Consumer Price Index, October 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-11-16

October 2022

6.9%

(12-month change)

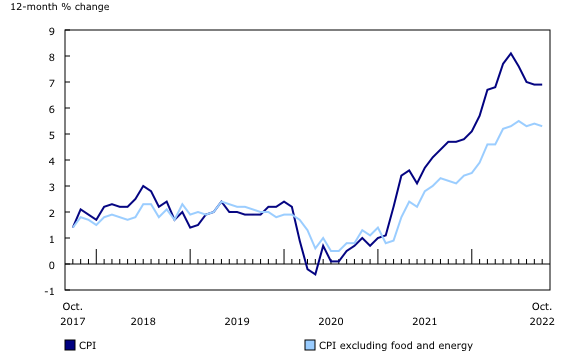

The Consumer Price Index (CPI) rose 6.9% year over year in October, matching the increase in September. Faster price growth for gas and mortgage interest costs were moderated by slowing price growth for food.

Excluding food and energy, prices rose 5.3% year over year in October, following a gain of 5.4% in September.

In October, higher prices at the gas pump put upward pressure on the all-items CPI. Additionally, Canadians renewed or initiated mortgages at higher interest rates, which led to acceleration in the Mortgage Interest Cost Index. Offsetting the upward pressure was slower price growth on a year-over-year basis for natural gas and groceries, particularly prices for fruit, vegetables, and meat.

On a monthly basis, the CPI rose 0.7% in October following a 0.1% gain in September, largely driven by increased prices for gasoline. This was the largest monthly increase since June 2022. On a seasonally adjusted monthly basis, the CPI was up 0.6%.

In October, average hourly wages rose 5.6% on a year-over-year basis, meaning that, on average, prices rose faster than wages. Although Canadians experienced a decline in purchasing power, the gap was smaller than in September.

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household — the Consumer Price Index (CPI).

Visit the Consumer Price Index Portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current (Latest Snapshot of the CPI) and historical (Price trends: 1914 to today) CPI data in a customizable visual format.

Find the answers to the most common questions about the CPI in the context of the COVID-19 pandemic and beyond.

Gasoline prices increase in October

On a monthly basis, gasoline prices increased 9.2% in October following a decrease in September (-7.4%). The announcement of future oil production cuts by the Organization of the Petroleum Exporting Countries Plus and a weaker Canadian dollar contributed to higher gasoline prices for Canadian consumers.

Gasoline prices rose 17.8% in October compared with October 2021, following a 13.2% increase in September 2022.

Price growth for groceries slows, but remains elevated

Prices for food rose less in October (+10.1%) compared with September (+10.3%) on a year-over-year basis. Prices for meat (+5.5%), fresh fruit (+8.9%), and fresh vegetables (+11.0%) increased at a slower pace in October compared with September, contributing to the deceleration in food prices.

Despite the slowdown in price growth, prices for food purchased from stores (+11.0%) continued to increase at a faster rate year over year than the all-items CPI for the eleventh consecutive month. Canadians paid more for dry or fresh pasta (+44.8%), margarine (+40.4%), lettuce (+30.2%), rice and rice-based mixes (+14.7%), and soup (+18.4%), among other food items.

Prices for some food commodities, such as dairy products (+10.6%) and eggs (+13.8%), increased year over year in October, mainly due to approved producer price increases from their respective governing boards.

Spotlight on shelter in the Consumer Price Index

Putting a roof over your head, whether you own or rent a home, takes up the largest share of average spending for most Canadians. This is reflected in the Consumer Price Index (CPI), as shelter accounts for approximately 30% of the CPI basket weight in 2021. Prices for owned and rented accommodation including goods and services associated with maintaining and insuring your home, as well as utilities, are all included in the shelter index.

Owned accommodation, which accounts for 19% of spending in the CPI, is one of the most conceptually complex components for statistical agencies to measure. Currently, there are a few different methods recommended internationally, depending on the use of the CPI, the availability of data, and housing market characteristics. Some countries do not measure owned accommodation at all as part of their CPI or have a separate inflation series for this component.

The CPI is a robust indicator, guided by internationally recognized standards, that Canadians have come to rely on since 1914. As a measure of consumption, the CPI is designed to capture the monthly costs of owning a home rather than the cost of buying one. When a Canadian purchases an asset like a house, they are moving money from the debt to the asset side of their personal ledger. Because of this, what gets measured in the CPI are all the ongoing costs homeowners are paying to live in and maintain their home.

During the past few years, Canadians have sought out more living space and outdoor amenities in response to the COVID-19 pandemic. This change in preferences, coupled with historically low interest rates, and other factors linked to the pandemic, such as higher building costs, helped push the year-over-year rise in the cost of home ownership in Canada to a 32-year high in early 2022. Since April, some of these conditions have started to reverse, another trend reflected in the CPI.

Statistics Canada has a variety of indicators that shed light on the housing market in Canada, such as those on the Housing statistics portal, indicators of household wealth and affordability, and distributions of household economic accounts. Decision makers should rely on a range of economic signals to measure impacts of the housing market, ensuring that the right indicators are used for the right purpose.

Homeowners' replacement costs rise at a slower rate, as mortgage interest costs, property taxes, and rent increase at a faster rate

The homeowners' replacement cost index, which is related to the price of new homes, slowed in October (+6.9%) after increasing 7.7% in September. This index has decelerated, on a year-over-year basis, every month since May 2022 (+11.1%).

The higher interest rate environment has pushed up lending rates in the Mortgage Interest Cost Index. In October, mortgage interest costs increased on a year-over-year basis by 11.4%, the highest increase since February 1991 (+11.7%).

Property taxes and other special charges, which are priced annually in October, rose 3.6% on a year-over-year basis in October 2022, compared with a 1.5% increase in October 2021. Property taxes rose the most in British Columbia (+8.9%), mainly due to higher assessment values. Manitoba (-2.8%) was the only province to experience a decline, largely due to a reduction in the provincial education tax.

The easing of public health measures in 2022, combined with post-secondary schools returning to in-person teaching and rising immigration, have contributed to higher rent prices. In October, rent prices increased by 4.7% compared with October 2021, following a gain of 4.2% in September 2022. This marks the ninth consecutive month in which rent prices have increased at a rate above 4%.

Prices increase for paper supplies

In October, prices for paper supplies (+12.2%) increased at a faster rate on a year-over-year basis compared with September (+6.4%). The increase was due to higher prices for stationary (+20.3%), and household paper supplies (+9.7%), which includes items such as tissue and bathroom paper. Sustained demand, along with higher input costs, contributed to higher prices for paper supplies.

November is Financial Literacy Month

We have exciting events and publications taking place during Financial Literacy Month in November.

Food infographic and paper

An infographic, "The rise in prices for wheat-based food products," and an accompanying article "Behind the Numbers: What's Causing Growth in Food Prices" are now available.

Reddit Ask Me Anything

Do you have questions about the Consumer Price Index (CPI), Canadian inflation or how the CPI basket measures consumer prices? Join us for our Reddit Ask Me Anything event on November 21, 2022, at 1:30 p.m., Eastern Time.

Regional highlights

Year over year, prices rose at a faster pace in October compared with September in eight provinces.

Fuel oil and other fuels

Atlantic Canadians paid more for fuel oil and other fuels than Canadians living in other provinces on a year-over-year basis, with prices rising at the fastest pace in Newfoundland and Labrador (+77.3%). Prices also increased in Nova Scotia (+67.8%), Prince Edward Island (+54.9%), and New Brunswick (+51.0%). Fuel oil is more commonly used for heating homes in Atlantic Canada, and as such, contribute more to price change in these provinces compared with others.

Natural gas prices decline while prices for gasoline rise in Alberta on a monthly basis

On a monthly basis, prices for natural gas declined in Alberta in October (-9.9%) compared with September (+3.1%). Among the provinces, only Albertans saw a month-over-month price decline.

Prices for gasoline in Alberta increased on a month-over-month basis in October (+17.1%) compared with September (-6.2%). The price increase was the largest monthly movement in Canada and is partially attributable to larger retail margins as well as a gradual re-introduction of the gasoline tax.

Note to readers

Find the answers to the most common questions about the CPI, including how food prices are collected, how shelter costs are measured, and why revisions to the CPI-common have been larger in recent months.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on November 28. For more information, consult the document "Real-time data tables."

Next release

The CPI for November will be released on December 21.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: