Consumer Price Index, September 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-10-20

September 2017

1.6%

(12-month change)

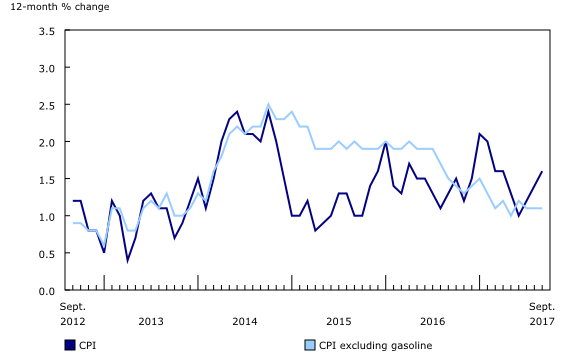

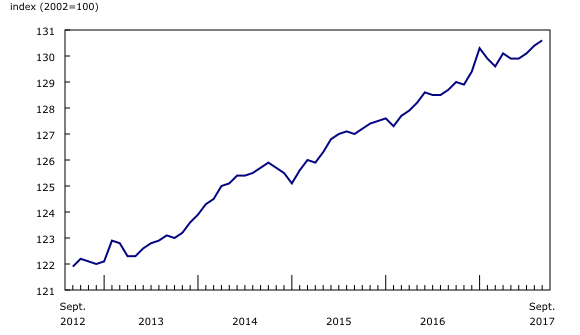

The Consumer Price Index (CPI) rose 1.6% on a year-over-year basis in September, following a 1.4% gain in August. The all-items CPI excluding gasoline rose 1.1% year over year in September, matching the gain in both July and August.

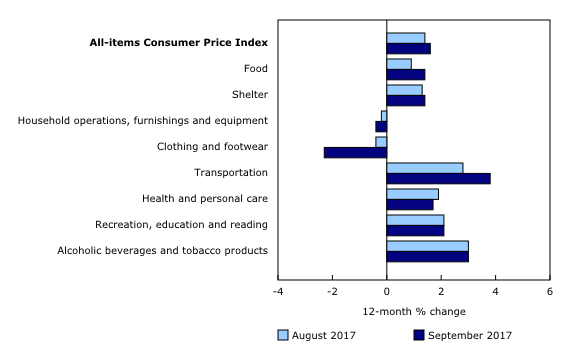

12-month change in the major components

Prices were up in six of the eight major CPI components in the 12 months to September, with the transportation and shelter indexes contributing the most to the year-over-year rise. The clothing and footwear index and the household operations, furnishings and equipment index both declined on a year-over-year basis.

Transportation costs rose 3.8% on a year-over-year basis in September, following a 2.8% increase in August. For a third consecutive month, gasoline prices were the largest contributor to the gain in transportation prices and also to their acceleration. The gasoline index rose 14.1% in the 12 months to September, largely due to supply disruptions caused by Hurricane Harvey. The purchase of passenger vehicles index accelerated 1.0% year over year in September, up from a 0.7% increase in August.

Consumer prices for food were up 1.4% on a year-over-year basis in September, after increasing 0.9% in August. Prices for food purchased from stores grew 0.9% year over year in September, largely due to the price declines reported in September 2016 not counting as part of the current 12-month movement. Prices for food purchased from restaurants rose 2.7% in September, up slightly from a 2.6% year-over-year gain in August.

Recreation, education and reading costs rose 2.1% on a year-over-year basis in September, matching the increase in August. Tuition fees grew 3.0% in the 12-month period ending in September.

In September, the household operations, furnishings and equipment index (-0.4%) declined on a year-over-year basis for the third consecutive month. The telephone services index contributed the most to this continued decline, down 3.1% in the 12 months to September. Consumers also paid 3.3% less for furniture in September compared with the same month a year earlier.

The clothing and footwear index declined 2.3% on a year-over-year basis in September. Prices for women's clothing contributed the most to the decrease in this major component, falling 4.6% in September, following a 1.9% decline in August. Men's clothing prices also posted a year-over-year decrease, falling 2.7%. In contrast, prices for clothing material and notions rose 3.5% in the 12 months to September.

12-month change in the provinces

Consumer prices rose more on a year-over-year basis in September than they did in August in seven provinces, while two provinces registered decelerations.

The CPI in Manitoba increased 1.5% on a year-over-year basis in September, after rising 0.9% in August. Consumers paid 3.4% more in the 12 months to September for food purchased from stores, which was a larger increase than in any other province. The fresh vegetables index (+11.7%) contributed the most to this rise in prices. Among the provinces, prices for household equipment fell the most year over year in Manitoba during September.

In British Columbia, the CPI gained 2.0% year over year, matching the increase in August. The homeowners' replacement cost index (+7.1%) contributed the most to the rise in the CPI in this province, and also matched the gain in August. The gasoline index (+8.9%) decelerated on a year-over-year basis compared with August. British Columbia was the only province to register a deceleration in this index.

Consumer prices in New Brunswick rose 1.7% year over year in September, following a 1.8% increase in August. The telephone services index fell 2.5% in the 12-month period ending in September, which contributed the most to the decline in prices in this province. The traveller accommodation index decreased by 4.5% on a year-over-year basis in September, following a 15.0% increase in August. In contrast, consumers paid more for recreational vehicles and outboard motors in September compared with the same month a year earlier.

Seasonally adjusted monthly Consumer Price Index

On a seasonally adjusted monthly basis, the CPI increased 0.2% in September, matching the gain in August.

In September, five major components increased on a seasonally adjusted monthly basis, while three decreased.

On a seasonally adjusted monthly basis in September, the transportation index (+1.1%) posted the largest gain, while the clothing and footwear index (-1.0%) posted the largest decline.

In celebration of the country's 150th birthday, Statistics Canada is presenting snapshots from our rich statistical history.

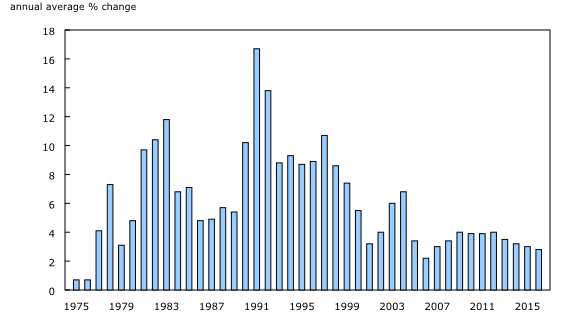

Canada's tuition fees price index, first published in 1973, tracks changes in tuition prices for publicly-funded universities and colleges. When the index was first published in the 1970s, public postsecondary education was heavily subsidized by the federal and provincial governments, which began directly funding universities in the period following the Second World War. Consequently, tuition fees paid by students remained low and annual increases to the index averaged about 3.2%.

Throughout the 1980s, federal transfer payments to fund postsecondary education gradually decreased, while at the same time university enrollment increased in response to a growing demand for higher education. Consumer prices for tuition rose steadily during this time, with the index increasing by an average of 7.1% each year.

The cost of tuition continued to rise, climbing at an average annual rate of 10.3% from 1990 to 1999. In response, provincial governments throughout the country implemented tuition caps or freezes to limit further increases.

Since 2000, growth in the tuition fees index has taken on a more moderate pace, with an average annual increase of 3.9%, and year-over-year decreases in tuition prices have been observed in six provinces.

Note to readers

A seasonally adjusted series is one from which seasonal movements have been eliminated. Users employing Consumer Price Index (CPI) data for indexation purposes are advised to use the unadjusted indexes. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Upcoming methodological change: New approach for estimating the Mortgage Interest Cost Index

The CPI measures the change in prices of consumer goods and services over time. To accurately reflect trends in the market and in consumer behaviour, Statistics Canada periodically reviews and updates the methods applied to various components of the CPI.

The release of the October 2017 CPI (to be published on November 17, 2017) will mark the implementation of new data sources and methodological changes for the calculation of the Mortgage Interest Cost Index (MICI).

The MICI represents 3.41% of the 2015 CPI basket at link month (December 2016) prices and is part of Shelter, one of the major CPI components.

This new approach will use administrative data to replace survey data, which will reduce survey response burden while better reflecting the Canadian residential mortgage market, and will allow for a simplified estimation process.

Detailed documentation describing the new MICI approach will be available with the October 2017 CPI release on November 17, 2017.

Upcoming changes to table entitled "Inter-city indexes of price differentials of consumer goods and services": Addition of a new geographic stratum

Data on inter-city indexes of price differentials of consumer goods and services will be updated to October 2016 with the release of the October 2017 CPI (to be published on November 17, 2017). As well, the geographic stratum "Calgary, Alberta" will be introduced in the table, reflecting data for the all-items index and its eight major components.

Real-time CANSIM tables

Real-time CANSIM table 326-8023 will be updated on November 6. For more information, consult the document Real-time CANSIM tables.

Next release

The CPI for October will be released on November 17.

Products

The September 2017 issue of The Consumer Price Index, Vol. 96, no. 9 (62-001-X) is now available.

More information about the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: