Consumer Price Index, June 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-07-21

June 2017

1.0%

(12-month change)

The Consumer Price Index (CPI) rose 1.0% on a year-over-year basis in June, following a 1.3% gain in May.

Energy prices decreased in the 12 months to June, after increasing in May. At the same time, prices for food rose year over year in June, following a small decline in May.

Excluding food and energy, the CPI was up 1.4% on a year-over-year basis in June, matching the gain in May.

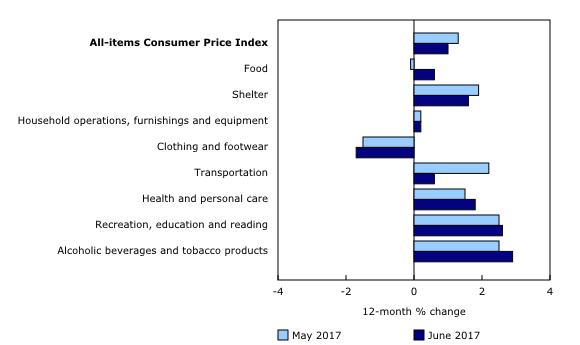

12-month change in the major components

Prices were up in seven of the eight major components in the 12 months to June, with the shelter index and the recreation, education and reading index contributing the most to the year-over-year rise in the CPI. The clothing and footwear index declined on a year-over-year basis.

Transportation costs rose 0.6% on a year-over-year basis in June, following a 2.2% gain in May. This deceleration was led by gasoline prices, which fell 1.4% in the 12 months to June, after increasing 6.8% in May. The purchase of passenger vehicles index declined for the first time since February 2015, down 0.2% year over year in June. Meanwhile, passenger vehicle insurance premiums rose 2.1% in the 12 months to June, following a 1.4% increase in May.

The shelter index increased 1.6% year over year in June, after rising 1.9% in May. Homeowners' replacement costs, which rose 4.1% on a year-over-year basis in June, contributed the most to this price increase. At the same time, prices for natural gas (+10.0%) and fuel oil (+7.8%) increased at a slower rate in the 12 months to June, than they did in May, contributing the most to the deceleration in the shelter index. On a year-over-year basis, growth in the rent index (+0.7%) rose to a rate not recorded since May 2016, while there was no change in mortgage interest cost for the third month in a row, following 31 months of declines.

Household operations, furnishings and equipment costs rose 0.2% on a year-over-year basis in June, matching the increase in May. The telephone services index was up 2.0% in the 12 months to June, following a 1.1% rise in May. At the same time, prices for household appliances declined 3.3% in June, after falling 2.1% in May.

The food index rose 0.6% in the 12 months to June, after posting declines for eight consecutive months. Prices for food purchased from stores decreased 0.3% on a year-over-year basis, after dropping 1.2% in May. Year-over-year declines in the meat and bakery products indexes moderated, while the fresh vegetables index increased at a faster pace in June than in May. On a year-over-year basis, prices for cereal products fell 3.7% in June, following a 2.7% decline in May. Prices for food purchased from restaurants registered a 2.5% gain in the 12 months to June.

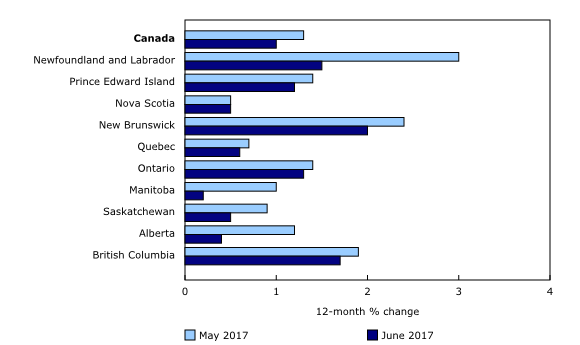

12-month change in the provinces

Consumer prices rose less on a year-over-year basis in nine provinces in June than they did in May. The 12-month increase in the CPI in Nova Scotia was unchanged from a month earlier.

In Newfoundland and Labrador, the CPI increased 1.5% on a year-over-year basis in June, after rising 3.0% in May. The gasoline index, which led this deceleration, declined 8.7% year over year in June, following a 22.9% increase in May. A reduction in the province's gasoline tax contributed to this decline. In contrast to the movement at the national level, prices for fresh vegetables (-7.4%) fell in the 12 months to June. The traveller accommodation index in Newfoundland and Labrador grew 3.1% year over year in June, after declining 5.1% the previous month.

The CPI in Ontario was up 1.3% in the 12 months to June, following a 1.4% gain in May. Homeowners' replacement costs contributed the most to this growth, up 6.9% year over year in June, following a 7.9% increase in May. Traveller accommodation prices increased at a faster rate in June (+10.1%) than in May (+5.9%). Prices for women's clothing declined 4.8% in the 12-month period ending in June.

In Alberta, the CPI increased 0.4% year over year in June, following a 1.2% gain in May. The natural gas index rose 14.2% on a year-over-year basis in June, after increasing 35.5% in May. Contrary to the movement at the national level, passenger vehicle insurance premiums (-1.4%) in Alberta fell in the 12-month period ending in June. Among the provinces, growth in women's clothing prices accelerated the most in Alberta.

Seasonally adjusted monthly Consumer Price Index

On a seasonally adjusted monthly basis, the CPI was unchanged in June, after declining 0.2% in May.

In June, the clothing and footwear index was unchanged on a seasonally adjusted monthly basis. At the same time, six major components increased, with the food index (+0.4%) and the alcoholic beverages and tobacco products index (+0.4%) recording the largest gains. The transportation index declined 0.5%.

In celebration of the country's 150th birthday, Statistics Canada is presenting snapshots from our rich statistical history.

Statistics Canada's purchase of passenger vehicles index, which tracks average changes in the prices of vehicles, was first published in 1949. At that time, the Dodge Coronet and the Oldsmobile 88 were making their debuts on the market.

In the nearly 70 years since the inauguration of that index, the average cost of a vehicle has almost quintupled. Interestingly, much of the increase occurred before the mid-1990s. From June 1997 to June 2007, the price of vehicles rose by only 2%.

However, from 2007 to 2009, automobile prices actually fell in the context of the global economic downturn. Manufacturers lowered prices and offered bigger discounts in the face of lower demand. On average, automobile prices fell by almost 7% year over year during the Great Recession, with the biggest drop (-9.4%) occurring in September 2008.

Since 2010, the index has been trending upward by 1.9% year over year, on average, and by the spring of 2016, had finally recovered to its pre-recession level. The latter stage of this growth, from mid-2015 to mid-2016, followed a strong depreciation in the Canadian dollar relative to the US dollar.

Note to readers

A new article, Inflation in Atlantic Canada fuelled more by oil-linked products, is available in Analysis in Brief (11-621-M).

A seasonally adjusted series is one from which seasonal movements have been eliminated. Users employing CPI data for indexation purposes are advised to use the unadjusted indexes. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

The special aggregate "energy" comprises electricity, natural gas, fuel oil and other fuels, gasoline, and fuel, parts and accessories for recreational vehicles.

Real-time CANSIM tables

Real-time CANSIM table 326-8023 will be updated on August 8. For more information, consult the document Real-time CANSIM tables.

Next release

The CPI for July will be released on August 18.

Products

The June 2017 issue of The Consumer Price Index, Vol. 96, no. 6 (62-001-X) is now available.

More information about the concepts and use of the Consumer Price Index (CPI) is available in The Canadian Consumer Price Index Reference Paper (62-553-X).

For information on the history of the CPI in Canada, consult the publication Exploring the First Century of Canada's Consumer Price Index (62-604-X).

Two videos, "An Overview of Canada's Consumer Price Index (CPI)" and "The Consumer Price Index and Your Experience of Price Change," are available on Statistics Canada's YouTube channel.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca) or Media Relations (613-951-4636; STATCAN.mediahotline-ligneinfomedias.STATCAN@canada.ca).

- Date modified: