Canadian international merchandise trade, April 2021

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-06-08

In April, Canada's merchandise imports fell 4.7%, while exports decreased 1.0%. Both declines were attributable in large part to significant decreases in trade of motor vehicles and parts. This was mainly the result of production shutdowns in the auto assembly industry in April because of the shortage of semiconductor chips.

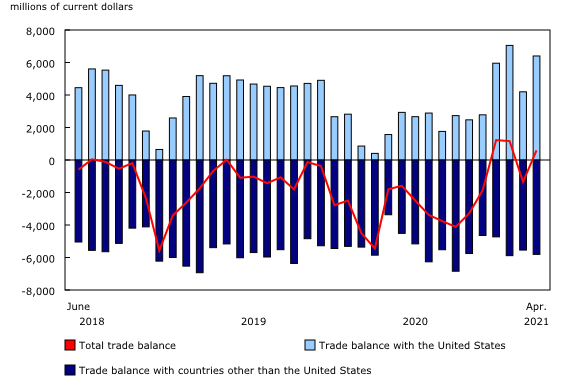

Canada's merchandise trade balance went from a deficit of $1.3 billion in March to a surplus of $594 million in April. The surplus in April was the third in 2021, but its value represented less than 0.6% of total monthly merchandise trade.

Explore the most recent results of Canada's international trade in an interactive format with the newly updated version of the "International trade monthly interactive dashboard." Starting this month, a section on trade in services is included in the dashboard.

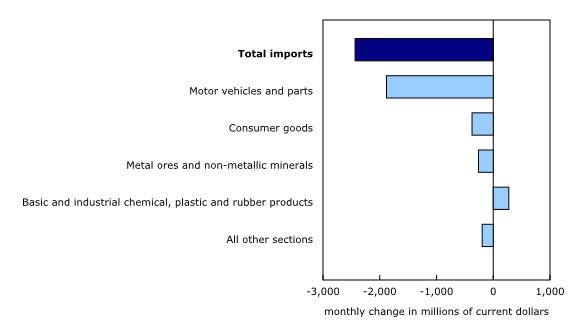

Motor vehicles and parts drive the decrease in imports

Following a 6.1% increase in March, total imports were down 4.7% in April to $49.6 billion. This represented the strongest percentage decrease since the historic declines of April 2020. Excluding motor vehicles and parts, imports fell 1.3%. In real (or volume) terms, total imports declined 6.8% in April.

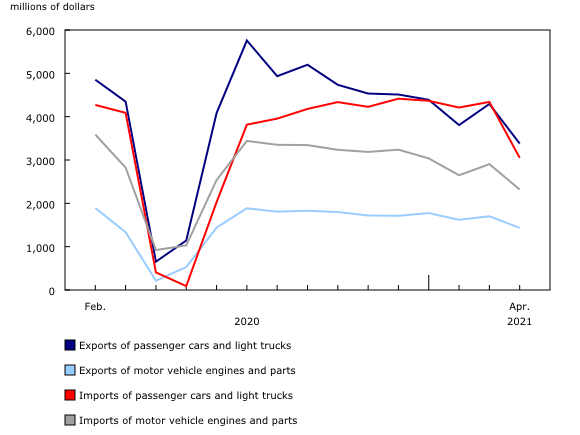

Imports of motor vehicles and parts decreased 22.1% in April to $6.6 billion. Excluding the lows of the first wave of the pandemic in 2020, this represents the lowest level since February 2012. Imports of passenger cars and light trucks (-29.7%) and engines and parts (-20.2%) both decreased significantly as many auto and parts manufacturers in North America and abroad stopped or slowed production because of the semiconductor chip shortage.

Semiconductor chips are generally not imported into Canada in large quantities as discrete products. Impacts of the global chip shortage will be more apparent in a variety of other manufactured product categories within the North American Product Classification System, where semiconductor chips are already integrated as important components within intermediate or finished goods.

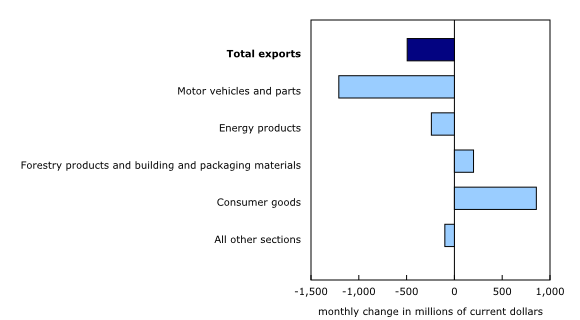

Exports of seafood products partially offset the decline in exports of motor vehicles and parts

Total exports were down 1.0% in April to $50.2 billion, with 6 of 11 product sections posting declines. Excluding the motor vehicles and parts category, exports rose 1.6% in April. In real (or volume) terms, total exports fell 3.5%.

Exports of motor vehicles and parts decreased 18.1% to $5.5 billion in April. Outside the lows of 2020, this was the lowest level since January 2014. The ongoing semiconductor chip shortage forced Canadian automakers to reduce or stop production in April, resulting in sharp decreases in exports of passenger cars and light trucks (-21.3%), as well as engines and parts (-15.7%). So far, production disruptions in the Canadian industry because of the shortage have been most significant in April. Production in May is expected to be slightly less severely impacted, although more than production in February and March. The semiconductor chip shortage remains fluid, with ongoing adjustments being made to automotive manufacturing operations worldwide.

Partially offsetting this decrease were higher exports of consumer goods (+14.4%). The rise was mainly the result of a surge in exports of prepared and packaged seafood products, which more than tripled in April. To reduce the risk for the endangered North American right whales, the snow crab season opened almost one month earlier this year, leading to a significant increase in exports of crab in April.

Surplus with the United States rises

Imports from the United States were down 5.2% in April, mainly because of the fall in imports of motor vehicles and parts. Exports to the United States increased 1.4%, supported by higher exports of seafood products and softwood lumber. As a result, Canada's trade surplus with the United States widened from $4.2 billion in March to $6.4 billion in April.

When the average exchange rates of March and April are compared, the Canadian dollar gained 0.5 US cents relative to the American dollar, reaching the 80-cent mark for the first time since January 2018. The Canadian dollar has increased 12.5% since April 2020.

Following a 12.8% increase in March, exports to countries other than the United States fell 7.2% in April, mainly on lower exports to Hong Kong (gold) and the United Kingdom (gold).

Imports from countries other than the United States were down 3.8% in April. Following a 27.8% increase in March, imports from China fell 18.8% in April, with widespread decreases across a number of product categories.

Canada's trade deficit with countries other than the United States widened from $5.5 billion in March to $5.8 billion in April.

Revisions to March merchandise export and import data

Imports in March, originally reported as $51.8 billion in the previous release, were revised to $52.0 billion in the release for the current reference month. Exports in March, originally reported as $50.6 billion in the previous release, were revised to $50.7 billion in the current month's release.

Trade in medical and protective goods and vaccines

Following a steep 23.8% increase in March, imports of medical and protective goods fell 21.2% to $2.6 billion in April on a customs basis. Imports of diagnostic products fell 34.3% after reaching a record high in March. Imports of medical equipment and products (-18.6%), personal protective equipment (-10.8%), and disinfectant and sterilization products (-14.3%) also decreased. Year over year, imports were 4.2% lower than in April 2020, which was the first full month after measures to contain the spread of COVID-19 in Canada were implemented. Meanwhile, exports of medical and protective goods decreased 5.6% to $1.4 billion in April, following two consecutive monthly increases. Year over year, exports were 7.7% lower than in April 2020.

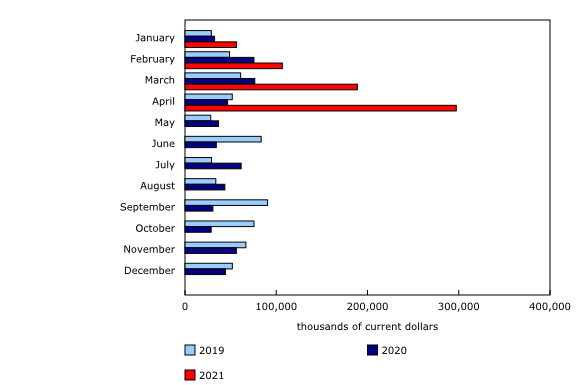

Imports of "vaccines for human medicine other than for influenza," the category that includes the COVID-19 vaccines, increased 57.4% in April to $297 million. Imports in April were more than six times higher year over year. COVID-19 vaccines were first approved for use in Canada in December 2020, and, since January 2021, import values in this category have grown substantially each month, with further increases expected in the months ahead.

Monthly trade in services

In April, monthly service exports were down 2.2% to $9.3 billion. Service imports increased 2.2% to $9.5 billion.

When international trade in goods and international trade in services were combined, exports fell 1.2% to $59.5 billion in April, while imports decreased 3.6% to $59.1 billion. As a result, Canada's trade surplus with the world for goods and services combined was $368 million in April.

Upcoming release of the new Canadian international merchandise trade web application

In fall 2021, Statistics Canada will launch the Canadian international merchandise trade (CIMT) web application, which will replace the existing CIMT online database. This modernized tool will provide users with a number of enhancements, including access to the full 8-digit (exports) and 10-digit (imports) Harmonized System product categories, as well as insights on CIMT in a more user-friendly, efficient and visually appealing manner. Watch this video to learn more about the added data and features.

Note to readers

Merchandise trade is one component of Canada's international balance of payments (BOP), which also includes trade in services, investment income, current transfers, and capital and financial flows.

International trade data by commodity are available on both a BOP and a customs basis. International trade data by country are available on a customs basis for all countries and on a BOP basis for Canada's 27 principal trading partners (PTPs). The list of PTPs is based on their annual share of total merchandise trade—imports and exports—with Canada in 2012. BOP data are derived from customs data by adjusting for factors such as valuation, coverage, timing and residency. These adjustments are made to conform to the concepts and definitions of the Canadian System of National Accounts.

For a conceptual analysis of BOP-based data versus customs-based data, see "Balance of Payments trade in goods at Statistics Canada: Expanding geographic detail to 27 principal trading partners."

For more information on these and other macroeconomic concepts, see the Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) and the User Guide: Canadian System of Macroeconomic Accounts (13-606-G).

The data in this release are on a BOP basis and are seasonally adjusted. Unless otherwise stated, values are expressed in nominal terms, or current dollars. References to prices are based on aggregate Paasche (current-weighted) price indexes (2012=100). Movements within aggregate Paasche prices can be influenced by changes in the share of values traded for specific goods, with sudden shifts in trading patterns—as observed currently with the COVID-19 pandemic—sometimes resulting in large movements in Paasche price indexes. Volumes, or constant dollars, are calculated using the Laspeyres formula (2012=100), unless otherwise stated.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Revisions

In general, merchandise trade data are revised on an ongoing basis for each month of the current year. Current-year revisions are reflected in both the customs-based and the BOP-based data.

The previous year's customs-based data are revised with the release of data for the January and February reference months, and thereafter on a quarterly basis. The previous two years of customs-based data are revised annually, and revisions are released in February with the December reference month.

The previous year's BOP-based data are revised with the release of data for the January, February, March and April reference months. To remain consistent with the Canadian System of Macroeconomic Accounts, revisions to BOP-based data for previous years are released annually in December with the October reference month.

Factors influencing revisions include the late receipt of import and export documentation, incorrect information on customs forms, the replacement of estimates produced for the energy section with actual figures, changes in merchandise classification based on more current information, and changes to seasonal adjustment factors.

For information on data revisions for exports of energy products, see Methodology for Exports of Energy Products within the International Merchandise Trade Program.

Revised data are available in the appropriate tables.

Real-time data table

The real-time data table 12-10-0120-01 will be updated on June 21.

Next release

Data on Canadian international merchandise trade for May will be released on July 2.

Products

The product "International merchandise trade monthly interactive dashboard" (71-607-X) is now available. This new interactive dashboard is a comprehensive analytical tool that presents monthly changes in Canada's international merchandise trade data on a balance of payments basis, fully supporting the information presented every month in the Daily text.

The product "The International Trade Explorer" (71-607-X) is now available online.

Customs-based data are now available in the Canadian International Merchandise Trade Database (65F0013X).

The updated "Canada and the World Statistics Hub" (13-609-X) is now available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China, Japan, Belgium, Italy, the Netherlands and Spain.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Benoît Carrière (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca), International Accounts and Trade Division.

- Date modified: