Consumer Price Index, August 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-09-20

August 2022

7.0%

(12-month change)

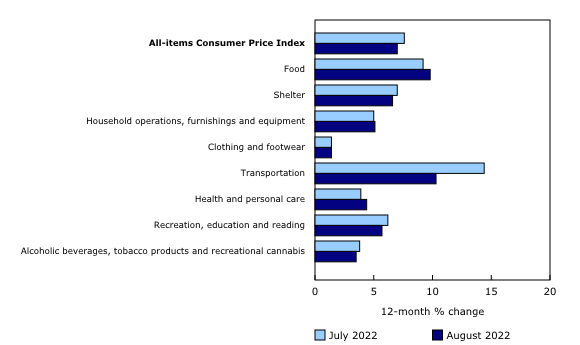

In August, the Consumer Price Index (CPI) rose 7.0% on a year-over-year basis, down from a 7.6% gain in July. This was the second consecutive slowdown in the year-over-year price growth and was largely driven by lower gasoline prices in August compared with July.

Excluding gasoline, prices rose 6.3% year over year in August, following a 6.6% increase in July. This is the first month since June 2021 that the year-over-year CPI, excluding gasoline, has slowed.

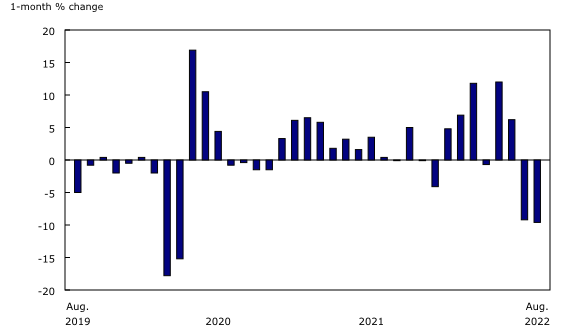

On a monthly basis, the CPI fell 0.3% in August, the largest monthly decline since the early months of the COVID-19 pandemic. On a seasonally adjusted monthly basis, the CPI was up 0.1%, the smallest gain since December 2020.

Transportation (+10.3%) and shelter (+6.6%) prices drove the deceleration in consumer prices in August. Moderating the slowing in prices were sustained higher prices for groceries, as prices for food purchased from stores (+10.8%) rose at the fastest pace since August 1981 (+11.9%).

Price growth for goods and services both slowed on a year-over-year basis in August. As non-durable goods (+10.8%) decelerated due to lower prices at the pump, services associated with travel and shelter services contributed the most to the slow down in service prices (+5.5%). Prices for durable goods (+6.0%), such as passenger vehicles and appliances, also grew at a slower rate in August.

In August, the average hourly wages rose 5.4% on a year-over-year basis, meaning that, on average, prices rose faster than wages. Although Canadians experienced a decline in purchasing power, the gap was smaller than in July.

Explore the Consumer Price Index tools

Check out the Personal Inflation Calculator! This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Consult the Consumer Price Index Data Visualization Tool to access current and historical CPI data in a customizable visual format.

Gasoline prices rise at a slower pace year over year

Year over year, gasoline prices rose less in August (+22.1%) compared with July (+35.6%). On a monthly basis, gasoline prices fell 9.6% following a decline in July (-9.2%). This was the largest monthly decline since April 2020.

The monthly gas price decline in August compared with July mainly stemmed from higher global production by oil-producing countries. According to data from Natural Resources Canada, refining margins, also fell from higher levels in July.

Price growth for traveller accommodation slows, but remains elevated

Prices for traveller accommodation (+33.0%) rose at a slower pace on a year-over-year basis in August compared with July. The slowdown was mainly due to the steep monthly price increase in August 2021 (+12.0%), the first August since the beginning of the pandemic with fewer COVID-19-related health restrictions in place.

Prices for durable goods increase at a slower rate

Year-over-year growth in durable goods slowed to 6.0% in August, following a 7.0% gain in July. Prices for household appliances (+9.0%) rose less in August than in July (+11.5%) amid reduced consumer demand. The moderation in price growth was observed for refrigerators and freezers (+12.0%), laundry and dishwashing appliances (+9.3%) and cooking appliances (+7.9%).

The purchase of passenger vehicles index rose 7.3% year over year in August, down from an 8.2% increase in July. Higher prices for passenger vehicles in August 2021 contributed to the year-over-year slowdown in August 2022. The same month a year earlier, prices rose amid a global shortage of semiconductor chips resulting in fewer discounts available to consumers. On a month-over-month basis, prices for used vehicles (-0.7%) fell in August.

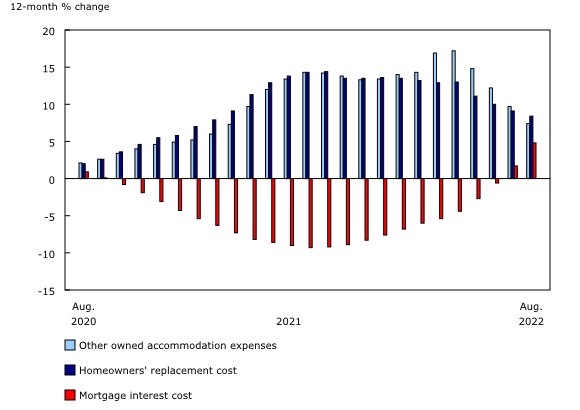

Growth in shelter prices continue to slow

In August, year-over-year growth in shelter prices (+6.6%) continued to slow. Other owned accommodation expenses, which includes commissions on the sale of real estate, slowed on a year-over-year basis in August (+7.4%) compared with July (+9.7%). The homeowners' replacement cost index (+8.4%), which is related to the price of new homes, also slowed in August. These movements reflect a general cooling of the housing market.

Conversely, the mortgage interest cost index increased at a faster rate in August (+4.8%) compared with July (+1.7%), the fastest pace since January 2020. The increase occurred amid elevated bond yields and a higher interest rate environment.

Prices for groceries rise at the fastest pace since 1981

Prices for food purchased from stores continued to increase in August (+10.8%), rising at the fastest pace since 1981 (+11.9%). The supply of food continued to be impacted by multiple factors, including extreme weather, higher input costs, Russia's invasion of Ukraine, and supply chain disruptions.

Food price growth remained broad-based. On a year-over-year basis, Canadians paid more for meat (+6.5%), dairy products (+7.0%), bakery products (+15.4%), fresh fruit (+13.2%), non-alcoholic beverages (+14.1%), condiments, spices, and vinegars (+17.2%), sugar and confectionery (+11.3%), and fish, seafood, and other marine products (+8.7%).

Regional highlights

Year over year, prices rose at a slower pace in August than in July in every province.

Gasoline prices decline the most in Saskatchewan and Alberta

Gasoline prices fell month over month in every province in August compared with July, contributing the most to the year-over-year slowdown.

Among the provinces, gasoline prices declined the most in Saskatchewan (-17.0%) and Alberta (-17.0%) on a monthly basis in August. This decline coincided with lower retailer margins, which represents the difference between the price a business pays for a product and the price at which it sells the product to consumers.

Note to readers

Find out answers to the most common questions posed about the Consumer Price Index (CPI) in the context of the COVID-19 pandemic and beyond.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on October 3. For more information, consult the document "Real-time data tables."

Next release

The CPI for September will be released on October 19.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Find out answers to the most common questions posed about the CPI in the context of COVID-19 and beyond.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: