Consumer Price Index, January 2022

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2022-02-16

January 2022

5.1%

(12-month change)

In January 2022, Canadian inflation surpassed 5% for the first time since September 1991, rising 5.1% on a year-over-year basis and up from a 4.8% gain in December 2021. In comparison, the headline Consumer Price Index (CPI) increased 1.0% on a year-over-year basis in January 2021.

Excluding gasoline, the CPI rose 4.3% year over year in January 2022—the fastest pace since the introduction of the index in 1999. COVID-19 pandemic-related challenges continue to weigh on supply chains, and consumer energy prices remain elevated. Taken together, Canadians continued to feel the impact of rising prices for goods and services, especially for housing, food and gasoline.

On a monthly basis, the CPI rose 0.9% in January, the largest increase since January 2017, following a 0.1% decline in December 2021.

Highlights

The Consumer Price Index (CPI) rose 5.1% on a year-over-year basis in January 2022, up from a 4.8% gain in December 2021. Excluding gasoline, the CPI rose 4.3% year over year—the fastest pace since the introduction of the index in 1999.

On a monthly basis, the CPI rose 0.9% in January 2022, the largest increase since January 2017, following a 0.1% decline in December 2021.

On a seasonally adjusted monthly basis, the CPI was up 0.6%.

In January, prices rose in all major components on a year-over-year basis, with shelter prices (+6.2%) contributing the most to the all-items increase.

Year over year, prices for services (+3.4%) rose in January, matching the increase in December 2021. Prices for goods (+7.2%) grew at a faster pace in January 2022 than in December 2021 (+6.8%), contributing to the price growth in the CPI.

Inflation is often compared with changes to average wages. In January 2022, the CPI rose 5.1% on a year-over-year basis. Wage data from the Labour Force Survey found wages rose 2.4% during the same period, meaning that, on average, prices rose faster than wages and Canadians experienced a decline in purchasing power.

Explore the Consumer Price Index tools that can help you make informed financial decisions

Check out the Personal Inflation Calculator! This interactive calculator allows you to enter dollar amounts in the common expense categories to produce a personalized inflation rate, which you can compare to the official measure of inflation for the average Canadian household—the Consumer Price Index (CPI).

Visit the Consumer Price Index Portal to find all CPI data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Consult the Consumer Price Index Data Visualization Tool to access current and historical CPI data in a customizable visual format.

Shelter costs rise at the fastest pace since 1990

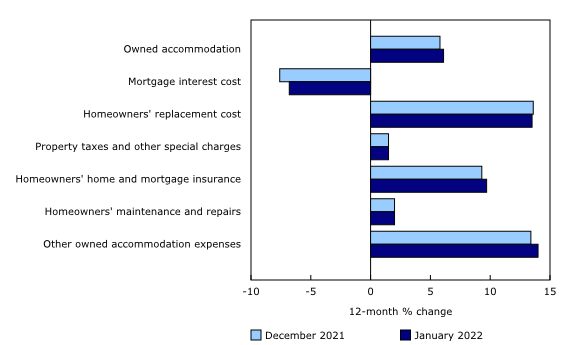

Shelter costs rose 6.2% year over year in January 2022, the fastest pace since February 1990.

Higher prices for new homes contribute to higher costs associated with the upkeep of a property, or the homeowners' replacement cost. Higher home prices also tend to raise other owned accommodation expenses. In contrast, lower interest rates bring borrowing costs down—measured in the CPI through the mortgage interest cost index, which includes both new and resale home prices.

The owned accommodation index, which measures the ongoing costs of home ownership, increased 6.1% year over year in January. On a yearly basis, homeowners' replacement cost (+13.5%) and other owned accommodation expenses (+14.0%), which includes commissions on the sale of real estate, put upward pressure on shelter prices amid rapid price growth in the housing market throughout the pandemic.

Conversely, mortgage interest cost fell 6.8% year over year in January, putting downward pressure on the shelter index.

Renters also saw a rise in prices, as the rented accommodation index increased 3.2% year over year, contributing to the higher shelter prices Canadians faced in January.

Prices for groceries increase at a faster pace

Year over year, shoppers paid more for groceries, as prices for food purchased from stores rose at a faster pace in January 2022 (+6.5%) than in December 2021 (+5.7%). This is the largest yearly increase since May 2009.

Prices for fresh or frozen beef (+13.0%), fresh or frozen chicken (+9.0%), and fresh or frozen fish (+7.9%) rose more in January 2022 compared with December 2021. Margarine (+16.5%), as well as condiments, spices and vinegars (+12.1%) were also up compared with January 2021. Higher input prices and shipping costs, because of ongoing supply chain disruptions, have contributed to the increase in the price of food.

In addition to supply chain disruptions, unfavourable growing conditions have led to higher prices for fresh fruit (+8.2%) and bakery products (+7.4%).

Consumers pay more for alcoholic beverages

Consumers paid more for alcohol in January 2022, as alcoholic beverages purchased from stores rose 2.9%, following a 1.6% gain in December 2021. Much of this increase stemmed from higher prices for both beer and wine, amid material shortages and increased shipping costs.

Gasoline prices remain elevated

On a monthly basis, Canadian drivers paid more at the pumps as gasoline prices rose 4.8% in January 2022. Gasoline prices increased amid concerns over global oil supplies in response to international political events.

Year over year, gasoline prices rose to a lesser extent in January 2022 (+31.7%) compared with December 2021 (+33.3%). This is because higher prices in January 2021, when gasoline prices rose 6.1% month over month, were used as the basis for the year-over-year comparison, leading to a slowdown in year-over-year growth in January 2022. For more information on base-year effects, visit the March 2021 release of the CPI.

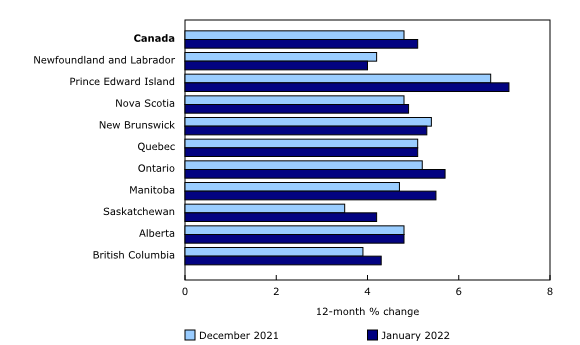

Regional highlights

Prices rose at a faster pace year over year in January 2022 than in December 2021 in six provinces. Year over year prices increased in Ontario (+5.7%), Manitoba (+5.5%) and Saskatchewan (+4.2%), with higher electricity prices contributing to the gains.

Higher prices for rent in British Columbia

Prices in British Columbia rose at a faster pace in January 2022 (+4.3%) compared with December 2021 (+3.9%), due in large part to higher rent prices (+4.2%). The gain in rent prices was partly attributable to increased demand as more people migrated to the region over the past year.

Note to readers

COVID-19 and the Consumer Price Index

Goods and services in the Consumer Price Index (CPI) that were not available to consumers in January due to COVID-19 restrictions received special treatments, effectively removing their impact on the monthly CPI. The following sub-indexes were imputed from the monthly change in the all-items index: some components of both spectator entertainment and use of recreational facilities and services in some areas.

The details of the special treatments from April 2020 to March 2021 are provided in technical supplements available through the Prices Analytical Series. Details and other treatment information for April 2021 and onwards are available upon request.

Upcoming enhancements

The CPI is continuously evolving to incorporate the most timely and accurate data sources and methods. In the coming months, new sources of administrative data will be introduced for the mortgage interest cost index and the cellular services price index.

Used vehicle prices

The Canadian CPI accounts for the sale of used vehicles by including a weight for used vehicles in the index for the purchase of passenger vehicles. However, price changes for new cars are used as a proxy for used cars to ensure price change for this product is still covered to the best extent possible. Work is under way to include the price of used cars and trucks in the purchase of passenger vehicles index. An analytical paper will be forthcoming in the Prices Analytical Series.

Expansion of monthly average retail prices

Beginning May 4, 2022, national average prices will be available in the Monthly Average Retail Prices for Selected Products (18-10-0245-01) table. At that time this table will also include an expanded list of products, based on enhanced data sources and methods. These new data series will begin with March 2022 data. This table uses scanner data (also known as transaction data) collected from Canadian retailers. Transaction data provide a comprehensive electronic record of the transactions made through a retailer's point-of-sale system, and contain relevant pricing information, such as product descriptions and quantities sold. The Monthly Average Retail Prices for Food and Other Selected Products (18-10-0002-01) table will no longer be published after March 16, 2022. Note that these tables are not directly comparable due to methodological differences, and do not contain all the same products and may contain different product definitions.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on February 28. For more information, consult the document "Real-time data tables."

Next release

The adjusted price index for October 2021 to December 2021 will be released on February 24, 2022.

The Consumer Price Index for February 2022 will be released on March 16, 2022.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: