Gross domestic product, income and expenditure, second quarter 2022

Released: 2022-08-31

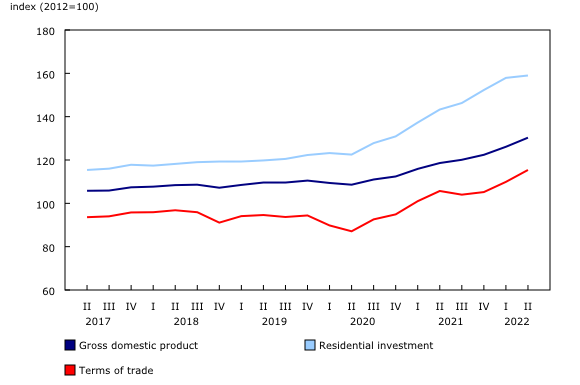

Real gross domestic product (GDP) rose 0.8% in the second quarter, driven by increased business investment in inventories, non-residential structures, machinery and equipment, and household spending on services and semi-durable goods. This was the fourth consecutive quarterly increase in real GDP.

Growth in the second quarter was moderated by declines in housing investment and household spending on durable goods and by a rise in imports that exceeded exports. Final domestic demand rose by 0.7%, following a 0.9% increase in the first quarter.

Business investment in inventories drives growth

The accumulation of business inventories, the major contributor to growth, amounted to $47.0 billion in the second quarter. Non-farm inventory investment was bolstered mainly by increases in wholesale durables (machinery and building supplies), non-durables (fertilizers), and manufacturing durables (machinery and aircraft). The economy-wide stock-to-sales ratio rose from 0.833 in the first quarter to 0.847 in the second quarter, approaching levels recorded immediately before the beginning of the COVID-19 pandemic.

Increased production of agricultural products in the second quarter, notably wheat and canola, resulted in the largest increase in farm inventory investments since 1961, the year when quarterly data were first recorded. Total crop production is forecast to increase in 2022 owing to better weather conditions compared with the previous year.

Household spending on semi-durable goods and services enhances growth

Driven by spending on garments and footwear, household spending on semi-durable goods rose 5.6% in the second quarter. The increase was largely attributable to increased travel and many people returning to the office. According to the Labour Force Survey, the percentage of workers usually working all of their hours at home fell in the second quarter, while the prevalence of hybrid work—splitting work hours between home and another location—rose.

The opening of the economy also boosted outlays for services (+3.9%) in the second quarter—the eighth consecutive quarterly increase. The major contributors were travel abroad, food and non-alcoholic beverage services, air transport, alcoholic beverage services, games of chance, and accommodation services.

Investment in housing dropped 7.8% in the second quarter as renovation spending declined. Rising mortgage rates and a slowdown in the resale market led to a 24.7% decrease in transfer costs, with Ontario and British Columbia recording the largest drops. Household mortgage debt rose at a slower pace in the second quarter.

Rising business investment in machinery and equipment and in engineering structures

With projects such as Kitimat Liquified Natural Gas in British Columbia and higher capital spending in oil and gas in Alberta, businesses continued to invest in engineering structures in the second quarter. After periods of reduced investment in 2019 and during the pandemic, the 3.6% increase in the second quarter of 2022 was the seventh consecutive quarterly increase. Owing to the resurgence of travel demand, business investment in machinery and equipment rose 4.5% in the second quarter; the key contributors to growth were aircraft, trucks, buses, and other motor vehicles.

With the rise in interest rates over the second quarter, accompanied by the Bank of Canada's policy interest rate hikes, businesses may find it more costly to finance future capital projects. Non-financial corporations recorded three consecutive months of net retirements in their debt securities up to June 2022, while their loan balances expanded. Non-financial corporations, in the aggregate, have also accumulated sizeable amounts of currency and deposits since 2020 that could be directed toward future investment activity.

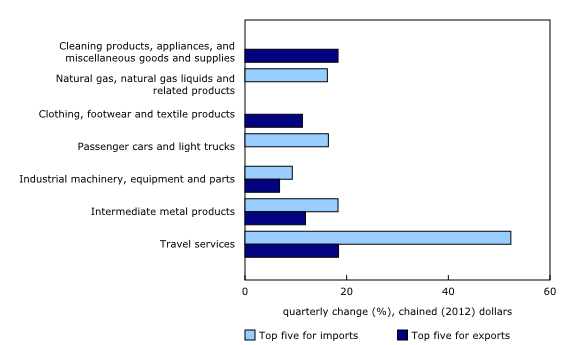

Imports grow faster than exports

A substantial rise in import volumes (+6.9%) in the second quarter was led by travel services and passenger cars and trucks, particularly electric and hybrid models, reflecting increased gas prices. Intermediate metal products and industrial machinery equipment and parts—primarily turbines and generators for a wind farm project in Alberta—were major contributors to growth.

Export volumes rose 2.6% in the second quarter, after falling 2.3% in the first quarter. The main factor in this growth was higher exports of intermediate metal products due to strong demand for aluminum from the United States. Exports of travel services rose 18.4% as business and personal travel increased.

Rising prices bolster nominal gross domestic product

Driven primarily by high energy prices, the GDP implicit price index, which reflects the overall price of domestically produced goods and services, rose 3.3% in the second quarter, the largest jump since the third quarter of 1974. Consequently, nominal GDP increased 4.2%, reaching $2.8 trillion in the second quarter.

The terms-of-trade—the ratio of the price of exports to the price of imports—was up 5.0% in the second quarter. This was led by an 8.8% increase in export prices, primarily because of a 24.5% hike in the price of exported crude oil and crude bitumen. Increased terms-of-trade was the major contributor to the 2.4% increase in real gross national income.

Compensation of employees was up 2.0% in the second quarter, led by professional and personal services, and mining, oil and gas extraction. Ontario and Alberta contributed the most to the national wage increase, while the Atlantic provinces' wage growth rates were almost double the national rate. Substantial growth in the mining, oil and gas industry helped push wages in Newfoundland and Labrador up 4.1%. Growth in the professional and personal services industry was the principal factor pushing wages up in Nova Scotia, New Brunswick and Prince Edward Island.

Non-financial corporations benefit from strong energy prices

Near record oil prices boosted the output of businesses involved in oil and gas, increasing the gross operating surplus of non-financial corporations by 9.8% in the second quarter. The increased value of crude oil and bitumen exports due to higher prices buoyed revenues among energy companies, which in many cases are also vertically integrated and able to benefit from upstream, midstream and downstream activity (such as higher refining margins and gasoline prices). As a result of stronger earnings growth, dividends paid by non-financial corporations were up 9.1% in the second quarter.

Financial corporations experience slowdown

The gross operating surplus of financial corporations declined 1.6% in the second quarter. The May storm that swept through southern Ontario and Quebec ranked among Canada's six most expensive insured events. Increased claims from this weather event, primarily due to high winds, dampened the operating surplus of property and casualty insurers. Declining markets in terms of both values and volumes traded also weighed on trading related incomes. At the same time, dividends paid by financial corporations rose 3.3% in the second quarter.

Household incomes rise

Household (nominal terms at quarterly rates) incomes increased in the second quarter, due to higher compensation of employees (+$6.6 billion), property incomes received (+$3.3 billion), which includes interest and dividend receipts, and net mixed income (the entrepreneurial income of unincorporated businesses) (+$2.3 billion). Within net mixed income, unincorporated farms posted growth of 30.0%, resulting primarily from higher prices for their goods, the second consecutive quarter of stronger growth for these farms. Household property incomes benefitted from higher interest receipts on deposits. This was accompanied by strong growth in dividend income as both financial corporations and non-financial corporations compensated shareholders in the second quarter.

Offsetting the gains in property income received in the second quarter was a 10.0% increase in property income paid, which includes mortgage interest expense (+5.7%) and non-mortgage interest expense such as interest on consumer credit (+15.9%). With the policy interest rate rising from 0.25% at the start of the first quarter to 1.5% by the end of June, variable rate debt products recorded sizeable gains in associated interest costs.

Government transfers decrease

Government transfers to households fell 6.6% in the second quarter, mainly as a result of a decline in other benefits received and employment insurance. While government transfers declined as COVID-19 supports ended, they remained higher than their level in the fourth quarter of 2019. However, as a share of all transfers received by households in the second quarter of 2022, they represented close to two-thirds, a return to the proportions recorded pre-pandemic. Employment insurance benefits nearly returned to the level recorded in the first quarter of 2020 as the national unemployment rate dipped below 5% in June.

Disposable income rises, but savings rate declines

Primarily as a result of rising incomes, overall household disposable income increased $3.6 billion at quarterly rates (+1.0%) in the second quarter. This was more than offset by a $15.1 billion expansion in household consumption (+4.3%) as an increase in the volume of real expenditures was significantly bolstered by price increases across the majority of consumption components. The result was a decline in net savings in the second quarter as the savings rate fell to 6.2% from 9.5% in the first quarter. By comparison, the savings rate at the end of 2019 was 2.7%. The household savings rate is aggregated across all income brackets; in general, savings rates are greater in higher income brackets.

Household net saving was more than double that recorded at the end of 2019, a continuation of the elevated levels that have persisted since the start of the pandemic. This was despite inflationary pressures as the cost of living and interest rates continued to climb higher by the end of June. Although these estimates suggest ongoing resiliency in household net savings, inflationary pressures on consumption and trends in employee compensation will likely be key determinants of future outcomes.

Final major federal government support measures conclude

The remaining targeted federal government support programs ended in the second quarter, including the Canada Recovery Hiring Program, the Hardest-Hit Business Recovery Program (HHBRP), the Tourism and Hospitality Recovery Program (THRP), and the Canada Worker Lockdown Benefit. The THRP and HHBRP boosted federal subsidies in the first quarter, but this contribution decreased substantially by the second quarter, and federal subsidies remained well below those recorded in 2020 and 2021.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

Data on gross domestic product, income and expenditure are an example of how Statistics Canada supports the reporting on global sustainable development goals. This release will be used to measure the following goals:

Note to readers

Accounting for e-commerce transactions with non-resident vendors

The indicators used to estimate Household Final Consumption Expenditure have been adjusted to account for non-resident e-commerce sales. The monthly retail trade survey collects data only on resident vendor e-commerce sales. The non-resident vendor e-commerce adjustment, which is applied to the indicators to estimate household consumption, mainly the Retail Commodity Survey, is a non-seasonally adjusted, quarterly value. This adjustment has been in place since the fourth quarter of 2019. For the second quarter of 2022, the adjustment represents $799.5 million compared with $727 million for the first quarter of the same year, applied to the household consumption indicators. The adjustment is derived using sources such as detail from customs transactions, Goods and Services Tax remittances and financial statements for certain enterprises.

Updates to first quarter of 2022

With this release, data have been updated for the first quarter of 2022 due to the incorporation of updated source data and seasonal adjustment.

For information on the gross domestic product (GDP) revision cycle, see GDP revision cycle.

Support measures by governments

To alleviate the economic impact of the pandemic, governments implemented programs which supported households and businesses, such as the Canada Emergency Wage Subsidy, Canada Emergency Rent Subsidy and the Canada Recovery Benefit. A comprehensive explanation of how government support measures were treated in the compilation of the estimates is available in "Recording COVID-19 measures in the national accounts" and "Recording new COVID measures in the national accounts."

Updated details up to the second quarter of 2022 of some of the more significant federal government measures will be released on September 12, along with the national balance sheet and financial flow accounts release. The previously published data can be found on the page Federal government expenditures on COVID-19 response measures.

General

Percentage changes for expenditure-based statistics (such as household spending, investment, and exports) are calculated from volume measures that are adjusted for price variations. Percentage changes for income-based statistics (such as compensation of employees and operating surplus) are calculated from nominal values; that is, they are not adjusted for price variations. Unless otherwise stated, growth rates represent the percentage change in the series from one quarter to the next; for instance, from the first quarter of 2022 to the second quarter of 2022.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Real-time tables

Real-time tables 36-10-0430-01 and 36-10-0431-01 will be updated on September 6.

Next release

Data on GDP by income and expenditure for the third quarter will be released on November 29.

Products

The data visualization product "Gross Domestic Product by Income and Expenditure: Interactive tool," which is part of the Statistics Canada – Data Visualization Products series (71-607-X), is now available.

The document, "Recording new COVID measures in the national accounts," which is part of Latest Developments in the Canadian Economic Accounts (13-605-X), is available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@statcan.gc.ca) or Media Relations (STATCAN.mediahotline-ligneinfomedias.STATCAN@statcan.gc.ca).

- Date modified: