Consumer Price Index, October 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-11-17

October 2021

4.7%

(12-month change)

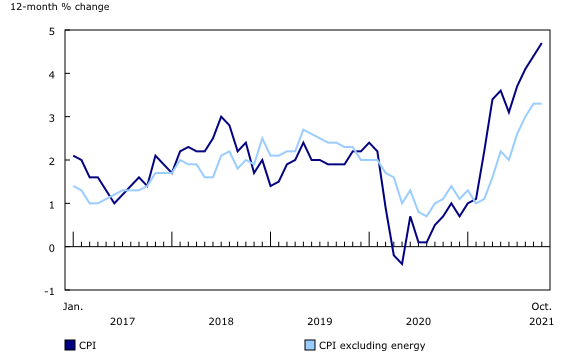

The Consumer Price Index (CPI) rose 4.7% on a year-over-year basis in October, up from a 4.4% increase in September. This was the largest gain since February 2003. Excluding energy, the CPI rose 3.3% year over year, matching the increase in September.

On a monthly basis, the CPI rose 0.7% in October, the largest gain since June 2020 (+0.8%), when energy prices began to recover following steep declines during the early months of the pandemic. On a seasonally adjusted monthly basis, the CPI rose 0.5%.

Inflation is often driven by higher prices for day-to-day basics, such as putting a roof over our heads, buying food and getting around. These three elements alone nationally account for 62.5% of our monthly "basket" of spending. Prices are currently rising for all three and, therefore, are affecting us all to a greater or lesser degree, depending on where we live, our lifestyle choices and personal circumstances.

To help Canadians better understand how price changes are affecting them individually, Statistics Canada has developed the Personal Inflation Calculator, which allows you to estimate your personal inflation rate based on your own household expenses.

Give it a try to see how your personal rate of inflation compares with the rate for the nation as a whole.

November is Financial Literacy Month

Join us for our upcoming webinar, "Consumer Price Index: Understanding inflation, how it's measured and what it means for you," on November 30, from 1 p.m. to 2 p.m., Eastern time. We'll be sharing how we measure price inflation and how it may impact your financial decisions. Click here to register: Canadian Financial Literacy Database—Canada.ca (fcac-acfc.gc.ca).

Explore the Consumer Price Index resources that can help you make informed financial decisions

Visit the Consumer Price Index portal to find all Consumer Price Index (CPI) data, publications, interactive tools, and announcements highlighting new products and upcoming changes to the CPI in one convenient location.

Check out the Consumer Price Index Data Visualization Tool to access current and historical CPI data in a customizable visual format.

Highlights

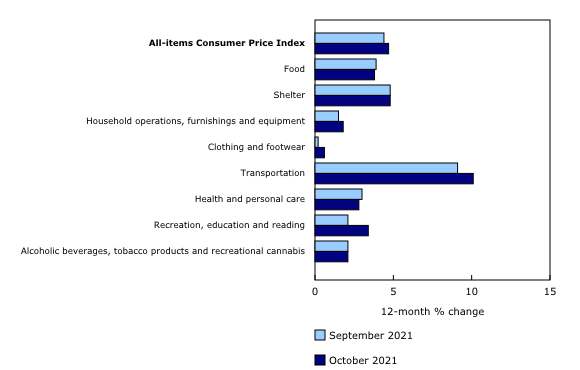

Prices rose in all eight major components on a year-over-year basis in October, with transportation prices (+10.1%) contributing the most to the growth in the all-items index. This was the highest increase for this component since March 2003. The increase in consumer prices for transportation was primarily driven by a rise in energy prices (+25.5%).

Energy prices rise in October

Energy prices were up 25.5% year over year in October, primarily driven by an increase in gasoline prices. Compared with October in the previous year, consumers paid 41.7% more for gasoline, as shortages in other energy sources, such as coal and natural gas, led major economies to use more oil for power generation. This contributed to higher prices at the pump.

Similarly, fuel oil and other fuels (+48.1%) are subject to oil price dynamics, and prices remained high compared with October 2020. Natural gas prices rose 18.7% on a year-over-year basis.

Passenger vehicle prices rise year over year

Prices for passenger vehicles remained high compared with October 2020, increasing 6.1% year over year amid a global shortage of semiconductor chips. In addition, prices for passenger vehicle parts, accessories and supplies rose 3.6% year over year.

Consumers pay more for meat

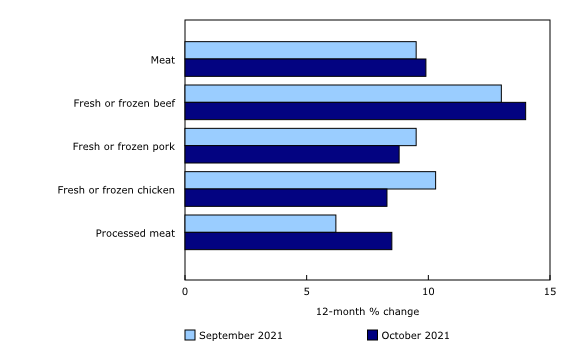

Prices for meat products (+9.9%) continued to rise in October, as fresh or frozen beef (+14.0%) and processed meat (+8.5%), which includes bacon (+20.2%), put upward pressure on prices. Labour shortages that have slowed down production, ongoing supply chain challenges and rising prices for livestock feed continued to factor into higher prices for meat.

Spotlight on property taxes in the Consumer Price Index

Property taxes are an ongoing cost of homeownership in Canada and are the main source of revenue for many municipalities. They are collected by municipalities to cover the cost of a variety of services.

Property taxes and other special charges, which are updated annually in the October Consumer Price Index (CPI), are determined by four factors: the assessed value of homes, municipal and provincial tax rates, charges levied by municipalities for specific services such as garbage collection, and homeowner tax rebates.

In 2021, consumers paid more for property taxes and other special charges (+1.5%). Of the 13 provinces and territories, 9 experienced an increase this year, while 4 saw charges decline. Higher property taxes paid in British Columbia (+5.6%) and Ontario (+2.1%) contributed to the increase, which was partially offset by a decline in property taxes paid in Manitoba (-6.7%) and Alberta (-1.1%).

In British Columbia, property taxes rose in part because of higher assessment values.

In Ontario, higher tax and sewer rates, set to cover rising costs of existing services and infrastructure projects, contributed to the increase.

The decline in property taxes in Manitoba, which is the largest on record for that province, was largely attributable to the introduction of a new education tax rebate.

In Alberta, lower assessment values contributed to the decline in property taxes.

Property taxes increased in Nova Scotia (+2.7%) and New Brunswick (+2.4%), after posting growth of 1.1% and 0.5%, respectively, in 2020. Higher assessment values, which were a result of strong demand for houses in Atlantic Canada, as more Canadians moved to the region, contributed to the increases. Homeowners' replacement cost, which is associated with the upkeep of a property and related to the price of new homes, rose in both Nova Scotia (+11.9%) and New Brunswick (+9.6%) in October.

Regional highlights

Year over year, prices rose at a faster pace in October than in September in eight provinces.

Rent prices rise in Prince Edward Island, Nova Scotia and New Brunswick

Among the eastern provinces, rent prices rose year over year in Prince Edward Island (+7.6%) in October. Higher demand arising from the migration of Canadians to the eastern provinces may have contributed to the price gain. Rent prices also increased in Nova Scotia (+7.1%) and New Brunswick (+9.4%). In contrast, rent prices in Newfoundland and Labrador fell 2.3% year over year.

Note to readers

COVID-19 and the Consumer Price Index

Starting in April 2020, goods and services in the Consumer Price Index (CPI) that were not available to consumers because of COVID-19 restrictions received special treatments, effectively removing their impact on the monthly CPI. When a good or service became available for consumption again, an adjustment factor was calculated to remove the impact of imputations so that the indexes reflect only observed price movements. More information on these adjustments can be found in the Technical Supplement for the March 2021 Consumer Price Index.

As a result of these adjustment factors, users are advised to exercise caution in interpreting the 12-month change for the next 10 months for the travel tours and air transportation indexes, which were reintroduced with the August 2021 CPI.

In October 2021, special treatments were applied only for cruise-based travel tours, accounting for 0.03% of the 2020 CPI basket. Statistics Canada will continue to monitor the impacted component and will remove these special treatments as it becomes widely available for consumption.

The details of the treatments from April 2020 to March 2021 are provided in technical supplements available through the Prices Analytical Series. Details and other treatment information for April 2021 to October 2021 are available upon request.

Statistics Canada continues to work with price experts, other national statistical organizations and other partners to ensure that the data and methods used in the calculation of the official CPI are aligned with international standards.

Average prices versus the Consumer Price Index

Statistics Canada also produces the tables Monthly average retail prices for food and other selected products and Monthly average retail prices for selected products, by province. The list of products included in the average prices tables represents a small subset of the products that feed into the CPI; therefore, the change in these average prices may not be the same as in the CPI. For the expanded list of products included in the CPI, check out the list of representative products.

The average prices tables do not measure pure price change, whereas the CPI does measure pure price change. Therefore, while average prices can be used to assess price levels in a given month, it is recommended to use the CPI and its sub-indexes (table 18-10-0004-01) to measure pure price change through time.

For more details on food prices in the CPI, see last month's release.

Real-time data tables

Real-time data table 18-10-0259-01 will be updated on November 29, 2021. For more information, consult the document "Real-time CANSIM tables."

Next release

The Consumer Price Index for November will be released on December 15, 2021.

A new study, "Consumer Price Index and inflation perceptions in Canada: Can measurement approaches or behaviour factors explain the gap?", will be available through the Prices Analytical Series in December 2021.

Products

The "Consumer Price Index Data Visualization Tool" is available on the Statistics Canada website.

More information on the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: