Job vacancies, first quarter 2022

Released: 2022-06-21

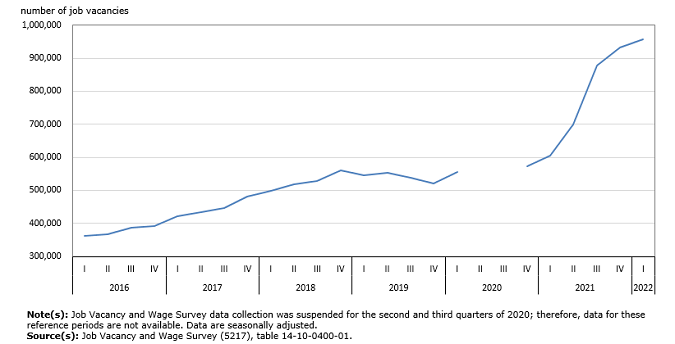

Job vacancies climbed to 957,500 in the first quarter, the highest quarterly number on record. As employers continued to face an increasingly tight labour market, vacancies were up 2.7% (+24,900) from the previous peak observed in the fourth quarter of 2021, and up 72.3% (+401,900) from the first quarter of 2020. (Key indicators from the quarterly Job Vacancy and Wage Survey [JVWS] are now available on a seasonally adjusted basis).

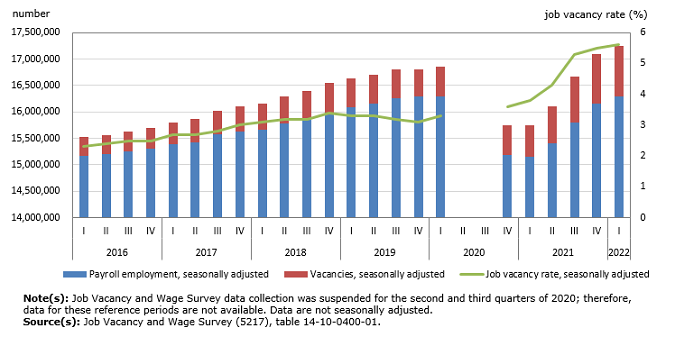

The job vacancy rate—which measures the number of vacant positions as a proportion of total labour demand (filled and vacant positions)—was 5.6% in the first quarter. The job vacancy rate has been trending upward since the first quarter of 2016. It increased sharply from 3.8% in the first quarter of 2021 to 5.3% in the third quarter of the same year. This was mainly the result of an increase in the number of vacancies (+45.3%), while payroll employment declined by 3.0% from the first to the third quarter of 2021. Since then, the job vacancy rate continued to increase, but at a slower pace as payroll employment was recovering, reaching 5.5% in the fourth quarter of 2021 and 5.6% in the first quarter of 2022.

Job vacancies reach another all-time high in the health care and social assistance sector

High labour demand in the health care and social assistance sector, intensified by the COVID-19 pandemic, continued to push the number of job vacancies up in this sector in the first quarter. The number of job vacancies reached a new record high of 136,800, up 5.0% (+6,600) from the peak of the fourth quarter of 2021. Compared with the first quarter of 2020, the number of vacant positions rose 90.9% (+65,100) in the first quarter of 2022 (seasonally adjusted). Among health occupations, the increases in vacant positions in nurse aides, orderlies, and patient service associates (+84.2% to 21,900); registered nurses and registered psychiatric nurses (+77.8% to 22,900); and licensed practical nurses (+166.0% to 11,300) accounted for 67.7% of the overall vacancies in health occupations (not seasonally adjusted).

Record high number of vacancies in the construction sector

On a seasonally adjusted basis, employers in the construction sector were actively seeking to fill 81,500 vacant positions in the first quarter, up 7.1% (+5,400) from the fourth quarter of 2021 and more than double the number (38,800) observed in the first quarter of 2020. Compared with the first quarter of 2020, the large increases in vacancies in the construction sector in the first quarter of 2022 were spread across many occupations, including construction trades helpers and labourers (+97%; +8,800) and carpenters (+149.1%; +6,600) (not seasonally adjusted).

Total labour demand in the sector was 9.3% (+100,900) higher than in the first quarter of 2020, as payroll employment rose 5.5% (+58,100) since that time.

Recent decline of job vacancies in accommodation and food services

On a quarter-over-quarter basis, the number of vacant jobs in the accommodation and food services sector decreased 12.2% (-18,500) to 133,800 in the first quarter of 2022, but was up 88.0% (+62,600) compared with the same quarter of 2020 (seasonally adjusted). The food services and drinking places subsector accounted for 92.4% of the overall increase in job vacancies in the sector in the first quarter of 2022, coinciding with the easing of public health restrictions related to COVID-19 in the second part of the quarter (not seasonally adjusted).

Although the sector had one of the largest increases in vacancies since the first quarter of 2020, total labour demand in the first quarter of 2022 was 10.8% (-152,800) below its level in the first quarter of 2020.

Job vacancies continue to reach new record highs in the manufacturing and retail trade sectors

The number of job vacancies peaked at 87,400 in the manufacturing sector in the first quarter, up 5.3% (+4,400) from the record high of the fourth quarter of 2021 and up 93.6% (+42,300) from the first quarter of 2020 (seasonally adjusted). Across all subsectors, the largest increases were in food manufacturing (+81.8%; +6,800) and fabricated metal product manufacturing (+115.7%; +6,100) (not seasonally adjusted).

In the retail trade sector, the number of job vacancies was 114,600 in the first quarter, up 12.8% (+13,000) from the peak of the fourth quarter of 2021 and up 68.5% (+46,600) from its level in the first quarter of 2020 (seasonally adjusted). Increases in vacancies occurred in the food and beverage stores (+93.2%; +10,300) and general merchandise stores (+102.3%; +4,700) subsectors (not seasonally adjusted).

Job vacancies little changed in professional, scientific and technical services sector

Employers in the professional, scientific and technical services sector were looking to fill a total of 68,800 vacant positions in the first quarter, little changed from the record high reached in the fourth quarter of 2021 but up 65.2% (+27,100) from the first quarter of 2020 (seasonally adjusted). Vacancies for computer and information systems professionals—many of whom are typically in the professional, scientific and technical services sector—rose 68.3% (+13,200) from the first quarter of 2020 (not seasonally adjusted).

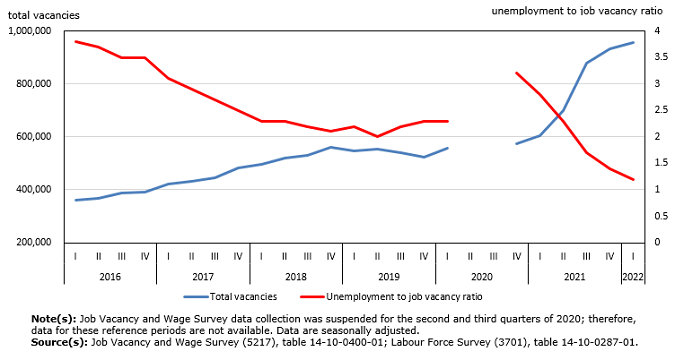

Pool of unemployed workers shrinks as vacancies grow

At the national level, the unemployment to job vacancy ratio was 1.2 in the first quarter, down from 2.3 in the same quarter of 2020. (Labour Force Survey, seasonally adjusted)

Prior to the COVID-19 pandemic, the ratio of unemployment to job vacancies dropped from a high of 3.8 in the first quarter of 2016 to 2.3 in the first quarter of 2020. The unprecedented increase in the number of unemployed (+41.3%; +529,300) from the first to the fourth quarter of 2020 pushed up the ratio of unemployment to job vacancies to 3.2.

One year later in the fourth quarter of 2021, the number of unemployed decreased by 513,900. As employers faced the challenges associated with mounting job vacancies, the pool of unemployed workers who could have filled vacant positions continued to dwindle, with further decreases in unemployment (-21.2%; -295,500) from October 2021 to March 2022. According to the Labour Force Survey (LFS), the unemployment rate dropped to a record low of 5.3% in March 2022, then again to a new record low of 5.1% in May 2022. As a result, the ratio of unemployment to job vacancies fell to 1.2 in the first quarter of 2022, less than half the level in the first quarter of 2021 (2.8).

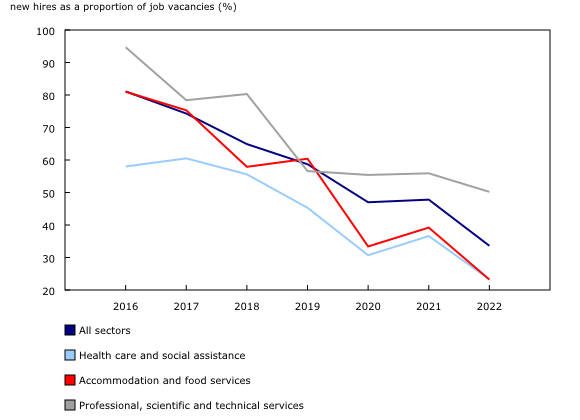

Rising vacancies and dwindling supply of potential workers pose hiring challenges

Due in part to a shrinking pool of unemployed workers, employers faced significant hiring challenges during the first quarter, when there were 33.6 newly hired employees (measured in the LFS) for every 100 vacancies (measured in the JVWS). In comparison, the ratio of new hires to vacancies was 47.8 in the first quarter of 2021 and 81.1 in the first quarter of 2016, when comparable data first became available. Consistent with these findings, recent results from the Canadian Survey on Business Conditions (January 4 to February 7, 2022) indicated that recruiting skilled employees was expected to be an obstacle for nearly two-fifths (38.5%) of businesses, while retaining skilled employees was expected to be an obstacle for 30.4%.

The ability of employers to fill vacancies is influenced by a number of factors, including variations across sectors in the supply of potential workers. Sectors where the ratio of new hires to vacancies was notably low in the first quarter included accommodation and food services (23.2, compared with 81.0 in the first quarter of 2016); health care and social assistance (23.3, compared with 58.0 in the first quarter of 2016); and professional, scientific and technical services (50.2, compared with 94.7 in the first quarter of 2016). (Data used in this section are not adjusted for seasonality).

Offered wages increase more than Consumer Price Index in more than half of the broad occupation groups

Faced with increasing vacancies and competition for a limited supply of workers, some employers are able to respond by raising the wages offered for vacant positions. Alternatively, some employers may be constrained to increase offered wages due to the nature of their business model. Across all sectors, offered wages were up 2.5% on a year-over-year basis in the first quarter. In comparison, the Consumer Price Index (CPI) increased by 5.8% over the same period and average hourly wages of all employees (measured in the LFS) rose 3.0%.

Sectors with notably high increases in offered wages from the first quarter of 2021 to the first quarter of 2022 included wholesale trade (+9.4% to $26.10); transportation and warehousing (+8.0% to $24.25); construction (+6.6% to $27.50); and manufacturing (+6.6% to $23.45). In comparison, sectors with smaller changes in offered wages included health care and social assistance (+2.4% to $25.60); utilities (+1.3% to $37.55); and educational services (-3.5% to $27.30).

On a year-over-year basis, the increase in average offered hourly wage matched or exceeded the CPI increase in 23 of the 40 broad national occupational classification groups, representing 52.2% of total vacancies. (Data used in this section are not adjusted for seasonality).

Reservation wages exceed offered wages in some sectors with high job vacancies

The ability of employers to attract new hires is influenced by many factors, including whether the wage and non-wage conditions (for instance, employer-sponsored pension plan, medical insurance, paid leave entitlements) associated with vacancies correspond to the expectations of job seekers.

In February and March 2022, the LFS collected information on reservation wages, or the minimum hourly wage at which job seekers are willing to accept a position. The mismatches between the expectations of workers and the offered wages associated with vacancies may be contributing to the elevated level of job vacancies.

Sectors where average offered wages fell short of average reservation wages in the first quarter included retail trade (average offered wage was 22.4% lower than the average reservation wage); accommodation and food services (-15.8%) and construction (-7.0%). (Data on reservation wages from the LFS and offered wages from JVWS are not adjusted for seasonality).

In many sectors, vacancies may be due to a shortage of highly specialized workers, rather than a mismatch between offered wages and reservation wages. In the health care and social assistance sector, for example, vacancies were up 37.3% on a year-over-year basis in the first quarter, despite average offered wages being 8.9% higher than the average reservation wage during the quarter.

Tighter labour markets in Quebec and British Columbia

On a seasonally adjusted basis, job vacancies increased from the fourth quarter of 2021 to the first quarter of 2022 in Newfoundland and Labrador (+12.6% to 8,500), New Brunswick (+8.7% to 16,300), Manitoba (+5.1% to 27,700) and Ontario (+3.1% to 359,000), and were little changed in the other provinces. On a quarter-over-quarter basis, the largest proportional increases in vacancies in the first quarter were in Cariboo (+26.3% to 5,100) in British Columbia, and in Moncton–Richibucto (+24.3% to 6,200) in New Brunswick.

Compared with the first quarter of 2020, there were 72.3% more job vacancies at the national level in the first quarter of 2022, with the largest proportional increases on a provincial level in Alberta (+80.8% to 95,200) and Ontario (+80.2% to 359,000). Proportionally, the largest increases across economic regions were in Southeast (+253.1% to 2,600) and South Central and North Central (+154.3% to 2,400) in Manitoba, and Muskoka–Kawarthas (+147.9% to 10,800) in Ontario.

The unemployment to job vacancy ratio also varied across provinces. While there was less than one unemployed person for every job vacancy in Quebec (0.9) and British Columbia (0.9), there were almost four unemployed people for every vacancy in Newfoundland and Labrador (3.8). A lower ratio indicates a tighter labour market and possible labour shortages.

Next release

April 2022 data for the Survey of Employment, Payrolls and Hours and the JVWS will be released on June 24, 2022. The second quarter of 2022 (April to June) JVWS results, which will continue to provide insights into job vacancies by subsector, vacancies by occupation and offered wages, will be released on September 20, 2022.

Note to readers

The Job Vacancy and Wage Survey (JVWS) provides comprehensive data on job vacancies and offered wages by industrial sector and detailed occupation for Canada and the provinces, territories and economic regions. Job vacancy and offered wage data are released quarterly.

Estimates by sector are based on the North American Industry Classification System 2017 Version 3.0. Estimates by geographical area are based on the Standard Geographical Classification 2016. Estimates by occupation reflect the National Occupational Classification (NOC) 2016 Version 1.3. The NOC is a four-tiered hierarchical structure of occupational groups with successive levels of disaggregation. The structure is as follows: (1) 10 broad occupational categories, also referred to as one-digit NOC; (2) 40 major groups, also referred to as two-digit NOC; (3) 140 minor groups, also referred to as three-digit NOC; and (4) 500 unit groups, also referred to as four-digit NOC.

Because of the COVID-19 pandemic, data collection for the JVWS was suspended for the second and third quarters of 2020.

In January 2020, a new electronic questionnaire was introduced. Minor changes to the content are documented in the most recent Guide to the Job Vacancy and Wage Survey (75-514-G).

Beginning with the reference period of October 2020, preliminary monthly estimates from the JVWS are released on a monthly basis alongside the Survey of Employment, Payrolls and Hours (SEPH) release. These estimates provide information on the number of job vacancies and the job vacancy rate by province and by industrial sector.

The target population of the survey includes all business locations in Canada, excluding those involved primarily in religious organizations and private households. Federal, provincial and territorial, as well as international and other extra-territorial public administrations are also excluded from the survey.

Seasonally-adjusted quarterly job vacancy data are used for the first time in this release and available online (tables 14-10-0398-01, 14-10-0399-01 and 14-10-0400-01). The analyses of the job vacancy levels and rates by sector (10 broad industrial sector groups), one-digit NOC (10 broad occupational categories), province and economic region are based on seasonally adjusted data. However, the analyses of the job vacancy levels and rates by subsector, two-digit NOC, three-digit NOC and four-digit NOC are based on non-seasonally adjusted data.

A supplementary question included in the February and March 2022 LFS asked people who were job searchers, on temporary layoff, or who wanted to work, the lowest amount of pay they would be prepared to accept if they found a suitable job. The lowest hourly wage they would be willing to accept is calculated based on whether they were looking for full-time or part-time work. If the respondent indicated that they would work for the minimum wage, the adult minimum hourly wage in their province was used. The estimates presented in this Daily release are for those aged 18 to 64, who are not full-time members of the armed forces, and reflect the average for February and March 2022.

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

Next release

Data on job vacancies from the JVWS for the second quarter of 2022 will be released on September 20, 2022.

Correction

Note that the unemployment to job vacancy ratio (seasonally adjusted) was corrected on June 23, 2022.

Products

More information about the concepts and use of data from the Job Vacancy and Wage Survey is available online in the Guide to the Job Vacancy and Wage Survey (75-514-G).

The product "Labour Market Indicators, by province, territory and economic region, unadjusted for seasonality" (71-607-X) is also available. This dynamic web application provides access to Statistics Canada's labour market indicators for Canada, by province, territory and economic region, and allows users to view a snapshot of key labour market indicators, observe geographical rankings for each indicator using an interactive map and table, and easily copy data into other programs.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: