Labour Force Survey, June 2017

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

Released: 2017-07-07

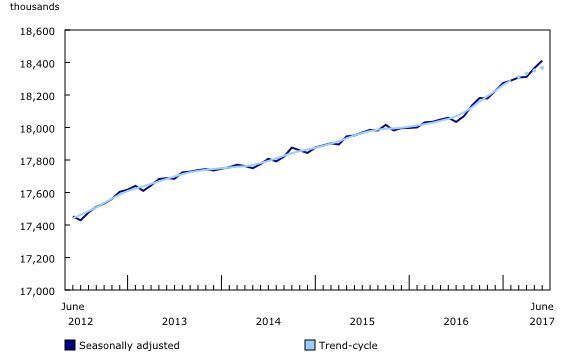

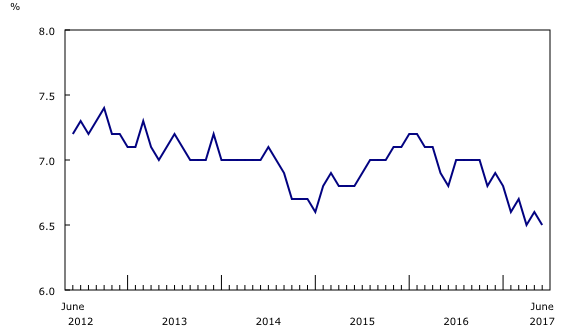

Employment rose by 45,000 in June, mostly in part-time work. The unemployment rate was 6.5%, down 0.1 percentage points from the previous month.

Compared with 12 months earlier, there were 351,000 (+1.9%) more people employed. Most of the growth was in full-time work (+248,000 or +1.7%), while part-time employment was also up (+103,000 or +3.0%). The total number of hours worked increased 1.4% over this period.

In the second quarter of 2017, overall employment grew by 103,000 (+0.6%), the fourth consecutive quarter of strong employment growth and the largest quarterly increase since 2010. In the first half of 2017, employment grew by 186,000 (+1.0%), compared with 64,000 (+0.4%) over the first half of 2016.

Highlights

In June, employment rose among women aged 55 and older and edged up among core-aged women, while it was little changed for the other demographic groups.

Employment increased in Quebec and British Columbia.

More people were employed in professional, scientific and technical services, as well as in agriculture. At the same time, employment declined in business, building and other support services.

Continued gains for older workers

In June, employment gains were led by people aged 55 and older, with an increase of 31,000, mostly among women. The unemployment rate for people aged 55 and older was little changed at 5.8%. On a year-over-year basis, employment for this group rose by 133,000 (+3.6%), reflecting a longer term trend related to population aging.

People between the ages of 55 and 64 accounted for about 8 out of 10 workers aged 55 and older. Their estimated year-over-year employment growth rate (unadjusted for seasonality) was 2.5%, relatively in line with their population increase (+2.1%). In comparison, people aged 65 and older comprised a smaller share of older workers, but had the fastest year-over-year employment growth rate among the major demographic groups, rising 6.9% and outpacing their rate of population growth (+3.7%). For more information about recent trends among older workers, see "The impact of aging on labour market participation rates".

Core-age employment edges up for women, holds steady for men

Employment for women aged 25 to 54 edged up by 17,000 in June. Their unemployment rate remained the lowest among the major demographic groups at 5.2%. The employment rate, which is the employment-to-population ratio, has been trending upward for this group, rising 1.0 percentage points to 78.8% compared with 12 months earlier. Employment gains over this period totalled 86,000 (+1.5%).

Among men aged 25 to 54, employment held steady in June, and the unemployment rate was little changed at 5.7%. Compared with 12 months earlier, their unemployment rate fell 0.4 percentage points. Over the same period, employment among men in this age group rose by 89,000 (+1.4%), while their employment rate increased 1.0 percentage points to 86.0%.

Youth employment virtually unchanged

Following an increase in May, there was virtually no change in the number of employed youth in June. Their unemployment rate remained at 12.0%, but was down from 13.0% in June 2016. On a year-over-year basis, employment for this group was up 43,000 or 1.8%, while their population decreased 0.8%.

Summer employment for students

From May to August, the Labour Force Survey collects labour market data on youths aged 15 to 24 who were attending school full time in March and who intend to return to school full time in the fall. The June survey results provide an early indication of the summer job market, especially for students aged 20 to 24, as many younger students are still in school. Published data are not seasonally adjusted, therefore comparisons can only be made with data for the same month in previous years.

Compared with June 2016, employment among students aged 20 to 24 was virtually unchanged, while the employment rate rose 2.6 percentage points to 66.6%. Over the same period, the unemployment rate for this group of students was little changed at 9.4%.

Quebec and British Columbia lead employment gains

There were 28,000 more employed people in Quebec in June, and the unemployment rate remained at a record low of 6.0%. Employment in the province increased notably on a year-over-year basis, up 122,000 (+3.0%).

In British Columbia, employment rose by 20,000 and the unemployment rate declined 0.5 percentage points to 5.1%. On a year-over-year basis, employment grew by 104,000 (+4.4%). Employment in the province has been on a strong upward trend since the spring of 2015.

Employment in Alberta held steady in June, and the unemployment rate fell 0.4 percentage points to 7.4%. Compared with June 2016, employment in the province rose by 49,000 (+2.2%), virtually all in full-time work.

In Ontario, there was little change in the number of people working, and the unemployment rate was also little changed at 6.4%. On a year-over-year basis, employment in the province grew by 75,000 (+1.1%). Employment in the province was virtually unchanged in the first half of 2017, following an upward trend in the second half of 2016.

Quarterly update for the territories

The Labour Force Survey collects labour market data in the territories, produced in the form of three-month moving averages.

In the second quarter of 2017, employment in Yukon was down by 500 compared with the first quarter. At the same time, the unemployment rate was little changed at 4.1%.

In the Northwest Territories, employment in the second quarter was little changed from the previous quarter. Over the same period, the unemployment rate edged down 0.8 percentage points to 6.2%.

Employment in Nunavut rose by 500 in the second quarter, while the unemployment rate was 16.3%.

Largest increase in professional, scientific and technical services

In June, there were 27,000 more people working in professional, scientific and technical services. Employment in this industry rose by 66,000 (+4.7%) compared with 12 months earlier, making it the fastest-growing industry over this period. Most of the increase was in computer system design services.

Employment in agriculture increased by 12,000 in June. Employment in this industry was at virtually the same level as it was 12 months earlier.

There were 15,000 fewer people working in business, building and other support services in June, bringing year-over-year losses to 23,000 (-3.0%). This industry is broad and includes administrative and cleaning services to businesses and buildings, as well as employment services.

In June, the number of employees was little changed in both the private and public sectors. Compared with 12 months earlier, the number of private sector employees increased by 227,000 (+1.9%), while the number of public sector employees increased by 105,000 (+2.9%).

Self-employment edged up in June (+21,000), but was little changed on a year-over-year basis.

In celebration of the country's 150th birthday, Statistics Canada is presenting snapshots from our rich statistical history.

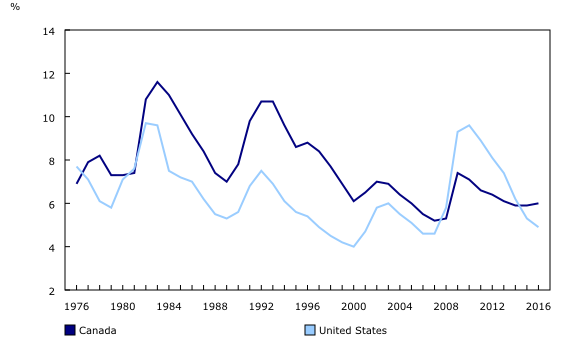

Evolution of labour market trends in Canada and the United States

The economies of Canada and the United States are closely linked and have a number of similarities. However, there have been notable differences in the labour markets of the two countries over the past 40 years.

Comparable data for the two countries have been available since 1976. Since then, changes in the unemployment rate (adjusted for the population aged 16 and older, and with passive job searchers removed from the definition of unemployment) have been notable for two reasons. First, the unemployment rate in the two countries has risen and fallen in almost the same pattern, reflecting the integration of the business cycles of the two economies. Second, the unemployment rate in Canada has been consistently higher than the unemployment rate in the United States.

A notable exception to these patterns occurred during the period from 2008 to 2015, when the unemployment rate was higher in the United States than in Canada, reflecting the depth of the financial crisis and subsequent recession in the United States. From 2007 to 2010, the US unemployment rate more than doubled (from 4.6% to 9.6%), while in Canada the increase was less dramatic (from 5.2% in 2007 to a peak of 7.4% in 2009). By 2016, the unemployment rate was 4.9% in the United States, compared with 6.0% in Canada (adjusted to US concepts).

Sources: CANSIM table 282-0086, U.S. Bureau of Labour Statistics, and "The Labour Market in Canada and the United States since the Last Recession." Economic Insights (11-626-X).

Note to readers

The Labour Force Survey (LFS) estimates for June are for the week of June 11 to 17.

The LFS estimates are based on a sample and are therefore subject to sampling variability. As a result, monthly estimates will show more variability than trends observed over longer time periods. For more information, see "Interpreting Monthly Changes in Employment from the Labour Force Survey." Estimates for smaller geographic areas or industries also have more variability. For an explanation of the sampling variability of estimates and how to use standard errors to assess this variability, consult the "Data quality" section of the publication Labour Force Information (71-001-X).

This analysis focuses on differences between estimates that are statistically significant at the 68% confidence level.

The LFS estimates are the first in a series of labour market indicators released by Statistics Canada, which includes indicators from programs such as the Survey of Employment, Payrolls and Hours (SEPH), Employment Insurance Statistics, and the Job Vacancy and Wage Survey. For more information on the conceptual differences between employment measures from the LFS and SEPH, refer to section 8 of the Guide to the Labour Force Survey (71-543-G).

The employment rate is the number of employed people as a percentage of the population aged 15 and older. The rate for a particular group (for example, youths aged 15 to 24) is the number employed in that group as a percentage of the population for that group.

The unemployment rate is the number of unemployed people as a percentage of the labour force (employed and unemployed).

The participation rate is the number of employed and unemployed people as a percentage of the population.

Full-time employment consists of persons who usually work 30 hours or more per week at their main or only job.

Part-time employment consists of persons who usually work less than 30 hours per week at their main or only job.

Seasonal adjustment

Unless otherwise stated, this release presents seasonally adjusted estimates, which facilitate comparisons by removing the effects of seasonal variations. For more information on seasonal adjustment, see Seasonally adjusted data – Frequently asked questions.

Chart 1 shows trend-cycle data on employment. These data represent a smoothed version of the seasonally adjusted time series, which provides information on longer-term movements, including changes in direction underlying the series. These data are available in CANSIM table 282-0087 for the national level employment series. For more information, see the StatCan Blog and Trend-cycle estimates – Frequently asked questions.

Next release

The next release of the LFS will be on August 4.

Products

A more detailed summary, Labour Force Information (71-001-X), is now available for the week ending June 17.

More information about the concepts and use of the Labour Force Survey is available online in the Guide to the Labour Force Survey (71-543-G).

The updated Labour Market Indicators dashboard (71-607-X) is now available. This new, interactive dashboard provides easy, customizable access to key labour market indicators. Users can now configure an interactive map and chart showing labour force characteristics at the national, provincial or census metropolitan area level.

Contact information

For more information, contact us (toll-free 1-800-263-1136; 514-283-8300; STATCAN.infostats-infostats.STATCAN@canada.ca).

To enquire about the concepts, methods or data quality of this release, contact Andrew Fields (613-951-3551; andrew.fields@canada.ca), Vincent Ferrao (613-951-4750); vincent.ferrao@canada.ca) or Client Services (toll-free 1-866-873-8788; statcan.labour-travail.statcan@canada.ca), Labour Statistics Division.

- Date modified: