Income Research Paper Series

Examining the Incomes of Veterans using Tax Data: Now and in the Future

Archived Content

Information identified as archived is provided for reference, research or recordkeeping purposes. It is not subject to the Government of Canada Web Standards and has not been altered or updated since it was archived. Please "contact us" to request a format other than those available.

by Mary Beth MacLean, Linda Van Til, Dominique Pinard and Alain Poirier

Skip to text

Text begins

Start of text box

Statistics Canada’s commitment to data security

As part of our mandate, guaranteeing the security of sensitive statistical information within Statistics Canada is one of our top priorities.

- Access to data for Statistics Canada employees requires justification and approval by senior management (Director and above). Employee access to data is also time bound and tracked.

- Information technology (IT) environment is secure:

- access by Statistics Canada employees is controlled by user ID and security groups;

- access by employees is limited to variables they need;

- direct identifiers are only available to the few employees working to anonymize the data or conducting record linkages; and

- direct identifiers are always kept in separate files.

- Based on confidentiality guidelines, only aggregate non-confidential data are released outside of Statistics Canada. Suppression or rounding rules are applied to the aggregate data to minimize risk of disclosure.

This project’s proposal (#020-2017) to conduct a linkage was reviewed and approved by Statistics Canada management. A summary of the approved microdata linkage is posted on Statistics Canada’s website.

End of text box

1. Introduction

This article is a summary of a report previously published by Department of National Defence (DND) and Veterans Affairs Canada (VAC): "Pre- and Post-Release Income of Regular Force Veterans: Life After Service Studies 2016" (MacLean and al.).

Veteran income and employment has long been a national policy issue, and interest in these topics date back to the First World War (MacLean et al., 2019). To date, policy has been focused on the role income and employment play in the reintegration of Veterans into civilian life and in the compensation of Veterans for earnings losses related to illness or injury. In transition to civilian life, Veterans who are employed, satisfied with their job or main activity, and not experiencing low income, have been found to be less likely to report difficulty in adjusting to civilian life (MacLean et al., 2014a). In transition to civilian life, as well as over their life course, income is an important factor when trying to achieve financial security while employment contributes to ones feeling of meaningful purpose in society. These are important domains of well-being, along with social integration, health, housing and physical, cultural and social environment (ex. bias, stigma) (VAC, 2017; PHAC, 2011).

This study presents an examination of the situation of certain groups of Veterans after release from the military compared to when they were in the military. It uses administrative data from the Department of National Defence (DND) and Veterans Affairs Canada (VAC) which has been combined with personal income information by Statistics Canada (see text box “Statistics Canada’s commitment to data security”). Combining DND and VAC administrative data with income information provides an opportunity to examine the incomes of subgroups of the Veteran population. The data includes all Veterans released between 1998 and 2014, regardless of their VAC clientNote status.

The data is used within the context of the Life After Service Studies (LASS) research program which aims to further the understanding of the transition from military to civilian life and ultimately improve the health of Veterans in Canada. It includes two major studies: the survey of health and well-being and the study of income trends pre- and post-release (also referred to as “the income study”). Two previous cycles of the income study focused more directly on income (the “financial security” domain identified in the LASS framework (VAC, 2017)). This paper presents data from the third cycle of the LASS income study which has now been expanded to include employment related outcomes such as the industries in which Veterans are employed and the continuity of such employment (the “purpose” domain) and changes in family status (the “social integration” domain), providing greater coverage of well-being indicators (MacLean et al., 2018). The main findings and the methodology for this third cycle of the income study were detailed in a report released in May 2018Note . The present paper summarizes these findings. After a brief description of the methodology, it presents the predominant demographic characteristics among Veterans. This is followed by two sections which focuses on income after release and one section on employment income and employer stability. The last section discusses the family situation of Veterans and changes in the family structure following release from the Forces.

2. Methodology

The administrative data from the Department of National Defence (DND) and Veterans Affairs Canada (VAC) contains various information on the military services of Veterans and some demographic characteristics which are factors likely to impact the income trajectory after release. However, this data has no information regarding the income of Veterans and their family. In order to have a detailed picture of the income of Veterans, Statistics Canada produced an analytical file by linking information from the DND and VAC files with tax data from the T1 family File (T1FF) for Regular ForceNote Veterans released from January 1, 1998 to December 31, 2014 (initial linked file had information on 68,120 Veterans). A military member of the Forces who leaves (or is discharged) is considered to be released from the Forces and is called a Veteran. Veterans who resume their services after being previously released and are still employed by the Forces are not included in the analysis. On average, about 91.9%Note of the Regular Force Veterans (i.e. military forces released from the Regular Force) were linked to the tax data of 1997 to 2014.

From this analytical file, Statistics Canada produced anonymized aggregate tables based on a specific target population. It included Veterans that were linked to the tax data the year before their release (pre-release) and the 3 years after their release from the Forces (3 years post-release). For this cycle of the study, Veterans that were in the Primary Reserve Forces (20,795) were excluded. About 62.6% of the remaining Regular Force Veterans released between 1998 and 2014 (42,645 Veterans) were included in the analysis. These Regular Force Veterans had been linked to tax files in the pre-release year (T-1) and in all of the first three years post-release. This cohort of Veterans used in the analysis allows for a comparison of pre-release and post-release income. Of the main analysis cohort (42,645 Veterans) 15,790 VAC clients (37% of the analysis cohort), received Disability Pensions and/or any programs under the New Veterans Charter as of March 2016.

In this study Veteran income (before tax) is expressed in relation to the time of release (pre-release, at the time of release or post-release). The income is expressed in 2014 constant dollars and was examined for the pre-release year to the average 3-year period post-releaseNote .

Description for Figure 1

This figure is a diagram showing who, from the 600,400Figure 1 Note 1 Canadian Armed Force Veterans, released between 1954 and 2016, is included in the analysis cohort for this study. These Canadian Armed Force Veterans are separated into two categories: the Primary Reserve Force Veterans (317,700Figure 1 Note 1) and the Regular Force Veterans (282,700Figure 1 Note 1). For this study, only the Regular Force Veterans will be included, and only those released between 1998 and 2014 (68,120Figure 1 Note 2). Of these Veterans, 62,620Figure 1 Note 2 (or 91.9%) were linked to the T1 Family File. The final analysis cohort includes the 42,645Figure 1 Note 2 Regular Force Veterans who linked to the tax information 1 year prior to their release and all 3 years after their release from the Force.

- Note 1

-

Source: VAC Facts & Figures, March 2016.

- Note 2

-

Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations.

3. Demographic characteristics of the cohort

The demographic variables are mainly sourced through the DND/VAC administrative data as they were derived from the DND Human Resources Management System Data. The Regular Force cohort of this study population were predominantly male (87%). The majority of the cohort were also 30 years of age or older (73%), had served 20 years or more (54%), were junior and senior non-commissioned membersNote at release (57%), and were not clients of VAC (63%).

Table 1 start

| Clients (37%) | Non-Clients (63%) | Total (100%) | ||||

|---|---|---|---|---|---|---|

| n | % | n | % | n | % | |

| Total | 15,790 | 100 | 26,855 | 100 | 42,645 | 100 |

| Age at release | ||||||

| 29 & under | 1,180 | 7.5 | 10,395 | 38.7 | 11,575 | 27.1 |

| 30 to 34 | 1,120 | 7.1 | 2,595 | 9.7 | 3,710 | 8.7 |

| 35 to 39 | 2,285 | 14.5 | 2,570 | 9.6 | 4,855 | 11.4 |

| 40 to 44 | 4,460 | 28.2 | 4,330 | 16.1 | 8,790 | 20.6 |

| 45 to 49 | 3,190 | 20.2 | 2,980 | 11.1 | 6,165 | 14.5 |

| 50 to 54 | 2,120 | 13.4 | 2,220 | 8.3 | 4,340 | 10.2 |

| 55 plus | 1,440 | 9.1 | 1,765 | 6.6 | 3,200 | 7.5 |

| Sex | ||||||

| Male | 13,825 | 87.6 | 23,050 | 85.8 | 36,875 | 86.5 |

| Female | 1,960 | 12.4 | 3,805 | 14.2 | 5,770 | 13.5 |

| Years of service | ||||||

| Less than 2 | 220 | 1.4 | 7,770 | 28.9 | 7,985 | 18.7 |

| 2 to 9 | 1,755 | 11.1 | 5,235 | 19.5 | 6,990 | 16.4 |

| 10 to 19 | 2,595 | 16.4 | 2,195 | 8.2 | 4,785 | 11.2 |

| 20 plus | 11,225 | 71.1 | 11,660 | 43.4 | 22,880 | 53.7 |

| Release type | ||||||

| Involuntary | 315 | 2.0 | 2,100 | 7.8 | 2,415 | 5.7 |

| Medical | 7,325 | 46.4 | 1,820 | 6.8 | 9,145 | 21.4 |

| Voluntary | 4,870 | 30.8 | 16,200 | 60.3 | 21,070 | 49.4 |

| Retirement Age | 970 | 6.1 | 1,440 | 5.4 | 2,405 | 5.6 |

| Service Complete | 2,255 | 14.3 | 5,210 | 19.4 | 7,460 | 17.5 |

| Unknown | 55 | 0.3 | 90 | 0.3 | 140 | 0.3 |

| Rank at release | ||||||

| Senior Officer | 1,310 | 8.3 | 2,445 | 9.1 | 3,755 | 8.8 |

| Junior Officer | 970 | 6.1 | 2,520 | 9.4 | 3,490 | 8.2 |

| Subordinate Officer | 85 | 0.5 | 1,530 | 5.7 | 1,615 | 3.8 |

| Senior NCM | 6,200 | 39.3 | 5,840 | 21.7 | 12,040 | 28.2 |

| Junior NCM | 6,440 | 40.8 | 5,935 | 22.1 | 12,375 | 29.0 |

| Private | 625 | 4.0 | 3,845 | 14.3 | 4,470 | 10.5 |

| Recruit | 155 | 1.0 | 4,745 | 17.7 | 4,900 | 11.5 |

| Environment at release | ||||||

| Army | 8,410 | 53.3 | 13,285 | 49.5 | 21,695 | 50.9 |

| Navy | 2,195 | 13.9 | 4,980 | 18.5 | 7,175 | 16.8 |

| Air Force | 5,185 | 32.8 | 8,590 | 32.0 | 13,775 | 32.3 |

| Province in 2014 | ||||||

| Newfoundland and Labrador | 450 | 2.8 | 655 | 2.4 | 1,105 | 2.6 |

| Prince Edward Island | 145 | 0.9 | 170 | 0.6 | 315 | 0.7 |

| Nova Scotia | 1,885 | 11.9 | 2,430 | 9.0 | 4,315 | 10.1 |

| New Brunswick | 965 | 6.1 | 1,150 | 4.3 | 2,115 | 5.0 |

| Quebec | 3,255 | 20.6 | 5,965 | 22.2 | 9,220 | 21.6 |

| Ontario | 4,345 | 27.5 | 7,770 | 28.9 | 12,115 | 28.4 |

| Manitoba | 475 | 3.0 | 730 | 2.7 | 1,205 | 2.8 |

| Saskatchewan | 220 | 1.4 | 520 | 1.9 | 740 | 1.7 |

| Alberta | 2,020 | 12.8 | 3,155 | 11.7 | 5,175 | 12.1 |

| British Columbia | 1,465 | 9.3 | 2,495 | 9.3 | 3,955 | 9.3 |

| Yukon | 10 | 0.1 | 30 | 0.1 | 40 | 0.1 |

| Northwest Territories | 20 | 0.1 | 45 | 0.2 | 65 | 0.2 |

| Nunavut | Note x: suppressed to meet the confidentiality requirements of the Statistics Act | Note x: suppressed to meet the confidentiality requirements of the Statistics Act | Note x: suppressed to meet the confidentiality requirements of the Statistics Act | Note x: suppressed to meet the confidentiality requirements of the Statistics Act | 20 | 0.0 |

| Other | 530 | 3.4 | 1,730 | 6.4 | 2,260 | 5.3 |

x suppressed to meet the confidentiality requirements of the Statistics Act

Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations. |

||||||

Table 1 end

4. Income sources and low-income

Looking at the evolution of total income and its sources based on time of release gives an idea of the impact of being released from the Forces for the Regular Force Veterans. The post-release income may vary between certain groups of Veterans. The total income (before tax) concept was used in this analysis. It includes employment income, government transfers, dividend and interest income, pension income and other income.

This following section presents some findings on the evolution of income for the total Veteran cohort as well as for various groups and low-income situation of Veterans.

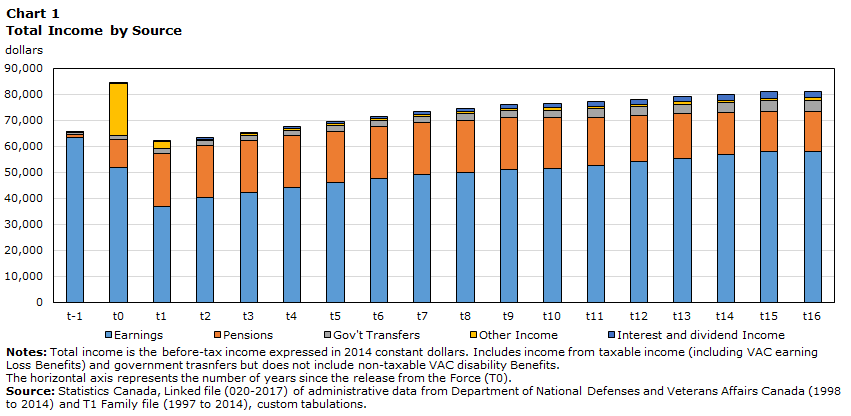

4.1 Income declines initially after release

Average income in the year prior to release was $65,470 (in 2014 constant dollars), increased in the release year, largely due to severance pay, and then declined by 5.6% the following year to $62,040. Post-release income reached pre-release income after three years post-release and continued to increase. During this post-release period, the largest source of income was earnings, followed by pensions and government transfers. While some sources of government transfers (employment insurance, social assistance, guaranteed income supplement) increased post-release, receipt of such was generally temporary.

Data table for Chart 1

| Earnings | Pensions | Gov't Transfers | Other Income | Interest and dividend Income | |

|---|---|---|---|---|---|

| dollars | |||||

| t-1 | 63,290 | 950 | 840 | 290 | 230 |

| t0 | 51,670 | 10,730 | 1,480 | 20,150 | 280 |

| t1 | 36,680 | 20,400 | 1,910 | 2,610 | 410 |

| t2 | 40,150 | 20,060 | 1,760 | 720 | 520 |

| t3 | 42,170 | 19,850 | 2,000 | 670 | 610 |

| t4 | 44,090 | 19,850 | 2,110 | 650 | 680 |

| t5 | 45,900 | 19,860 | 2,280 | 690 | 810 |

| t6 | 47,410 | 19,900 | 2,410 | 700 | 940 |

| t7 | 48,850 | 20,070 | 2,500 | 710 | 1,110 |

| t8 | 49,680 | 20,160 | 2,620 | 770 | 1,210 |

| t9 | 51,070 | 19,920 | 2,750 | 760 | 1,530 |

| t10 | 51,470 | 19,310 | 3,050 | 910 | 1,680 |

| t11 | 52,440 | 18,540 | 3,340 | 780 | 1,850 |

| t12 | 53,890 | 17,820 | 3,370 | 850 | 1,870 |

| t13 | 55,160 | 17,270 | 3,420 | 1,110 | 2,070 |

| t14 | 56,630 | 16,400 | 3,590 | 860 | 2,180 |

| t15 | 57,920 | 15,530 | 3,860 | 970 | 2,700 |

| t16 | 57,890 | 15,380 | 4,170 | 1,120 | 2,270 |

|

Note: Total income is the before-tax income expressed in 2014 constant dollars. Includes income from taxable income (including VAC earning Loss Benefits) and government trasnfers but does not include non-taxable VAC disability Benefits. The horizontal axis represents the number of years since the release from the force (T0) Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations. |

|||||

4.2 Changes in income vary across groups

The average decline in income from the pre-release year to the first three years post-release for the Regular Force cohort was 3%. Female Veterans had a 21% decline in income compared to less than 1% decrease among males. Female Veterans earned about 60% of what male Veterans earned regardless of their industry of employment (except for mining). Medically released Veterans (-19%) and those who served 2 to 9 years (-16%) also experienced greater declines in income.

Table 2 start

| Change (%) Pre-Release Yr to Avg First 3 Yrs Post-Release |

% of VAC Clients (n=15,790) | % of Cohort (n= 42,645) | |

|---|---|---|---|

| Total | -3 | 37 | 100 |

| Largest Increases | |||

| Recruit | 42 | 3 | 12 |

| Nunavut resident | 41 | Note x: suppressed to meet the confidentiality requirements of the Statistics Act | Note x: suppressed to meet the confidentiality requirements of the Statistics Act |

| Served less than 2 years | 38 | 3 | 19 |

| Largest Decreases | |||

| Female | -21 | 34 | 14 |

| Medical release | -19 | 80 | 21 |

| Served 2 to 9 years | -16 | 25 | 16 |

|

x suppressed to meet the confidentiality requirements of the Statistics Act Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations. |

|||

Table 2 end

4.3 Low-income rates also varied across groups

During the first year of post-release, about 6% of the Veterans were in low income based on the Census Family Low-Income Measure Before TaxNote . This rate correspond to the peak for the Veteran’s cohort as it gradually levels off at 3% a few years after release. For the full period after release, the majority of the 15% of Veterans who were in low income at least one year post-release were not VAC clientsNote . Veterans who were released as recruits (38%), involuntary releases (37%) or those with less than 2 years of service (37%)Note had the highest rates of experiencing low income at least one year post-release. However, low-income rates were quite low among Veterans who released at retirement age (1%), those aged 50 and older at release (2%) and senior officers (2%).

Table 3 start

| Low Income Rate (%) | % Clients (n=15,790) | % of Cohort (n=42,645) | |

|---|---|---|---|

| Total | 15 | 37 | 100 |

| Lowest Rates | |||

| Retirement age | 1 | 40 | 6 |

| Age 50 plus | 2 | 47 | 18 |

| Senior officer | 2 | 35 | 9 |

| Highest Rates | |||

| Recruit | 38 | 3 | 10 |

| Involuntary release | 37 | 13 | 6 |

| Less than 2 years of service | 37 | 3 | 19 |

|

|||

Table 3 end

5. Labour-market earnings were related to occupation prior to release

The vast majority (93%) of the Veterans had labour-market earnings (earnings) post-release. On average, labour-market earningsNote remained the largest source of income for Veterans even after being released from the forces. It is in fact, the largest source of income in each year post-release, followed by pensions and government transfers.

Among those who had reported earnings, the highest average earnings were among those whose service pre-release was in medical occupations and the lowest were among those who were in the combat arms pre-release. There were large variations in labour-market earnings across industries. Earnings were highest for those who were working in mining, utilities and professional services and lowest in accommodations and food services, retail trade, and agriculture. These patterns are comparable to the overall population of individuals living in Canada who earned wages, salaries and commissions in 2017Note .

Data table for Chart 2

| Pre-Release Yr | Post-Release (avg. 3 yrs.) | |

|---|---|---|

| dollars | ||

| Civilian comparable | 67,900 | 39,270 |

| Unique to military | 48,860 | 30,860 |

| Combat Arms | 46,760 | 30,550 |

| Communications | 61,870 | 39,290 |

| Maritime | 66,130 | 37,390 |

| Aviation | 74,150 | 45,340 |

| Admin/Logistics/Secur/Int/Emergency Svcs. | 62,360 | 31,960 |

| Engineering/Technical | 62,880 | 41,700 |

| Medical | 83,610 | 49,170 |

| General Officer Specialist | 91,050 | 35,710 |

| Total occupation at release | 63,220 | 37,360 |

| Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations. | ||

6. Main industries and employers

This section gives an overview of the employment situation of the Veterans in terms of industry and employers stability. Because of the nature of the analysis, the cohort was further limited to included only the individuals that received at least wages, commissions and salaries recorded on a T4 slips (16,660 Veterans) and does not take into account Veterans that had only net self-employment income.

The industry corresponds to the industry classificationNote from which the Veterans earned the highest wages, salaries and commissions regardless of their self-employment income source when applicable. It is based only on the main employerNote . The classification is determined according to several criteria such as main activities of the employer.

6.1 The public service was the largest employer

The industry which represent the single largest employer of Veterans was public administration (federal, provincial, municipal and regional). This accounted for over one-third of Veterans who were working in the year after release. This was followed by administrative services (10%), manufacturing (10%), retail trade (7%), construction (6%) and transportation/warehousing (6%). These six industries accounted for almost three-quarters of all employed Veterans.

Data table for Chart 3

| Percent | |

|---|---|

| Public administration | 34 |

| Manufacturing | 10 |

| Administrative and support, waste management and remediation services | 10 |

| Retail trade | 7 |

| Construction | 6 |

| Transportation, warehousing | 6 |

| Other | 27 |

| Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations. | |

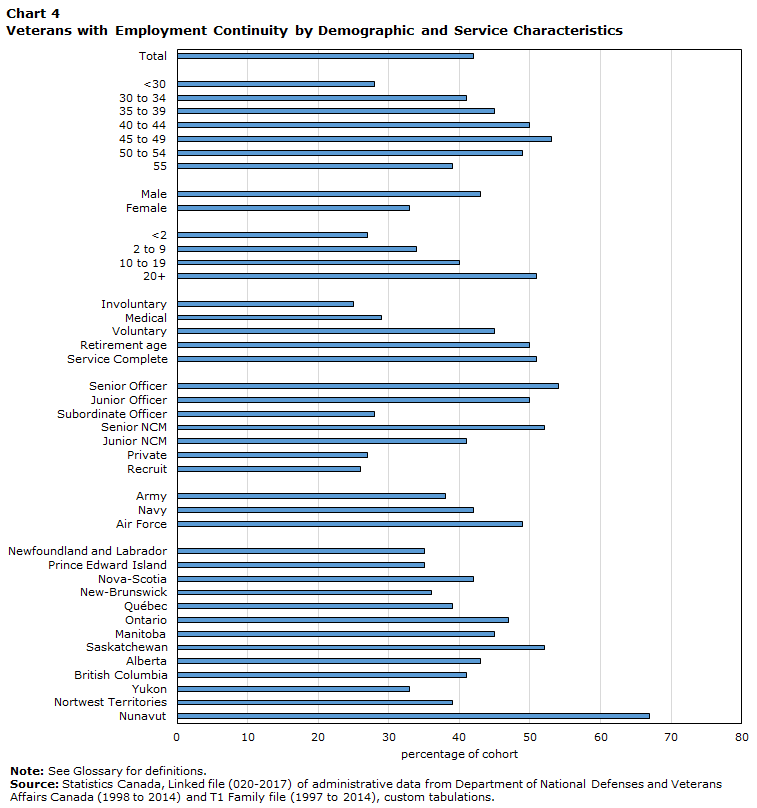

6.2 The majority of Veterans changed employers within the first three years post-release

Changing employers was common as less than half of Veterans had the same employer during the first three years post-release. Veterans who were living in Nunavut in the year following release were the most likely to have employment continuity (67%), followed by senior officersNote (54%) and those aged 45 to 49 at release (52%). Those with the lowest employment continuity were involuntarily released Veterans (25%) and recruits (27%), and those with less than 2 years of service (27%).

Data table for Chart 4

| Percentage of cohort | |

|---|---|

| Total | 42 |

| <30 | 28 |

| 30 to 34 | 41 |

| 35 to 39 | 45 |

| 40 to 44 | 50 |

| 45 to 49 | 53 |

| 50 to 54 | 49 |

| 55 | 39 |

| Male | 43 |

| Female | 33 |

| <2 | 27 |

| 2 to 9 | 34 |

| 10 to 19 | 40 |

| 20+ | 51 |

| Involuntary | 25 |

| Medical | 29 |

| Voluntary | 45 |

| Retirement age | 50 |

| Service Complete | 51 |

| Senior Officer | 54 |

| Junior Officer | 50 |

| Subordinate Officer | 28 |

| Senior NCM | 52 |

| Junior NCM | 41 |

| Private | 27 |

| Recruit | 26 |

| Army | 38 |

| Navy | 42 |

| Air Force | 49 |

| Newfoundland and Labrador | 35 |

| Prince Edward Island | 35 |

| Nova-Scotia | 42 |

| New-Brunswick | 36 |

| Québec | 39 |

| Ontario | 47 |

| Manitoba | 45 |

| Saskatchewan | 52 |

| Alberta | 43 |

| British Columbia | 41 |

| Yukon | 33 |

| Nortwest Territories | 39 |

| Nunavut | 67 |

|

Note: See Glossary for definitions. Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations. |

|

7. Family characteristics

Even though, families of Veterans rely heavily on the Veterans’ income, a change in family structure post-release is common. The family structure of Veterans is based on the information available on the tax data. It was established based on the presence or absence of a spouse and/or children according to the tax records. The family income includes income from all family members, i.e. it might include income earned by the children.

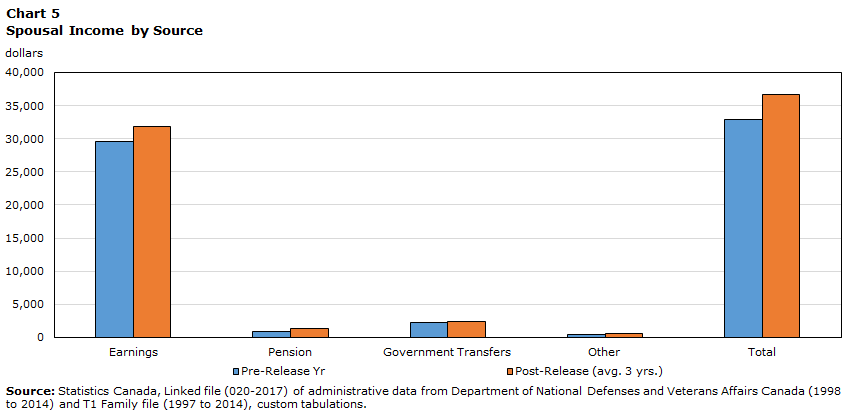

7.1 Families rely heavily on the Veterans income

Families of Regular Force Veterans rely quite heavily on the Veteran’s income both pre- and post-release, with the Veteran’s income accounting for about 70% of total family income. Spousal total income rose 11% from $33,000 in the year prior to the Veterans’ release to, on average, almost $37,000 during the first three years post-release.

Data table for Chart 5

| Pre-Release Yr | Post-Release (avg. 3 yrs.) | |

|---|---|---|

| dollars | ||

| Earnings | 29,580 | 31,830 |

| Pension | 890 | 1,300 |

| Government Transfers | 2,200 | 2,420 |

| Other | 480 | 560 |

| Total | 32,890 | 36,650 |

| Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations. | ||

7.2 Changes in family structure is common post-release

Many Veterans had a change in family structure during the first 3 years post-release; almost one in ten left their couple relationship (separated), one in five Veterans entered in a couple relationship, and one in five Veterans had their first child post-release. The highest rates of separation were among Veterans aged 30 to 34 at release and Veterans who had 10 to 19 years of service, both at 13%.

Table 4 start

| Population | % of Cohort (n=42,645) | |

|---|---|---|

| Were no longer in a couple relationship | 3,395 | 8 |

| Rates for selected characteristics | ||

| Aged 30 to 34 at release | 490 | 13 |

| 10 to 19 years of service | 620 | 13 |

| Involuntary release | 260 | 11 |

| Junior NCM | 1,340 | 11 |

| Other changes in family status | ||

| Entered in a couple relationship | 8,845 | 21 |

| Had children (none to at least one) | 9,580 | 22 |

| Source: Statistics Canada, Linked file (020-2017) of administrative data from Department of National Defenses and Veterans Affairs Canada (1998 to 2014) and T1 Family file (1997 to 2014), custom tabulations. | ||

Table 4 end

8. Summary and future considerations

Results of this income study indicate that, in general, the cohort of Veterans examined experienced little decline in income post-release and relatively few Veterans overall experienced low income post-release. These findings are similar to earlier Life After Service studies (MacLean et al., 2014b). However, while certain groups, such as older Veterans and senior officers, were unlikely to experience low income, there are several groups that warrant further research and consideration including female Veterans, younger Veterans, and medically released Veterans.

A strength of this study is that it uses data from the Department of National Defence and Veterans Affairs Canada administrative data to identify Veterans (both clients and non-clients of Veterans Affairs Canada) which is linked by Statistics Canada to tax files from the T1 family File program. The T1 Family File represents a very robust source of annual income data, and the linkage provided longitudinal data for up to 16 years of follow-up after release from the military.

Additional research could be conducted using this data. This third cycle of the income study included new information on employment, including earnings, industry and employer continuity, and on family characteristics, including number of children and partnership status. Therefore, this could be used to explore well-being areas beyond income. The data could also be used to explore additional areas of concern to policy-makers such as the overall effect of military experience, reasons for release from the military (medical, voluntary, involuntary, retirement) and the impact of service-related impairments on civilian earnings following release from the Forces. Other research could also develop comparisons between the cohort of veterans and the general population.

9. Glossary

Change of employer: A change of employer happens if the main employer of an individual (based on the wages, salaries and commissions) changes overtime based on the Business number associated with the employer.

Employer: An employer is the entity which issues a T4 slip to its employee. The main employer of an individual is the one from which they received the most income (based on the wages, salaries and commissions).

Employment continuity: Employment continuity exists if the main employer of an individual (based on the wages, salaries and commissions) remain stable during the three years post-release based on the Business Number associated with the employer.

Industry: The industry is defined using the North American Industry Classification System (NAICS) for Canada (for more information, see Statistics Canada’s industry classification). The term “industry” in this article refers to the two-digit NAICS industry sector (e.g., sector code 23 refers to construction). This article identifies the industry of Veterans as the industry of the employer which issued the highest wages and salaries T4 slip to the individual (Box 14). The industry can be derived using the employer information on the T4 slip. In this paper, the section on industry includes only Veterans whose T4 slip information from the employer was available and sufficient to identify an industry.

Labour-market earnings: (also referred to as earnings): Labour-market earnings includes wages, salaries and commissions and net self-employment income. In the context of this current analysis, it excludes other income from paid employment.

Low income situation: Someone is considered to be in a situation of low income if their adjusted family income falls below the Census Family Low Income Measure.

Non-commissioned member officers: Non-Commissioned Members (NCM) are skilled personnel who provide operational and support services in the Canadian Armed Forces. NCM start out as recruits and are trained to do specific jobs.

Post-release: Post-release refers to the time after being released from the Force (leaving the Force) voluntarily or involuntarily.

Pre-release: Pre-release refers to the year before being released from the Force (leaving the Force) voluntarily or involuntarily.

Primary Reserve Forces: Members of the Reserve Force serve part time in the Canadian Armed Forces and do not have a set Term of Service. Their main role is to support the Regular Force at home and abroad. Reservists typically serve one or more evenings a week and/or during weekends at locations close to home. Some Reservists may volunteer to be deployed on operations, if there are positions available, but are not required to be deployed. Benefits are also provided to Reserve Members (for more information, see the Canadian Armed Forces).

Ranks: The ranks in this study were grouped for ease of analysis.

- Senior Officer

- Navy: Lieutenant-Commander to Admiral

- Army/Air Force: Major to General

- Junior Officer

- Navy: Acting Sub-Lieutenant to Lieutenant

- Army/Air Force: Second-Lieutenant to Captain

- Subordinate Officer: Navy Cadet or Officer Cadet

- Senior Non-Commissioned Member (NCM)

- Navy: Petty Officer 2nd Class to Chief Petty Officer 1st Class

- Army/Air Force: Sergeant to Chief Warrant Officer

- Junior Non-Commissioned Member (NCM)

- Navy: Leading Seaman to Master Seaman

- Army/Air Force: Corporal to Master Corporal

- Private: Able Seaman (Ordinary Seaman), Private (trained), Private (basic)

- Recruit: Ordinary Seaman-Recruit or Private-Recruit

Source: Canadian Forces Identity System

Regular Force: Members of the Regular Force serve full time protecting Canada and defending its sovereignty. They contribute to international peace and security, and work with the United States to defend North America. They are ready to respond at a moment’s notice to threats, natural disasters or humanitarian crises at home and around the world.

Release: An individual is released from the Force when they leave the Force voluntarily or involuntarily.

Release type: Release type corresponds to the reason for leaving the Forces. They are group in three major types:

- Voluntary

- Voluntary immediate annuity,

- Voluntary fixed service;

- Voluntary other causes;

- Retirement Age (completed service)

- Service Complete

- Medical

- Medical

- Medical military occupation

- Involuntary

- Sentenced to dismissal

- Service misconduct

- Illegally absent

- Fraudulent statement on enrolment

- Unsatisfactory service

- Unsatisfactory performance

- Service complete - reduction in strength

- Not advantageously employed

- Irregular enrolment

- Unsuitable for further service

Source: Department of National Defence

Severance pay: Severance pay is a compensation an employer pays to an employee who loses their job through none of their fault.

Total Income: Total income is the sum of employment income (including self-employment), dividend and interest income, government transfers (Employment insurance benefits, pension income, federal child benefits, harmonized sales tax credit, workers’ compensation benefits, social assistance benefits, provincial refundable tax credits/family benefits, other government transfers), private pensions, Registered Retirement Savings Plan/ Pooled Registered Pension Plan Income and other income (Net limited partnership income, alimony, net rental income, other income as reported on line 130 of the tax form, Registered Disability Savings Plan (RDSP)).

Transfers received from the VAC Disability Benefits Program were not included in the total income as both disability pensions and awards including related special awards such as attendance allowance are non-taxable hence not reported in tax data.

Veterans: Veterans are former members of the Canadian Armed Forces.

VAC client: Veterans Affairs Canada (VAC) clients are Veterans who receive VAC benefits, mainly disability benefits. Other benefits include any program under the New Veteran Charter as of March 2016 (Disability awards, Rehabilitation, Earning Loss, Career Transition Services and Canadian Forces Income Support). A Veteran could be a client or a non-client of VAC.

10. References

Fecteau, E. and D. Pinard. Annual wages, salaries and commission of T1 Tax filers, 2017. Statistics Canada, Catalogue no. 89-503-X. https://www150.statcan.gc.ca/n1/pub/75f0002m/75f0002m2019002-eng.htm

MacLean, M. B., Roach, M. B., Keough, J., & MacLean, L. (2019). Veteran income and employment policies in Canada. Journal of Military, Veteran and Family Health, 5(S1), 111-119. https://jmvfh.utpjournals.press/doi/pdf/10.3138/jmvfh.5.s1.2018-0037

MacLean MB, Van Til L, Poirier A and McKinnon K (2018). Pre- and Post-Release Income of Regular Force Veterans: Life After Service Studies 2016. Charlottetown (PE): Veterans Affairs Canada, Research Directorate Technical Report; May 1, 2018.

MacLean MB, Van Til L, Thompson J, Sweet J, Poirier A, Sudom K, Pedlar D (2014a). Post-military adjustment to civilian life: Potential risk and protective factors. Physical Therapy August 2014, 94:8. https://www.ncbi.nlm.nih.gov/pubmed/23766397

MacLean MB, Campbell L, Van Til L, Poirier A, Sweet J, McKinnon K, Sudom K, Dursun S, Herron M, Pedlar D (2014b). Pre- and Post-Release Income: Life After Service Studies. Charlottetown (PE): Veterans Affairs Canada Research Directorate; 2014 Jul 3. 49p. Technical Report. Available from: http://publications.gc.ca/pub?id=9.629603&sl=0

Pinard, D. Methodology Changes: Census Family Low Income Measure Based on the T1 Family File, Statistics Canada, catalogue no. 75F0002M

Public Health Agency of Canada (2011). What Determines Health?, Oct. 11, 2011. https://www.canada.ca/en/public-health/services/health-promotion/population-health/what-determines-health.html

Veterans Affairs Canada. Monitoring the well-being of veterans: A veteran well-being surveillance framework. Charlottetown (PE): Veterans Affairs Canada Strategic Policy Unit; 2017 Aug. http://www.publications.gc.ca/pub?id=9.849051&sl=0

- Date modified: