Monthly Survey of Manufacturing, October 2019

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2019-12-17

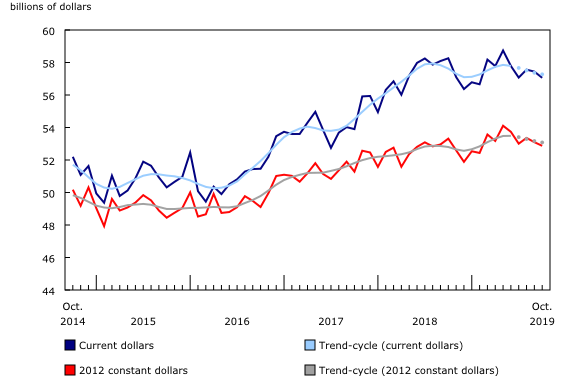

Manufacturing sales declined 0.7% to $57.1 billion in October, the second consecutive monthly decrease. Lower sales in the transportation equipment and fabricated metal product industries were partly offset by higher sales in the petroleum and coal product industry.

Sales were down in 11 of 21 industries, representing 48.8% of total manufacturing sales. Sales of durable goods fell 2.4% to $29.9 billion, while sales of non-durable goods rose 1.3% to $27.2 billion.

In volume terms, manufacturing sales decreased 0.4%.

The transportation equipment and fabricated metal product industries post the largest declines

Sales of transportation equipment were down for the second consecutive month, falling 3.1% to $11.0 billion in October. The decline was mainly attributable to lower sales in the motor vehicle assembly (-4.7%) and motor vehicle parts (-4.6%) industries. This reflected lower activity at some assembly plants as well as at several parts plants which were impacted by the United Auto Workers strike in the United States. In constant dollars, sales volumes decreased 4.9% in the motor vehicle assembly industry and were down 4.0% in the motor vehicle parts industry in October.

Sales of fabricated metal products decreased 8.2% to $3.3 billion in October. This was the third decline in thirteen months. The decreases in October were widespread across the fabricated metal industries but more pronounced in the boiler, tank and shipping container as well as the other fabricated metal product industries. Sales of fabricated metal products in constant dollars were down 8.0%.

Sales in current dollars also declined in the plastics and rubber products (-5.7%) and wood product (-3.3%) industries, reflecting lower volumes.

These decreases were partially offset by increases in the petroleum and coal product and food industries.

In the petroleum and coal product industry, sales rose 6.2% to $6.4 billion in October, following four consecutive monthly declines. Several major refineries ramped up production following shutdowns and maintenance in September. The production increase following the shutdowns was reflected in higher capacity utilization rates for the industry, which rose from 81.9% in September to 86.8% in October. In constant dollars, sales in the industry were up 5.2%.

Sales in the food industry increased 1.9% in October, following a 0.8% decline in September. The growth in this industry was mostly the result of higher sales of meat products in Alberta and Ontario. In constant dollars, volumes of food products sold rose 1.3% in October.

Ontario posts the largest decrease in October

Sales were down in three provinces in October, led by Ontario and British Columbia. New Brunswick reported the largest monthly increase.

Following two consecutive monthly gains, sales in Ontario fell 3.1% to $25.7 billion in October. The decline stemmed from lower sales in the motor vehicle (-3.9%), fabricated metal product (-11.1%), plastic and rubber products (-8.7%), primary metal (-7.0%), as well as motor vehicle parts (-4.3%) industries.

In British Columbia, sales were down 3.6% to $4.3 billion, following a 3.3% increase in September. Lower sales in the petroleum and coal product, paper and wood product industries contributed the most to the declines in October. These decreases were partly offset by gains in the primary metal, non-metallic mineral product and miscellaneous industries.

The largest monthly increase in dollar terms was in New Brunswick, where sales rose 26.5% to $2.0 billion, mostly attributable to higher sales of non-durable goods.

Manufacturing sales in Alberta increased 1.6% to $6.3 billion in October, following a 2.8% decline in September. The gain was mostly attributable to higher sales in the food (+8.9%) and chemical (+3.2%) industries.

Manufacturing sales in Toronto increase

Manufacturing sales on an unadjusted basis rose in 8 of 12 census metropolitan areas in October, led by Toronto (+5.1%) and Edmonton (+5.4%).

In Toronto, widespread gains were observed in several major industries, led by the transportation equipment and food industries.

Manufacturing sales in Edmonton were up in 15 of 21 industries, with the largest increases in the petroleum and coal product, chemical and machinery industries.

In Montréal, lower sales of transportation equipment were behind the decrease in October, reflecting declines in the aerospace product and parts industry as well as in the motor vehicle and machinery industries.

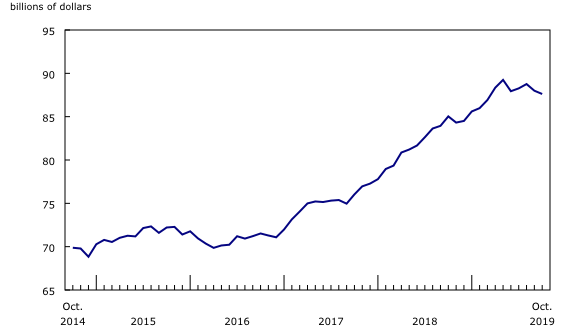

Inventory levels decrease

Inventory levels declined 0.4% to $87.6 billion in October, the second consecutive monthly decrease. Inventories were down in 10 of 21 industries, led by the paper (-4.8%), machinery (-1.9%), primary metal (-1.5%) and petroleum and coal product (-2.1%) industries. These decreases were partly offset by a 1.0% increase in transportation equipment inventories, due to higher levels of inventories of motor vehicles and motor vehicle parts.

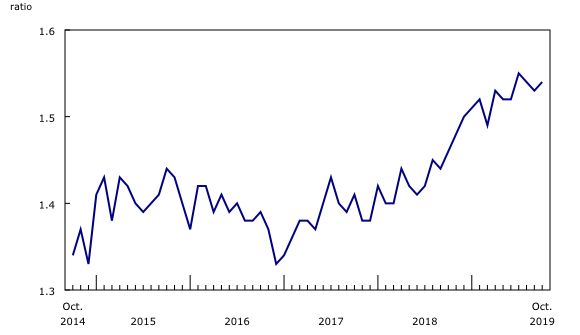

The inventory-to-sales ratio increased from 1.53 in September to 1.54 in October, due to a larger decline in manufacturing sales than in total inventories. This ratio measures the time, in months, that would be required to exhaust inventories if sales were to remain at their current level.

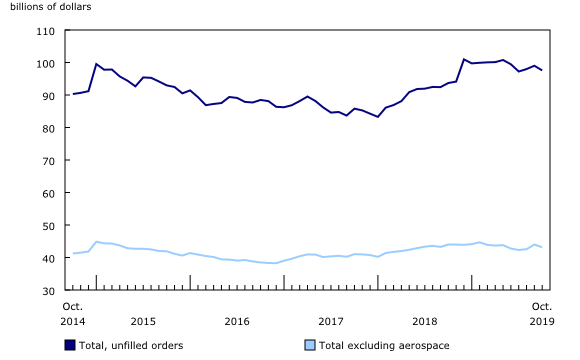

Unfilled orders decline

Estimates of unfilled orders were revised upwards, to $99.0 billion in September, reflecting new information received from respondents.

Unfilled orders fell 1.5% to $97.6 billion in October. Overall, unfilled orders were down in 16 of 21 industries, with the largest decreases in the transportation equipment industry and the fabricated metal product industry.

These declines were partially offset by an increase in unfilled orders in the furniture and related products industry.

New orders fell 4.9% to $55.6 billion in October, following two consecutive monthly gains. The decrease mostly reflected lower new orders in the transportation equipment industry and, to a lesser extent, the fabricated metal product and machinery industries.

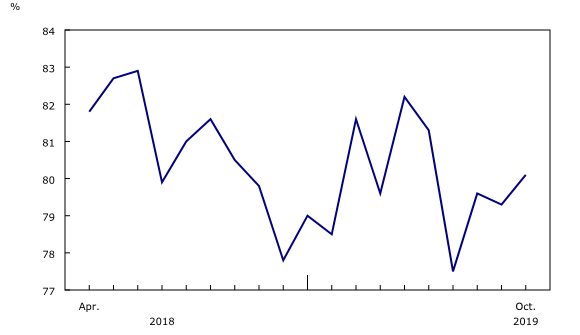

Capacity utilization rate

The unadjusted capacity utilization rate for the manufacturing sector increased 0.8 percentage points, from 79.3% in September to 80.1% in October.

Overall, the capacity utilization rate rose in 12 of 21 industries in October, led by the petroleum and coal product industry, which increased 4.9 percentage points to 86.8%. The increase was mostly attributable to higher production at several refineries, which had shut downs and maintenance during the previous months.

The capacity utilization rate for the chemical industry decreased 3.7 percentage points to 71.3% in October. The decline mostly reflected a lower capacity utilization rate in the pesticide, fertilizer and other agricultural chemical manufacturing industry.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The Monthly Survey of Manufacturing is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goal:

Note to readers

Monthly data in this release are seasonally adjusted and are expressed in current dollars unless otherwise specified.

For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions. For information on trend-cycle data, see Trend-cycle estimates – Frequently asked questions.

Non-durable goods industries include food, beverage and tobacco products, textile mills, textile product mills, clothing, leather and allied products, paper, printing and related support activities, petroleum and coal products, chemicals, and plastics and rubber products.

Durable goods industries include wood products, non-metallic mineral products, primary metals, fabricated metal products, machinery, computer and electronic products, electrical equipment, appliances and components, transportation equipment, furniture and related products, and miscellaneous manufacturing.

Production-based industries

For the aerospace and shipbuilding industries, the value of production is used instead of the value of sales of goods manufactured. The value of production is calculated by adjusting monthly sales of goods manufactured by the monthly change in inventories of goods in process and finished products manufactured. The value of production is used because of the extended period of time that it normally takes to manufacture products in these industries.

Unfilled orders are a stock of orders that will contribute to future sales assuming that the orders are not cancelled.

New orders are those received, whether sold in the current month or not. New orders are measured as the sum of sales for the current month plus the change in unfilled orders from the previous month to the current month.

Manufacturers reporting sales, inventories and unfilled orders in US dollars

Some Canadian manufacturers report sales, inventories and unfilled orders in US dollars. These data are then converted to Canadian dollars as part of the data production cycle.

For sales, based on the assumption that they occur throughout the month, the average exchange rate for the reference month established by the Bank of Canada is used for the conversion. The monthly average exchange rate is available in table 33-10-0163-01. Inventories and unfilled orders are reported at the end of the reference period. For most respondents, the daily average exchange rate on the last working day of the month is used for the conversion of these variables.

However, some manufacturers choose to report their data as of a day other than the last day of the month. In these instances, the daily average exchange rate on the day selected by the respondent is used. Note that because of exchange rate fluctuations, the daily average exchange rate on the day selected by the respondent can differ from both the exchange rate on the last working day of the month and the monthly average exchange rate. Daily average exchange rate data are available in table 33-10-0036-01.

Revision policy

Each month, the Monthly Survey of Manufacturing releases preliminary data for the reference month and revised data for the three previous months. Revisions are made to reflect new information provided by respondents and updates to administrative data.

Once a year, a revision project is undertaken to revise multiple years of data.

Real-time data tables

Real-time data tables 16-10-0118-01, 16-10-0119-01, 16-10-0014-01 and 16-10-0015-01 will be updated on December 24.

Next release

Data from the Monthly Survey of Manufacturing for November 2019 will be released on January 21, 2020.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: