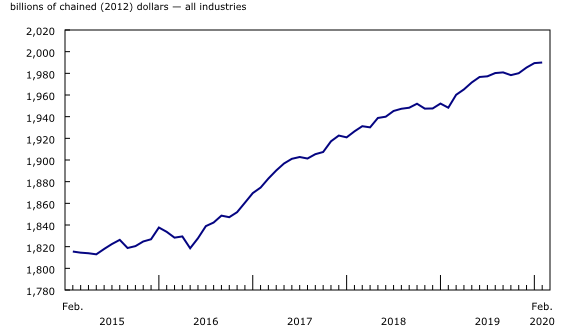

Gross domestic product by industry, February 2020

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2020-04-30

February 2020

0.0%

(monthly change)

Flash estimates for March 2020 (-9%) and the first quarter of 2020 (-2.6%) were released by Statistics Canada on April 15. The March and first quarter of 2020 estimates remain the same following this release of gross domestic product (GDP) by industry for February. The official estimates of GDP for March and the first quarter of 2020 will be released on May 29.

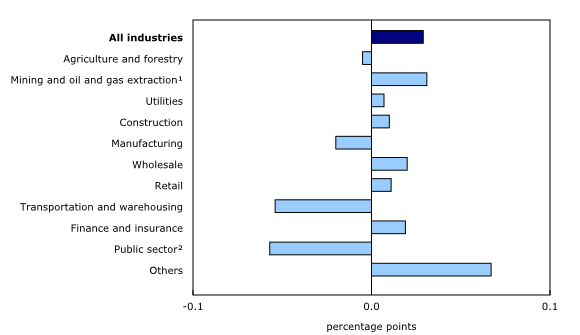

Following three months of growth, real GDP was essentially unchanged in February, as declines particularly in educational services, and disruptions in the transportation and warehousing sector stalled the economy. Excluding these two sectors, the economy would have grown 0.2%. Overall, 13 out of the 20 sectors increased in February.

Impact of the coronavirus on gross domestic product by industry

The global spread of the novel coronavirus (also known as COVID-19) continued affecting the potential growth of Canada's gross domestic product (GDP) in February through reduced movement of people, goods and services. Lower trade with China, disrupted global supply chains and advisories against non-essential international travel were indications of broader challenges to come.

Impacts in the coming months

While measures to slow the spread of the virus were being discussed, developed and introduced as advisories in February, the full disruptive effect on the Canadian economy of measures such as physical distancing, self-isolation, and closures of schools, public institutions and non-essential businesses, will be reflected in Canadian GDP figures notably in March and subsequent reference months. Preliminary indications and Nowcast, March 2020 suggest that the economic contraction in March was the largest since the series started in 1961.

Statistics Canada will continue to monitor and report on impacts of COVID-19 on Canada's GDP as information becomes available.

Goods-producing industries edged up 0.1% in February as the majority of the sectors expanded. Services-producing industries remained essentially unchanged.

Educational services down as Ontario labour unrest continues

Educational services fell 1.8% in February, the biggest decline since June 2014, as intensifying rotating strikes by Ontario elementary and secondary school teachers resulted in the notable decrease.

Transportation and warehousing down for third time in four months

The transportation and warehousing sector was down for the third time in four months, contracting 1.1% in February, as 7 of 10 subsectors declined in the month. Rail transportation declined 5.1% in February, following a 0.7% decrease in January, as 21-day rail blockades across many parts of the country and a train derailment near Saskatoon impacted the movement of people and goods.

Air transportation declined 2.6% in February, following a 2.8% decrease in January, as lower movement of both goods and passengers produced the largest back-to-back monthly pullback since 2009. Air Canada, and many other air carriers around the world, extended the cancellation of all of its flights between Canada and China and announced reduced capacity to Hong Kong.

In March, Statistics Canada's leading indicator of international arrivals to Canada by air indicated that compared with March 2019, the number of international travellers arriving in Canada by air fell 61% and the number of Canadian residents returning from abroad fell 32%. This suggests an even more pronounced decline in air transportation in March, during what would typically be a busy March break travelling season.

Water transportation was down 1.3% in February, coinciding with disruptions at several international ports as a result of new regulations related to COVID-19.

Offsetting some of the decline was a 2.3% growth in pipeline transportation as pipeline movement of natural gas, and crude oil and other transportation both increased in February.

Real estate sector grows

Activity at the offices of real estate agents and brokers rose 5.9% in February, the largest uptick since December 2017, as home resale activity increased in the majority of Canada's urban markets, led by the Greater Toronto Area.

Preliminary indications show home resale activity across the country slowed during the second half of March, as measures put in place to limit the spread of COVID-19 contributed to a double-digit drop in activity in March.

Mining, quarrying, and oil and gas extraction increases

The mining, quarrying, and oil and gas extraction sector was up 0.9% in February.

Support activities for mining, and oil and gas extraction (+4.2%) were up on account of higher drilling services. Mining and quarrying (except oil and gas) was up 0.6% in February as a 9.2% increase in non-metallic mineral mining, led by a 25.2% increase in potash mining, more than offset declines in metal ore (-1.9%) and coal mining (-6.0%).

Oil and gas extraction was essentially unchanged as a 1.6% growth in oil and gas extraction (except oil sands), led by higher natural gas extraction, was offset by a 1.4% contraction in oil sands extraction, driven by lower crude bitumen and synthetic oil production in Alberta.

Manufacturing contracts

The manufacturing sector contracted 0.2% in February following a 0.8% increase in January, as a decrease in non-durable manufacturing (-1.1%) more than offset an increase in durable manufacturing (+0.6%).

Non-durable manufacturing was down in February following two months of growth with six of nine subsectors contracting. Chemical (-3.9%) and food (-1.1%) manufacturing contributed most to the decline as rail blockades hindered receipts of raw materials and shipment of products to market.

Durable manufacturing was up for the third time in four months as growth concentrated in transportation equipment (+3.5%) and fabricated metal products (+4.8%) more than offset declines in the other subsectors.

Transportation equipment was up following two consecutive monthly contractions. Higher production at assembly plants that were affected by extended shutdowns in January contributed to notable increases in motor vehicle (+9.4%) and motor vehicle parts (+2.9%) manufacturing.

Preliminary indications of motor vehicle production in March suggest a decline in activity of approximately 33% from February in the motor vehicle manufacturing industry, which will significantly impact motor vehicle parts manufacturers as well.

Other industries

Accommodation and food services were down 0.9% in February, coinciding with expanding travel restrictions around the world.

Wholesale trade grew for the third consecutive month, increasing 0.4% as five of nine subsectors were up. The growth was led by motor vehicles and motor vehicle parts and accessories (+2.8%), food, beverage and tobacco (+1.2%) and building material and supplies (+0.8%) wholesaling.

Finance and insurance grew 0.3% as increases in banks and other non-depository intermediation (+0.4%), and insurance carriers and related activities (+0.3%) offset a decline in financial investment services, funds and other financial vehicles (-0.5%).

Professional services rose 0.3%, continuing uninterrupted growth that began in November 2017, led by increases in computer systems design and related services (+0.5%) and legal services (+0.9%).

Retail trade grew for the fourth consecutive month, edging up 0.2% in February, as 7 of the 12 subsectors rose.

Construction edged up 0.1% in February as most types of construction activity were up.

Sustainable development goals

On January 1, 2016, the world officially began implementing the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports global sustainable development goal reporting. This release will be used to help measure the following goal:

Note to readers

Monthly data on gross domestic product (GDP) by industry at basic prices are chained volume estimates with 2012 as the reference year. This means that the data for each industry and each aggregate are obtained from a chained volume index multiplied by the industry's value added in 2012. The monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUT) up to the latest SUT year (2016).

For the period starting in January 2017, data are derived by chaining a fixed-weight Laspeyres volume index to the prior period. The fixed weights are 2016 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on GDP, see the video "What is Gross Domestic Product (GDP)?"

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2019.

Each month, newly available administrative and survey data from various industries in the economy are integrated, resulting in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time table

Real-time table 36-10-0491-01 will be updated on May 11.

Next release

Data on GDP by industry for March will be released on May 29.

Products

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Ederne Victor (613-863-6876), Industry Accounts Division.

- Date modified: