Consumer Price Index, September 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-10-19

September 2022

6.9%

(12-month change)

In September, the Consumer Price Index (CPI) rose 6.9% on a year-over-year basis, decelerating from a 7.0% gain in August, marking the third consecutive monthly slowdown in headline inflation. Lower gasoline prices were mostly responsible for the deceleration.

While prices at the gas pump dropped in September compared with August, Canadians continued to feel the pinch from higher food prices.

Excluding food and energy, prices rose 5.4% year over year in September, following a gain of 5.3% in August. Prices for durable goods, such as furniture and passenger vehicles, grew at a faster pace in September compared with August.

In September, the Mortgage Interest Cost Index continued to put upward pressure on the all-items CPI, as Canadians renewed or initiated mortgages at higher interest rates.

On a monthly basis, the CPI rose 0.1% in September. On a seasonally adjusted monthly basis, the CPI was up 0.4%.

Average hourly wages rose 5.2% on a year-over-year basis in September, meaning that, on average, prices rose faster than wages. The gap in September was larger compared with August.

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator. This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household — the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Browse the Consumer Price Index Data Visualization Tool to access current and historical CPI data in a customizable visual format.

Find the answers to the most common questions about the CPI in the context of the COVID-19 pandemic and beyond.

Gasoline prices fall in September compared with August

On a monthly basis, gasoline prices dropped 7.4% in September following a 9.6% decrease in August. This is the third consecutive month-over-month price decline for gasoline. An increase in global supply of crude oil was a contributing factor to falling gasoline prices compared with August.

Year over year, gasoline prices rose 13.2% in September, down from 22.1% in August.

Consumers pay more for groceries

In September, prices for food purchased from stores (+11.4%) grew at the fastest pace year-over-year since August 1981 (+11.9%). Prices for food purchased from stores have been increasing at a faster rate than the all-items CPI for 10 consecutive months, since December 2021.

Contributing to price increases for food and beverages were unfavourable weather, higher prices for important inputs such as fertilizer and natural gas, as well as geopolitical instability stemming from Russia's invasion of Ukraine.

Food price growth remained broad-based in September. On a year-over-year basis, Canadians paid more for meat (+7.6%), dairy products (+9.7%), bakery products (+14.8%), and fresh vegetables (+11.8%), among other food items.

Other owned accommodation expenses rise at a slower pace amid a cooling housing market

In September, prices for other owned accommodation expenses (+5.8%), which includes commissions on the sale of real estate, increased at a slower rate compared with August (+7.4%). Other owned accommodation expenses have decelerated, on a year-over-year basis, for five consecutive months.

The homeowners' replacement cost index, which is related to the price of new homes, slowed in September (+7.7%) after increasing (+8.4%) in August. This index has decelerated on a year-over-year basis every month since May 2022 (+11.1%). These movements reflect a general cooling of the housing market.

In contrast, Canadians have renewed or initiated mortgages at higher interest rates since the onset of recent rate increases, measured in the CPI through the mortgage interest cost index (+8.3%), which has increased on a year-over-year basis for three consecutive months.

Prices for passenger vehicles and furniture rise

On a year-over-year basis, prices for durable goods increased faster in September (+6.7%) compared with August (+6.0%). The purchase of passenger vehicles index, rising 8.4% in September, contributed the most to the increase. The gain was partially attributable to the ongoing shortage of semi-conductor chips.

Prices for furniture increased at a faster pace on a year-over-year basis in September (+13.3%) compared with August (+12.2%), mainly driven by higher prices for other furniture (+10.3%), specifically mattresses.

Students pay more for tuition fees in 2022

Priced annually, tuition fees rose 2.3% year over year in September compared with September 2021 (+1.9%), increasing the most in Alberta (+7.7%). The price of tuition in Newfoundland and Labrador increased 6.8% in September, following the lifting of a tuition freeze, which had been in place since 1999.

Regional highlights

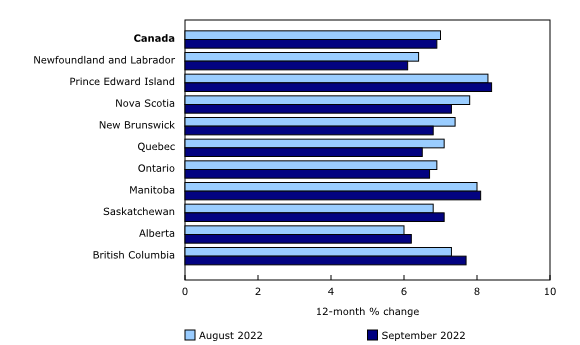

Year over year, prices rose at a slower pace in September compared with August in five provinces.

Gasoline prices rise in British Columbia

Year-over-year gasoline prices increased at a slower rate in every province in September compared with August, except in British Columbia. In September, prices for gasoline increased by 27.0% in British Columbia compared with an increase of 17.7% in August. The increase is partially attributed to reduced supply amid multiple refinery shutdowns in the Pacific Northwest.

Note to readers

Find the answers to the most common questions about the CPI, including how food prices are collected, how shelter costs are measured, and why revisions to the CPI-common have been larger in recent months.

Hurricane Fiona

Price collection for the September CPI was unaffected by the recent storm as the majority of prices were collected prior to the weather events. Statistics Canada continues to monitor the impacts of the storm on consumer prices.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on October 31. For more information, consult the document "Real-time data tables."

Next release

The CPI for October will be released on November 16.

Food infographic and paper

An infographic, "Behind the Numbers: The rise in prices for wheat-based food products", and an accompanying paper "Behind the Numbers: What's Causing Growth in Food Prices?" will be available during Financial Literacy Month in November 2022.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: