National balance sheet and financial flow accounts, first quarter 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-06-12

National net worth falls as COVID-19 pandemic impacts Canadian economy

National net worth, the sum of national wealth and Canada's net foreign asset position, fell to $12,640.3 billion in the first quarter, down $126.9 billion from the fourth quarter of 2019. The value of equity and investment funds declined sharply, while currency and deposits recorded the largest quarterly increase on record as the household savings rate jumped and the central bank began market operations to support the economy. On a per capita basis, national net worth declined $4,207 to $332,703.

Canada's net foreign asset position decreased by $77.3 billion in the first quarter to $934.2 billion, after rising $198.1 billion in the fourth quarter of 2019. Both international assets and liabilities decreased substantially in the quarter, as equity markets fell considerably in March. The revaluation effect from fluctuations in exchange rates moderated the overall decrease in Canada's net foreign asset position, as Canadians hold a larger share of international assets in foreign currencies than international liabilities.

National wealth, the value of non-financial assets in the Canadian economy, edged down 0.4% to $11,706.0 billion in the first quarter. As energy prices tumbled, the value of natural resources dropped $185.6 billion, marking a third consecutive quarter of decline. Real estate partially offset the decline in national wealth, rising $103.5 billion in the first quarter, despite residential sales volumes being moderated in March by the implementation of COVID-19-related restrictions.

Household sector net worth falls as equity markets drop

The household sector's net worth fell by $443.4 billion to $11,293.9 billion in the first quarter. The value of financial liabilities rose $14.3 billion, while financial assets fell $532.0 billion. Equity and investment funds were the main contributor to the drop in financial assets, shrinking 15.5% to $2,450.0 billion, the lowest level since the third quarter of 2016. The decrease in equity and investment funds can mostly be attributed to downward revaluations (-$426.2 billion), as investors reacted to increased economic uncertainty. On the domestic side, the Toronto Stock Exchange (TSX) decreased 21.6% by the end of the first quarter, including a 17.7% monthly decline in March. However, the TSX showed signs of recovery after the quarter, recovering some of the lost ground in April (+10.5%). As global stock markets experienced considerable losses, Canadian investors shed a record dollar amount of foreign shares from their holdings in March and saw the value of their holdings decline significantly. On a per capita basis, household net worth fell from $309,735 to $297,266.

Currency and deposit assets increased 3.2% in the first quarter, the largest quarterly increase recorded, as households reacted to the effects of the COVID-19 pandemic. The household savings rate increased from 3.6% to 6.1% in the first quarter, mainly as a result of a record decrease in household spending (-2.1%). The household savings rate is aggregated across all income brackets; in general, savings rates are higher for higher income brackets.

The value of non-financial assets grew $102.9 billion in the first quarter, largely attributable to an increase of $77.4 billion in residential real estate, with strong price growth in January and February 2020 that carried through to the end of the quarter. Residential sales volumes, reflecting activity in the housing market, were 37.3% higher in January and February 2020 than the same period in 2019. Meanwhile, March 2020 saw a year-over-year increase of 22.0% in sales volumes relative to March 2019.

Consumer credit borrowing declines

On a seasonally adjusted basis, total credit market borrowing increased $1.9 billion to $27.6 billion in the first quarter. Demand for mortgage loans rose to $23.1 billion, up $3.8 billion. Demand for consumer credit and non-mortgage loans fell to $4.5 billion in the first quarter, down $1.9 billion from the previous quarter.

The stock of credit market debt (consumer credit, and mortgage and non-mortgage loans) totalled $2,334.4 billion at the end of the quarter. Mortgage debt was $1,532.3 billion and consumer credit and non-mortgage loans stood at $802.1 billion.

The household debt service ratio—measured as total obligated payments of principal and interest on credit market debt as a proportion of household disposable income—dropped from 14.81% to 14.67%, with total debt payments declining 0.6%. Payment deferrals related to the COVID-19 pandemic had a slight impact in the quarter, reducing the obligated principal; this is expected to continue in subsequent quarters.

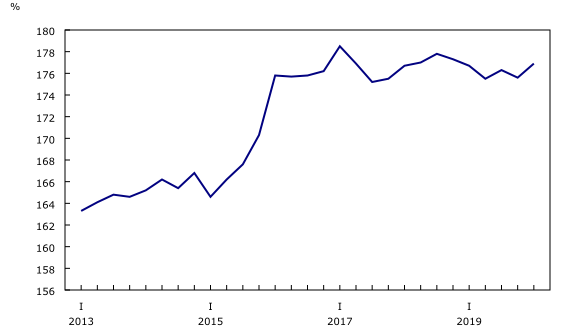

Household credit market debt as a proportion of household disposable income rose from 175.6% to 176.9%. In other words, there was $1.77 in credit market debt for every dollar of household disposable income. The credit market debt to disposable income ratio is aggregated across all income brackets; however, annual trends show that lower income quintiles tend to have a higher debt to disposable income ratio.

Government borrowing increases in response to COVID-19 pandemic

The federal government demand for credit market debt was $28.7 billion, the largest net issuance since the first quarter of 2009 and the eighth consecutive quarter where issuances outstripped retirements. Federal government borrowing was primarily in the form of issuances of short term paper (+$26.0 billion). Other levels of government (excluding social security funds) also increased borrowing in the first quarter to $17.8 billion, up $6.3 billion from the fourth quarter, mainly in the form of bond issuances.

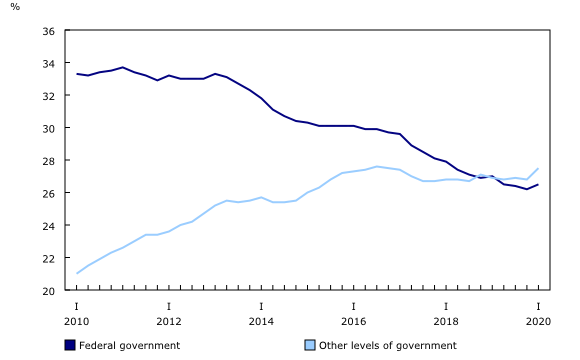

The ratio of federal government net debt (book value of total financial liabilities less total financial assets) to gross domestic product (GDP) rose to 26.5%, as federal government net debt increased and GDP was impacted by COVID-19-related shutdowns. The ratio of other government net debt (excluding social security funds) to GDP increased from 26.8% to 27.5%.

Non-mortgage borrowing by non-financial private corporations rises

The demand for funds by non-financial private corporations was $39.0 billion in the first quarter, the highest level since the first quarter of 2019. Borrowing in the form of non-mortgage loans was at the highest point on record during the first quarter of 2020 (+$49.1 billion), partially offset by net retirements of bonds (-$13.1 billion) and short-term paper (-$4.4 billion).

The debt-to-equity ratio (market value) of private non-financial corporations jumped from 188.6% to 212.3% in the first quarter, the highest level since the first quarter of 2009. Equity held by private non-financial corporations declined more than their debt holdings, as corporate bond prices fell during the quarter. However, the value of their debt denominated in foreign currencies increased due to a weak Canadian dollar.

Financial sector lending surges

The financial sector provided $171.5 billion in funds to the economy through financial market instruments in the first quarter, up from $41.3 billion in the previous quarter. First quarter financing was mainly in the form of non-mortgage loans (+$92.6 billion), which reached their highest level on record. Prior to this, the highest non-mortgage lending on record was $44.5 billion in the second quarter of 2017. Short-term paper (+$33.3 billion) and mortgage loans (+$22.8 billion) also contributed to first quarter lending, while consumer credit financing fell $6.0 billion.

The market value of financial assets edged down 0.6% to $15,574.4 billion. Increased loan assets were more than offset by $475.6 billion of downward revaluations, primarily in equity and investment funds, as markets were roiled by uncertainty.

Chartered banks increased their currency and deposit holdings by $54.6 billion as the central bank undertook market operations to support the economy and provide liquidity to financial markets. On the liability side, chartered banks and mutual funds accounted for a significant portion of the decrease in equity values among financial sectors. Equity shares in these sectors held by households contributed to the reduction in household net worth.

Measurement impacts of COVID-19

The COVID-19 pandemic has impeded Statistics Canada's measurement activities, putting unforeseen constraints on data collection and statistical operations for essential source data, which, in turn, has necessitated modifications to standard conceptual treatments and compilation methods. The most important impacts of these modifications are outlined below, along with efforts to mitigate potential effects on data quality.

Data gaps and operational constraints

Financial data on corporations: Starting with the first quarter of 2020, the Quarterly Survey of Financial Statements underwent a planned transition to a new design to better harmonize and integrate operations and update content. While survey response was not markedly impacted, unanticipated operational complexities resulted in delays for some sectors. Estimates were, therefore, based on in-progress estimates and do not fully incorporate the final results. Larger-than-usual revisions in the future may be anticipated.

Government finance statistics: Operational delays with the onset of the pandemic led to later-than-usual receipt of data files for federal and provincial governments and created new complexities associated with estimation of current quarter results for Government Financial Statistics. Auxiliary information was incorporated wherever possible. The resulting estimates are likely to have larger-than-usual revisions as new information is received and validated at a detailed level.

Specific conceptual treatments and adjustments

In Canada, as in other countries, governments imposed wide-ranging restrictions and implemented support measures in response to COVID-19, generally beginning in mid-March 2020. To produce first quarter estimates, each of these support measures was examined, and the appropriate treatment in macroeconomic statistics was determined, in accordance with international standards. Several support measures were not implemented until April and therefore did not have an impact on the first quarter estimates. Some important exceptions are highlighted below.

In order to ease the impact of the COVID-19 pandemic, governments have offered payment deferrals in a variety of forms. In government accounts, the deferred revenue will be booked as it normally would be and an accounts receivable item will be recorded. The cash position of the sector receiving the deferrals will increase for the duration of the deferrals, while that of the governments concerned will decrease, compared to the case with no such deferrals.

The Bank of Canada has introduced a number of initiatives designed to support the Canadian economy. For example, it announced the establishment of the Commercial Paper Purchase Program, aimed to alleviate strains in short-term finance markets. The effects of these initiatives, among others, will be seen in the Financial and Wealth Accounts.

Canadian banks and mortgage providers have offered mortgage deferrals to help customers manage financial hardships caused by the COVID-19 pandemic. To the extent that normal mortgage payments are deferred, principal payments by households to financial corporations will be lower than they would otherwise be before increasing when the deferral concludes. The household debt service ratio will reflect the reduced payments of principal; however, interest payments will not show the same decline as they are on an accrual basis. The lending institutions will add these amounts to the outstanding loan assets on their balance sheets.

For a comprehensive explanation of the treatment of the broad range of government support measures in response to COVID-19, see "Recording COVID-19 measures in the national accounts."

Note to readers

Revisions

This first quarter release of the national balance sheet and financial flow accounts includes revised estimates from the first quarter of 2019 to the fourth quarter of 2019. These data incorporate new and revised data, as well as updated data on seasonal trends. Additionally, as of the release for the third quarter of 2019, new financial subsector detail is available. The subsector "Other private financial institutions" was broken down into additional financial subsectors and specific financial sectors have been re-grouped. This will help align more closely with current international classifications. An overview of these changes to the sector classification and information on other conceptual, methodological, and statistics revisions is available in "An overview of revisions to the Financial and Wealth Accounts, 1990 to 2019" (13-605-X).

In the near future, data enhancements to the national balance sheet and financial flow accounts, such as the development of detailed counterparty information by sector, will be incorporated. To facilitate this initiative and others, it is necessary to extend the annual revision period (normally the previous three years) at the time of the third quarter release. Consequently, for the next two years, with the third quarter release of the financial and wealth accounts, data will be revised back to 1990 to ensure a continuous time series.

Financial and wealth accounts on a from-whom-to-whom basis: Selected financial instruments

The data visualization product "Financial accounts on a from-whom-to-whom basis, selected financial instruments" has been updated with data from the first quarter of 2019 to the first quarter of 2020.

Next release

Data on the national balance sheet and financial flow accounts for the second quarter will be released on September 11.

Overview of the Financial and Wealth Accounts

This release of the Financial and Wealth Accounts comprises the National Balance Sheet Accounts (NBSA), the Financial Flow Accounts (FFA), and the other changes in assets account.

The NBSA are composed of the balance sheets of all sectors and subsectors of the economy. The main sectors are households, non-profit institutions serving households, financial corporations, non-financial corporations, government and non-residents. The NBSA cover all national non-financial assets and all financial asset-liability claims outstanding in all sectors. To improve the interpretability of financial flows data, selected household borrowing series are available on a seasonally adjusted basis (table 38-10-0238-01). All other data are unadjusted for seasonal variation. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The FFA articulate net lending or borrowing activity by sector by measuring financial transactions in the economy. The FFA arrive at a measure of net financial investment, which is the difference between transactions in financial assets and liabilities (for example, net purchases of securities less net issuances of securities). The FFA also provide the link between financial and non-financial activity in the economy, which ties estimates of saving and non-financial capital acquisition (for example, investment in new housing) to the underlying financial transactions.

While the FFA record changes in financial assets and liabilities between opening and closing balance sheets that are associated with transactions during the accounting period, the value of assets and liabilities held by an institution can also change for other reasons. These other types of changes, referred to as other economic flows, are recorded in the other changes in assets account.

There are two main components to this account. One is the other changes in the volume of assets account. This account includes changes in non-financial and financial assets and liabilities relating to the economic appearance and disappearance of assets, the effects of external events such as wars or catastrophes on the value of assets, and changes in the classification and structure of assets. The other main component is the revaluation account, showing holding gains or losses accruing to the owners of non-financial and financial assets and liabilities during the accounting period as a result of changes in market price valuations.

At present, only the aggregate other change in assets is available within the Canadian System of Macroeconomic Accounts; no details are available on the different components.

Definitions concerning financial indicators can be found in Financial indicators from the National Balance Sheet Accounts and in the Canadian System of Macroeconomic Accounts glossary.

Products

The data visualization product "Financial accounts on a from-whom-to-whom basis, selected financial instruments," part of Statistics Canada—Data Visualization Products (71-607-X), is now available.

The data visualization product "Infrastructure Statistics Hub," which is part of Statistics Canada—Data Visualization Products (71-607-X), is now available.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

The Economic accounts statistics portal, accessible from the Subjects module of our website, features an up-to-date portrait of national and provincial economies and their structure.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: