Gross domestic product by industry, October 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-12-23

October 2021

0.8%

(monthly change)

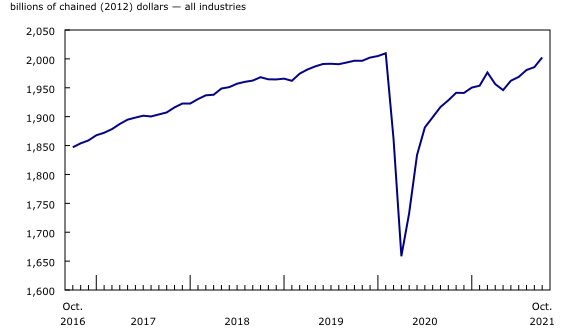

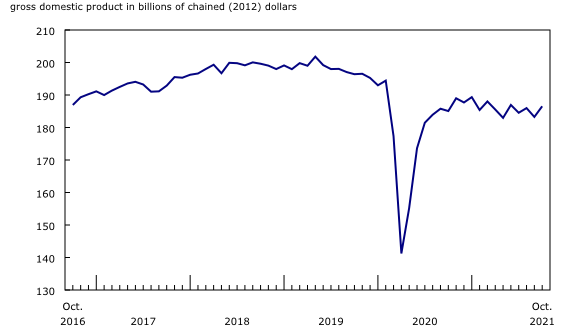

Real gross domestic product (GDP) rose 0.8% in October, following a 0.2% growth in September, as broad-based increases across sectors contributed to the fifth consecutive monthly expansion.

Both goods-producing (+1.6%) and services-producing (+0.6%) industries were up, with 17 of 20 industrial sectors posting gains in October.

Advance information indicates that real GDP increased 0.3% in November. Leading the growth were accommodation and food services, wholesale trade, construction and the arts and entertainment sectors, while the mining, quarrying, and oil and gas extraction sector offset some of the gains. Owing to its preliminary nature, this estimate will be updated on February 1, 2022, with the release of the official GDP data for November 2021.

Manufacturing rebounds

The manufacturing sector rebounded 1.8% in October, more than offsetting a 1.5% contraction in September, with both durable and non-durable goods manufacturing contributing to the growth.

Durable manufacturing grew 1.9% in October, led by a 9.3% rebound in transportation equipment manufacturing. The output of motor vehicle (+47.8%) and motor vehicle parts (+13.1%) manufacturing facilities bounced back strongly in October, largely offsetting September's declines, despite the ongoing global semiconductor chip shortage and other supply chain issues that have disrupted consistent production.

Non-durable manufacturing was up 1.7% in October, more than offsetting a 1.3% drop in September, as the majority of subsectors expanded. Plastics and rubber products manufacturing (+5.8%) contributed the most to the growth, partly due to higher demand from motor vehicle and motor vehicle parts manufacturers. Further contributing to the growth were beverage and tobacco product (+6.3%), chemical (+1.9%) and food (+1.3%) manufacturing. Petroleum and coal product (-1.7%) and paper (-1.1%) manufacturing offset some of the gains.

Construction grows as all subsectors are up

Construction rose 1.6% in October, following four declines in the previous five months, as all forms of construction activity were up in the month.

Residential building construction (+2.0%) led the growth in October as higher home alteration and improvement activities, along with an increase in multi-unit dwellings construction, more than offset continued declines in single-family homes construction.

Non-residential building construction expanded 1.3% in October, a fourth consecutive gain, as all types of non-residential building construction were up over the course of the month. Repair construction rose 1.9%, while engineering and other construction activities grew 1.2% in October.

Real estate grows on a country-wide increase in activity

The real estate and rental and leasing sector expanded 0.8% in October, the largest increase since December 2020. The output of offices of real estate agents and brokers jumped 8.8% in October as home resale activity rose from coast to coast, led by Ontario, British Columbia, Quebec and Alberta.

Legal services, which derive much of their activity from real estate transactions, increased 1.6% in October; the industry grew for the fourth month in a row.

In addition to legal services, all industries comprising the professional, scientific and technical services sector (+1.2%) recorded growth as well. Computer systems design and related services (+1.5%), architectural, engineering and related services (+1.2%) and other professional, scientific and technical services including scientific research and development (+0.9%) contributed the most to the growth.

Mining, quarrying, and oil and gas extraction keeps expanding

Mining, quarrying, and oil and gas extraction grew 1.5% in October, up for the sixth month in a row, as all three subsectors were up.

The oil and gas extraction subsector grew 1.5% in October, up for the fifth time in six months. Oil sands extraction was up 3.9% as strong increases in crude bitumen and synthetic crude production in Alberta led the growth. Robust global demand, prices for energy products and the completion of planned maintenance activities at some oil sands upgraders contributed to the increase. Oil and gas extraction (except oil sands) contracted 1.8% as higher natural gas extraction was more than offset by lower crude petroleum extraction, particularly off of Canada's North Atlantic coast.

Mining excluding oil and gas extraction rose 1.7% in October due to broad-based industry gains. Non-metallic mineral mining and quarrying increased 4.1%, driven by strength in potash mining (+5.1%). Metal ore mining rose 0.6% as iron ore mining (+3.6%) as well as copper, nickel, lead and zinc mining (+1.5%) were up, buoyed by increased exports; gold and silver ore mining (-4.6%) tempered some of the increase. Coal mining increased 1.6% in October.

Transportation and warehousing sector continues to grow

Transportation and warehousing services increased 1.6% in October as 7 of 10 subsectors were up.

For a fourth time in the last five months, air transportation (+19.0%) experienced double-digit growth as more domestic and international travellers took to the skies. Despite these gains, the subsector is still approximately 69% below the January 2020 level of activity. Both trucking and support activities for transportation increased 1.1%. Pipeline transportation grew 0.6% as both crude oil and natural gas movement were up.

Postal services and couriers and messengers (-0.5%) and warehousing services (-0.9%) offset some of the growth in October.

Other industries

Retail trade increased 1.0% in October with 8 of 12 subsectors posting gains. Sporting goods, hobby, book and music stores (+12.6%) led the growth, while motor vehicle and parts dealers grew 1.9%, driven by higher retailing activity at new car dealers. Retailing activity at gasoline stations (-3.6%) declined in October.

The arts, entertainment and recreation sector was up 7.1% in October as all subsectors were up, benefiting from continued easing of capacity limits for large group gatherings. Performing arts, sports and heritage institutions (+15.4%) led the growth, while amusement, gambling and recreation industries increased 1.9%.

Agriculture, forestry, fishing and hunting rose 2.3% in October, led by crop production. Crop production (except cannabis) began its recovery from a dismal crop year. It grew 3.4% in October as farmers completed their harvest and began to prepare their fields for the next crop year.

Finance and insurance (+0.5%) increased for the fifth month in a row on widespread growth across the sector. Increased market activity, specifically on debt instruments, and gains in equity mutual funds led to increases in financial investment services (+1.4%) and depository credit intermediation and monetary authorities (+0.4%). Insurance carriers and related activities edged down 0.1%.

Wholesale trade increased by 0.6%, driven mainly by increases in new vehicles and parts (+6.4%) and in personal and household goods (+2.3%) wholesaling.

Accommodation and food services declined 0.5% in October as growth in accommodation services was more than offset by a second consecutive monthly decline in food services and drinking places.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the following 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports global sustainable development goal reporting. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry's value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUTs) up to the latest SUT year (2018).

For the period starting in January 2019, data are derived by chaining a fixed-weight Laspeyres volume index to the prior period. The fixed weights are 2018 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

An advance estimate of industrial production for November 2021 is available upon request.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)? "

Revisions

Monthly industry GDP figures, for both the flash and the official estimates, are designed to be very timely and as a consequence are continuously updated as more complete and better information becomes available on the Canadian economy.

Estimates of the monthly GDP by industry program are subject to different types of revisions. Some involve the availability of source data used in the compilation process, which are routine as more complete and more comprehensive information becomes available, on a monthly, quarterly or annual basis. Other revisions may come from changes to the statistical system, such as survey redesigns, while others can stem from conceptual, classification and definitional changes, as well as methodological changes such as improvements to estimation methods. Finally, assumptions used and standard changes to seasonal adjustment calculations can also contribute to revisions incorporated in each release.

With this release of monthly GDP by industry, revisions have been made back to January 2021. The only revision of note for the total GDP was a 0.1 percentage point upward revision to growth in September 2021.

Real-time table

Real-time table 36-10-0491-01 will be updated on January 10, 2022.

Next release

Data on GDP by industry for November 2021 will be released on February 1, 2022.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca).

To enquire about the concepts, methods or data quality of this release, contact Ederne Victor (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca), Industry Accounts Division.

- Date modified: