Pension Satellite Account, 2021

Released: 2022-12-12

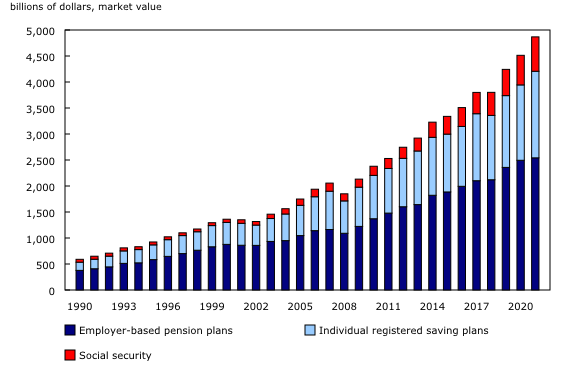

Pension wealth buoyed by strong markets

After the market recovery in the second half of 2020, following the sharp decline at the onset of the COVID-19 pandemic, equities continued to rise throughout 2021. The Standard & Poor's 500 posted annual gains of 26.9% in 2021, outperforming domestic markets which saw the Toronto Stock Exchange increase 21.7%. That sustained momentum was a significant contributor to the growth in total pension wealth, which rose 7.9% in 2021 to reach nearly $4,867.8 billion by the end of year.

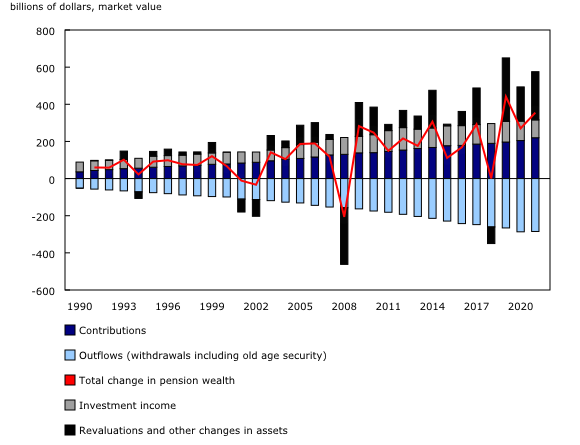

Revaluations (the change in wealth due to changes in asset prices) and other changes increased pension wealth by $259.4 billion in 2021, following the $184.2 billion upward revaluations in the previous year, as equity markets posted back-to-back gains in 2020 and 2021. These revaluations helped bring trusteed pensions plans' invested assets into a surplus position relative to their pension obligations.

Previously, pension wealth (excluding social security plans) generally accounted for around one-quarter of household's total assets. However, that ratio took a notable dip from 24.2% in 2020 down to 22.4% in 2021. This was primarily due to significant growth in the value of household residential real estate which rose from $6,551.8 billion to $8,139.0 billion by the end of the year, gaining more share of household's total assets.

Pension wealth, shifting demographics, and life expectancies

According to the annual population estimates, Canada's demographic landscape is shifting: as of July 1, 2022, 18.8% of Canadians were over the age of 65, up from 12.2% in 2000. The ratio of persons aged 15 to 64 years to those aged 65 years and older fell from 5.6 in 2000 to 3.5 in 2022. This may result in increased pension withdrawals over time, as more individuals enter retirement and draw upon their pension savings. At the same time, life expectancy fell by more than half a year in 2020, a record single-year decline. Health issues stemming from the pandemic were at least partially related to the decreased life expectancy. However, defined benefit pensions plans incorporate assumptions of such things as life expectancy and interest rates and base investment strategies and contribution rates on these expectations to ensure that plans remain actuarially sound over time.

Wealth of social security plans once again outpaces other pension tiers

Although pension wealth grew among all three pension tiers, social security funds led the group, with an increase of 16.2% to reach $661.0 billion in 2021. Within that tier, the largest growth rate was in the Québec Pension Plan (+21.0%), whose net assets crossed the $100 billion mark for the first time to reach $106.9 billion by the end of the year. Similarly, the Canada Pension Plan notched a milestone of its own, as net assets surpassed the half trillion-dollar mark to land at $554.1 billion, up 15.4% (+$73.8 billion) from 2020.

The growth in the value of individual registered saving plans nearly kept pace with social security plans, posting an increase of 14.9%, climbing to $1,665.3 billion by the end of 2021. This comfortably exceeded the 5.1% increase in 2020, which was undoubtedly impacted by more turbulent markets and uncertainty surrounding the onset of the pandemic.

Trusteed pension plans invested assets outweigh pension obligations

The largest tier, employer-based pension plans, rose 1.9% to reach $2,541.5 billion by the end of 2021. While this performance appears weak compared with the other tiers, it includes more than just the invested assets, which grew 9.7% in 2021. Specifically, trusteed pension plans, which represent the bulk of employer-based pensions plans, include the net claims on pension fund managers as part of the trusteed pension plans' net assets. The net claims on pension fund managers shifted into negative territory in 2021 as many trusteed plans switched to overfunded status, indicating that their invested assets were more than sufficient to cover their current and future pension obligations.

Contributions and investment income up, withdrawals dip in 2021

Pension wealth was also pushed higher by inflows from contributions, which were up 7.4% from the previous year to reach $219.9 billion in 2021. Contributions to social security plans grew 13.1%, a marked increase from the 1.5% rise in 2020 when pandemic lock downs impacted labour market. Moreover, in 2019, the enhancements to the Canada Pension Plan and the Québec Pension Plan came into effect, which saw contributions slowly increase to fund these additional plans. In step with these higher contributions, pension benefits will also increase over time.

Investment income of total pension plans was down 8.2% in 2021, after a decrease of 6.1% in 2020. In 2020, all three tiers posted similar declines in investment income, which were partially related to the impacts of the pandemic, such as companies reducing dividend payments. Moreover, the investment income of trusteed pension plans includes imputed investment income, which is directly related to the overall funded status of the plans. With the positive funded ratio in 2021, the total investment income of employer-based pension plans declined 14.9% as a result of negative imputed investment income on the surplus assets. However, when considering only actual investment income, total pension plans saw an increase of 8.9% to $112.9 billion in 2021.

Total withdrawals posted a slight decrease of 0.7% in 2021 compared with the 7.9% growth recorded in 2020. The growth in 2020 was largely due to some trusteed pension plans electing to reduce their pension obligation through the purchase of annuities (de-risking), which resulted in larger-than-normal withdrawals (+13.5%). Comparatively, over the 10 years prior to 2021, trusteed pension plan withdrawals grew at a compound rate of 3.6% annually.

A look ahead to 2022

So far this year, while the impact of the pandemic has diminished, other global challenges have arisen, including the impact of the Ukraine–Russia conflict, persistently high inflation, and tightening monetary policy. Both the Toronto Stock Exchange (-13.1%) and the Standard & Poor's 500 (-24.8%) have dropped significantly in the first three quarters of 2022, while bond prices and housing market activity also declined over the same period. These market headwinds have tempered some of the gains in pension wealth, as trusteed pension plan net invested assets fell by 10.2% in the third quarter of 2022. Social security wealth declined by 3.0% during the same period. Both trusteed pensions and social security plans invest in a wide variety of assets, and this diversification may help limit the impact of any one market.

Note to readers

The Pension Satellite Account (PSA) provides an integrated stock-flow representation of the Canadian pension system. The PSA fully articulates the wealth positions (level of assets) as well as the pension inflows (contributions, investment income), outflows (withdrawals), and realized and unrealized gains and losses that contribute to change in wealth (revaluations and other changes in assets).

The PSA presents annual estimates for each of the three tiers of the Canadian pension system: social security, employer-based pension plans, and voluntary individual registered savings plans. The institutional dimension of the PSA presentation has been mainly defined by data availability. The breakdown of the three tiers into further detail is provided where data supported it and reflects a mixture of detail by program and by institutional dimension.

In the Canadian System of Macroeconomic Accounts, net claims on pension fund managers, imputed contributions and imputed investment income are evaluated for trusteed pension plans.

Trusteed pension plans include both the claims on pension fund managers by pension funds (asset of trusteed pension plans) for funds that are underfunded and the claims on pension funds by pension fund managers (liability of trusteed pension plans) for funds that are overfunded. Together, this asset and liability results in a net claim on pension fund managers as part of the trusteed pension plans net assets. These net claims may be overall positive if plans are underfunded or overall negative if they are overfunded.

Imputed contributions are residually derived as the accrual of pension entitlements due to employment in the current period plus the costs of operating the scheme minus all actual contributions in the period. Positive imputed contributions occur when, for example, a contribution holiday results in actual contributions being insufficient to cover the current periods accrued pension entitlements plus operating costs. Alternatively, negative imputed contributions indicate that actual contributions were higher than the accrued pension entitlements plus operating costs. This might occur when special contributions were made to help reduce the underfunded status of a plan.

Imputed investment income is calculated on the underfunded or overfunded amount of the trusteed pension plan. If the trusteed pension plans are underfunded, a positive imputed investment income is evaluated to represent the investment income that could have been earned if the trusteed pension plan was fully funded. Alternatively, if the plans are overfunded, a negative imputed investment income is estimated to offset the portion of the actual investment income that was generated on surplus assets.

For this release, the PSA was revised from 2000 to 2020 to incorporate the most up-to-date data from the National Balance Sheet Accounts.

Products

The data visualization product "Pension satellite account: Interactive tool," which is part of Statistics Canada – Data Visualization Products (71-607-X), is now available.

The Economic accounts statistics portal, accessible from the Subjects module of the Statistics Canada website, features an up-to-date portrait of national and provincial economies and their structure.

The Latest Developments in the Canadian Economic Accounts (13-605-X) is available.

An overview of the scope and structure of the Pension Satellite Account and a description of the sources and methods used to derive its stock and flow estimates are available in the Guide to the Canadian Pension Satellite Account (13-599-X).

The User Guide: Canadian System of Macroeconomic Accounts (13-606-G) is available.

The Methodological Guide: Canadian System of Macroeconomic Accounts (13-607-X) is available.

Contact information

For more information, or to enquire about the concepts, methods or data quality of this release, contact us (toll-free 1-800-263-1136; 514-283-8300; infostats@statcan.gc.ca) or Media Relations (statcan.mediahotline-ligneinfomedias.statcan@statcan.gc.ca).

- Date modified: