Consumer Price Index, May 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-06-22

May 2022

7.7%

(12-month change)

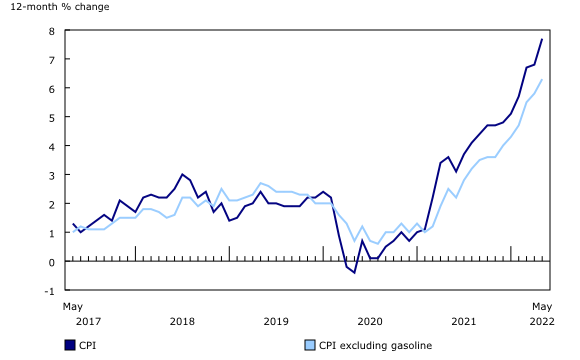

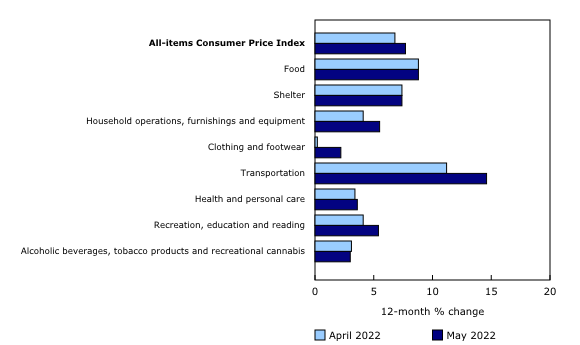

Canadians continued to feel the impact of rising prices in May as consumer inflation rose 7.7% year over year. This was the largest yearly increase since January 1983 and up from a 6.8% gain in April.

Excluding gasoline, the CPI rose 6.3% year over year in May, after a 5.8% increase in April. Price pressures continued to be broad-based, pinching the pocketbooks of Canadians and in some cases affecting their ability to meet day-to-day expenses.

The acceleration in May was largely due to higher prices for gasoline, which rose 12.0% compared with April 2022 (-0.7%). Higher prices for services, such as hotels and restaurants, also contributed to the increase. Food prices and shelter costs remained elevated in May as price growth was unchanged on a year-over-year basis.

On a monthly basis, the CPI rose 1.4% in May, following a 0.6% increase in April. On a seasonally adjusted monthly basis, the CPI was up 1.1%, the fastest pace since the introduction of the series in 1992.

Wage data from the Labour Force Survey found that average hourly wages rose 3.9% year over year in May, meaning that, on average, prices rose faster than wages in the previous 12 months. However, understanding the dynamics of wage changes—and their relationship to rising consumer prices—requires a range of indicators above and beyond average hourly wages. For more information on a range of wage indicators, see the release "Disaggregating wage growth: Trends and considerations."

Energy prices increase on supply uncertainty and higher demand

Energy prices rose 34.8% on a year-over-year basis in May, driven primarily by the largest one-month price increase since January 2003. Compared with May 2021, consumers paid 48.0% more for gasoline in May, stemming from high crude oil prices, which also resulted in higher prices for fuel oil and other fuels (+95.1%).

On a month-over-month basis, gasoline prices increased 12.0% in May, after a 0.7% decline in April. This was the largest monthly increase since May 2020, when oil prices began to recover following major price declines in the early stages of the COVID-19 pandemic in March and April 2020.

Crude oil prices rose in May as a result of supply uncertainty amid Russia's invasion of Ukraine, as well as higher demand as travel continued to grow in response to eased COVID-19 restrictions.

Prices for groceries remain elevated

Grocery prices remained elevated in May as prices for food purchased from stores rose 9.7%, matching the gain in April. With price increases across nearly all food products, Canadians reported food as the area in which they were most affected by rising prices. Supply chain disruptions, as well as higher transportation and input costs, continued to put upward pressure on prices.

Edible fats and oils (+30.0%) recorded its largest increase on record, mainly driven by higher prices for cooking oils.

Fresh vegetable prices increased 10.3% in May, following an 8.2% gain in April. Prices for other fresh vegetables, including onions, peppers and carrots, contributed the most, rising 10.2% on a year-over-year basis.

Prices for fresh or frozen fish rose 11.7% year over year in May. Increased input costs and the recent introduction of tariffs amid Russia's invasion of Ukraine pushed prices higher.

Meat prices increased at a slower pace in May (+9.0%) compared with April (+10.1%), moderating the food purchased from stores index.

Introduction of used vehicle prices

With the introduction of used vehicle prices in the calculation of the May CPI, two new series have been published: purchase of new passenger vehicles (2022-04=100) and purchase of used passenger vehicles (2022-04=100). Both price index series are available starting April 2022 and are published at the national level.

On a month-over-month basis, purchase of new passenger vehicles rose 0.1% and purchase of used passenger vehicles rose 2.2% in May. The headline CPI for May 2022 would have been the same without the introduction of used vehicle prices.

For more information, consult the technical paper entitled "Measuring price change for used vehicles in the Canadian Consumer Price Index."

Year over year shelter costs in May match the increase in April

In May, shelter costs rose 7.4% year over year, matching the increase in April.

Year over year, homeowners' replacement cost rose to a lesser extent in May (+11.1%) compared with April (+13.0%), as prices for new homes showed signs of cooling.

Although prices for mortgage interest cost continued to decrease on a year-over-year basis, prices fell less in May (-2.7%) compared with April (-4.4%), putting upward pressure on the headline CPI.

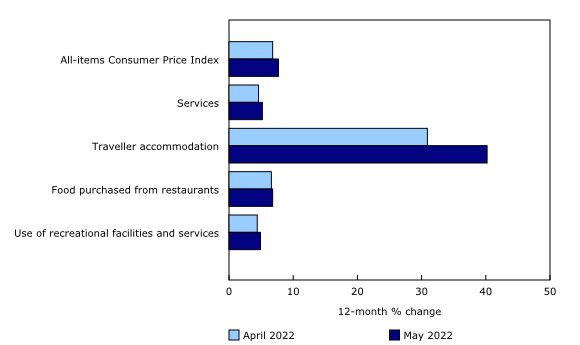

Prices for services rise at a faster pace year over year

Year-over-year growth in prices for services increased to 5.2% in May, following a 4.6% gain in April. As public health measures have eased, Canadians have sought out leisure activities, stayed in hotels and have eaten out more often.

Higher year-over-year prices for traveller accommodation (+40.2%), most notably in Ontario (+56.8%), British Columbia (+43.2%) and Nova Scotia (+41.8%), reflected increased demand for travel within Canada compared with May 2021 when some COVID-19 restrictions were still in place.

Higher prices for food purchased from restaurants (+6.8%) in May also contributed to the increase in services prices.

Canadians pay more for furniture

Canadians paid more to furnish their living spaces in May, as prices for furniture rose 15.8% year over year amid higher shipping and input costs. The introduction of tariffs for imported upholstered furniture (+22.7%) from China and Vietnam, first implemented in early May 2021, have contributed to the increase in prices.

Explore the Consumer Price Index tools that can help you make informed financial decisions

Check out the Personal Inflation Calculator! This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Consult the Consumer Price Index Data Visualization Tool to access current and historical CPI data in a customizable visual format.

Listen to the latest Eh Sayers podcast, to learn more about supply chains.

Regional highlights

On a year-over-year basis, prices rose more in May than in April in every province, led by higher prices at the gas pump.

Among the provinces, prices increased the most in Prince Edward Island (+11.1%), as a result of higher prices for gasoline (+57.7%) and fuel oil and other fuels (+120.2%).

Note to readers

Reddit Ask Me Anything

Do you have questions about the Consumer Price Index (CPI), Canadian inflation or what the new CPI basket means for measuring consumer prices? Join us for our Reddit Ask Me Anything event on June 23, 2022, at 1:30 p.m., Eastern Time.

Basket Update

The basket of goods and services used in the calculation of the CPI has been updated with the release of the May 2022 data. The new basket weights, available in table 18-10-0007-01, are based on 2021 expenditure data, which include information on pandemic impacts with some recovery and the emergence of new consumption patterns, ensuring the relevance of the CPI as a reflection of the most recent consumer expenditure data available.

The new basket weight reference period is 2021, based on the most recent Household Final Consumption Expenditure (HFCE) data, and supplemented by data from the Survey of Household Spending (SHS). Additional data sources were used to better inform expenditure weights for specific aggregates, or where HFCE or SHS data were unavailable.

The base period, in which the all-items CPI is set to equal 100, remains 2002.

The headline CPI for May 2022 would have been the same using the 2020 basket weights.

For more detailed information, consult the document entitled "An Analysis of the 2022 Consumer Price Index Basket Update, Based on 2021 Expenditures" in the Prices Analytical Series (62F0014M).

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on July 4. For more information, consult the document "Real-time data tables."

Next release

The Consumer Price Index for June will be released on July 20.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: