Canadian international merchandise trade, April 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-06-04

In April, production shutdowns in a number of manufacturing industries, falling energy product prices, the closure of many retail stores, and weaker demand due to physical distancing measures related to the COVID-19 pandemic, resulted in drastic decreases in Canada's exports and imports.

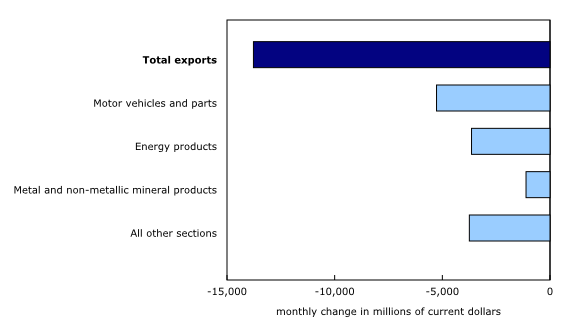

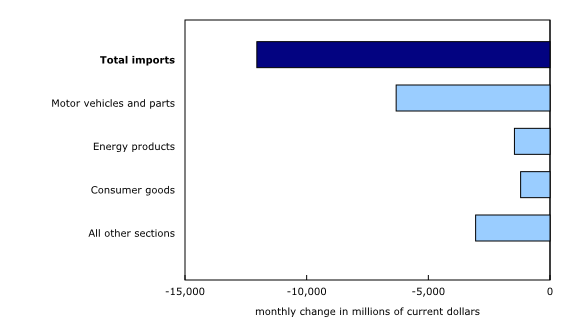

Exports fell 29.7% to $32.7 billion in April, the lowest level in more than 10 years. Imports were down 25.1% to $35.9 billion, a value not seen since February 2011. These declines, in both absolute value and percentage, are unparalleled, as monthly decreases of this magnitude have never been observed.

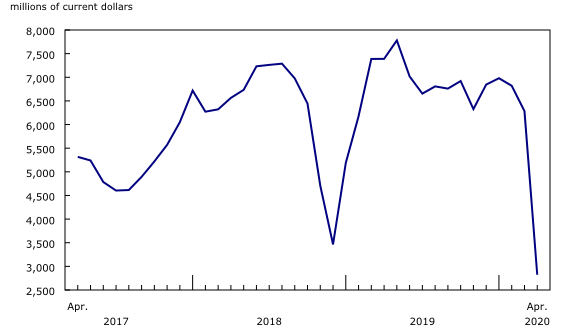

Canada's merchandise trade deficit with the world widened from $1.5 billion in March to $3.3 billion in April. Despite this increase, it is important to note that trade deficits of more than $3 billion are not uncommon, most recently occurring in February 2019 (deficit of $3.4 billion).

In real (or volume) terms, exports were down 19.9% in April and imports fell 24.8%.

Automotive sector shutdowns account for the largest decrease in exports and imports

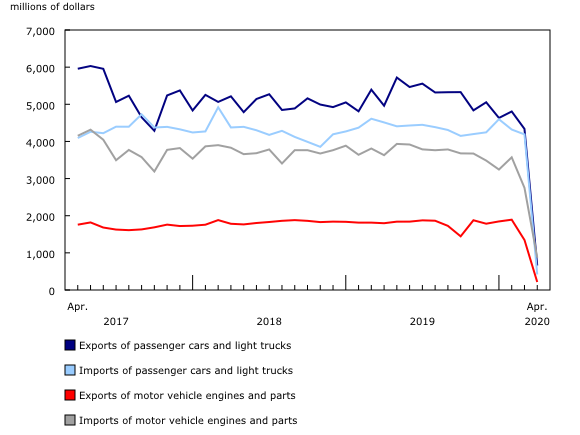

Motor vehicles and parts showed the largest decreases in both exports and imports. These declines came as total trade for these goods was already at its lowest level in nearly five years in March.

The value of exports of these products fell from $6.4 billion in March to $1.1 billion in April, the largest decline ever observed. Due to production shutdowns in all motor vehicle assembly plants in Canada, exports of passenger cars and light trucks posted the largest decrease, falling 84.8% to $659 million. In 2019, the monthly average export value for these products was $5.2 billion. Since no new vehicles were manufactured in April, the low level of exports represented vehicles from inventory as well as used vehicles.

Exports of engines and parts (-84.0%) also fell significantly in April. In addition to disruptions in the Canadian engine and parts manufacturing industry, motor vehicle production shutdowns in the United States contributed to the decrease in Canadian deliveries of engines and parts to American assembly plants in April.

Imports of motor vehicles and parts fell from $8.2 billion in March to $1.9 billion in April, another unprecedented decline. Imports of passenger cars and light trucks (-90.0%) posted the largest decrease. The widespread production shutdowns in motor vehicle manufacturing throughout the world and lower demand for new vehicles across Canada were responsible for the decline in these imports in April. Imports of engines and parts also fell sharply (-68.3%), mostly due to vehicle production shutdowns in Canada, but also to shutdowns in the production of engines and parts in the United States and Mexico.

In May, most auto assembly plants in North America gradually resumed production, which should lead to increased trade in the coming months. However, given physical distancing restrictions, complexities surrounding restarting supply chains, and low demand for new vehicles, a return to pre-COVID-19 production levels is not expected in the near term.

Trade in energy products falls sharply

Energy products were a key contributor to the April decline in exports and imports. Exports of energy products fell by $3.6 billion, the largest decrease on record. This drop was led by a sharp decline in crude oil exports, which fell 55.1%. Reduced demand for energy products in April due to confinement measures resulted in a drastic decrease in crude oil export prices, as well as lower export volumes.

Despite the recent increase in market prices, crude oil export prices are likely to remain low in May, as crude oil price fluctuations are generally observed in export data with a certain delay.

Imports of energy products fell by more than half in April, driven mostly by significant decreases in crude oil imports (-61.0%). As with exports, the drop in demand led to lower prices and volumes in April. Volumes were also down because of the partial or complete closure of a number of Canadian refineries that import crude oil. Imports of refined petroleum products (-67.3%) also fell in April on lower prices and volumes.

Trade in consumer goods declines

Because many retail stores were closed in April and the demand for consumer products fell due to lockdown measures imposed in every province, imports and exports of consumer goods also fell considerably in April. The decrease in imports of consumer goods (-11.6%) was the largest since 1988. All but 4 of the 20 product groups in this section fell, with imports of clothing, footwear and accessories (-33.6%) showing the largest decline. A number of retail stores that were closed in April gradually reopened in May.

Of the four product groups that showed increases, imports of pharmaceutical products (+9.7%) grew for a third consecutive month. Moreover, imports of carpets, textile furnishings and other textile products (+31.4%) reached a record high, driven by imports of medical face masks from China. Alcoholic beverage imports (+9.0%) also reached a record in April.

The United States contributes the most to the drop in Canada's international trade

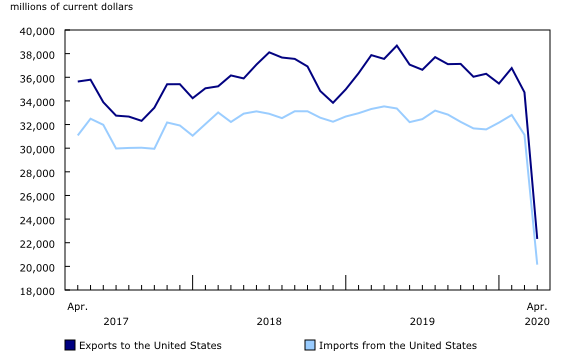

While total trade declined $25.8 billion in April, total trade with the United States fell $23.4 billion, representing more than 90% of the decrease in Canada's trade activity in April. The impact of COVID-19 on the Canadian and American auto manufacturing and energy product industries—which are heavily integrated—accounted for most of the decline observed in trade with the United States.

Exports to the United States fell 35.7%, while imports were down 35.3%. As a result, Canada's trade surplus with the United States narrowed from $3.5 billion in March to $2.2 billion in April.

When the average exchange rates of March and April are compared, the Canadian dollar lost 0.6 cents US relative to the American dollar. This follows a strong decrease in the Canadian exchange rate from February to March, which resulted in inflated export and import values in March.

Exports to countries other than the United States decreased 11.7% in April. The strongest declines were in exports to Germany, the United Kingdom and Mexico. Imports from non-US countries were down 6.3%, primarily due to lower imports of motor vehicles and parts from Mexico, Japan and Germany. Following significant declines earlier this year, imports from China (+30.8%) rebounded in April, mainly on higher imports of computers and peripherals as well as textiles (face masks).

As a result, Canada's trade deficit with countries other than the United States widened from $5.1 billion in March to $5.4 billion in April.

Revisions to March merchandise exports and imports

Imports in March, originally reported as $47.7 billion in the previous release, were revised to $48.0 billion in the current month's release. Exports in March, originally reported as $46.3 billion in the previous release, were revised to $46.4 billion.

Due to the unprecedented changes in trade activity resulting from the COVID-19 pandemic, atypical results may be observed within international merchandise trade statistics, and larger than usual revisions may be applied in future months.

Trade in medical and protective goods

The article "Trade in medical and protective goods, April 2020" was released today. Following the recent publication of trends in trade in medical and protective goods, this article provides a summary of Canada's international trade of these goods in April 2020, including an overview of imports of personal protective equipment.

Monthly trade in services

Monthly exports of services decreased 20.5% to $8.1 billion in April, while imports of services fell 30.7% to settle at $7.8 billion.

Combining international trade in goods and services, exports declined 28.0% to $40.8 billion in April, while imports were down 26.2% to $43.7 billion. As a result, Canada's trade deficit with the world for goods and services combined totalled $2.9 billion in April.

Note to readers

Merchandise trade is one component of Canada's international balance of payments (BOP), which also includes trade in services, investment income, current transfers, and capital and financial flows.

International trade data by commodity are available on both a BOP and a customs basis. International trade data by country are available on a customs basis for all countries and on a BOP basis for Canada's 27 principal trading partners (PTPs). The list of PTPs is based on their annual share of total merchandise trade—imports and exports—with Canada in 2012. BOP data are derived from customs data by making adjustments for factors such as valuation, coverage, timing and residency. These adjustments are made to conform to the concepts and definitions of the Canadian System of National Accounts.

For a conceptual analysis of BOP versus customs-based data, see "Balance of Payments trade in goods at Statistics Canada: Expanding geographic detail to 27 principal trading partners."

For more information on these and other macroeconomic concepts, see the Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) and the User Guide: Canadian System of Macroeconomic Accounts (13-606-G).

Data in this release are on a BOP basis and are seasonally adjusted. Unless otherwise stated, values are expressed in nominal terms, or current dollars. References to prices are based on aggregate Paasche (current-weighted) price indexes (2012=100). Volumes, or constant dollars, are calculated using the Laspeyres formula (2012=100).

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Revisions

In general, merchandise trade data are revised on an ongoing basis for each month of the current year. Current-year revisions are reflected in both the customs and BOP-based data.

The previous year's customs-based data are revised with the release of the January and February reference months, and thereafter on a quarterly basis. The previous two years of customs-based data are revised annually, and revisions are released in February with the December reference month.

The previous year's BOP-based data are revised with the release of data for the January, February, March and April reference months. To remain consistent with the Canadian System of Macroeconomic Accounts, revisions to BOP-based data for previous years are released annually in December with the October reference month.

Factors influencing revisions include the late receipt of import and export documentation, incorrect information on customs forms, replacement of estimates produced for the energy section with actual figures, changes in classification of merchandise based on more current information, and changes to seasonal adjustment factors.

For information on data revisions for crude oil and natural gas, see "Revisions to trade data for crude oil and natural gas."

Revised data are available in the appropriate tables.

Real-time data table

Real-time table 12-10-0120-01 will be updated on June 15.

Next release

Data on Canadian international merchandise trade for May will be released on July 2.

Products

Because of the current situation, the product "International Trade Explorer" (71-607-X) will not be updated with revised data published in the current month.

Customs-based data are now available in the Canadian International Merchandise Trade Database (65F0013X).

The updated Canada and the World Statistics Hub (13-609-X) is now available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China, Japan, Belgium, Italy, the Netherlands, and Spain.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Benoît Carrière (613-415-5305; benoit.carriere@canada.ca), International Accounts and Trade Division.

- Date modified: