Gross domestic product by industry, October 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-12-23

October 2020

0.4%

(monthly change)

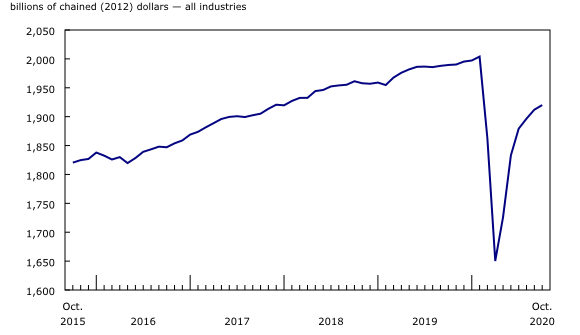

Real gross domestic product (GDP) grew for the sixth consecutive month, up 0.4% in October following a 0.8% increase in September. The upward movement of real GDP continued to offset the steepest drops on record in Canadian economic activity observed in March and April. Total economic activity was about 4% below February's pre-pandemic level.

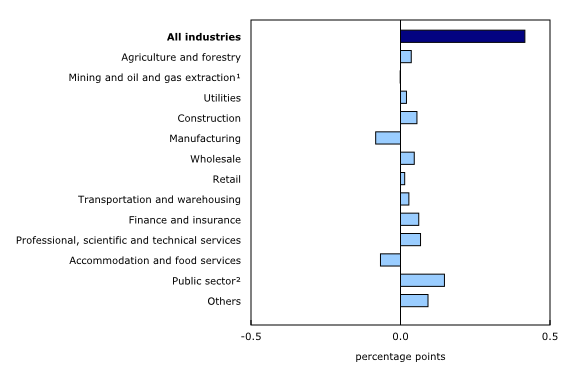

Both goods-producing (+0.1%) and services-producing (+0.5%) industries were up as 16 of 20 industrial sectors posted increases in October.

Preliminary information indicates an approximate 0.4% increase in real GDP for November. Manufacturing, wholesale trade and finance and insurance led the growth, while construction tempered the increase. Owing to its preliminary nature, the estimate will be revised on January 29, 2021, with the release of the official GDP data for November.

Finance and insurance expands

The finance and insurance sector increased 0.8% in October, on widespread growth across all subsectors.

The momentum, seen in the third quarter in the securities markets, continued into October as the highest level of trading activity of federal government bonds—along with increased activity in other securities such as the money market and the repo bond market—contributed to a 2.2% growth in financial investment services and a 0.7% gain in depository credit intermediation and monetary authorities. Insurance carriers and related activities were up for the sixth consecutive month, increasing 0.4% in October.

Manufacturing declines

Following five months of growth, the manufacturing sector contracted 0.8% in October, largely as result of lower inventory formation.

Durable manufacturing declined 2.5% in October as 7 of 10 subsectors were down. Contributing the most to the decline were transportation equipment (-3.7%), machinery (-4.1%) and fabricated metal product manufacturing (-3.5%), while wood products (+2.8%) and miscellaneous manufacturing (+1.7%) were up. Non-durable manufacturing rose 1.2% as six of nine subsectors were up, led by petroleum and coal products (+6.5%) and plastics and rubber products (+4.3%).

Professional services keep growing

The professional services sector grew 1.0% in October, up for the sixth consecutive month, as all types of service grew. Computer systems design and related services led the growth with a 1.1% increase in October. With the exception of declines in March and April, the industry has been continuously growing since November 2016. Legal services (+1.8%), management, scientific and technical consulting services (+1.6%) and architectural, engineering and related services (+0.8%) were other notable contributors.

Public sector continues to grow

The public sector (educational services, health care and social assistance, and public administration) grew 0.7% in October, as all three components were up. Health care and social assistance rose 0.9% as all subsectors, except for hospitals (-0.5%), increased. Educational services were up for the sixth consecutive month, rising 0.9% in the month. October marked the first full month of the new school year, following a late start in September, as continued efforts by elementary and secondary school teachers, support staff and administrators across the country to guide students (in-person or virtually) through a schoolyear like no other led to a 1.8% increase in elementary and secondary schools. Public administration grew 0.4%.

Accommodation and food services down

Activity in the accommodation and food services sector declined for the second consecutive month, contracting 3.9% in October, as momentum from the spring-reopening and summer season continued to dissipate. As the mercury began to drop across the country—effectively bringing to a close "al fresco" dining season—and the number of COVID-19 cases and public health measures related to indoor dining increased, the output of food services and drinking places fell 4.5% in October. Aside from the contractions in March and April, this was the largest monthly decline in the subsector since January 1991.

Accommodation services were down 2.1% as continued domestic and international travel restrictions, along with rising COVID-19 cases across the country, contributed to the pullback in the subsector.

Construction grows across most types of activity

Following a 0.6% decrease in September, the construction sector grew 0.7% in October, as the majority of subsectors increased.

Residential construction grew 1.9% in October as single-unit and multi-unit dwelling construction, along with home alterations and improvements, all contributed to the sixth consecutive monthly growth. Repair construction increased 1.4%, while engineering and other construction edged up 0.3%. Non-residential construction was down for the fourth consecutive month, declining 2.1% in October, as all three types of non-residential construction (commercial, industrial and public) decreased.

Wholesale resumes growth

The wholesale trade sector was up 0.8% in October as six of nine subsectors contributed to the growth. With the fourth expansion in the last six months, the sector largely offset declines experienced in March and April and edged closer to the pre-pandemic level of activity. Machinery, equipment and supplies wholesaling (+1.9%) led the growth as higher imports and exports of all types of machinery commodities contributed to increases in the subsector. Building materials and supplies wholesaling was up 2.6%, benefiting from increased construction activity. Offsetting some of the growth were food, beverage and tobacco (-1.7%) and petroleum and petroleum products wholesaling (-2.3%).

Mining, quarrying, and oil and gas extraction essentially unchanged

Mining, quarrying, and oil and gas extraction was essentially unchanged in October as gains in oil and gas extraction and support activities offset mining and quarrying contractions. Oil and gas extraction (+1.2%) grew for the second month in a row, as a 3.3% increase in oil sands extraction more than offset a 1.0% decline in oil and gas extraction (except oil sands). Support activities for mining, and oil and gas extraction grew 2.4% on account of higher rigging services and support activities for mining. Mining and quarrying (except oil and gas) decreased 3.7%, as a decline in potash mining (-25.1%) and metal ore mining (-1.8%) more than offset a 13.0% uptick in coal mining.

Other industries

Following five months of growth to reach unprecedented record-setting levels, activity at the offices of real estate agents and brokers decreased 1.9% in October, as lower housing resale activity in the Greater Toronto, Hamilton-Burlington and the Greater Vancouver areas contributed most to the decline. Nevertheless, the level of activity was second only to the peak reached in September.

Agriculture, forestry, fishing and hunting rose 1.6% in October, up for the third consecutive month, as three of five subsectors grew. Higher crop production (+2.3%), stemming from elevated grain and cannabis production, contributed the most to the growth.

Utilities rose 0.9% in October, largely offsetting two previous monthly declines, as higher electric power generation, transmission and distribution (+0.7%) and natural gas distribution (+3.1%) contributed to the growth.

Transportation and warehousing grew 0.8% in October, as 7 of 10 subsectors were up, led by pipeline transportation (+2.9%) of both oil and natural gas and support activities for transportation (+1.7%). Truck transportation (-0.8%) and postal service, couriers and messaging services (-1.1%) offset some of the growth.

Retail trade edged up 0.3% in October as the 10 subsectors were evenly split between increases and decreases.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports global sustainable development goal reporting. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry's value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUTs) up to the latest SUT year (2017).

For the period starting in January 2018, data are derived by chaining a fixed-weight Laspeyres volume index to the prior period. The fixed weights are 2017 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?"

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2016.

Each month, newly available administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time table

Real-time table 36-10-0491-01 will be updated on January 11, 2021.

Next release

Data on GDP by industry for November 2020 will be released on January 29, 2021.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Ederne Victor (613-863-6876), Industry Accounts Division.

- Date modified: