Education, learning and training: Research Paper Series

Projected Financial Impact of the COVID-19 Pandemic on Canadian Universities for the 2020/21 Academic Year

Skip to text

Text begins

Extended abstract

The COVID-19 pandemic has impacted many segments of Canadian society, including post-secondary institutions, given, among other things, the uncertainty surrounding enrolments of international students. With the international travel restrictions in place in Canada and requests by health authorities to practice physical distancing in most of 2020, the majority of universities have been planning to utilize online learning as the primary source of teaching for the 2020/21 academic year, which may have an impact on enrolment of international and domestic students. Over the last decade, universities have increasingly relied on tuition fees as a revenue source. This growth has been estimated to come mostly from an increasing share of international students who pay, on average, four times more in tuition fees as compared to domestic students, to pursue schooling in Canadian universities (Statistics Canada, 2021). From 2005/06 to 2018/19, the number of international students enrolled in Canadian universities has more than tripled (223%) while domestic student enrolments have increased by 14% (Statistics Canada, 2021).

The aim of this report is to develop projection scenarios to estimate the potential financial losses in the 2020/21 school year for Canadian universities by province. These projection scenarios are based on a drop in international students using the most recent Immigration Refugee and Citizenship Canada (IRCC) study permit holder data as a proxy for enrolment. These scenarios also incorporate a potential variation in domestic student enrollments, as well as an influx of $450 million in federal funding for research announced by Innovation, Science and Economic Development Canada (ISED). This forecast model uses various sources of administrative and survey data available at Statistics Canada, such as the Financial Information of Universities and Colleges (FIUC), Post-Secondary Information System (PSIS) and Tuition and Living Accommodations Costs (TLAC) and the Labour Force Survey (LFS) as well as using international study permit holder data from Immigration Refuges and Citizenship Canada (IRCC).

Discussion

Provincial grants and contributions are the main source of revenues for Canadian universities, but have declined as a percent of total revenue over the last two decades. As such, universities have started to rely more heavily on tuition fees as a source of revenue. At the national level, revenues from tuition fees increased by 41.1%, from $8.7 billion in 2013/14 to $12.2 billion in 2018/19 (Statistics Canada, 2021). The proportion of revenue from tuition fees also grew from 24.7% in 2013/14 to 29.4% in 2018/19. At the provincial level, in 2018/19 tuition fees as a proportion of total revenue were as high as 39.5% in Ontario, where it has surpassed provincial revenue and remained the most important single source of revenue since 2013/14. This increase is largely driven by both rising tuition fees, as well as the increasing number of international students choosing to study in Canadian post-secondary institutions.

In 2018/19, there was a total of 216,096 international student enrolments in Canadian universities, representing 16.0% of total university enrolments. This proportion has grown significantly in recent years, as the total number of international enrolments has increased by 35.6% from 2014/15 to 2018/19. Over this same time period, domestic student enrolment has only increased by less than one percent. In 2018/19, the most recent year of student enrolment data available, 80% of all international students were concentrated in Ontario (37.2%), British Columbia (21.7%), and Quebec (21.1%) (Statistics Canada, 2021).

Data table for Chart 1

| Domestic Students | International Students | |

|---|---|---|

| percent | ||

| Canada | -0.18 | 8.42 |

| N.L. | -1.88 | 10.18 |

| P.E.I. | -1.78 | 16.12 |

| N.S. | -1.47 | 7.42 |

| N.B. | -2.49 | -7.09 |

| Que. | -0.30 | 6.61 |

| Ont. | 0.02 | 10.67 |

| Man. | -0.60 | 9.02 |

| Sask. | 1.38 | 3.85 |

| Alta. | 0.67 | 4.76 |

| B.C. | -0.63 | 9.73 |

| Source: Postsecondary Student Information System. | ||

Over the same five-year period, the average amount of tuition fees paid by international students has also increased faster than that of domestic students. In 2018/19, the average annual tuition for an international undergraduate student was $27,613, equal to an increase of 34.1% since 2014/15 (Statistics Canada, 2021). Comparatively, the average annual tuition for a domestic student in 2018/19 was $6,822, an increase of 13.7% since 2014/15. In total, international university students accounted for an estimated $5.1 billion of tuition and other fees, equal to approximately 12.2% of total university revenues. Regulations for annual tuition increases differ greatly between domestic and international students. Between 2014/15 and 2018/19, the increase in average tuition for an international student was as high as 38.0% in Ontario. At the same time, the increase for Canadian students in the same jurisdiction was 16.3%.

The growth of the international student population, as well as the importance of international student tuition payments, have had a significant impact on the post-secondary sector as well as the Canadian economy as a whole. According to a study conducted by Global Affairs Canada (Global Affairs Canada, 2017),

“It is estimated that spending associated with international students studying in Canada amounted to $15.5 billion in 2016. This spending translated into a $12.8 billion contribution to Canada’s GDP in 2016 and supported 168,860 jobs. By way of comparison, this $15.5 billion in education service exports in 2016 was greater than Canada’s exports of auto parts, lumber or aircrafts”.

As outlined in the Government of Canada’s Building on Success International Education Strategy (Global Affairs Canada, 2019), this growing international student population has become strategically important for both the financial health of post-secondary institutions as well as for the growth of the Canadian economy. This strategic plan outlines a number of steps for the collaboration of several federal departments to boost Canada’s efforts to attract and benefit from the opportunities associated with this growing sector.

As the reliance on international tuition revenue has increased among a large number of universities, so has the risk of financial losses if a drop in international student enrolments were to occur. The COVID-19 pandemic has begun to highlight this risk, as travel restrictions, campus closures, lost personal income affecting affordability, and a shift to online learning has universities across Canada facing a potentially significant decline in international enrolment in the 2020/21 academic year. One survey completed by Quacquarelli Symonds of more than 2,800 international students intending to study in Canada found that 54% of the students surveyed intended to defer admission by a year due to the new learning environment (Friesen J. , 2020). However, other research conducted by IDP Connect shows a more optimistic picture for universities. They found 69% of the 6,900 international students surveyed with current offers of acceptance from universities in Australia, Canada, New Zealand, the United Kingdom and the United States expect to commence their studies as planned (Butler, 2020).

International study permit holder data from Immigration Refugee and Citizenship Canada (IRCC, 2021) has historically been correlated with post-secondary international student enrolments. Although this does not consider international students who choose to study abroad without a study permit, in 2018/19 this group had only made up less than 3% of all international students. The extent to which this group increases as a result of the pandemic has not been considered in this model. A comparison of the total number of study permits issued from June through September of 2020, to the same months in 2019, as seen in Chart 2, can be used as a proxy to model this potential drop in international enrolment in Canada. At the national level, the data indicates a 41.6% decrease, and at the provincial level the declines range from 35.3% in Manitoba to 62.9% in New Brunswick.

Data table for Chart 2.1

| Canada | ||

|---|---|---|

| 2019 | Jan | 28,914 |

| Feb | 15,550 | |

| Mar | 20,087 | |

| Apr | 32,015 | |

| May | 27,795 | |

| Jun | 23,767 | |

| Jul | 32,512 | |

| Aug | 112,707 | |

| Sep | 43,763 | |

| Oct | 14,980 | |

| Nov | 12,546 | |

| Dec | 49,701 | |

| 2020 | Jan | 25,299 |

| Feb | 11,514 | |

| Mar | 11,006 | |

| Apr | 18,720 | |

| May | 30,432 | |

| Jun | 15,825 | |

| Jul | 13,280 | |

| Aug | 39,908 | |

| Sep | 55,260 | |

| Oct | 15,054 | |

| Source: Immigration Refugee and Citizenship Canada. | ||

Key factors to this overall decline in study permits could be related to a number of factors, including the ability to enter and maintain useful employment status in the country, public health directives on gatherings, student decisions related to quality of learning and affordability, and travel restrictions. Up to October 20th, 2020, only students with a study permit granted before or on March 18th, 2020 were authorised to enter Canada. Following which, only international students with a valid study permit, attending a designated learning institutions could travel into Canada (IRCC, 2021). Additionally, during the first few months of the pandemic, major industries in the travel sector ceased operations, limiting the ability of new entrants to travel into Canada as well as the ability of university recruiters to effectively engage with potential students. Closures of student visa offices also slowed down the processing of applications.

Data sources and methodology

In order to measure the impact of a possible decline in student enrolment for the 2020/21 academic year, various data sources have been integrated into a series of potential scenarios. The main source of data in the scenarios is the Immigration Refugee and Citizenship Canada (IRCC) monthly international study permit holders’ data provided to Statistics Canada. There has also been use of various survey/administrative data from Statistics Canada such as:

- Financial Information of Universities and Colleges (FIUC), measuring Canadian universities’ financial information

- Post-Secondary Information System (PSIS), detailing university enrolment for international and domestic students

- Tuition and Living Accommodations Costs (TLAC), providing average tuition prices for international and domestic students

- Labour Force Survey (LFS), used to estimate the proportion of domestic students likely to enroll in 2020/2021

Due to the evolving nature and uncertainty around the pandemic, a series of methodological assumptions are necessary to create these scenarios. The first step in developing these scenarios is to estimate the total tuition coming from international students versus domestic students in the 2020/21 academic year. To do so:

- A baseline of university tuition revenue for 2020/21 was developed using the 5-year average growth rate of tuition revenue from 2012/13 to 2018/19. This baseline value sets the benchmark for expected university tuition revenue absent the impact of COVID-19 for the upcoming academic year. Using this methodology, the projected baseline for tuition revenue in the 2020/21 academic year, without the effects of the COVID-19 pandemic, was estimated to be $14.1 billion at the national level.

- Next, to understand the impact of a decline in international students, the projected baseline for tuition revenue is disaggregated between domestic and international students. TLAC information was used to find the average tuition fee paid by each domestic and international student. These average tuition fee amounts were then multiplied by the total full-time equivalent counts of domestic and international students, measured by PSIS, to derive the approximate proportion of total tuition paid by international and domestic students.

- Finally, to estimate the potential decline of international student tuition fees paid, recent trends in IRCC international study permit holder data were used to develop potential drops, by province, for international enrolments which can be combined with the baseline tuition revenue value.

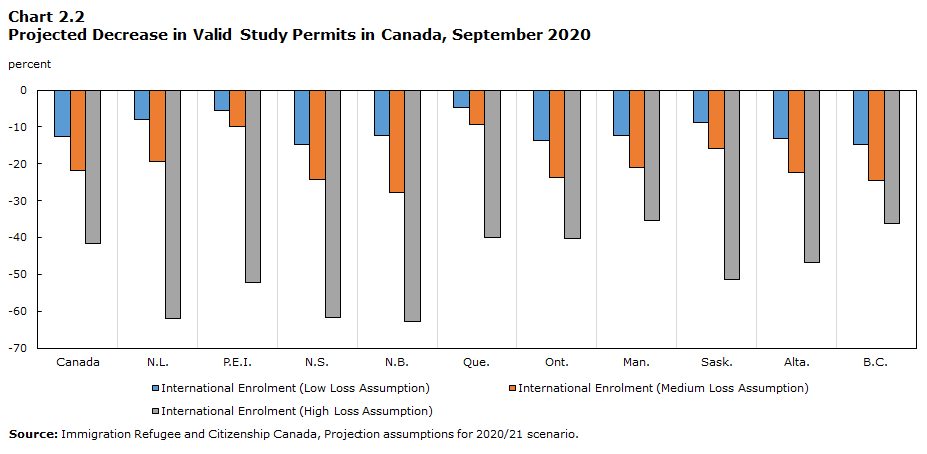

The data on international study permit holders from IRCC has historically been correlated with international student enrolments. At the time of the study, data were available until October 2020, and projections were made based on the year over year reduction of valid permits using several potential scenariosNote . This data was used to produce the following assumptions for international student enrolments, which underlie the forecasted scenarios

- Assumption 1: International student enrolment low loss assumption (-12.5% nationally): Based on a comparison of historical level for months of June to September for the 2020 compared to 2019

- Assumption 2: International student enrolment medium loss assumption (-21.8% nationally): Based on already granted permits that would still be valid in September 2020

- Assumption 3: International student enrolment high loss assumption (-41.6% nationally): Based on already granted permits that would still be valid in January 2021

Data table for Chart 2.2

| Canada | N.L. | P.E.I. | N.S. | N.B. | Que. | Ont. | Man. | Sask. | Alta. | B.C. | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| percent | |||||||||||

| International Enrolment (Low Loss Assumption) | -12.52 | -8.12 | -5.65 | -14.64 | -12.32 | -4.74 | -13.62 | -12.37 | -8.76 | -13.04 | -14.72 |

| International Enrolment (Medium Loss Assumption) | -21.78 | -19.44 | -9.83 | -24.32 | -27.69 | -9.43 | -23.73 | -21.12 | -15.93 | -22.51 | -24.60 |

| International Enrolment (High Loss Assumption) | -41.59 | -62.04 | -52.27 | -61.63 | -62.94 | -40.08 | -40.31 | -35.32 | -51.34 | -46.74 | -36.15 |

| Source: Immigration Refugee and Citizenship Canada, Projection assumptions for 2020/21 scenario. | |||||||||||

The IRCC permit holder data suggests that there would likely be a significant decline in international enrolments for the 2020/21 academic year. However, expectations for the domestic student population are not as clear. During the 2008 recession in Canada, it was thought that affordability of post-secondary education would become a significant deterrent to enroll. However, in part due to an increased demand for new skills training and upgrading, paired with additional support from the government, domestic student enrolments in universities actually increased by 7.4%.

At the start of COVID-19 pandemic there were significant closures of businesses across Canada and the rest of the world, leading to a disproportionate loss of personal earnings for both current and potential students. In Canada, during the months of March and April, a total of 3 million jobs were lost, and the unemployment rate for students, aged 15 to 24, increased significantly to 31.7% (Statistics Canada, 2020). Employment for this group had the fastest decline in the early months of the pandemic, as they were more likely to hold less secure jobs in harder-hit industries. These losses in earnings for students, as well as parents abroad, may lead to difficulties in continuing to pay for their studies. A Statistics Canada crowdsourcing survey of more than 100,000 post-secondary students that was conducted in April, 2020 found,

“Over one-third of student participants who were enrolled in post-secondary education and had lined up a summer work placement had reported that their placement had been delayed or cancelled as a result of COVID-19. Also, one-half of post-secondary students reported being extremely concerned about paying for tuition, increasing their student debt or paying for current expenses” (Statistics Canada, 2020).

The Labor Force Survey (LFS) also asked full-time students, aged 17 to 24 years who had planned to return to school full-time in the upcoming academic year, what their new intentions for the upcoming fall semester would be. The results of this survey, for the months of June through August 2020, estimated a potential 20.1% drop in domestic student enrolment at the national level.

Based on these findings, two new assumptions were developed to factor in potential changes to domestic student enrolment. These exclude students in Quebec, aged 17 to 19, who are most likely enrolled in CEGEP.

- Assumption 4: Domestic student enrolment increase of 7.4% nationally

- Assumption 5: Domestic student enrolment decrease of 20.1% nationally

- Assumption 6 : Domestic student enrolment remains stable (0% change from baseline estimate)

It is also important to note, that an investment of $450 million in 2020/21 for universities was announced by the federal government in May of 2020 (GOC, 2020). Since this investment by the federal government could offset some of the expected financial losses, it has been integrated into the scenarios used to forecast the impact of COVID-19 on university revenues. Federal funding is mainly used for the purposes of research activities. To obtain this funding, universities usually need to make applications through the granting councils. In order to estimate the distribution of this investment between the provinces, an average of the provincial distribution of funding from the past five years was used.

Based on the information and assumptions previously mentioned, the following scenarios were compiled to estimate the potential impact of the COVID-19 pandemic on Canadian university revenues. The varying levels of enrolments projected within these scenarios, shown also in Chart 3 below, highlight the numerous possibilities and various potential consequences of the pandemic, including the level of international and domestic student registration in Canadian universities for 2020/21. These scenarios are as follows:

- Low (L1) scenario: (Assumption 6) Domestic student enrolment remains stable (0%) + (Assumption 1) low decrease in international student enrolment (-12.5%) + $450M federal research funding

- Medium (M1) scenario: (Assumption 6) Domestic student enrolment remains stable (0%) + (Assumption 2) medium decrease in international student enrolment (-21.8%) + $450M federal research funding

- Medium (M2) scenario: (Assumption 4) Increase in domestic student enrolment (7.4%) + (Assumption 2) medium decrease in international student enrolment (-21.8%) + $450M federal research funding

- High (H1) scenario: (Assumption 5) Decrease in domestic student enrolment (-20.1%) + (Assumption 2) medium decrease in international student enrolment (-21.8%) + $450M federal research funding

- High (H2) scenario: (Assumption 6) Domestic student enrolment remains stable (0%) + (Assumption 3) high decrease in international student enrolment (-41.6%) + $450M federal research funding

Data table for Chart 3

| 2005 / 2006 | 2006 / 2007 | 2007 / 2008 | 2008 / 2009 | 2009 / 2010 | 2010 / 2011 | 2011 / 2012 | 2012 / 2013 | 2013 / 2014 | 2014 / 2015 | 2015 / 2016 | 2016 / 2017 | 2017 / 2018 | 2018/2019 | 2019/2020 | 2020/2021 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| percent | ||||||||||||||||

| Canadian students | 100 | 102 | 102 | 106 | 114 | 116 | 118 | 119 | 119 | 118 | 117 | 118 | 118 | 118 | 118 | Note ...: not applicable |

| International Students | 100 | 102 | 104 | 109 | 123 | 133 | 149 | 163 | 179 | 198 | 209 | 223 | 244 | 268 | 291 | Note ...: not applicable |

| Valid Students Permits (Sept) | 100 | 121 | 133 | 139 | 145 | 161 | 172 | 199 | 217 | 243 | 250 | 282 | 331 | 399 | 453 | Note ...: not applicable |

| International Students (low) | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | 291 | 276 |

| International Students (med) | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | 291 | 247 |

| International Students (high) | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | 291 | 184 |

| Canadian students (low) | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | 118 | 126 |

| Canadian students (high) | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | Note ...: not applicable | 118 | 94 |

|

… not applicable Source: PSIS Student Enrollments, IRCC Study permit Holders and Projection assumptions for 2020/21 scenarios. |

||||||||||||||||

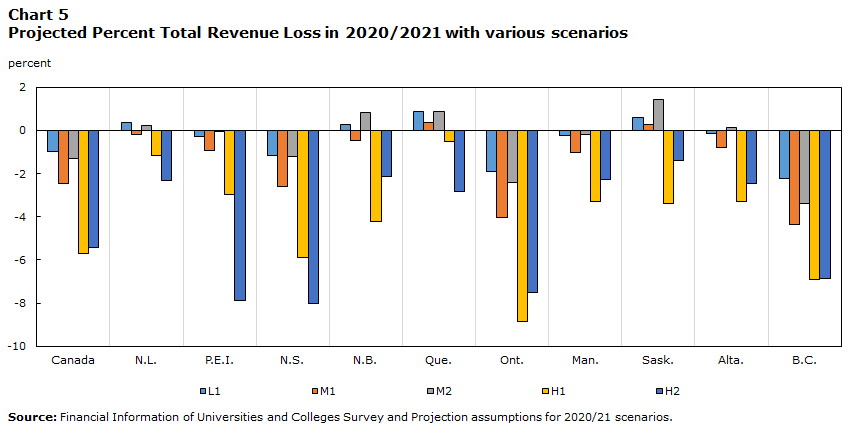

Key results

According to this study, Canadian universities could lose between $438 million (-1.0%) to $2.5 billion (-5.7%) of projected revenues for 2020/2021. In the most pessimistic scenario (High-H1), with a decrease of 21.8% of international students combined with a 20.1% decrease of domestic students, revenue losses could reach $2.5 billion. In this scenario, the greatest impact, as a share of existing revenues, would be experienced among universities in Ontario (-$1.7 billion or -8.9% of projected revenues) and British Columbia (-$430 million or –6.9% of projected revenues). In contrast, the high (H2) scenario, estimates a larger decline in international enrolment (41.6%) combined with stable growth in domestic students, resulting in a lower impact on tuition fee revenue at the national level (-5.4%).

In the medium loss scenario (M1), the financial loss could reach 2.5% of projected university revenues, equal to $1.1 billion, if international enrolment were to decline by 21.8% at the national level. According to the medium loss scenario (M2) scenario, with a decrease of 21.8% of international students, and an increase in domestic student enrolment (7.4%), the financial loss could reach 1.3% of overall projected university revenues for 2020/2021, equal to approximately $574 million. Finally, in the most optimistic scenario (L1), assuming international student enrolments would decrease by 12.5%, losses would be equal to approximately 1.0% of projected total revenues or $438 million at the national level.

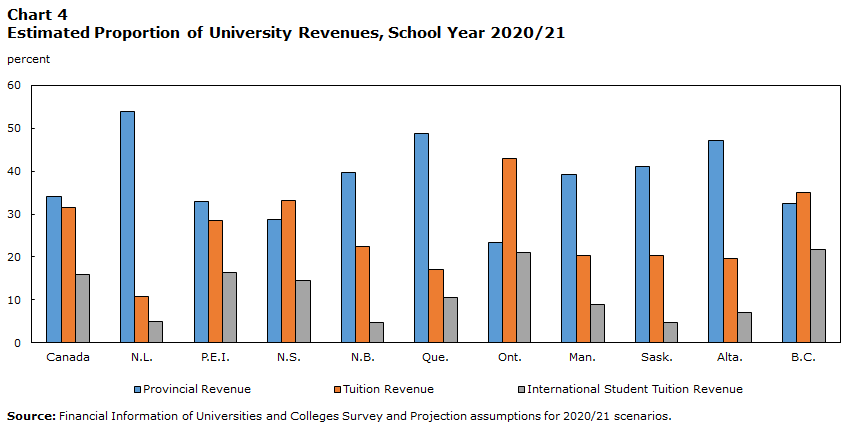

At the provincial level, the impact of a drop in student enrolments is much greater in those jurisdictions where universities rely more heavily on tuition revenue. As seen in Chart 4, the estimated percent of tuition revenue for 2020/21 is highest in Ontario (42.9%), British Columbia (34.9%), and Nova Scotia (33.1%). The COVID-19 impact will also be compounded in these jurisdiction as they contain a relatively larger proportion of international students.

Data table for Chart 4

| Provincial Revenue | Tuition Revenue | International Student Tuition Revenue | |

|---|---|---|---|

| percent | |||

| Canada | 34.19 | 31.52 | 15.81 |

| N.L. | 53.82 | 10.71 | 4.96 |

| P.E.I. | 32.88 | 28.46 | 16.34 |

| N.S. | 28.77 | 33.10 | 14.59 |

| N.B. | 39.73 | 22.41 | 4.78 |

| Que. | 48.70 | 17.06 | 10.49 |

| Ont. | 23.36 | 42.85 | 21.01 |

| Man. | 39.23 | 20.27 | 8.94 |

| Sask. | 40.98 | 20.36 | 4.72 |

| Alta. | 47.12 | 19.68 | 6.92 |

| B.C. | 32.50 | 34.93 | 21.65 |

| Source: Financial Information of Universities and Colleges Survey and Projection assumptions for 2020/21 scenarios. | |||

While a number of Canadian universities were planning to increase tuitions fees for 2020/21 to possibly compensate losses from decreased enrolment, Ontario universities are still coping with an income reduction due to the provincial government’s decision to decrease tuition fees by 10% for domestic students in September 2019 which would then be frozen for the 2020/21 and 2021/22 academic years (MoCU, 2020). This means Ontario universities must rely increasingly on tuition fees from international students in the upcoming year to make up for the deficit and replenish lost reserves. As seen in Chart 5, in the High Loss Scenario (H1), this could result in a total revenue loss equal to 8.9% of the projected baseline revenues for the 2020/21 academic year. This scenario is defined by a drop of 23.7% of international students in Ontario, and a decline of 22.2% of domestic students. In a more optimistic scenario for Ontario universities (Loss – L1), total revenue losses could be limited to 1.9% if the domestic student population remains stable and the drop of international students is limited to 13.6%.

In response to the situation in Ontario, the provincial and federal governments have proposed special aid to compensate universities for the impacts of the COVID-19 pandemic. Specifically, in Ontario, the Ministry of Colleges and Universities has created a $20 million COVID-19 Rapid Research Fund. This fund can be accessed by Ontario colleges, universities and other research institutes for COVID-19 prevention, detection and treatment research (MoCU, 2021). The Ontario Ministry has also announced $164 million in capital funding for 2020/21, an increase of $73 million from the previous year, to be used to modernize classrooms, upgrade technology as well as to purchase new equipment to support virtual learning during the COVID-19 pandemic (MoCU, 2020). Together this amounts to an additional $93 million, equal to 26.0% of the estimated loss of $357.7 million in the Low (L1) scenario and 5.6% of the estimated loss in the High (H1) scenario. Ontario universities are also expected to receive a large portion, approximately 39.8%, of the $450 million dollar Canada Research Continuity Emergency Fund, based on recent trends of federal research funding distribution.

Data table for Chart 5

| L1 | M1 | M2 | H1 | H2 | |

|---|---|---|---|---|---|

| percent | |||||

| Canada | -0.98 | -2.45 | -1.29 | -5.70 | -5.44 |

| N.L. | 0.36 | -0.20 | 0.23 | -1.15 | -2.31 |

| P.E.I. | -0.25 | -0.94 | -0.04 | -2.98 | -7.87 |

| N.S. | -1.17 | -2.58 | -1.21 | -5.90 | -8.03 |

| N.B. | 0.28 | -0.45 | 0.86 | -4.22 | -2.14 |

| Que. | 0.87 | 0.38 | 0.87 | -0.52 | -2.83 |

| Ont. | -1.91 | -4.03 | -2.41 | -8.87 | -7.51 |

| Man. | -0.24 | -1.02 | -0.18 | -3.27 | -2.29 |

| Sask. | 0.61 | 0.28 | 1.44 | -3.40 | -1.39 |

| Alta. | -0.13 | -0.78 | 0.16 | -3.29 | -2.46 |

| B.C. | -2.22 | -4.36 | -3.37 | -6.91 | -6.86 |

| Source: Financial Information of Universities and Colleges Survey and Projection assumptions for 2020/21 scenarios. | |||||

In recent years, universities in British Columbia, similar to those in Ontario, have also experienced a significant increase in international student enrolments. As seen in Chart 4, it was estimated that in 2020/2021, universities in British Columbia would have derived as much as 34.9% of their total revenues from student tuition fees. This is the second highest proportion relative to other provinces, had they not been impacted by the pandemic. However, having the largest proportion of revenue coming from international students also equates to having the largest risk of lost tuition revenue when modelling the effects of the COVID-19 pandemic on the international student population. In the most pessimistic scenario for British Columbia (High – H1), a 24.6% decrease in international student enrolment could result in lost tuition revenue equal to 6.9% of total revenue. Even under the most optimistic scenario (Low-L1), due to the large proportion of revenue coming from international students, universities in British Columbia have the potential to incur the largest loss of revenue relative to other provinces, equal to 2.2% of total revenue.

Although it is very difficult to accurately predict which scenario Canadian universities would face in the 2020/2021 academic year, the most recent international study permit holder data depicts a relatively more optimistic picture in British Columbia compared to other provinces. In the month of August, when historically the largest amount of international study permits are issued, British Columbia had the smallest decline of permits issued comparing 2020 to 2019, in relation to other provinces. Specifically, international study permits issued for British Columbia in August 2020, dropped by 54.4% from 2019, which was 16.3% less than the national average decline of 70.7%. Also, when comparing the number of international study permits issued in the month of September 2020 to the same month in the previous year, British Columbia had the largest percentage increase in relation to other provinces. In September 2020, international study permits issued in British Columbia increased by 43.9% from 2019, compared to the national average increase of 1.7%.

While universities in British Columbia and other jurisdictions have had the ability to substantially increase their international student population in recent years, most have done so while their domestic student population has declined. Alberta is one of three provinces that had a growing domestic student population from 2017 to 2018. This growing student population will be especially important for the financial health of universities in Alberta since the provincial government has recently announced the end of a five year freeze of university tuition fees for domestic students (Alberta, 2020). Following the end of the tuition freeze in Alberta, there was a 7.1% increase in average tuition fees for domestic undergraduate programs for the 2020/21 academic year.

Changes to the regulations surrounding domestic student tuition in Alberta were also closely timed with changes to provincial funding. In 2020/21, the Alberta government also announced that operating grants were planned to be decreased by 7.9% for post-secondary institutions (Alberta, 2019). This decision also follows a formal review of provincial funding which found Alberta was spending approximately $10,300 more per post-secondary student than the national average. To help control education costs, in a time when declining oil prices were having a substantial impact on the provincial economy (Alberta, 2020), the province also developed a new performance based funding model (UofA, 2020). The new model was aimed to further control institutional spending by setting levels of funding based on the institution’s ability to meet expenditure targets.

Based on the scenarios listed above, universities in Alberta have the potential to lose up to 3.3% of total revenue from a decline in overall enrolment. The province has announced a $2.1 million special grant towards two of their universities for COVID-19 research (Johnson, 2020).

Similar to Alberta, and prior to the 2019 Atlantic Accord where Newfoundland and Labrador saw higher federal transfers, the province was also operating in a net deficit position leading in to the COVID-19 pandemic (Statistics Canada, 2020). In the few months prior to the outbreak, in large part due to declining oil prices and lost production, the resource driven provincial economy had the highest net debt and debt charges, per capita, in Canada (Locke, 2019). In a province where its sole university derives over half of its revenues from the Government of Newfoundland and Labrador, any circumstances that may constrain these funds could add significant financial pressure to the institution. This reliance was created in part through the Newfoundland and Labrador provincial government’s tuition freeze for domestic students from Newfoundland and Labrador. The tuition freeze has been maintained by a grant in lieu of tuition increases from the government to the university, in place since 1999 (MUN, 2020). With the exception of 2018/19, Newfoundland and Labrador has had the lowest average tuition fee for Canadian undergraduate programs since 2013/14. International undergraduate students studying in Newfoundland and Labrador have also paid the lowest amount, on average, for tuition dating back to 2009/10.

As Newfoundland and Labrador’s sole university relies more heavily on provincial government grants and contributions, compared to tuition fees, the potential impact of a decline in international student enrolment on tuition revenue is not as high relative to other provinces. In the most optimistic scenario (Low – L1), discounting changes to provincial funding and the impact on ancillary operations, Newfoundland and Labrador has the potential of gaining revenues compared to the baseline figure due to the added share of federal funding for COVID-19 research. In the most pessimistic scenario (High – H1), if international student enrolment were to decline by 19.4%, Newfoundland & Labrador’s university has the potential of incurring a 1.2% loss of total revenue in 2020/21.

All of these scenarios measure the potential impact of the COVID-19 pandemic on tuition fee revenues, however, the effects on universities’ finances can be much more wide-ranging. Changes in enrolment can impact the level of provincial funding as well as the success of ancillary operations. A decline in various markets can also result in investment losses and shrinking support from business grants and donations from individuals. Since a large portion of provincial grants and contributions are enrolment based, a drop in enrolment could also result in a decrease of government funding, leading to potentially significant impacts for those universities where a large portion of their funding is derived from the province, or for those who were hoping these amounts could make up for lost tuition revenue.

In anticipation of this, the Quebec provincial government plans to revise public funding to post-secondary institutions to become equivalent to the support received based on 2018/19 enrolment numbers. In addition, Quebec has instituted a special $75 million grant to universities and colleges to improve the pedagogical and psychosocial support offered to the student community during the pandemic. In part, the results of this funding led to a, “reasonably satisfactory fall semester for those students in Quebec”, according to a survey carried out by the Quebec Ministry of Higher Education. The survey of 600 students in Quebec’s colleges and universities found that, generally speaking (60%), students were satisfied with their session (MES, 2020). On campus, they were particularly satisfied with the general experience and implementation of health measures, and overall, the majority of students (71%) were optimistic about further studies. The impact of this type of government investment and the successful integration of prevention and response strategies for the COVID-19 pandemic within each province may also help to drive demand back to universities in each jurisdiction.

Other examples of additional support from provincial governments can be seen in Nova Scotia, where the government has added new funds by way of a $25 million special grant for universities impacted by COVID-19 (MLAE, 2021). This support is particularly important for a select number of universities in Nova Scotia, which have an especially high proportion of international students in the 2018/19 academic year compared to all other universities that offer undergraduate programs in Canada. According to Cape Breton University in Nova Scotia, the vice-president of finance and operations expects a loss between $15 – 20 million of revenue in 2020/21, mainly due to a decline of international enrolment (Sullivan, 2021).

Manitoba also responded to the potential financial impact of the pandemic on its postsecondary institutions. The provincial government decided to delay previously planned decreases to provincial funding and announced a $25.6 million fund that public post-secondary institutions can access to deal with the uncertainty of revenues (MB, 2020).

These newly added provincial funds will also help deal with the potential losses to ancillary revenues from closed or partially opened campuses. In 2018/19, sales of services and products made up 7.6% of university revenue, ranging from 3.5% in Newfoundland and Labrador to 12.9% in Prince Edward Island. These revenues may decline as demand for parking services, student housing, facility rentals, meal plans and cafeterias are directly related to the numbers of students physically on a campus.

A number of provincial governments, as well as the federal government, have also significantly increased financial support to students to help encourage enrolment. In April, the Government of Canada announced a large investment into the financial assistance of post-secondary students. The government’s plan includes $9 billion worth of aid through the new Canada Emergency Student Benefit, Canada Student Service Grant, increased Canada Student Grants and employment programs, as well as new plans to remove the interest on the federal portion of student loans.

With an ever evolving situation due to the pandemic and changes in travel and lockdown restrictions, it is difficult to predict how students will react to the new challenges. Successful vaccine administration, declining infection rates, or increased financial support for students and institutions may ease worries and increase the demand for post-secondary education in Canada. Historically, Canadian universities have been relatively resilient to environmental and economic change. Some universities have also already begun to incorporate new programs to help adapt to the consequences of the pandemic, offering enhanced services to help international students settle in and self-isolate upon arrival. Some Canadian universities now offer airport pickups, regular food and amenity deliveries, daily check-ins with health professionals, and separate hotel rooms for quarantining (Friesen J. , 2020). Most have also developed cost-cutting strategies to incorporate into the 2020/21 academic year. This includes reductions of non-discretionary spending, delays for capital projects and staff reductions. Universities may continue to adapt and find new ways to better position themselves as an attraction for both international and domestic students, and by the end of the 2021 academic year, there should be more clear measures of the impact the pandemic has had on these institutions.

Tables

| Low Loss (L1) | Medium Loss (M1) | Medium Loss (M2) | High Loss (H1) | High Loss (H2) | |

|---|---|---|---|---|---|

| percent | |||||

| Canada | -12.5 | -21.8 | -21.8 | -21.8 | -41.6 |

| Newfoundland and Labrador | -8.1 | -19.4 | -19.4 | -19.4 | -62.0 |

| Prince Edward Island | -5.6 | -9.8 | -9.8 | -9.8 | -52.3 |

| Nova Scotia | -14.6 | -24.3 | -24.3 | -24.3 | -61.6 |

| New Brunswick | -12.3 | -27.7 | -27.7 | -27.7 | -62.9 |

| Quebec | -4.7 | -9.4 | -9.4 | -9.4 | -40.1 |

| Ontario | -13.6 | -23.7 | -23.7 | -23.7 | -40.3 |

| Manitoba | -12.4 | -21.1 | -21.1 | -21.1 | -35.3 |

| Saskatchewan | -8.8 | -15.9 | -15.9 | -15.9 | -51.3 |

| Alberta | -13.0 | -22.5 | -22.5 | -22.5 | -46.7 |

| British Columbia | -14.7 | -24.6 | -24.6 | -24.6 | -36.1 |

| Low Loss (L1) | Medium Loss (M1) | Medium Loss (M2) | High Loss (H1) | High Loss (H2) | |

|---|---|---|---|---|---|

| percent | |||||

| Canada | -1.0 | -2.5 | -1.3 | -5.7 | -5.4 |

| Newfoundland and Labrador | 0.4 | -0.2 | 0.2 | -1.2 | -2.3 |

| Prince Edward Island | -0.3 | -0.9 | 0.0 | -3.0 | -7.9 |

| Nova Scotia | -1.2 | -2.6 | -1.2 | -5.9 | -8.0 |

| New Brunswick | 0.3 | -0.5 | 0.9 | -4.2 | -2.1 |

| Quebec | 0.9 | 0.4 | 0.9 | -0.5 | -2.8 |

| Ontario | -1.9 | -4.0 | -2.4 | -8.9 | -7.5 |

| Manitoba | -0.2 | -1.0 | -0.2 | -3.3 | -2.3 |

| Saskatchewan | 0.6 | 0.3 | 1.4 | -3.4 | -1.4 |

| Alberta | -0.1 | -0.8 | 0.2 | -3.3 | -2.5 |

| British Columbia | -2.2 | -4.4 | -3.4 | -6.9 | -6.9 |

| Low Loss (L1) | Medium Loss (M1) | Medium Loss (M2) | High Loss (H1) | High Loss (H2) | |

|---|---|---|---|---|---|

| thousands of dollars | |||||

| Canada | -438,313 | -1,094,641 | -574,023 | -2,543,748 | -2,428,295 |

| Newfoundland and Labrador | 2,768 | -1,504 | 1,745 | -8,764 | -17,595 |

| Prince Edward Island | -451 | -1,660 | -65 | -5,277 | -13,934 |

| Nova Scotia | -18,811 | -41,518 | -19,416 | -94,842 | -129,068 |

| New Brunswick | 1,952 | -3,144 | 5,948 | -29,305 | -14,830 |

| Quebec | 72,704 | 31,756 | 72,292 | -43,148 | -235,548 |

| Ontario | -357,668 | -756,575 | -452,181 | -1,664,778 | -1,410,293 |

| Manitoba | -3,578 | -15,192 | -2,689 | -48,597 | -34,065 |

| Saskatchewan | 9,461 | 4,252 | 22,134 | -52,328 | -21,473 |

| Alberta | -6,499 | -39,570 | 8,223 | -166,238 | -124,247 |

| British Columbia | -138,191 | -271,485 | -210,013 | -430,471 | -427,241 |

References

Alberta. (2019). Budget 2019 : a plan for jobs and the economy.

Alberta. (2020). Budget 2020.

Alberta. (2020). Tuition regulations.

Butler, E. (2020). New research shows international students keeping study dreams alive, for now.

Friesen. (2020). Universities, colleges face potential budget crunch as they assess impact of COVID-19 on international student enrolment.

Friesen, J. (2020). Retrieved from Canadian universities scramble to maintain flow of international students and the revenue they bring.

Friesen, J. (2020). Canadian universities scramble to maintain flow of international students and the revenue they bring.

Global Affairs Canada. (2017). Economic impact of international education in Canada.

Global Affairs Canada. (2019). Building on success international education strategy.

GOC. (2020). Prime Minister announces support for research staff in Canada.

IRCC. (2021). Coronavirus disease (COVID-19): designated learning insitutions reopening to international students.

IRCC. (2021). Temporary residents: study permit holders.

Johnson, L. (2020). Seven COVID-19 research projects split $2.1 million in Alberta government funding.

Locke, M. (2019). Newfoundland and Labrador's debt management strategy.

MB. (2020). Manitoba announces distribution of $25.6 million transitional support fund for post-secondary institutions.

MES. (2020). Session de l'automne 2020 - sondage auprès des étudiants.

MLAE. (2021). Retrieved from Financial relief for Nova Scotia Universities.

MoCU. (2020). Annual Reports 2019-2020: Ministry of Colleges and Universities.

MOCU. (2020). Ontario increases funding to renew and modernize colleges and Universities.

MoCU. (2021). Ontario COVID-19 Rapid Research Fund.

MUN. (2020). Memorial at a glance.

Statistics Canada. (2020). Labour Force Survey, April 2020.

Statistics Canada. (2020). Labour Force Survey, May 2020.

Statistics Canada. (2020). Largest deficit in seven years in 2019; full impact of pandemic yet to be seen.

Statistics Canada. (2021). Table 37-10-0005-01 International undergraduate tuition fees by field of study.

Statistics Canada. (2021). Table 37-10-0018-01 Postsecondary enrolments, by registration status, institution type, status of student in Canada and gender.

Statistics Canada. (2021). Table 37-10-0026-01 Revenues of universities and degree-granting colleges (x 1,000).

Sullivan. (2021). Capte Breton University using $2.2 million grant for remote learning COVID related expenditures.

UofA. (2020). Alberta's performance-based funding model for post-secondary institutions.

- Date modified: