Tourism Human Resource Module, 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-10-30

In 2019, the tourism sector accounted for 1.9 million jobs in Canada, up 1.5% from 2018, compared with an increase of 2.1% for the economy overall. The strongest job growth in the tourism sector was observed in Saskatchewan (+9.2%) and Nova Scotia (+8.4%), while only New Brunswick (-4.4%) saw a notable decline.

Strong growth in Saskatchewan and Nova Scotia was mostly the result of gains in the food and beverage services industry, which account for 64.6% of all jobs in the tourism sector in Saskatchewan and 63.4% in Nova Scotia. The food and beverage services industry is particularly volatile, as it relies heavily on part-time workers.

The data published in this human resource module do not account for the impact of the COVID-19 pandemic, but will serve as an important benchmark in the future.

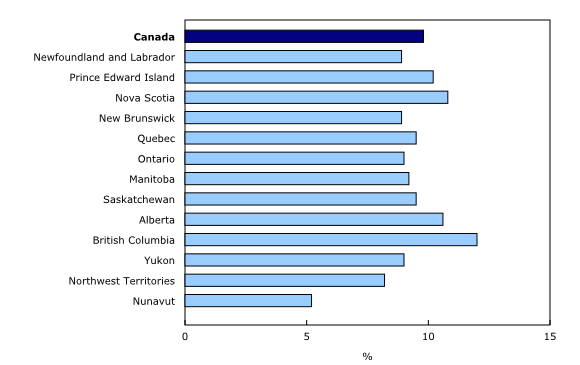

The tourism sector accounts for almost one-tenth of all jobs in Canada

In 2019, the tourism sector represented 9.8% of all jobs in Canada, about the same as the previous three years.

British Columbia held the highest-share of tourism sector jobs (12.0%), followed by Nova Scotia (10.8%) and Alberta (10.6%). Meanwhile, Nunavut held the lowest share of tourism-sector jobs (5.2%).

Tourism sector has a shorter average work week than the rest of the economy

The tourism sector has consistently had a shorter average work week than the average for all sectors of the economy. In 2019, the average work week in tourism industries was 28.5 hours, compared with 32.5 for all sectors of the economy. All provinces and territories followed this trend, except for the Northwest Territories, which averaged 34.1 hours per week in the tourism sector and 33.4 for all sectors of the economy.

Since 1997, the average work week in the tourism sector has decreased by 2.8 hours (-8.8%), dropping at a faster rate than the economy overall (2.1 hours or -6.0%). This can be attributed to the increase in part-time jobs in tourism industries.

Average hourly compensation growth in the sector is steady

Average hourly compensation in Canada's tourism sector has been increasing steadily—from $13.34 in 1997 to $25.27 in 2019, and up 4.7% since 2018.

Northwest Territories ($40.63), Nunavut ($32.77) and Yukon ($31.12) had the highest average hourly compensation, while Prince Edward Island ($17.08), New Brunswick ($18.51) and Nova Scotia ($20.54) had the lowest. This discrepancy was driven largely by the fact that the territories had more jobs in the higher-paying transportation industry and fewer jobs in the lower-paying food and beverage services industry, while the reverse is true for the three Maritime provinces.

Compared with the economy as a whole, the tourism sector's average hourly compensation is generally lower. In 2019, the gap in hourly compensation between the tourism industries and the economy overall was $12.08, with the largest difference observed in Nunavut ($32.77 vs. $49.77) and the smallest observed in Yukon ($31.12 vs. $41.54). The gap in average hourly compensation is the result of tourism having a larger proportion of jobs in lower-paying industries, such as food and beverage services ($18.33 average hourly compensation) and accommodation ($22.33).

Part-time jobs are growing at a faster rate than full-time jobs

In 2019, employee jobs accounted for 92.1% of all jobs in the tourism industries. In addition, 57.0% of employee jobs and 60.7% of self-employed jobs were occupied by full-time workers. Since 2007, part-time employee and part-time self-employed jobs have increased by 37.3% and 26.4%—respectively—while full-time jobs have increased by 22.4% for employees and 1.1% for self-employed workers.

Women occupied 53.6% of employee jobs and were more likely to hold a part-time employee job (48.4%) than men (36.9%).

Younger workers hold one-third of employee jobs in the sector

Younger workers (aged 15 to 24) held more employee jobs in the tourism industries than any other age group (34.1%), followed by workers aged 45 and older (28.5%). However, younger workers worked an average of 18.5 hours per week and earned an average of $15.44 per hour, compared with 33.2 hours and $27.38 per hour for workers aged 45 and older.

The highest share of younger workers in tourism industries was observed in Manitoba (39.6%) and Quebec (36.3%), while Northwest Territories (19.5%) and Yukon (24.6%) had the lowest share.

Older workers (aged 45 and older) in tourism industries occupied the highest share of employee jobs in Nova Scotia (34.3%) and New Brunswick (34.1%), while Yukon (20.0%) had the lowest share of older workers.

Immigrant workers are on the rise in the tourism sector

Immigrant workers made up 27.6% of all employee jobs in the tourism industries in 2019, compared with 20.0% in 1997. While Ontario has the most immigrant workers in tourism industries, British Columbia (35.0%) and Alberta (34.3%) had the highest proportion of immigrant workers. Meanwhile, Nunavut (7.2%) and Newfoundland and Labrador (8.4%) had the lowest proportion of immigrant workers. This is consistent with immigration trends, as British Columbia and Alberta tend to receive a large number of new immigrants, while Nunavut and Newfoundland and Labrador receive far fewer.

Note to readers

The Tourism Human Resource Module is funded through a partnership agreement with Tourism HR Canada. It provides timely and reliable statistics on the human resource dimension of the tourism sector. Estimates include data for Canada and the provinces and territories from 1997 to 2019.

The human resource module provides information on jobs, compensation and hours worked in tourism industries and includes jobs that are attributable to demand from both tourists and non-tourists. This information is different from the data on tourism jobs in the National Tourism Indicators and Tourism Satellite Account, which take into account only those jobs that are attributable directly to demand from tourists. These variables are aggregated into five industry groups: transportation, accommodation, food and beverage services, recreation and entertainment, and travel services.

Employee jobs are defined as jobs for which the employer must complete a Canada Revenue Agency T4 form. Jobs in which workers are paid by tips or commissions are also included.

Jobs from self-employment include jobs performed by working owners of unincorporated enterprises and members of their household who work without a wage or salary (i.e., unpaid family workers).

Products

The Economic accounts statistics portal, which can be accessed through the Subjects module of our website, features an up-to-date portrait of the national and provincial economies and their structure.

Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: