Gross domestic product by industry, April 2018

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2018-06-29

April 2018

0.1%

(monthly change)

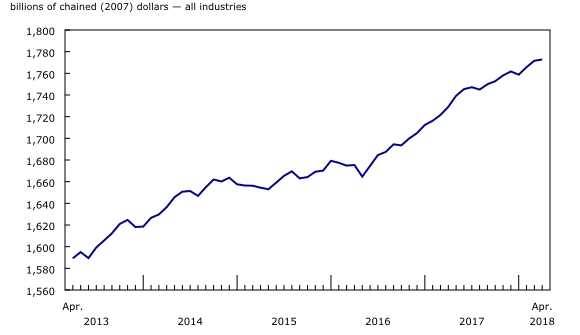

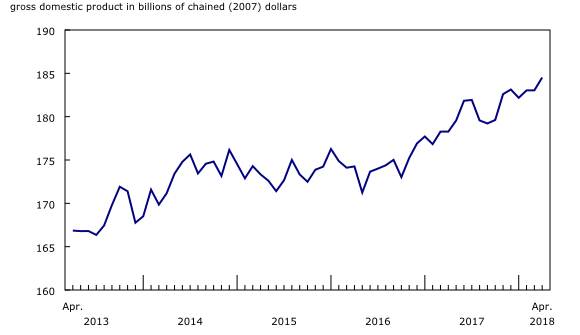

Real gross domestic product (GDP) edged up 0.1% in April as 12 of 20 industrial sectors increased. After a decline in January, GDP has risen every month since the beginning of 2018.

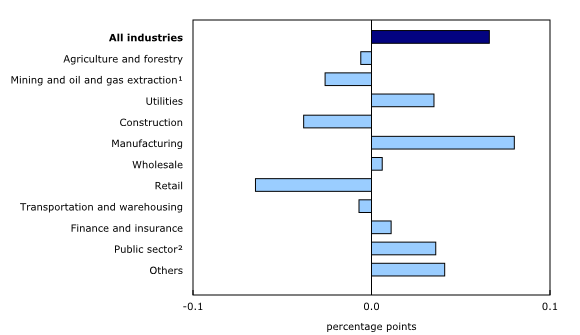

The output of goods-producing industries rose 0.2%, as gains in the manufacturing and utilities sectors more than offset declines in construction and in mining, quarrying, and oil and gas extraction.

Services-producing industries were essentially unchanged overall as a notable decline in retail trade was offset by increases in the majority of subsectors.

Manufacturing increases

Manufacturing was up 0.8% in April as the output of both durable and non-durable manufacturing grew. This reflects in part higher inventory buildup, as the real inventory-to-sales ratio was the highest since 2009.

Durable manufacturing expanded 1.0% as the majority of subsectors were up. The largest increase in terms of output was a 2.8% gain in machinery manufacturing, with increases in most of its industries. Non-metallic mineral products (+4.8%) and primary metal products (+2.7%) manufacturing grew as exports of metal and non-metallic mineral products increased in April. Transportation equipment was down 1.3% from a decline in other transportation equipment such as all-terrain vehicles.

After three months of declines, non-durable manufacturing rose 0.6%, with increases in seven of nine subsectors. Food products were up 4.0% with widespread growth across the subsector. Chemical products grew 4.9% mainly on the strength of an 8.9% increase in pharmaceutical and medicine manufacturing as exports to the United States increased. Petroleum and coal products fell 18.6% as partial shutdowns at a number of refineries across the country for maintenance work reduced the subsector's production capacity.

Weather conditions a factor in many industries

Even though spring officially started on March 20, the first full month—the month of April—was anything but spring-like, as colder-than-normal temperatures across the country, coupled with an ice storm across Central and Eastern Canada, impacted several industries.

Utilities grew 1.6%, as electric power generation, transmission and distribution (+1.9%) and natural gas distribution (+0.6%) responded to an increased demand for heating, due to colder than usual temperatures.

Following two consecutive monthly increases, retail trade was down 1.3% in April. Colder-than-normal temperatures were a factor in the declines of store types associated with springtime activities such as general merchandise stores (-2.7%), clothing and clothing accessories stores (-2.6%) and building material and garden equipment and supplies dealers (-2.8%). Activity was down 3.7% at motor vehicle and parts dealers, more than offsetting March's increase.

Construction was down 0.5% in April, the largest decline since the strike-influenced decrease in May 2017. Residential building construction was down 1.0% from decreased activity in the construction of most types of structures. Repair construction (-0.7%) and engineering and other construction (-0.2%) also declined. Non-residential construction was up for a sixth consecutive month, increasing 0.3%, its slowest monthly growth during that period.

Weather conditions may have played a role in the 0.9% decline in food services and drinking places, the largest monthly decline since December 2013. Activity in this subsector has been muted since the fourth quarter of 2017.

Offices of real estate agents and brokers up for the first time in 2018

The real estate and rental and leasing sector was up 0.3% in April. Following three consecutive monthly declines, the output of offices of real estate agents and brokers was up 0.5%, as the industry was impacted by new mortgage lending rules that came into effect in January 2018.

Wholesale trade edges up

Wholesale trade edged up 0.1% in April, following a 0.8% increase in March.

There were notable increases in machinery, equipment and supplies (+1.4%), food, beverage and tobacco (+1.5%) and personal and household goods (+0.7%) wholesaling. Petroleum product wholesalers increased 4.0%, as sales activity continued despite the domestic manufacturing production slowdown, with imports of petroleum products up significantly in April.

In contrast, motor vehicle and parts (-4.0%) and building material and supplies (-1.8%) wholesalers both registered notable declines in activity.

Mining, quarrying, and oil and gas extraction declines in April

Following two consecutive monthly increases, mining, quarrying, and oil and gas extraction decreased 0.3% in April.

Mining excluding oil and gas extraction was down 9.1% in April, as a labour disruption in iron ore mining (-46.6%) significantly impacted production. Non-metallic mineral mining was down 6.6%, as a result of a notable slowdown in potash production (-18.2%).

Oil and gas extraction was up 0.6% in April, a third consecutive monthly increase. Conventional oil and gas extraction was up 1.3%, mainly from increased crude petroleum production. Non-conventional oil extraction edged down 0.1%, as maintenance activities held back production in April.

Support activities for mining and oil and gas extraction rose 7.7% in April as a result of an increase in both drilling and rigging services.

Other industries

The public sector grew 0.2%, due to increases in health care and social assistance (+0.3%) and educational services (+0.2%).

Professional services increased 0.4%, with increases in legal services (+1.0%) as well as architectural, engineering and related services (+1.0%).

Finance and insurance increased 0.2% in April. Depository credit intermediation was up 0.3%, while financial investment services (+0.1%) as well as insurance carriers and related activities (+0.1%) both edged up.

Transportation and warehousing services edged down 0.2% in April. Rail transportation declined 2.3% from lower carloadings of manufactured products, and grain and fertilizer. Pipeline transportation was down 0.5% from lower transportation of natural gas. Air transportation was up 0.8%, while trucking transportation edged up 0.1%.

Sustainable Development Goals

On January 1, 2016, the world officially began implementation of the 2030 Agenda for Sustainable Development—the United Nations' transformative plan of action that addresses urgent global challenges over the next 15 years. The plan is based on 17 specific sustainable development goals.

The release on gross domestic product by industry is an example of how Statistics Canada supports the reporting on the Global Goals for Sustainable Development. This release will be used in helping to measure the following goal:

Note to readers

Monthly gross domestic product (GDP) by industry data at basic prices are chained volume estimates with 2007 as the reference year. This means that data for each industry and each aggregate are obtained from a chained volume index, multiplied by the industry's value added in 2007. Monthly data are benchmarked to annually chained Fisher volume indexes of GDP obtained from the constant-price supply and use tables (SUT) up to the latest SUT year (2014).

For the period starting with January 2015, data are derived by chaining a fixed-weight Laspeyres volume index to the prior period. The fixed weights are 2014 industry prices.

This approach makes the monthly GDP by industry data more comparable with expenditure-based GDP data, which are chained quarterly.

All data in this release are seasonally adjusted. For information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

For more information on GDP, see the video What is Gross Domestic Product (GDP)?

Revisions

With this release of monthly GDP by industry, revisions have been made back to January 2017.

Each month, newly available administrative and survey data from various industries in the economy are integrated and result in statistical revisions. Updated and revised administrative data (including taxation statistics), new information provided by respondents to industry surveys, and standard changes to seasonal adjustment calculations are incorporated with each release.

Real-time table

Real-time table 36-10-0491 will be updated on July 16.

Next release

Data on GDP by industry for May will be released on July 31.

Products

For more information about monthly national gross domestic product by industry, see the System of Macroeconomic Accounts module on our website.

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is also available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is also available.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Ederne Victor (613-863-6876), Industry Accounts Division.

- Date modified: