Half of recent postsecondary graduates had student debt prior to the pandemic

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-08-25

A growing number of young Canadians are pursuing postsecondary education, and are therefore staying in school longer than previous generations of students. According to the National Graduates Survey (NGS), the number of postsecondary graduates increased by 57% from 2000 to 2015, with master's degree holders doubling during this period. Although graduating with a postsecondary qualification improves long-term labour market outcomes, one consequence of spending more time in school is the accumulation of student debt.

Examining the debt load of young Canadians is particularly important in the context of the COVID-19 pandemic, as many students lost their jobs or had a work placement cancelled or delayed as a result of the pandemic. According to recent Statistics Canada data, the employment rate fell by 23.6 percentage points among students aged 20 to 24 from February to April 2020. Moreover, over one-third (35%) of participants to an online crowdsourcing survey had a work placement cancelled or delayed due to the pandemic. This may result in some students having to accumulate more debt to compensate for the loss of income. In addition, recent graduates may experience difficulties finding full-time employment due to the economic conditions, which in turn may affect their ability to repay their student debt.

A new study, "Trends in student debt of postsecondary graduates in Canada: Results from the National Graduates Survey, 2018," uses data from the last four cycles of the NGS to examine changes in the proportion of students with debt over time, as well as the median amount of student debt at graduation. Dollar estimates are expressed in 2015 constant dollars.

One in two postsecondary graduates had student debt at graduation

Half of students who graduated in 2015 reported that they had student debt when they completed their program (50%), and this proportion varied little from 2000 to 2015. In 2015, graduates with a doctorate degree were the least likely to have student debt at graduation (36%), while most with a professional degree graduated with debt (85%).

The high prevalence of student debt among professional degree holders is related to the high costs of these programs, which include degrees in law, medicine, dentistry, veterinary medicine, optometry or pharmacy. In the 2014/2015 academic year, tuition fees for Canadian students in professional programs were the highest of all undergraduate programs in Canada.

Graduates depended largely on government-sponsored student loans (74%). The prevalence of this type of loan in 2015 varied by level of study, from 69% for college graduates and graduates with a master's degree to 86% for graduates with a professional degree. The popularity of government-sponsored student loans may be explained in part by the fact that they do not need to be repaid in the first six months after graduation and do not accumulate interest for the duration of the student's program.

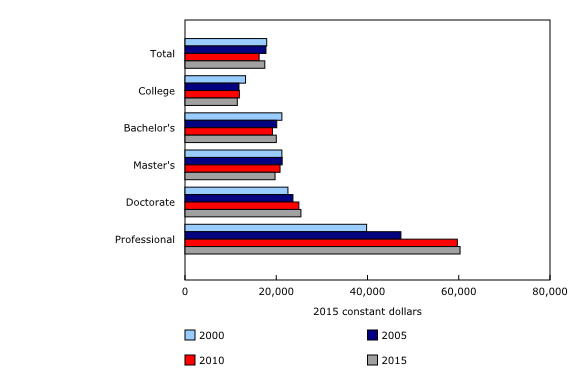

Median debt remained stable from 2000 to 2015 for most levels of study

The amount of student debt at graduation also remained stable for most graduates from 2000 to 2015 in real terms, with a median debt of $17,500 for students who graduated in 2015, compared with a debt of $17,900 for those who graduated 15 years earlier.

Student debt varied by level of study. Professional degree holders recorded the highest median debt, at $60,300 in 2015. This level of debt was three times that reported by graduates with a bachelor's degree ($20,000) or with a master's degree ($19,700). Furthermore, they experienced the greatest change in their debt load from 2000 to 2015, with their debt rising from $39,800 to $60,300 during this period. College graduates recorded the lowest median student debt ($11,500).

Student debt also varied by field of study. Graduates of health and related studies programs were the most likely to have student debt at graduation and also had the highest median amounts of student debt among bachelor's ($26,700), master's ($20,700) and professional ($69,100) degree holders. By contrast, college graduates of education programs were among the least likely to have student debt, and their median debt was the lowest ($9,200).

Approximately two-thirds of the class of 2015 had not fully repaid their debt by 2018

Approximately two-thirds of students who graduated with debt in 2015 still had outstanding debt in 2018 (64%). This proportion was similar by level of study.

A number of factors are associated with faster student debt repayment. Despite some differences by level of study, factors such as a smaller debt size at graduation, higher employment income, living in Ontario and being part of a couple with no children were generally associated with faster debt repayment. By contrast, graduating at a relatively older age, living in the Atlantic provinces or in Quebec, being a lone parent and reporting a disability were associated with slower debt repayment.

Note to readers

The 2018 National Graduates Survey (NGS) collected information on individuals who graduated from a public postsecondary institution in Canada in 2015. The questions relate to educational pathways; the financing of postsecondary studies, including government-sponsored student loans; and the transition to the labour market. The target population for this survey is the 2015 postsecondary graduates who were residing in Canada at the time the survey was conducted in 2018.

This study focuses only on college and university graduates who did not pursue further education after graduation in 2015 (i.e., up to the time the NGS was conducted in 2018).

College level: Includes college and non-university certificates and diplomas, and diplomas or certificates from general and vocational colleges (CEGEPs).

Bachelor's level: Includes bachelor's degrees and university certificates and diplomas below the bachelor's level.

Master's level: Includes master's degrees and university diplomas and certificates above the bachelor level, including masters of business administration.

Professional level: Includes bachelor's degrees and university certificates or diplomas above the bachelor's level in medicine, dentistry, veterinary medicine, optometry and pharmacy.

Products

The study "Trends in student debt of postsecondary graduates in Canada: Results from the National Graduates Survey, 2018" is now available in Insights on Canadian Society (75-006-X).

The infographic "Trends in student debt of postsecondary graduates in Canada" is now available as part of the series Statistics Canada — Infographics (11-627-M).

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: