Survey of Innovation and Business Strategy, 2017 to 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2021-04-26

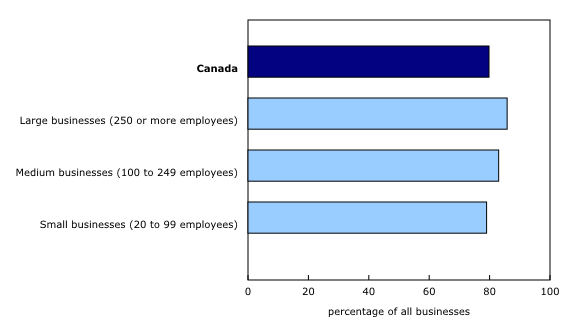

Innovation is a key factor in the economic growth and sustainability of businesses and by extension, it impacts productivity critical to maintaining our standard of living. Over the 2017-to-2019 period, approximately 80% of Canadian businesses indicated that they were engaged in innovative practices and strategies.

Businesses are considered innovative if they introduce or bring into use new or improved goods, services or business processes that differed significantly from their previous, goods, services or business processes.

Larger businesses (250 or more employees) were more likely to be innovative (85.8%) than businesses with fewer employees, with 79.0% of businesses with fewer than 100 employees being innovative in the 2017-to-2019 reference period. Ontario had the highest share of innovative businesses (83.1%), followed by the "rest of Canada" category (which includes Manitoba, Saskatchewan, Alberta, British Columbia, Yukon, the Northwest Territories and Nunavut) at 79.4%, Quebec (77.9%), and the Atlantic region (68.5%).

Business activities also figure into the propensity to be innovative. Sectors that had among the highest rates of innovation in the 2017 Survey of Innovation and Business Strategy (SIBS) continued to rank high in SIBS 2019. The professional, scientific and technical services sector posted the highest proportion of innovative businesses (89.1%), followed by the information and cultural industries sector (88.8%) and the wholesale trade sector (83.3%). Conversely, the management of companies and enterprises sector (60.8%) and the agriculture, forestry, fishing and hunting sector (65.4%) had the lowest proportion of innovative businesses.

Businesses report cost savings from their business process innovations

During the three-year period, 52.7% of businesses introduced or brought into use product (good or service) innovations. The rate was even higher for business process innovations (72.7%).

Among businesses that introduced business process innovations from 2017 to 2019, 4 in 10 (39.3%) reported that their innovations resulted in cost savings related to the production of goods or services. Additionally, one-third of businesses were able to save on costs related to support business functions.

A higher proportion of large businesses reported cost savings on the production of goods or services (51.5%) and support business functions (44.5%) from their business process innovations. For small businesses, 37.6% saved on the production of goods or services, while 32.4% were able to save costs on support business functions.

Less than one-fifth of businesses cooperate with others on innovation activities

Fewer than one in five (17.8%) businesses cooperated on innovation activities with other businesses or organizations. Among these businesses, 53.0% cooperated with suppliers, while 43.0% cooperated with their parent, affiliated or subsidiary businesses. Suppliers were also ranked as the most critical partner for cooperation on innovation activities by 33.0% of businesses, followed by parent, affiliated or subsidiary businesses (28.7%). For these key cooperation partners, over four-fifths of suppliers (88.0%) and affiliated businesses (81.9%) were located in Canada.

From a sectoral perspective, businesses in the finance and insurance sector (excluding the monetary authorities subsector) had the highest rate of cooperation related to innovation activities (35.4%). By contrast, businesses in the construction sector had the lowest rate (10.1%) of cooperation.

Over half of businesses report that their innovations with environmental benefits are new to their market

During the 2017-to-2019 period, businesses acknowledged a number of environmental benefits associated with product or process innovations. For instance, nearly half of businesses indicated that they experienced an environmental benefit from production through efficient use of resources. Businesses also highlighted that the innovation they introduced had environmental benefits related to the consumer or end user (35.8%).

Among businesses that introduced innovations with environmental benefits, three in five (60.3%) reported that their innovations related to the consumer or end user were new to the business's market. As well, over half of all businesses that introduced innovations with environmental benefits related to increased environmental protection activities or efficient use of resources, indicated that these innovations were new to their markets.

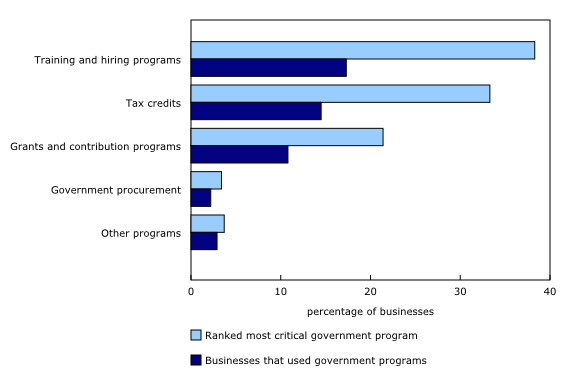

Three in 10 businesses used government programs to aid innovation-related activities

Approximately 3 in 10 businesses in Canada indicated that they used various types of government programs from various levels of government to aid in their innovation-related activities over the 2017-to-2019 period. This statistic was driven by small businesses (28.4%), whereas, among large businesses, 42.0% accessed government programs for aid on innovation activities.

These government aid programs included tax incentives, grants, procurement, training and hiring, and other support programs. Of businesses that used at least one government program, 38.3% found that training and hiring programs were the most critical for innovation-related activities. This statistic, however, hides underlying differences between large and small businesses. Small businesses preferred the use of government training and hiring programs, while large businesses favoured tax incentive or tax credit programs.

Businesses in Quebec had the highest usage rate of government programs (35.4%) for innovation-related activities, followed by businesses in the Atlantic region (32.3%), Ontario (31.7%), and the rest of Canada (24.5%).

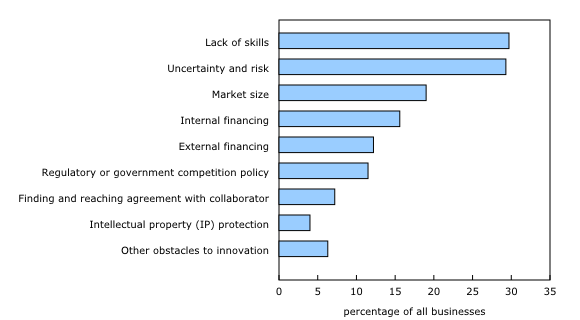

Over half of Canadian businesses face obstacles to innovation

Slightly more than half of all businesses in Canada reported that they faced obstacles related to innovation in 2019. Of these obstacles, almost one in three cited lack of skills (29.7%) and uncertainty and risk (29.3%) as the most frequent barriers.

Most businesses that encountered obstacles indicated that they took measures to overcome them. For nearly every type of obstacle, businesses reported that their measures were successful in mitigating them with the exception of obstacles related to innovation from regulatory or government competition policies. Of the businesses that took measures to address this obstacle, 39.3% found success in mitigating it.

The vast majority of businesses did not use government programs as a means to overcome obstacles to innovation. For instance, government programs aimed towards external financing barriers were used by about one in five businesses (22.3%). Furthermore, 4.4% of businesses sought government assistance to overcome obstacles related to market size.

Note to readers

The 2019 Survey of Innovation and Business Strategy (SIBS) is a joint initiative of Statistics Canada; Innovation, Science and Economic Development Canada; Global Affairs Canada; the Bank of Canada; the Atlantic Canada Opportunities Agency; the Institut de la statistique du Québec; and the Ontario Ministry of Economic Development, Job Creation and Trade.

SIBS is the primary source of business innovation data for the Canadian economy. Between the release of the 2017 SIBS and 2019 SIBS results, the definition of what constitutes innovation changed slightly.

As a result of changes in terminology and content between the 2019 SIBS and previous iterations of SIBS, caution is recommended when making comparisons at more detailed levels of aggregation.

Data for the 2015-to-2017 and 2017-to-2019 reference periods are available by sector, according to the North American Industry Classification System; by enterprise size; and by economic region, according to the Standard Geographical Classification.

Data from the 2009 and the 2012 SIBS are available in archived tables (12-604-X).

Definitions

Definition of innovation in the 2019 SIBS: An innovation is a new or improved product or process (or combination thereof) that differs significantly from the unit's previous products or processes and that has been made available to potential users (product) or brought into use by the unit (process) [Source: Oslo Manual, 4th edition, page 20].

Definition of innovation in the 2017 SIBS: An innovation is the implementation of a new or significantly improved product (good or service) or process, a new marketing method, or a new organizational method in business practices, workplace organization or external relations [Source: Oslo Manual, 3rd edition, page 46].

Small businesses: Interchangeable with small enterprises. These firms have between 20 to 99 employees.

Large businesses: Interchangeable with large enterprises. These firms have 250 or more employees.

Good or service innovation: New or improved good or service that differs significantly from the enterprise's previous goods or services with respect to its characteristics, functions or performance specifications and that has been introduced on the market.

Business process innovation: New or improved process for one or more business activities or functions that differs significantly from this business's previous business processes and that has been brought into use by this business in its internal or outward-facing operations.

Atlantic region: Includes Newfoundland and Labrador, Prince Edward Island, Nova Scotia, and New Brunswick.

Rest of Canada: Includes Manitoba, Saskatchewan, Alberta, British Columbia, Yukon, the Northwest Territories and Nunavut.

Benefits from production through efficient use of resources: (1) Improved resource efficiency through reduced material use per unit of output; (2) improved resource efficiency through reduced energy use per unit of output; (3) improved resource efficiency by replacing material with less greenhouse-gas-intensive alternatives; (4) reduced consumption of resources through recycling (water, waste or material); and (5) renewable fuels: ethanol, biodiesel, biogas, biochar and hydrogen.

Benefits related to increased environmental protection activities: (1) Reduced air, water, soil or noise pollution; and (2) reduced greenhouse gas emissions.

Benefits related to consumer or end user: (1) Reduced energy use or increased energy efficiency for the consumer or end user; (2) reduced material use or increased recycling for the consumer or end user; (3) reduced air, water, soil or noise pollution for the consumer or end user; and (4) reduced greenhouse gas emissions for the consumer or end user.

References

OECD/Eurostat (2018), Oslo Manual 2018: Guidelines for Collecting, Reporting and Using Data on Innovation, 4th Edition, The Measurement of Scientific, Technological and Innovation Activities, OECD Publishing, Paris/Eurostat, Luxembourg.

OECD/Eurostat (2005), Oslo Manual: Guidelines for Collecting and Interpreting Innovation Data, 3rd Edition, The Measurement of Scientific and Technological Activities, OECD Publishing, Paris.

Products

Today, Statistics Canada is launching a new interactive dashboard for the Intellectual Property Awareness and Use Survey to celebrate World Intellectual Property Day. With this tool, data users can explore various dimensions of intellectual property by business characteristics.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: