks, still above pre-pandemic levels

The consolidated Canadian general government (CGG) deficit (which includes all federal, provincial, territorial and local governments) dropped sharply from $291.9 billion in 2020 to $99.0 billion in 2021, a 66.1% decrease. The increase in revenues (+13.9%)—particularly driven by corporate income taxes (+26.4%), taxes on goods and services (+17.1%) and personal income taxes (+9.7%)—combined with the decrease in expenses (-6.8%) contributed to the reduced deficit. The decrease in expenses was driven by decreased COVID-19-related transfers, shown by large declines in subsidies (-44.0%) and social benefits (-22.2%).

The net operating balance is the difference between revenues and expenses for a given period and is a summary measure of the sustainability of government operations. When revenues are lower than expenses, a deficit is recorded, while the reverse induces a surplus.

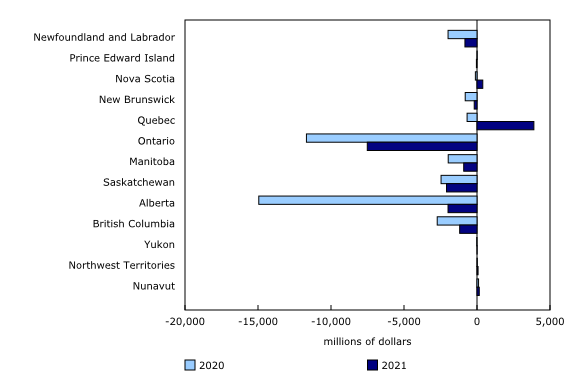

The federal government accounted for the majority ($88.7 billion) of the CGG deficit, while the consolidated provincial, territorial and local governments (PTLGs) recorded a deficit of $10.2 billion. Compared with 2020, the federal government deficit declined by 65.2%, while that of PTLGs shrank by 72.6%.

As a percentage of nominal gross domestic product (GDP), the CGG deficit decreased sharply to 3.9% after reaching 13.2% in 2020. The strong growth in GDP (+13.6%) and the quick reduction of the federal government deficit contributed to the improvement of the deficit-to-GDP ratio.

Revenue goes up as gross domestic product surges

In 2021, federal government revenue grew by $34.3 billion (+9.8%) linked to significant increases in taxes on income, profits and capital gains (+$20.0 billion) and taxes on goods and services (+$12.1 billion). Federal government expenses decreased sharply (-21.7%) compared with 2020, from $605.5 billion to $473.9 billion. Decreased expenses were primarily attributable to fewer subsidies and social benefits: Canada Emergency Wage Subsidy and Canada Emergency Response Benefits totalled $149.2 billion in 2020 and $19.1 billion in 2021.

PTLG revenues went up by $65.8 billion (+10.6%) compared with 2020. Tax revenues grew by 16.8%, mainly driven by higher personal income taxes (+$19.2 billion or +16.6%), taxes on goods and services (+$17.2 billion or +15.2%) and corporate income taxes (+$16.7 billion or +48.0%). Property income increased by 56.5%, mostly attributable to the jump in rent revenue from oil and gas royalties (+351.6%). This growth is mostly explained by a surge in oil and natural gas prices on the world markets: in Alberta alone, oil and gas royalties ascended to $16.0 billion in 2021 (from $3.0 billion in 2020).

PTLG expenses increased by $38.8 billion (+5.9%), thus mitigating the impact of strong revenue growth on the deficit. Among all provinces, expenses increased most sharply in Saskatchewan (+17.6%), followed by Prince Edward Island (+9.2%), Nova Scotia (+7.0%) and British Columbia (+6.9%). The growth in Saskatchewan's expenses was mainly due to higher agricultural subsidies. Indeed, extreme weather conditions have caused significant damage to crops, resulting in a sharp increase in crop insurance claims.

Among the provinces, Quebec ($3.9 billion or 0.8% of GDP) and Nova Scotia ($0.4 billion or 0.8% of GDP) posted a surplus in 2021, while other provinces remained in deficit. Compared with 2020, the deficit-to-GDP ratio improved in all provinces, except in Prince Edward Island. The highest deficits expressed as a percentage of GDP were observed in Saskatchewan (2.4%), Newfoundland and Labrador (2.2%) and Manitoba (1.1%).

Canadian general government fiscal burden remains stable

Fiscal burden measures the taxes and social contributions paid to governments by individuals, businesses, and non-residents, expressed as a percentage of GDP. These compulsory transfers constituted 83.5% of total revenues generated by the CGG in 2021.

Including the Canada Pension Plan (CPP) and Quebec Pension Plan (QPP), taxes and social contributions in Canada totalled $878.6 billion in 2021, up from $772.4 billion in 2020 (+$106.2 billion or +13.7%). This represented a fiscal burden of 35.0% of nominal GDP in 2021, a similar level to the previous year.

While federal government revenues from taxes and social contributions as a percentage of GDP decreased, from 14.9% in 2020 to 14.5%, the PTLG fiscal burden increased in 2021 to 17.3% of GDP from 16.8%. PTLG fiscal burden as a percentage of GDP was highest in Quebec (23.1%), followed by Ontario (18.1%) and Nova Scotia (18.0%), while Alberta (10.1%) posted the lowest fiscal burden among the provinces. The territories recorded a significantly lower fiscal burden than the provinces, with Nunavut posting the lowest at 3.8%. The territories rely more heavily on federal transfers than on fiscal revenues to deliver essential goods and services to the population.

Federal transfers to the provinces and territories decline from the peak of 2020

The federal government extends different types of grants to the provinces and territories to help them provide essential programs and services to all Canadians, such as health care, education, social assistance, and childhood development. The largest transfers are the Canada Health Transfer, the Canada Social Transfer, equalization payments and territorial formula financing.

In 2021, PTLGs received $112.4 billion in federal grants, down from the peak of $129.5 billion in 2020. In 2020, the federal transfers to PTLGs included $19.7 billion related to the Safe Restart Agreement. Grants received by Ontario ($32.5 billion) and Quebec ($30.0 billion) represented 55.6% of the total federal grants to the PTLGs. These two provinces had 61.2% of the Canadian population in 2021.

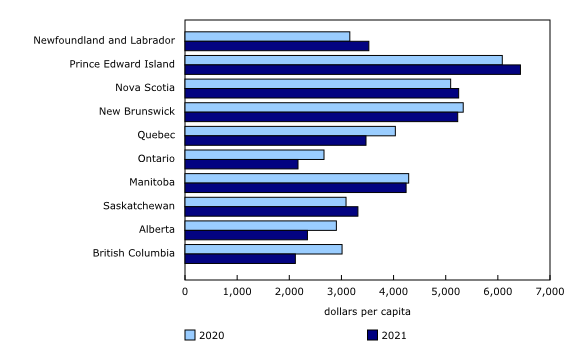

On a per capita basis, federal transfers paid to PTLGs declined, from $3,397 in 2020 to $2,909 in 2021. Among all provinces, Prince Edward Island received the highest grants per capita ($6,433), followed by Nova Scotia ($5,248) and New Brunswick ($5,230). By contrast, British Columbia received the lowest grants per capita ($2,116), closely followed by Ontario ($2,167) and Alberta ($2,348).

In the territories, federal grants amounted to $57,273 per capita in Nunavut, $44,028 in the Northwest Territories and $35,847 in Yukon. Federal transfers accounted for 77.9% of total revenues in the territories.

Interest charges remain low despite debt accumulation

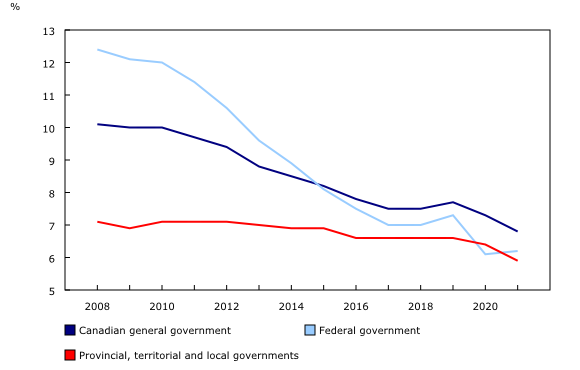

Canada's total outstanding general government debt costs billions of dollars each year in interest charges. In 2021, CGG's interest expenses accrued on debt liabilities totalled $64.6 billion (+6.2%) compared with $60.8 billion in 2020. Thus, Canadian governments spent 6.8 cents of every dollar earned on debt charges.

In 2021, the federal government spent $24.0 billion on interest, up 12.2% compared with 2020. The interest expense to revenue ratio was relatively stable at 6.2 cents (6.1 cents in 2020). In the early 1990s, despite a similar level of gross debt as a percentage of GDP, the federal government was paying more than 30 cents in interest for every dollar of revenue received, reflecting much higher interest rates at that time.

In 2021, at the Canada level for PTLG, interest expenses totalled $40.7 billion (+3.0%), which represented 5.9 cents for every dollar of revenue, down from 6.4 cents in 2020. At the provincial level, Quebec (8.7 cents) and Manitoba (8.5 cents) spent the most on interest per dollar of revenue in 2021, while British Columbia (3.4 cents) and Alberta (3.6 cents) spent the least.

Gross debt-to-gross domestic product ratio goes down, but remains higher than pre-pandemic levels

During the economic downturn related to the pandemic, Canadian general government revenue decreased and spending rose sharply, which significantly contributed to debt accumulation. In 2021, the CGG's liabilities (gross debt) totalled $2,942.2 billion ($76,135 per capita), an increase of $69.9 billion compared with the previous year. In 2021, the federal gross debt ($1,569.6 billion) remained higher than that of PTLG ($1,460.4 billion).

While the gross debt-to-GDP ratio of CGG fell to 117.2%, down from the peak of 130.0% reached in 2020, it remained significantly above pre-pandemic levels (105.6% in 2019). Gross debt at the Canada level for PTLG decreased, from 66.6% of GDP in 2020 to 58.2% in 2021. Among all provinces, the gross debt-to-GDP ratio decreased most significantly in Alberta, from 53.9% to 39.5%, and in New Brunswick, from 80.2% to 65.9%. British Columbia (35.7%) and Alberta (39.5%) recorded the lowest ratios of gross debt-to-GDP, while Manitoba (88.6%) and Quebec (88.0%) posted the highest levels.

Growth in financial assets outpaces liabilities, lowering net debt

While gross debt represents the magnitude of outstanding debt, it does not take into account financial assets. It only provides information about liabilities (unconditional obligations to creditors) of the government. Net debt or net liability (total liabilities less total financial assets) gives a more comprehensive view of the financial position of the government. Net debt is used as a key indicator to assess the sustainability of fiscal policy.

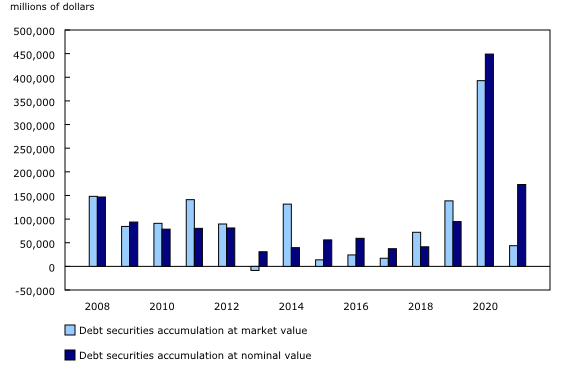

Net debt of the Canadian general government ($1,452.8 billion) fell, from 68.7% of GDP in 2020 to 57.9% in 2021. This decrease in net debt is mainly explained by the large downward revaluation of liabilities in the form of debt securities, such as bills and bonds, at their market value. The price of bonds has an inverse relationship with interest rates. Market anticipation of sharp increases in interest rates to counter inflation made the yield on outstanding debt securities less attractive to investors, driving down their market value.

Debt securities: market and nominal value

In Government Finance Statistics (GFS), assets and liabilities are valued at current market prices, as if they were acquired in market transactions on the balance sheet reference period. For liabilities in the form of debt securities, the market value thus represents the amount that the government would pay to buy back (extinguish) a debt security in the secondary market.

Nominal value for a debt security refers to the amount of principal advanced (issue price) and accrued unpaid interest, which the government owes at a specific point in time to the creditor. Liabilities at nominal value in GFS are recorded as a memorandum item in the balance sheet.

The difference between market and nominal value represents the changes in the value of government tradable debt instruments on the market.

Federal government net debt edged down in 2021 (-$4.1 billion) to $910.5 billion, still above pre-pandemic levels. Federal government net debt-to-GDP ratio decreased to 36.3% in 2021, following the upswing from 29.8% in 2019 to 41.4% in 2020.

PTLGs accounted for more than 90% of the decrease in CGG's net debt. In 2021, PTLG net debt was down $60.4 billion to $542.3 billion, or 21.6% of GDP, from 27.3% in 2020. It was the lowest net debt-to-GDP ratio since 2008. Financial assets of the PTLG increased by 5.7% (+$49.5 billion), while their liabilities decreased slightly (-0.7% or -$10.9 billion) to $1,460.4 billion in 2021.

In 2021, a decline in net debt was observed in all provinces. The largest decreases in net debt were recorded in British Columbia (-59.0%), New Brunswick (-25.4%) and Alberta (-18.1%).

Among PTLGs, Newfoundland and Labrador recorded the highest net debt per capita ($19,478), followed by Ontario ($18,697), Quebec ($18,545) and Manitoba ($17,233).

Expressed as a percentage of GDP, the highest net debt was recorded in Quebec (31.8%), followed by Manitoba (30.3%), Ontario (29.3%) and Newfoundland and Labrador (26.9%). Again, in 2021, British Columbia posted the lowest net debt ratios by far (1.5% of GDP or $1,010 per capita), well below the Canada total level for PTLG (21.6% of GDP or $14,032 per capita).

The Northwest Territories, Yukon and Nunavut were the only jurisdictions to post a positive net financial worth (total financial assets less total liabilities). Debt in the territories was low compared with the provinces, as their borrowing capacity is restricted to limits set by the federal government.

Social contributions to Canada Pension Plan and Quebec Pension Plan increase

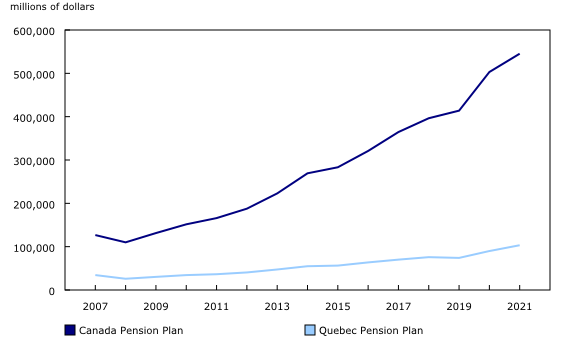

The CPP and QPP are the largest social security funds in the country; along with Old Age Security, they are the foundation of Canada's public retirement income system. In 2021, Canadian workers' and employers' contributions to the CPP and QPP significantly increased (+14.0%), from $72.5 billion in 2020 to $82.6 billion in 2021. Beneficiaries of these plans, mostly retired citizens, received $69.1 billion (+3.2%) in social security benefits in 2021, up from $66.9 billion in 2020.

In 2021, Canadians' nest eggs grew by 9.4%, a more-than-decent return on the funds' investments, following one of the best performances on record in 2020 (+21.5%). Thus, the funds' net financial worth reached $648.6 billion in 2021 (25.8% of GDP) compared with $592.9 billion in 2020 (26.8% of GDP). In a rare occurrence, the growth of the QPP net financial worth (+14.9%) has outpaced CPP growth (+8.4%) in 2021.

The net financial worth of the CPP and QPP measures the net financial assets available for the payment of future social security benefits. At the end of 2021, net financial worth was $16,783 per capita, up 7.9% from $15,553 in 2020.

Note to readers

This release includes revisions to both unconsolidated and consolidated Canadian Government Finance Statistics (CGFS) data for the 2019 and 2020 reference periods, as well as the addition of the 2021 reference period.

Annual data correspond to the end of the fiscal year closest to December 31. For example, data for the federal government fiscal year ending on March 31, 2022 (fiscal year 2021/2022), are reported for the 2021 reference year.

Preliminary CGFS data are published eight months after the end of the fiscal year; therefore, estimates were prepared before several public accounts and financial statements were audited and published by government entities.

CGFS data differ from reports published by governments due to differences in institutional coverage, accounting rules, timing and integration with the Canadian macroeconomic accounts.

Consolidation is a method of presenting one overarching statistic for a set of units. It involves eliminating all transactions and debtor–creditor relationships among the units being consolidated. In other words, the transaction of one unit is paired with the same transaction as recorded for the second unit and both transactions are eliminated.

In 2021, the consolidation method removed $374.3 billion in internal revenues and expenses, as well as $286.5 billion related to internal debtor–creditor relationships for the Canadian General Government (CGG).

Consolidated data are released for the CGG, which combine federal government data with provincial, territorial and local government (PTLG) data, but exclude data for the Canada Pension Plan and Quebec Pension Plan.

Consolidated data are also released for the PTLGs, which include provincial and territorial governments, health and social service institutions, universities and colleges, municipalities and other local public administrations, and school boards.

The constitutional framework of PTLGs in the territories differs from that in the provinces, leading to differences in the roles and financial authorities of government. These differences, as well as other geographic, demographic and socioeconomic dissimilarities between the North and the rest of Canada, give rise to marked disparities in government finance statistics.

PTLG data can be compared across provinces and territories because consolidation takes into account differences in administrative structure and government service delivery by removing the effects of internal public sector transactions within each jurisdiction.

Because PTLG finance statistics vary significantly across jurisdictions in Canada due to size differences, per capita data are used to facilitate comparisons. Per capita data are based on population estimates as of April 1 for Canada, the provinces and the territories, available in Table 17-10-0009-01.

Calculations as a percentage of gross domestic product are based on the nominal GDP at market prices, expenditure-based, estimates for Canada, the provinces and the territories, available in Table 36-10-0222-01.

In this release, revenues, expenses, assets and liabilities are reported in nominal terms.

Net financial worth is the total value of financial assets minus the total value of liabilities. When financial assets are greater than liabilities, the measure is referred to as net financial assets. When liabilities are greater than financial assets, the measure is referred to as net liabilities or net debt as per public accounts.

Products

The Canadian Government Finance Statistics 2014 classification structure is now available in the Definitions, data sources and methods module of our website.

Additional information can be found in the Latest Developments in the Canadian Economic Accounts (13-605-X). The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available. This publication has been updated with Chapter 9. Government Finance Statistics.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: