Trade by exporter and importer characteristics: Services, 2021

Released: 2023-11-09

In 2021, Canadian firms operating in the professional services industry as well as in the information industry led the increase in imports of commercial services. Overall, imports rose by $13.0 billion to $112.2 billion, with these two sectors accounting for over three-quarters of the growth. These services imports were increasingly coming from the United States, reflecting an acceleration in services delivered to Canadian businesses and households through digital multinational enterprises.

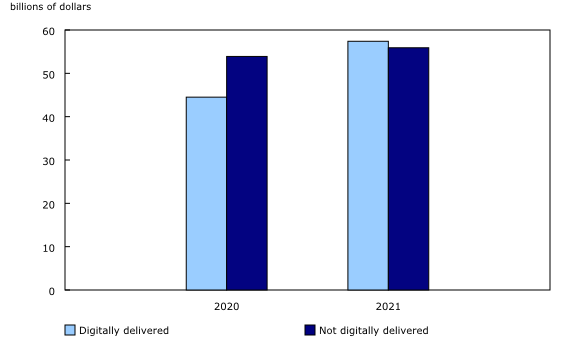

Activities of exporters of commercial services in Canada continued to be affected by the COVID-19 pandemic into 2021; however, unlike travel and transportation services, commercial services can be delivered digitally. While exports of commercial services grew 15.2% to $113.3 billion overall in 2021, the value of services exports that were digitally delivered grew 29.2%, following a similar increase in 2020. The share of Canada's commercial services exports reported as digitally delivered to customers abroad—also referred to as digital intensity—continued its upward trend to reach 53% in 2021, up from 48% in 2020 and 39% in 2019.

Digital intensity of small- and medium-sized enterprises increases

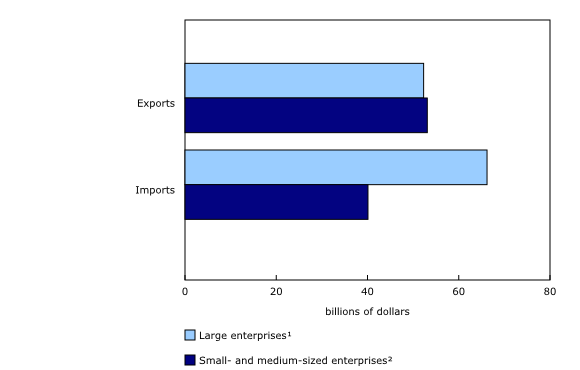

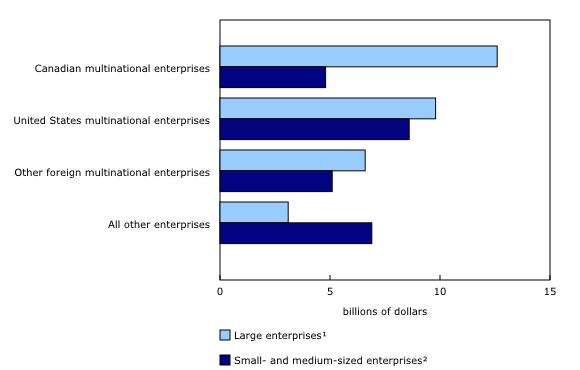

Commercial services exports provided by small- and medium-sized enterprises (SMEs) (with 0 to 499 employees) increased by 12% to $53.1 billion in 2021, while their imports rose 9% to $40.1 billion. Commercial services exports by large firms (with 500 or more employees) operating in Canada increased 20% to $52.3 billion in 2021. Large enterprises imported $66.2 billion worth of commercial services in 2021, up 15% from 2020.

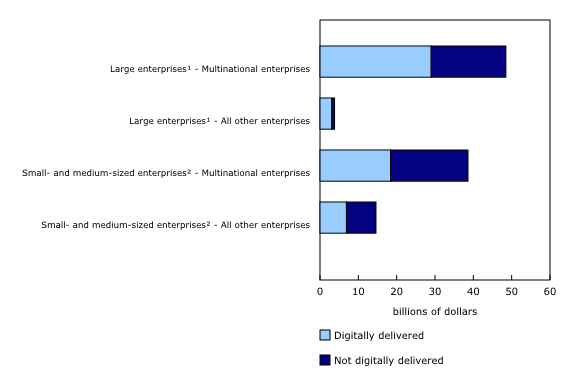

The digital intensity of large firms' services exports edged up from 60% in 2020 to 61% in 2021, while the digital intensity of SMEs grew from 38% to 48%. SMEs digitally delivered $25.3 billion of commercial services in 2021, while large firms digitally delivered $32.1 billion.

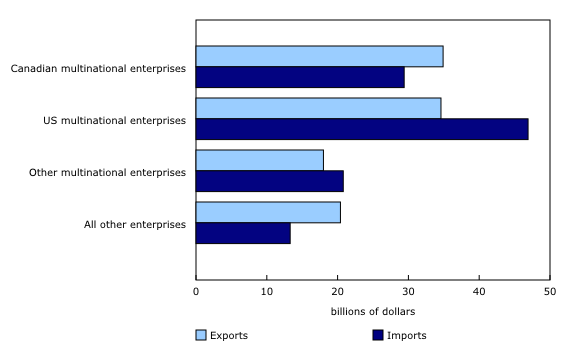

US multinational enterprises in Canada responsible for a higher share of total services trade than Canadian multinationals

Overall, multinational enterprises (MNEs) accounted for 87% of all commercial services imports and more than three-quarters (77%) of exports in 2021. Canadian MNEs accounted for 26% of imports and 31% of exports. Compared with Canadian multinationals, US MNEs accounted for a much larger share of overall imports at 42%, but an equivalent share of exports (31%).

MNEs accounted for $47.5 billion of the $57.4 billion worth of services exports that were digitally delivered in 2021. MNEs reported a higher digital intensity, at 54.3% of overall exports, than Canadian companies without controlling interest abroad (those not accessing international markets through foreign affiliates), which digitally delivered 48.6% of their exports.

Note to readers

This release includes information on international trade in services by exporters and importers characteristics, providing further insights on the profile of Canadian enterprises engaged in cross-border commercial services trade from 2010 to 2021.

In this release, a certain share of export value and import value could not be linked to a particular employment size class or multinational status as a result of limitations in data sources used to compile data on certain commercial services.

Multinational enterprises (MNEs) are corporations with majority-owned operations in more than one country. The ownership of more than 50% of voting shares by enterprises outside the country is used to identify foreign MNEs. Canadian MNEs are defined as enterprises based in Canada that own more than 50% of the voting shares of an enterprise abroad. Small- and medium-sized enterprises (SMEs) in Canada can be part of a larger multinational framework. As a result, the analysis of the data by multinational status reflects the activities of these SMEs.

Data on digitally delivered services exports are provided for the dimensions of multinational status and enterprise size class for 2021. Digitally delivered services exporters are primarily identified through Statistics Canada's International transactions in commercial services survey, within which they are asked to identify the share of their exports that are digitally delivered per services category, combined with administrative data sources.

Products

The Canada and the World Statistics Hub (13-609-X) is available online. This product illustrates the nature and extent of Canada's economic and financial relationship with the world using interactive graphs and tables. This product provides easy access to information on trade, investment, employment and travel between Canada and a number of countries, including the United States, the United Kingdom, Mexico, China and Japan.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: